Escrow involves a neutral third party holding funds or assets temporarily until contract terms are fulfilled, ensuring security and trust in transactions. Custody refers to the safekeeping and management of assets by a trusted entity, usually for long-term storage or investment purposes. Understanding the distinction between escrow and custody is crucial for making informed decisions in financial transfers and asset management.

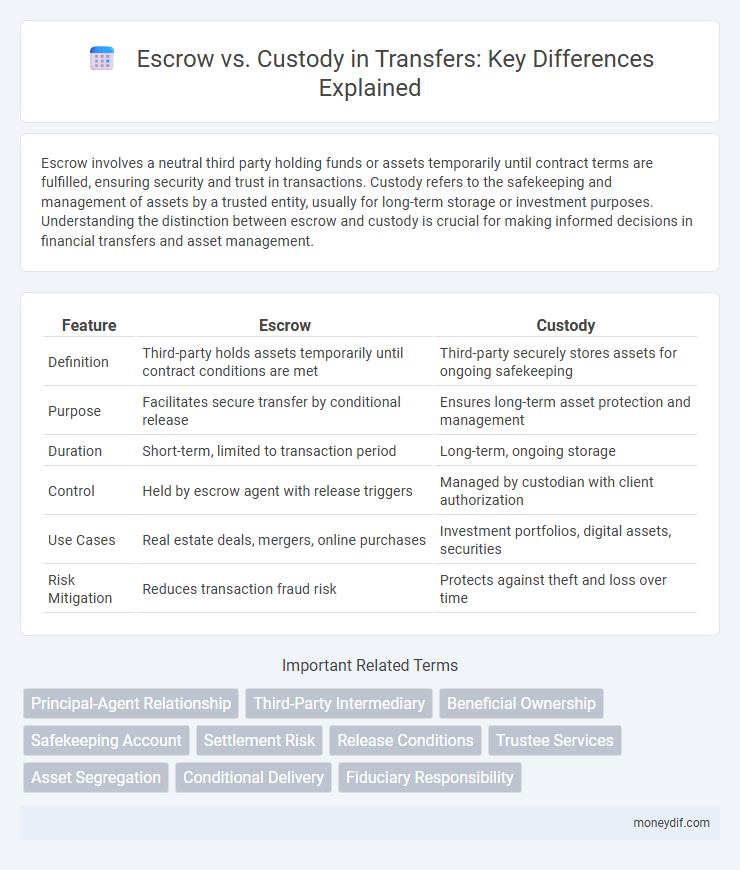

Table of Comparison

| Feature | Escrow | Custody |

|---|---|---|

| Definition | Third-party holds assets temporarily until contract conditions are met | Third-party securely stores assets for ongoing safekeeping |

| Purpose | Facilitates secure transfer by conditional release | Ensures long-term asset protection and management |

| Duration | Short-term, limited to transaction period | Long-term, ongoing storage |

| Control | Held by escrow agent with release triggers | Managed by custodian with client authorization |

| Use Cases | Real estate deals, mergers, online purchases | Investment portfolios, digital assets, securities |

| Risk Mitigation | Reduces transaction fraud risk | Protects against theft and loss over time |

Understanding Escrow and Custody: Key Definitions

Escrow involves a neutral third party holding funds or assets until contractual conditions are met, ensuring secure and conditional transfer between buyer and seller. Custody refers to the safekeeping and management of assets on behalf of the owner, often provided by financial institutions with regulatory compliance. Understanding these distinctions is essential for selecting the appropriate method for asset protection and transfer.

Core Differences Between Escrow and Custody Services

Escrow services hold funds or assets temporarily during a transaction to ensure both parties meet agreed conditions before release, providing transaction-specific protection. Custody services involve the ongoing safekeeping and management of assets on behalf of clients, often including administrative tasks like reporting and compliance. The core difference lies in escrow's conditional, short-term holding versus custody's long-term asset management and security.

How Escrow Works in Asset Transfers

Escrow in asset transfers involves a neutral third party holding funds or assets until all contractual conditions are met, ensuring security for both buyers and sellers. The escrow agent verifies compliance with transfer terms, releases assets only upon confirmed fulfillment, and mitigates risks of fraud or disputes. This process enhances trust and smooth execution in high-value transactions such as real estate, mergers, and digital asset exchanges.

The Role of Custody in Secure Asset Management

Custody plays a crucial role in secure asset management by providing safekeeping and administrative oversight of assets, ensuring proper regulatory compliance and risk mitigation. Unlike escrow which temporarily holds funds during transactions, custody services offer long-term asset protection with enhanced security measures and reporting. Institutional investors and asset managers rely on custody solutions to safeguard digital and physical assets, reducing exposure to fraud and operational errors.

Legal and Regulatory Considerations in Escrow vs Custody

Legal and regulatory considerations in escrow and custody revolve around asset protection and compliance with financial laws, where escrow arrangements typically require third-party neutrality and transparency under strict contractual obligations. Custody services are governed by regulatory frameworks such as the Investment Advisers Act and custodial rules that mandate fiduciary responsibility and safeguard client assets against misuse or insolvency risks. Understanding jurisdiction-specific regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements, is essential for ensuring lawful transfers and maintaining the integrity of escrow and custody agreements.

Choosing the Right Solution for Your Transfer Needs

Choosing the right transfer solution depends on the level of security and control required; escrow services provide a third-party intermediary to hold funds until contract terms are met, ensuring secure and conditional transactions. Custody solutions offer direct management and safekeeping of assets, ideal for long-term storage and immediate access needs. Evaluate the complexity and risk of your transaction to determine whether escrow's conditional release or custody's asset control aligns best with your transfer goals.

Risk Management: Escrow vs Custody Explained

Escrow services provide risk mitigation by holding assets securely until contract conditions are met, ensuring transaction integrity and reducing counterparty default risk. Custody solutions focus on safeguarding assets for long-term storage, emphasizing security protocols but relying on the custodian's operational stability. Escrow limits exposure during transactional risks, whereas custody primarily addresses asset protection over extended periods.

Costs and Fees: Escrow Compared to Custody

Escrow services typically charge a flat fee or a small percentage of the transaction value, making them cost-effective for single or infrequent transfers, while custody accounts often involve ongoing management fees, which can accumulate over time. Escrow fees are generally transparent and upfront, reducing unexpected expenses, whereas custody fees might include administrative, account maintenance, and transaction charges that vary by provider. Choosing between escrow and custody requires evaluating the total cost structure relative to the frequency and volume of asset transfers.

Use Cases: When to Choose Escrow or Custody

Escrow services are ideal for transactions requiring neutral third-party involvement, such as real estate deals or online marketplaces, ensuring funds or assets are securely held until contract terms are met. Custody is preferred for long-term asset management, including institutional investors or cryptocurrency holders needing secure storage and regulatory compliance. Selecting escrow supports conditional transfers with built-in dispute resolution, while custody focuses on safeguarding assets with ongoing control and access management.

Future Trends in Escrow and Custody Services

Future trends in escrow and custody services emphasize the integration of blockchain technology to enhance transparency and security in asset transfers. Automated smart contracts are increasingly adopted to streamline escrow processes, reducing settlement times and minimizing human error. The demand for hybrid models combining traditional custody with decentralized escrow solutions is rising to meet regulatory compliance while offering innovation in digital asset management.

Important Terms

Principal-Agent Relationship

In the principal-agent relationship, an escrow arrangement acts as a neutral third party holding funds or assets until specific conditions are met, ensuring compliance and trust between buyer and seller. Custody services, contrastingly, involve a custodian safeguarding and managing assets on behalf of the principal, emphasizing asset protection and administration rather than conditional transaction facilitation.

Third-Party Intermediary

A third-party intermediary in escrow services securely holds funds or assets until contractual conditions are met, ensuring transaction integrity and minimizing risk for both buyer and seller. In contrast, custody services involve the third party maintaining long-term possession and management of assets, focusing on safekeeping rather than conditional release.

Beneficial Ownership

Beneficial ownership defines the true owner of assets held in escrow or custody, where escrow involves a neutral third party temporarily holding assets until contract conditions are met, and custody refers to a financial institution safeguarding assets on behalf of the beneficial owner.

Safekeeping Account

A safekeeping account securely holds client assets under custody services, distinctly differing from escrow accounts where funds are temporarily held by a neutral third party pending transaction completion.

Settlement Risk

Settlement risk arises when one party fails to deliver the agreed-upon asset or payment in a transaction, making escrow accounts essential to hold funds or securities until all conditions are met, thereby minimizing the risk of non-settlement. Custody services, by securely holding and managing assets on behalf of clients, reduce settlement risk by ensuring proper asset transfer and safekeeping, but do not provide conditional release like escrow arrangements.

Release Conditions

Release conditions in escrow agreements specify precise criteria and timelines for fund or asset transfer, ensuring transactional security and compliance with contractual terms. Custody arrangements, however, focus on safekeeping and management without predetermined release triggers, emphasizing asset protection over conditional transfer.

Trustee Services

Trustee services manage legal ownership and fiduciary responsibilities, distinguishing escrow arrangements that hold assets temporarily for transaction completion from custody services focused on secure long-term asset storage and record-keeping.

Asset Segregation

Asset segregation in escrow involves legally separating client funds within a third-party account for specific transactions, while custody refers to the safekeeping and management of assets by a custodian without immediate segregation for individual transactions.

Conditional Delivery

Conditional delivery in financial transactions involves transferring assets only when predefined conditions are met, which distinguishes escrow arrangements--where a neutral third party holds assets--from custody agreements, where a custodian safeguards assets without enforcing transaction prerequisites. Escrow ensures conditional release based on agreed terms, while custody primarily focuses on secure asset storage and management without conditional delivery mechanisms.

Fiduciary Responsibility

Fiduciary responsibility in escrow involves a neutral third party holding funds securely until contract conditions are met, whereas custody requires a fiduciary to actively manage and safeguard client assets.

Escrow vs Custody Infographic

moneydif.com

moneydif.com