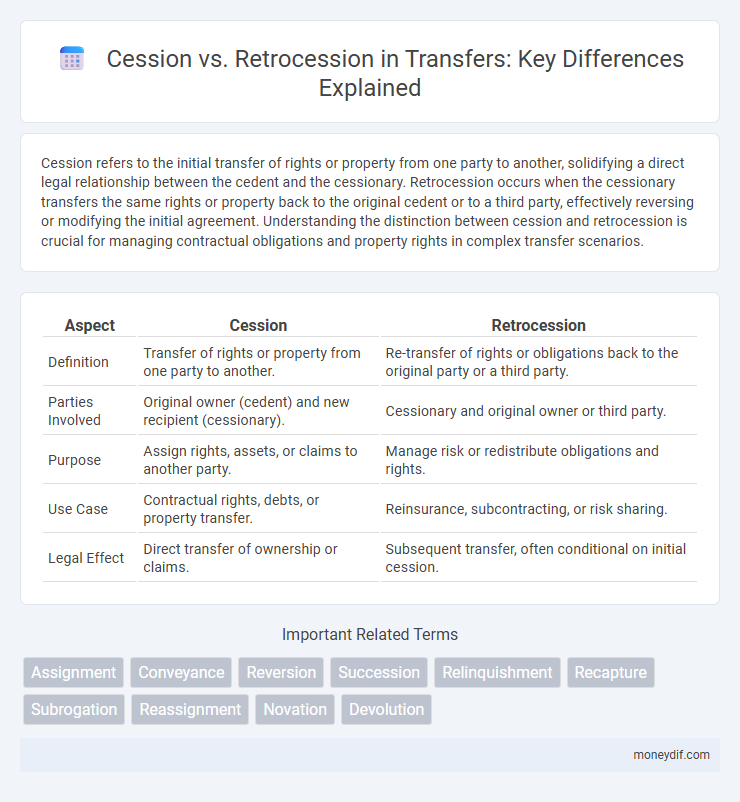

Cession refers to the initial transfer of rights or property from one party to another, solidifying a direct legal relationship between the cedent and the cessionary. Retrocession occurs when the cessionary transfers the same rights or property back to the original cedent or to a third party, effectively reversing or modifying the initial agreement. Understanding the distinction between cession and retrocession is crucial for managing contractual obligations and property rights in complex transfer scenarios.

Table of Comparison

| Aspect | Cession | Retrocession |

|---|---|---|

| Definition | Transfer of rights or property from one party to another. | Re-transfer of rights or obligations back to the original party or a third party. |

| Parties Involved | Original owner (cedent) and new recipient (cessionary). | Cessionary and original owner or third party. |

| Purpose | Assign rights, assets, or claims to another party. | Manage risk or redistribute obligations and rights. |

| Use Case | Contractual rights, debts, or property transfer. | Reinsurance, subcontracting, or risk sharing. |

| Legal Effect | Direct transfer of ownership or claims. | Subsequent transfer, often conditional on initial cession. |

Introduction to Cession and Retrocession

Cession refers to the legal transfer of rights or property from one party, the cedent, to another, the cessionary, commonly used in insurance and financial contracts. Retrocession occurs when the cessionary further transfers part or all of the acquired rights or risks to a third party, often in reinsurance arrangements. Both processes facilitate risk distribution and capital management within the insurance and financial sectors.

Defining Cession in Legal and Financial Contexts

Cession in legal and financial contexts refers to the formal transfer of rights or claims from one party to another, often involving contractual agreements. This process legally enables the ceding party to assign receivables, debts, or insurance policies, ensuring the assignee gains enforceable rights. Unlike retrocession, which involves the reassignment of risks or assets within reinsurance, cession primarily denotes the initial transfer of ownership or claim rights.

What is Retrocession? Key Concepts Explained

Retrocession refers to the re-transfer of risk from a reinsurer back to another reinsurer, often called a retrocessionaire, to spread exposure and enhance risk management. This process allows the original reinsurer to mitigate potential losses by diversifying risk portfolios and maintaining underwriting capacity. Understanding retrocession is crucial for effective risk transfer strategies within the reinsurance market.

Main Differences Between Cession and Retrocession

Cession refers to the initial transfer of insurance risk from the original insurer (cedent) to a reinsurer, while retrocession involves a reinsurer transferring part of the assumed risk to another reinsurer. The main difference lies in the parties involved: cession occurs between the primary insurer and the reinsurer, whereas retrocession takes place between reinsurers. Cession aims to spread risk from insurer to reinsurer, whereas retrocession further distributes risk within the reinsurance market to enhance capacity and manage exposure.

Legal Implications of Cession vs Retrocession

Cession involves the legal transfer of rights or claims from the cedent to the cessionary, often requiring formal documentation to ensure enforceability against third parties. Retrocession is the subsequent transfer of these rights by the cessionary back to the original party or a third entity, potentially complicating the chain of title and affecting liability allocation. Understanding the nuances of these transfers is critical for managing contractual obligations and mitigating risks in financial and insurance transactions.

Practical Applications in Insurance and Reinsurance

Cession in insurance refers to the primary insurer transferring a portion of risk to a reinsurer, reducing exposure and stabilizing loss experience. Retrocession occurs when a reinsurer further transfers risk to another reinsurer, enhancing risk diversification and capital management. Practical applications of cession and retrocession optimize risk distribution, improve underwriting capacity, and enhance financial stability within insurance and reinsurance markets.

Advantages and Disadvantages of Cession and Retrocession

Cession allows the direct transfer of risk from the ceding company to the reinsurer, providing capital relief and risk diversification, but it may involve higher costs and loss of control over underwriting decisions. Retrocession enables reinsurers to further distribute risk to other parties, enhancing portfolio stability and reducing exposure, though it can complicate claims management and increase counterparty risk. Both processes require careful evaluation of cost-benefit trade-offs to optimize risk management and financial outcomes.

Regulatory Framework Governing Both Processes

Cession and retrocession are governed by a stringent regulatory framework designed to ensure transparency and risk management within the insurance and reinsurance markets. Regulatory bodies require detailed reporting, capital adequacy assessments, and compliance with solvency standards to oversee cession agreements and retrocession contracts. These regulations aim to maintain market stability, prevent excessive risk concentration, and protect policyholders across jurisdictions.

Real-World Examples: Case Studies of Cession vs Retrocession

Cession involves the transfer of risk or assets from a primary insurer to a reinsurer, exemplified by Lloyd's of London transferring risks to multiple reinsurers to manage exposure. Retrocession occurs when a reinsurer further transfers parts of these risks to other reinsurers, as seen in Munich Re's practice of distributing risk through retrocession to stabilize financial impact. Case studies reveal cession as the initial risk-sharing step, while retrocession functions as a strategic redistribution within the reinsurance market.

Choosing the Right Transfer Method: Factors to Consider

Choosing between cession and retrocession depends on the risk profile, nature of the contract, and financial objectives involved in the transfer. Cession involves the direct transfer of rights or claims to a third party, suitable for straightforward asset or liability transfers, while retrocession implies reinsurers transferring risks to other reinsurers, ideal for risk diversification and capital management. Understanding regulatory requirements, cost implications, and the strategic impact on balance sheets is essential in selecting the appropriate transfer method.

Important Terms

Assignment

Assignment transfers contractual rights from one party to another, while cession specifically involves the transfer of claims or rights, and retrocession refers to the process where an insurer cedes risks previously assumed to another reinsurer.

Conveyance

Conveyance in legal terms involves the transfer of property rights, where cession refers to the transfer of rights or claims to another party, while retrocession denotes the transfer of those rights back to the original owner or a third party.

Reversion

Reversion in insurance law refers to the return of risk or coverage rights from a ceding insurer to the original insurer after a cession, where the initial insurer transfers risk to a reinsurer; retrocession occurs when the reinsurer further transfers part of this risk to another reinsurer. Understanding the distinctions between cession, retrocession, and reversion is crucial for managing the flow of risk and liability through multiple layers of insurance contracts.

Succession

Succession in legal terms involves the transfer of rights and obligations from one party to another, often in inheritance or contract scenarios, contrasting with cession which specifically denotes the voluntary transfer of rights or claims. Retrocession refers to the act of returning rights or property previously ceded, highlighting a reversal process within contractual or territorial agreements.

Relinquishment

Relinquishment involves voluntarily giving up rights or claims, whereas cession refers to the formal transfer of rights or property, and retrocession denotes the subsequent transfer of those rights back or to a third party.

Recapture

Recapture in insurance refers to the process where a ceding company reclaims premium or risk from a reinsurer, often affecting the balance between cession and retrocession agreements. Cession involves transferring risk from the insurer to the reinsurer, while retrocession entails the reinsurer passing part of that risk to another reinsurer, with recapture enabling adjustments in these risk-sharing arrangements.

Subrogation

Subrogation involves the legal right for an insurer to pursue a third party responsible for a loss after indemnifying the insured, while cession refers to the transfer of risk from the cedent (original insurer) to a reinsurer, and retrocession is the further transfer of that risk from the reinsurer to another reinsurer. These mechanisms ensure risk distribution within insurance and reinsurance markets, optimizing financial stability and claim recovery processes.

Reassignment

Reassignment in the context of insurance involves the transfer of risk or rights from one party to another, differentiating from cession where the original insurer transfers risks to a reinsurer, and retrocession which occurs when a reinsurer further transfers portions of those risks to another reinsurer. These processes optimize risk management, ensuring diversified exposure and financial stability within reinsurance contracts.

Novation

Novation in insurance involves replacing the original party with a new one, transferring all rights and obligations, differing from cession where the original insurer transfers risk to a reinsurer without releasing liability. Retrocession refers to a reinsurer ceding part of the assumed risk to another reinsurer, effectively redistributing risk within the reinsurance chain.

Devolution

Devolution refers to the transfer of power or property rights from a central authority to a local entity, distinguishing itself from cession where ownership is formally surrendered to another party, and retrocession which involves the return of previously ceded territory or rights back to the original owner. Understanding these concepts is crucial in legal and political contexts, especially in treaty negotiations and administrative law.

Cession vs Retrocession Infographic

moneydif.com

moneydif.com