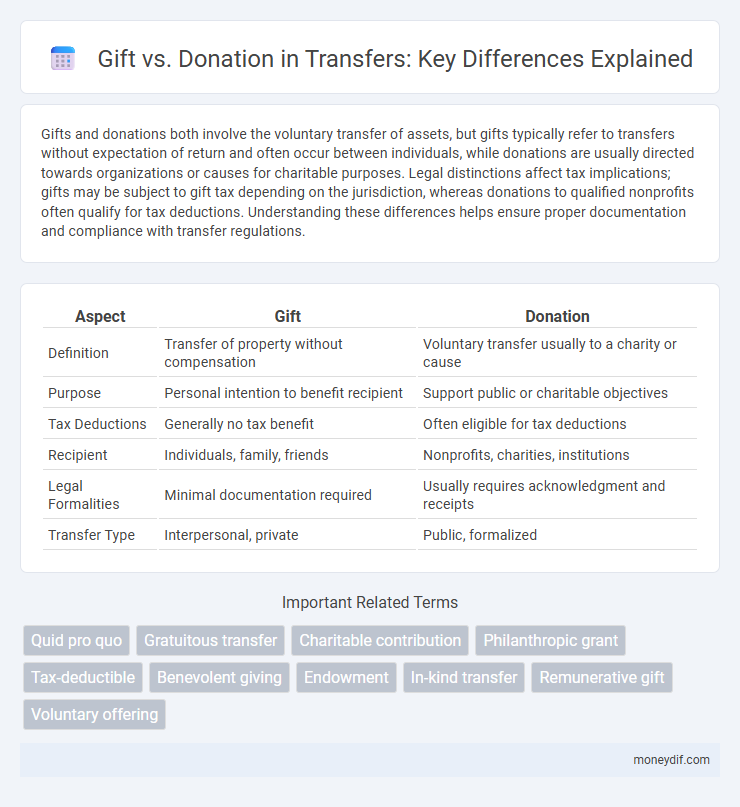

Gifts and donations both involve the voluntary transfer of assets, but gifts typically refer to transfers without expectation of return and often occur between individuals, while donations are usually directed towards organizations or causes for charitable purposes. Legal distinctions affect tax implications; gifts may be subject to gift tax depending on the jurisdiction, whereas donations to qualified nonprofits often qualify for tax deductions. Understanding these differences helps ensure proper documentation and compliance with transfer regulations.

Table of Comparison

| Aspect | Gift | Donation |

|---|---|---|

| Definition | Transfer of property without compensation | Voluntary transfer usually to a charity or cause |

| Purpose | Personal intention to benefit recipient | Support public or charitable objectives |

| Tax Deductions | Generally no tax benefit | Often eligible for tax deductions |

| Recipient | Individuals, family, friends | Nonprofits, charities, institutions |

| Legal Formalities | Minimal documentation required | Usually requires acknowledgment and receipts |

| Transfer Type | Interpersonal, private | Public, formalized |

Understanding the Difference: Gift vs Donation

A gift is a voluntary transfer of property or money without expecting anything in return, often given out of personal generosity or affection. A donation, while also voluntary, typically refers to contributions made to charitable organizations or causes, often providing tax benefits to the donor. Understanding the difference helps individuals and organizations comply with legal definitions and optimize financial or tax planning.

Legal Definitions of Gifts and Donations

Gifts are transfers of property made voluntarily without consideration or expectation of return, legally requiring donative intent, delivery, and acceptance to be valid. Donations typically refer to gifts given to charitable organizations, often accompanied by documentation for tax deduction purposes under tax law. The key legal distinction lies in the donor's intent and the beneficiary's nature, where gifts can be private transfers, while donations generally support public or charitable causes.

Key Characteristics of a Gift

A gift is a voluntary transfer of property or funds without expecting anything in return, characterized by the intent to benefit the recipient freely. It involves no legal obligation or consideration, distinguishing it from donations that may carry specific conditions or tax implications. Key features include the donor's clear intent, delivery of the gift, and acceptance by the recipient.

Essential Features of a Donation

A donation involves the voluntary transfer of assets or funds to a recipient, typically a nonprofit or charitable organization, without expecting anything in return. Essential features include the donor's intent to support a cause, the transfer being irrevocable, and the recipient accepting the gift for public benefit. Unlike a gift, donations often qualify for tax deductions and must comply with regulatory standards governing charitable contributions.

Tax Implications: Gift vs Donation

Gifts are typically transferred without receiving anything in return and may incur gift tax if they exceed the annual exclusion limit, which is $17,000 per recipient as of 2024. Donations to qualified charitable organizations are generally tax-deductible, reducing taxable income for the donor, provided proper documentation is maintained. Understanding the differences in IRS regulations for gifts and donations is crucial to optimize tax benefits and avoid penalties.

Motivations Behind Giving: Gift vs Donation

Gift giving often stems from personal relationships, emotional connections, and social obligations, reflecting gratitude or affection toward a specific individual. Donations are primarily motivated by altruism, social responsibility, or support for a cause, aiming to create broader community impact or address societal needs. Understanding these motivations helps organizations tailor communication strategies to engage donors or gift recipients effectively.

Formalities and Documentation Required

Gift transfers require a formal agreement or deed of gift, often notarized, to establish clear ownership and intent, with minimal tax reporting unless exceeding certain thresholds. Donations typically involve standardized documentation, such as donation receipts or acknowledgment letters, necessary for tax deduction claims and must comply with regulatory reporting standards. Both processes demand accurate record-keeping to ensure legal validity and transparency during transfer.

Impact on Recipient: Gift vs Donation

Gifts provide immediate and personal value to the recipient, often enhancing individual experiences or fulfilling specific needs, while donations typically support broader causes or organizations that address community-wide issues. The impact of a gift is usually direct and tangible, fostering personal connections and gratitude. Donations, on the other hand, create systemic change by funding programs, resources, and services that benefit multiple recipients over time.

Common Scenarios: When to Gift or Donate

Gifting typically occurs in personal contexts such as birthdays, weddings, or holidays where the intent is to provide a tangible item or monetary value without expecting anything in return. Donations are common in charitable settings or fundraising events, aimed at supporting a cause, nonprofit organization, or community initiative. Understanding the purpose--personal appreciation versus philanthropic support--guides whether to gift or donate in each scenario.

Choosing the Right Option: Gift or Donation

Choosing between a gift and a donation depends on the intent and tax implications of the transfer. Gifts are typically personal transfers without expecting anything in return, often subject to gift tax rules, whereas donations are contributions made to qualified charitable organizations and may be tax-deductible. Evaluating the recipient's status and the financial benefits will help determine the most appropriate option for your transfer.

Important Terms

Quid pro quo

Quid pro quo involves exchanging goods or services for something of value, distinguishing it from a gift or donation, which is given without expecting anything in return.

Gratuitous transfer

A gratuitous transfer, such as a gift, involves voluntarily giving property or assets without expecting anything in return, whereas a donation typically refers to a gift given specifically for charitable purposes.

Charitable contribution

Charitable contributions include both gifts and donations, with gifts often referring to assets transferred without expecting anything in return, while donations typically emphasize financial support given to qualified organizations, eligible for tax deductions under IRS regulations. Understanding the distinction between a gift and a donation is crucial for proper tax reporting and maximizing tax benefits.

Philanthropic grant

Philanthropic grants differ from gifts and donations primarily in that grants are typically awarded by foundations or organizations with specific goals and accountability requirements, while gifts and donations are often voluntary contributions given without formal obligations.

Tax-deductible

Donations to registered charities are typically tax-deductible gifts, whereas gifts to individuals or non-charitable entities generally do not qualify for tax deductions.

Benevolent giving

Benevolent giving emphasizes altruistic support through both gifts and donations, where gifts often carry personal significance or reciprocity, while donations are typically unconditional contributions to charitable causes. Understanding the distinction highlights the impact of benevolence by encouraging targeted generosity that meets specific needs efficiently.

Endowment

An endowment is a financial asset, typically a donation, invested to generate income for an organization, whereas a gift may refer broadly to any transfer of assets without expectation of return. Unlike one-time donations, endowments provide sustainable funding by preserving the principal amount and using only the investment income for ongoing support.

In-kind transfer

In-kind transfers involve non-cash gifts such as goods or services provided without monetary exchange, distinguishing them from monetary donations given as direct financial support.

Remunerative gift

Remunerative gifts involve compensation or expected returns, distinguishing them from donations, which are voluntary transfers made without expectation of repayment or reward.

Voluntary offering

Voluntary offerings encompass both gifts and donations, where gifts are typically given without obligation and often carry a personal or sentimental value, while donations are usually contributions made to support a cause, organization, or charity, often qualifying for tax deductions. Understanding the distinction aids in navigating legal, financial, and cultural contexts of voluntary giving.

Gift vs Donation Infographic

moneydif.com

moneydif.com