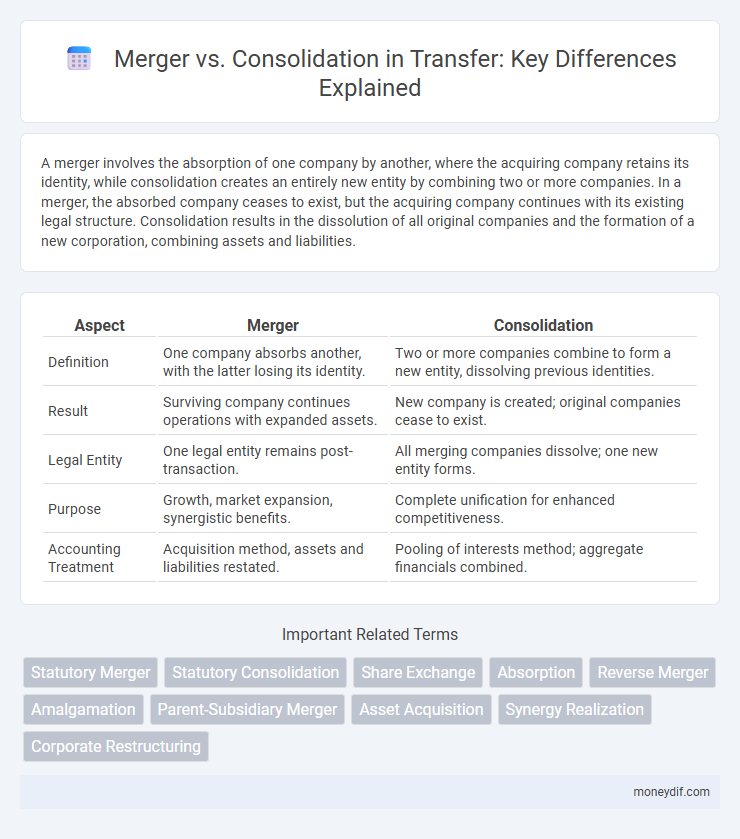

A merger involves the absorption of one company by another, where the acquiring company retains its identity, while consolidation creates an entirely new entity by combining two or more companies. In a merger, the absorbed company ceases to exist, but the acquiring company continues with its existing legal structure. Consolidation results in the dissolution of all original companies and the formation of a new corporation, combining assets and liabilities.

Table of Comparison

| Aspect | Merger | Consolidation |

|---|---|---|

| Definition | One company absorbs another, with the latter losing its identity. | Two or more companies combine to form a new entity, dissolving previous identities. |

| Result | Surviving company continues operations with expanded assets. | New company is created; original companies cease to exist. |

| Legal Entity | One legal entity remains post-transaction. | All merging companies dissolve; one new entity forms. |

| Purpose | Growth, market expansion, synergistic benefits. | Complete unification for enhanced competitiveness. |

| Accounting Treatment | Acquisition method, assets and liabilities restated. | Pooling of interests method; aggregate financials combined. |

Understanding the Basics: Merger vs Consolidation

A merger involves the combination of two or more companies into one, where one entity survives and the others cease to exist, whereas a consolidation creates an entirely new company, and all merging businesses dissolve. In a merger, the acquiring company retains its identity and assets, while in consolidation, new ownership and assets are established under the new entity. Understanding the distinction between merger and consolidation is essential for evaluating corporate restructuring, asset reallocation, and regulatory implications.

Key Differences Between Mergers and Consolidations

Mergers involve two or more companies combining where one entity survives while the others are absorbed, retaining its original identity and stock. Consolidations create an entirely new entity, dissolving all original companies and combining their assets, liabilities, and ownership into the new corporation. Key differences include the survival of companies in mergers versus the formation of a new company in consolidations, along with distinct legal and operational impacts on ownership structure and regulatory requirements.

Legal Frameworks Governing Mergers and Consolidations

Legal frameworks governing mergers and consolidations define distinct processes: mergers involve one company absorbing another, while consolidations create a new entity by combining multiple companies. Jurisdiction-specific corporate laws detail requirements for approvals, shareholder votes, and regulatory filings to ensure compliance and protect stakeholder interests. Antitrust regulations and securities laws also play critical roles in preventing market monopolies and safeguarding transparency during these business transfers.

Strategic Objectives: When to Merge vs When to Consolidate

Mergers are strategically pursued to achieve synergies, expand market share, and enhance competitive advantage by combining two entities under one organizational structure while maintaining individual identities. Consolidations are optimal when aiming to unify multiple companies into a new single entity, streamlining operations, reducing redundancies, and creating a stronger, integrated organization. Choosing between merger and consolidation depends on the desired level of integration, cultural alignment, and long-term strategic goals for growth and market positioning.

Structural Impacts of Mergers Compared to Consolidations

Mergers result in one company absorbing another, leading to a unified legal entity that retains the acquirer's structure and identity, often causing restructuring of management and operations. Consolidations create an entirely new entity by combining two or more companies, dissolving the original companies and forming a new corporate structure with shared governance and resources. Structural impacts of mergers typically involve integration challenges within an existing framework, while consolidations require establishing a new organizational hierarchy and operational system from the ground up.

Financial Implications: Analyzing Mergers vs Consolidations

Mergers often involve one company absorbing another, resulting in a streamlined balance sheet with potential cost synergies and tax benefits, while consolidations create an entirely new entity combining assets and liabilities of both firms. Financial implications of mergers typically include retained earnings adjustments and goodwill recognition, whereas consolidations require comprehensive asset revaluation and liabilities restructuring. Understanding these distinctions is crucial for evaluating impact on shareholder value, debt capacity, and future financial performance.

Due Diligence in Mergers and Consolidations

Due diligence in mergers involves a comprehensive evaluation of the target company's financials, legal obligations, and operational risks to ensure alignment with the acquiring company's strategic goals. In consolidations, due diligence extends beyond individual entities to assess the combined entity's financial health, regulatory compliance, and integration challenges, emphasizing synergies and post-combination value creation. Effective due diligence reduces transactional risks and supports informed decision-making in both mergers and consolidations.

Regulatory Challenges: Navigating Mergers vs Consolidations

Mergers often face complex regulatory hurdles due to antitrust laws designed to prevent market monopolies, requiring thorough approval processes from agencies like the FTC or the European Commission. Consolidations, which create an entirely new entity, may attract intense scrutiny because they fundamentally alter market structures, triggering comprehensive evaluations of competitive impact. Understanding specific jurisdictional regulations is critical, as both mergers and consolidations must comply with detailed reporting requirements and timelines to ensure legal conformity and transaction success.

Real-World Examples: Mergers and Consolidations in Practice

In the real world, the 2015 merger of Kraft Foods and Heinz created one of the largest food and beverage companies, exemplifying a strategic merger aimed at combining resources while maintaining distinct legal entities. Conversely, the consolidation of United Airlines and Continental Airlines in 2010 formed a single new entity to streamline operations and branding, demonstrating how consolidation merges companies into a completely new organization. These cases illustrate how mergers combine companies under a unified management structure without dissolving original entities, while consolidations integrate multiple firms to form a new corporate identity.

Choosing the Right Path: Factors to Consider in Mergers vs Consolidations

Choosing between a merger and consolidation depends on factors such as the desired level of integration, legal structure, and tax implications. Mergers typically combine one company into another, preserving the identity of the acquiring entity, while consolidations create a new organization by combining the original companies. Evaluating operational synergies, stakeholder impact, and long-term strategic goals ensures selecting the optimal path for business growth and continuity.

Important Terms

Statutory Merger

A statutory merger occurs when one company absorbs another, with the acquired company ceasing to exist, whereas a consolidation creates a new entity by combining two or more companies, dissolving the originals. Both processes result in the transfer of assets and liabilities, but statutory mergers typically involve simpler integration compared to the formation of a completely new corporation in consolidations.

Statutory Consolidation

Statutory consolidation merges two or more companies into a new legal entity, unlike a merger where one company absorbs another, maintaining the surviving company's identity.

Share Exchange

Share exchange involves one company acquiring shares of another as part of a merger, where one entity survives, whereas consolidation creates a new company by combining the merging firms, dissolving the original entities. In mergers, share exchanges transfer ownership without forming a new entity, while consolidations result in a new legal entity with new shares issued to original shareholders.

Absorption

Absorption in mergers involves one company completely integrating another, where the absorbed firm's identity ceases to exist, while in consolidation, two or more companies combine to form a new entity, dissolving the original companies involved. This distinction highlights absorption as a form of acquisition, whereas consolidation creates an entirely new corporate structure with shared assets and liabilities.

Reverse Merger

A reverse merger enables a private company to become publicly traded by acquiring a public shell company, differing from a merger where two companies combine and from consolidation where both entities dissolve to form a new company.

Amalgamation

Amalgamation involves combining two or more companies into a single new entity, differing from a merger where one company absorbs another and from consolidation where companies unite to form an entirely new organization.

Parent-Subsidiary Merger

A parent-subsidiary merger involves a parent company absorbing its subsidiary, resulting in the subsidiary ceasing to exist as a separate legal entity, whereas a consolidation creates an entirely new company by combining two or more existing firms, with all original entities dissolving. In merger vs consolidation, the parent-subsidiary structure typically simplifies integration due to existing ownership ties, while consolidation requires more complex legal and organizational restructuring to unify distinct corporate identities.

Asset Acquisition

Asset acquisition in mergers involves purchasing specific assets and liabilities of a target company, whereas consolidation creates a new entity by combining two or more companies' assets, liabilities, and operations.

Synergy Realization

Synergy realization in mergers versus consolidations focuses on maximizing combined operational efficiencies, cost savings, and revenue enhancements by fully integrating complementary assets and capabilities.

Corporate Restructuring

Corporate restructuring involves strategic mergers where two companies combine with one surviving entity, whereas consolidations create a new company absorbing the merging firms to unify resources and operations.

Merger vs Consolidation Infographic

moneydif.com

moneydif.com