Endorsement and indorsement both refer to the act of signing a negotiable instrument to transfer ownership or rights, but "endorsement" is the more widely accepted and modern spelling in English. Indorsement, an older variant, appears mainly in historical or legal texts and carries the same meaning of authorizing the assignment of the instrument. Understanding the subtle distinction in usage is important for legal clarity and accurate documentation in financial transactions.

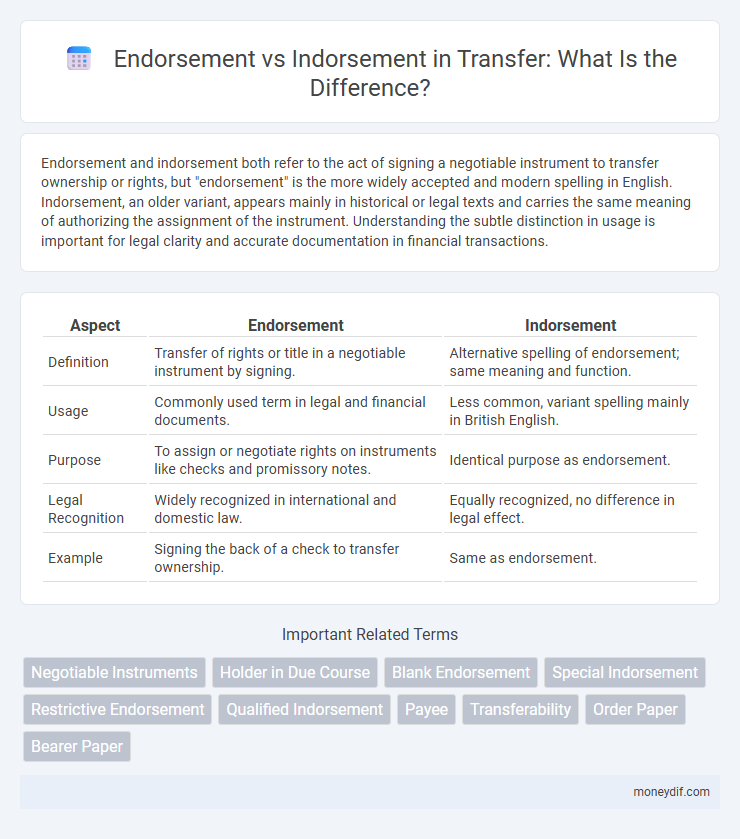

Table of Comparison

| Aspect | Endorsement | Indorsement |

|---|---|---|

| Definition | Transfer of rights or title in a negotiable instrument by signing. | Alternative spelling of endorsement; same meaning and function. |

| Usage | Commonly used term in legal and financial documents. | Less common, variant spelling mainly in British English. |

| Purpose | To assign or negotiate rights on instruments like checks and promissory notes. | Identical purpose as endorsement. |

| Legal Recognition | Widely recognized in international and domestic law. | Equally recognized, no difference in legal effect. |

| Example | Signing the back of a check to transfer ownership. | Same as endorsement. |

Understanding Endorsement vs Indorsement: Key Differences

Endorsement refers to the act of signing a negotiable instrument, such as a check or promissory note, to transfer ownership or guarantee payment, while indorsement is an alternative spelling used primarily in older legal documents with the same meaning. The key difference lies mainly in spelling and regional usage rather than in the legal or financial implications of the terms. Understanding this distinction is crucial for correctly interpreting transfer documents in banking and commercial transactions.

Historical Evolution of Endorsement and Indorsement

Endorsement and indorsement have evolved as critical mechanisms in the transfer of negotiable instruments, with endorsement tracing back to Roman law practices that allowed the transfer of obligations through written consent. Indorsement, a variant that emerged in medieval Europe, expanded the functionality by enabling not only the transfer of rights but also conditional instructions tied to the instrument's use. This historical evolution reflects the gradual formalization and differentiation of transfer techniques, laying the foundational legal principles seen in modern commercial and financial transactions.

Legal Definitions: Endorsement vs Indorsement

Endorsement refers to the official signing or approval of a document or instrument, legally transferring rights or title to another party, often seen in negotiable instruments like checks. Indorsement, a variant spelling primarily used in legal contexts, carries the same meaning as endorsement and involves the act of signing on the back of a negotiable instrument to validate or transfer ownership. Both terms firmly establish legal consent for the transfer of rights, with no difference in their legal implications or enforceability.

Significance of Endorsement in Transfer of Negotiable Instruments

Endorsement plays a critical role in the transfer of negotiable instruments by legally authorizing the transferee to receive payment or further negotiate the instrument. It serves as a written evidence of the transferor's intent to transfer ownership, ensuring the instrument's negotiability and enforceability. The presence of a valid endorsement enables seamless circulation of the instrument in commerce, facilitating liquidity and trust among parties.

Role of Indorsement in Ownership Transfer

Indorsement plays a critical role in the transfer of ownership by legally signifying the transferor's intent to assign rights in a negotiable instrument to another party. This act creates a binding chain of title, ensuring the new holder gains valid ownership and the right to enforce payment. Clear indorsements facilitate secure and efficient negotiation, minimizing disputes over ownership claims.

Types of Endorsement and Indorsement Explained

Types of endorsement include blank, special, restrictive, and qualified endorsements, each defining how a negotiable instrument can be transferred or restricted. Indorsement refers to the act of signing the back of a document to assign rights or authorize payment, with common types being blank indorsement, which makes the instrument bearer paper, and special indorsement, specifying a particular endorsee. Understanding these types ensures proper handling of negotiable instruments, facilitating secure and clear transfer of ownership or payment rights.

Common Mistakes: Endorsement vs Indorsement in Documentation

Common mistakes in transfer documentation often arise from confusing endorsement with indorsement, despite both referring to the act of signing over rights. Endorsement typically signifies a formal approval or support, while indorsement is the actual signature on negotiable instruments like checks or promissory notes, crucial for validating the transaction. Misuse of these terms can lead to legal ambiguities, delayed processing, and challenges in enforcing transfer rights.

Impact on Rights and Liabilities: Endorsement vs Indorsement

Endorsement transfers the title and rights of a negotiable instrument to a specific endorsee, creating direct liability between the parties involved. Indorsement, often a misspelling of endorsement, refers to the same legal act and thus carries identical implications for rights and liabilities. Proper endorsement ensures clear negotiation and enforceability, directly impacting the transferability and responsibility for payment of the instrument.

Jurisdictional Variations: Endorsement vs Indorsement

Jurisdictional variations between endorsement and indorsement primarily affect the legality and effectiveness of negotiable instruments, with endorsement widely recognized in common law countries and indorsement used in civil law jurisdictions. Endorsement typically involves signing over a negotiable instrument to another party to transfer ownership, while indorsement may include specific local formalities or terminology that influence enforceability. Understanding these differences is crucial for international transactions to ensure that transfers comply with regional legal standards and maintain the instrument's negotiability.

Best Practices for Proper Endorsement and Indorsement

For proper endorsement and indorsement, always ensure clarity by clearly specifying the type of endorsement--such as blank, special, or restrictive--to avoid ambiguity in transferability. Verify the authenticity of signatures and maintain accurate records to prevent disputes and enhance the security of negotiable instruments. Following standardized procedures, including timely endorsement and adherence to legal requirements, optimizes the transfer process and safeguards the rights of all parties involved.

Important Terms

Negotiable Instruments

Negotiable instruments allow transfer of rights through endorsement, which involves signing the instrument to assign ownership, whereas indorsement refers specifically to the act of signing the back of the instrument to enable its negotiation.

Holder in Due Course

A Holder in Due Course obtains valid title to a negotiable instrument through proper endorsement, distinguishing between endorsement as the act of signing and indorsement as the legal transfer of rights.

Blank Endorsement

Blank endorsement, a type of endorsement involving only the signature without specifying a payee, differs from a full endorsement that clearly identifies the endorsee, making the instrument payable to the bearer.

Special Indorsement

Special indorsement specifies the endorsee's name, restricting further negotiation to that individual and enhancing transaction security, unlike a blank indorsement which allows transfer by mere delivery. In endorsement versus indorsement contexts, the term "indorsement" refers to the formal act of signing and transferring a negotiable instrument, while endorsement highlights the broader practice of approving or supporting a document or idea.

Restrictive Endorsement

Restrictive endorsement limits the negotiability of a financial instrument by specifying conditions, such as "For Deposit Only," ensuring the instrument can only be processed in a certain way, which contrasts with a general endorsement that transfers full ownership rights. The term "indorsement" is an older, less common spelling of "endorsement," both referring to the act of signing a negotiable instrument to endorse it.

Qualified Indorsement

Qualified indorsement limits the liability of the indorser by adding terms such as "without recourse," differentiating it from a standard indorsement which transfers full liability to the indorser.

Payee

Payee refers to the party entitled to receive payment on a negotiable instrument, where endorsement (or indorsement) involves the payee's signature transferring ownership or rights to another party.

Transferability

Transferability of financial instruments depends on the type of endorsement or indorsement, with blank endorsements allowing unrestricted transfer and restrictive endorsements limiting negotiation.

Order Paper

The Order Paper facilitates the transfer of ownership rights in negotiable instruments through endorsement, which differs from indorsement by its specific legal implications and variations in spelling depending on jurisdiction.

Bearer Paper

Bearer paper allows transfer of ownership by physical delivery alone, while endorsement involves signing the instrument to assign rights to another party.

endosement vs indorsement Infographic

moneydif.com

moneydif.com