Vesting defines the process by which an employee earns non-forfeitable rights to employer-provided assets, typically through stock options or retirement benefits, ensuring gradual ownership over time. Divestiture involves the deliberate sale or disposal of assets, subsidiaries, or investments by a company to streamline operations, raise capital, or comply with regulatory requirements. Understanding the differences between vesting and divestiture is crucial for managing corporate asset transfers and employee compensation strategies effectively.

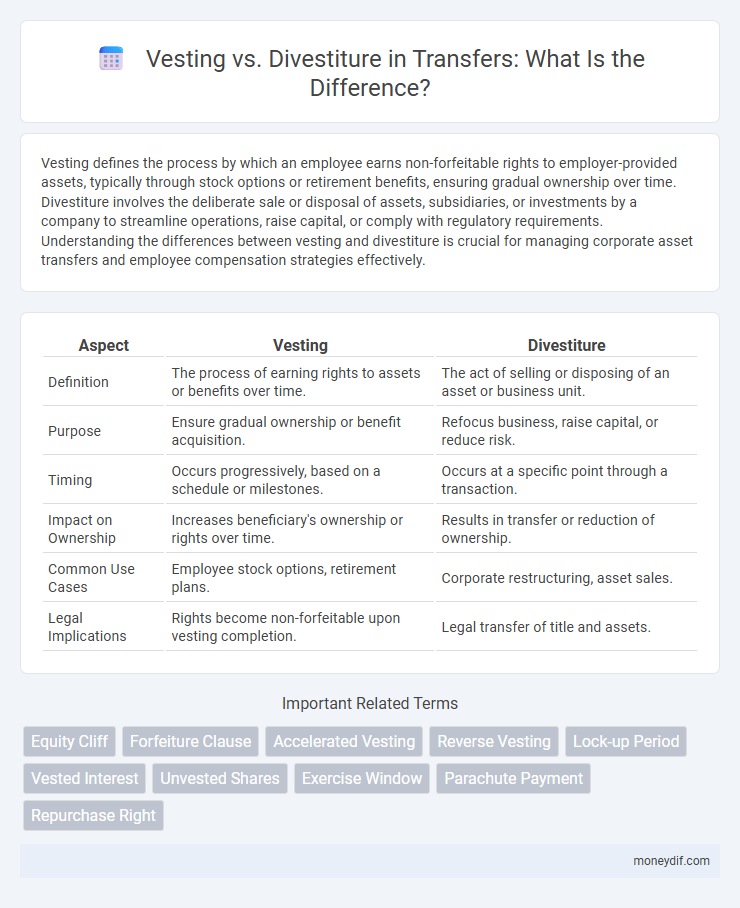

Table of Comparison

| Aspect | Vesting | Divestiture |

|---|---|---|

| Definition | The process of earning rights to assets or benefits over time. | The act of selling or disposing of an asset or business unit. |

| Purpose | Ensure gradual ownership or benefit acquisition. | Refocus business, raise capital, or reduce risk. |

| Timing | Occurs progressively, based on a schedule or milestones. | Occurs at a specific point through a transaction. |

| Impact on Ownership | Increases beneficiary's ownership or rights over time. | Results in transfer or reduction of ownership. |

| Common Use Cases | Employee stock options, retirement plans. | Corporate restructuring, asset sales. |

| Legal Implications | Rights become non-forfeitable upon vesting completion. | Legal transfer of title and assets. |

Understanding Vesting and Divestiture in Transfers

Vesting in transfers refers to the process where an individual gains full ownership rights over assets or shares after meeting specific conditions, ensuring secured benefits. Divestiture involves the deliberate sale or disposal of assets or business units, often used to streamline operations or comply with regulatory requirements. Understanding the distinctions between vesting, which secures ownership over time, and divestiture, which involves asset liquidation, is crucial for strategic transfer decisions.

Key Differences Between Vesting and Divestiture

Vesting refers to the process by which an individual obtains full ownership rights to assets or benefits, often over a predetermined period, while divestiture involves the deliberate sale or disposal of assets or subsidiaries by a company. Vesting is commonly applied in employee stock options and retirement plans to secure ownership rights, whereas divestiture is a strategic financial decision used to streamline operations or raise capital. Key differences include the direction of asset control--vesting grants rights to an individual, whereas divestiture transfers ownership away from the original holder.

The Legal Framework: Vesting vs Divestiture

The legal framework governing vesting establishes conditions under which ownership rights irrevocably transfer to an individual or entity, typically after fulfilling specific time or performance criteria, thereby securing full control over assets or shares. In contrast, divestiture involves a deliberate legal process where a company or individual relinquishes ownership of assets or business units, often to comply with regulatory requirements or strategic realignments, with strict adherence to contractual and statutory obligations. Understanding the distinctions in legal implications, regulatory compliance, and contractual enforcement is crucial for effectively managing asset transfers in corporate law and mergers and acquisitions.

Practical Examples of Vesting and Divestiture

Vesting occurs when an employee gains full ownership of employer-granted stock options after meeting specific conditions, such as working a set number of years; for example, a startup grants 1,000 shares that vest over four years with a one-year cliff. Divestiture refers to a company selling or disposing of assets or business units to streamline operations or raise capital; for instance, a corporation might divest a non-core subsidiary to focus on its primary market. These practical examples highlight vesting's role in employee retention and divestiture's strategic function in corporate restructuring.

Impact on Ownership Rights During Transfer

Vesting establishes an individual's ownership rights by legally securing shares or assets over a specified period, ensuring gradual control transfer and protection against premature loss. Divestiture involves the complete sale or disposal of assets or shares, resulting in immediate forfeiture of ownership rights and cessation of any associated benefits. The impact on ownership rights during transfer is significant; vesting preserves future ownership potential, while divestiture terminates all claims instantaneously.

Vesting Explained: Process and Implications

Vesting refers to the process by which an individual gains full ownership of assets or rights over time, often used in employee stock options or retirement plans. The implications of vesting include guaranteeing that beneficiaries receive benefits only after fulfilling specific conditions, such as continuing employment for a set period. Understanding vesting schedules is crucial for managing financial planning and ensuring compliance with contractual agreements.

Divestiture Defined: What It Means for Stakeholders

Divestiture involves the partial or full disposal of a company's assets, subsidiaries, or business units to streamline operations or raise capital. This strategic transfer affects stakeholders by altering ownership structures, potentially impacting employee job security, shareholder value, and market competition. Understanding divestiture's implications is crucial for stakeholders to navigate changes in control, financial health, and long-term organizational goals.

Choosing Between Vesting and Divestiture in Asset Transfers

Choosing between vesting and divestiture in asset transfers depends on the strategic goals of ownership retention and risk management. Vesting secures long-term control and gradual transfer of rights, ensuring stakeholders maintain an interest over time, while divestiture involves the outright sale or disposal of assets, optimizing liquidity and refocusing core business operations. Careful evaluation of legal, financial, and operational implications is essential for selecting the appropriate method to align with corporate objectives and market conditions.

Tax and Financial Consequences of Vesting and Divestiture

Vesting triggers tax implications as employees recognize income when rights to stock or options become nonforfeitable, resulting in ordinary income tax on the vested amount. Divestiture, the sale or disposal of assets, may lead to capital gains or losses depending on the holding period and asset basis, affecting the overall financial outcome. Understanding these tax and financial consequences is crucial for strategic planning in corporate transfers to optimize after-tax returns and compliance.

Common Challenges in Transfer: Vesting vs Divestiture

Common challenges in transfer involving vesting versus divestiture include navigating complex legal frameworks that dictate ownership rights and timelines for asset control. Differentiating between vesting, where rights to an asset are gradually granted, and divestiture, which entails a complete disposal of assets, requires precise financial and tax planning to avoid penalties. Effective management of stakeholder expectations and regulatory compliance remains critical to minimize disputes and ensure a smooth transition.

Important Terms

Equity Cliff

Equity cliffs in vesting schedules delay ownership rights until a set period passes, preventing divestiture of shares before initial earning thresholds are met.

Forfeiture Clause

A forfeiture clause in contracts ensures that vested rights may be divested if specific conditions, such as failure to meet performance or tenure requirements, are not satisfied within a predetermined period.

Accelerated Vesting

Accelerated vesting triggers immediate ownership of stock options or shares upon divestiture events such as mergers, acquisitions, or termination, contrasting with standard vesting schedules that require a fixed period before full ownership.

Reverse Vesting

Reverse vesting ensures founders retain ownership by gradually transferring shares back to the company if certain conditions are unmet, contrasting with divestiture where assets or shares are actively sold or liquidated.

Lock-up Period

The lock-up period restricts the sale or divestiture of vested shares to maintain market stability and align shareholder interests with long-term company performance.

Vested Interest

Vested interest in a company refers to the secured ownership rights an individual gains through vesting, distinguishing it from divestiture, which involves the partial or complete disposal of assets or shares.

Unvested Shares

Unvested shares represent equity that has not yet met the required vesting schedule, meaning the holder does not fully own them until certain conditions, such as duration of employment or performance milestones, are fulfilled. Vesting ensures the gradual ownership transfer over time, while divestiture involves the sale or disposal of shares, typically applicable only after shares have fully vested.

Exercise Window

Exercise Window refers to the specific time frame during which an employee can convert vested stock options into shares before any divestiture restrictions or expiration dates apply.

Parachute Payment

Parachute payments triggered by divestiture clauses often require careful analysis of vesting schedules to determine eligibility and tax implications under Section 280G of the Internal Revenue Code.

Repurchase Right

Repurchase Right allows a company to buy back unvested shares upon employee departure, effectively linking share ownership to vesting schedules and preventing divestiture of unearned equity.

vesting vs divestiture Infographic

moneydif.com

moneydif.com