Vesting secures an individual's right to property or benefits, ensuring ownership over time or upon meeting conditions, while reversion involves the return of property rights to the original owner or their heirs if vesting conditions are not fulfilled. Vesting guarantees a future interest that is legally enforceable, whereas reversion is a future interest retained by the grantor when the property or benefits revert back. Understanding the distinction between vesting and reversion is crucial for managing property transfers and estate planning effectively.

Table of Comparison

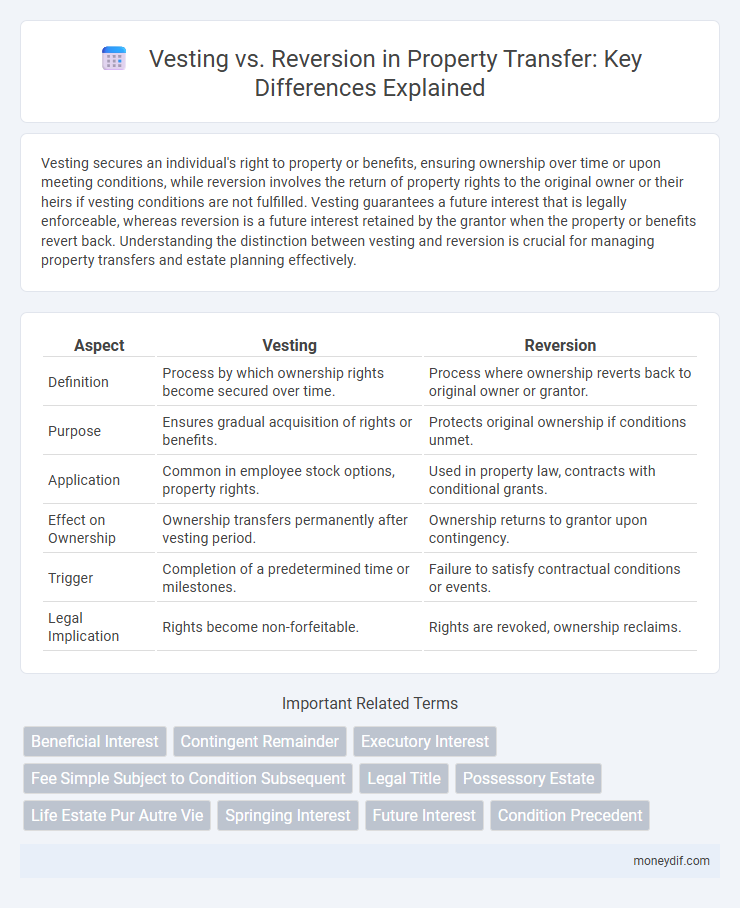

| Aspect | Vesting | Reversion |

|---|---|---|

| Definition | Process by which ownership rights become secured over time. | Process where ownership reverts back to original owner or grantor. |

| Purpose | Ensures gradual acquisition of rights or benefits. | Protects original ownership if conditions unmet. |

| Application | Common in employee stock options, property rights. | Used in property law, contracts with conditional grants. |

| Effect on Ownership | Ownership transfers permanently after vesting period. | Ownership returns to grantor upon contingency. |

| Trigger | Completion of a predetermined time or milestones. | Failure to satisfy contractual conditions or events. |

| Legal Implication | Rights become non-forfeitable. | Rights are revoked, ownership reclaims. |

Understanding Vesting in Property Transfers

Vesting in property transfers establishes the legal ownership rights of a grantee immediately upon transfer, ensuring clear title and possession. It defines the exact nature and extent of ownership, such as fee simple absolute or life estate, thereby preventing disputes over property claims. Understanding vesting is crucial for determining tax implications, inheritance rights, and the ability to transfer or encumber the property.

The Basics of Reversion in Legal Transactions

Reversion in legal transactions refers to the automatic return of property rights to the original grantor upon the occurrence of a specified event or condition, often when a vested interest ends. It serves as a key mechanism to control the future ownership of property, contrasting with vesting, which grants an immediate and enforceable interest to a beneficiary. Understanding reversion helps clarify how property interests are managed and transferred under specific legal terms in real estate and trust law.

Key Differences Between Vesting and Reversion

Vesting grants a person's irrevocable right to a property or asset after meeting specific conditions, often related to time or performance. Reversion refers to the return of property rights to the original owner or their heirs once a particular event, such as termination of a lease or life estate, occurs. Key differences include vesting providing secured ownership interest while reversion signifies a future interest contingent on predefined conditions ending.

Legal Implications of Vesting vs. Reversion

Vesting secures an individual's legal right to an asset or benefit after meeting specific conditions, typically preventing the original owner from reclaiming it, while reversion allows the asset to return to the grantor if those conditions are unmet. The legal implications of vesting establish enforceable ownership, ensuring protection against forfeiture, whereas reversion provisions maintain contingent ownership, often subject to expiration or failure of performance. Courts interpret vesting as a completed transfer of interest, contrasting with reversion which is treated as a future interest conditional upon specific events or breaches.

Vesting: Rights and Responsibilities of Ownership

Vesting establishes the legal right to ownership, granting property holders control and responsibility over assets once specific conditions are met, such as time or performance milestones. Rights vested in an owner include transferability, income generation, and protection under law, while responsibilities often involve maintenance, taxes, and adherence to regulatory requirements. The clarity of vesting ensures that ownership interests are enforceable, providing security and predictability in property and asset transfers.

Reversion: When Ownership Returns to the Grantor

Reversion occurs when property ownership automatically returns to the grantor or their heirs after a specified condition or period lapses, maintaining the grantor's control over the asset's future. This interest ensures that the property rights are preserved and can be reclaimed without the need for a formal transfer process. Unlike vesting, which grants full ownership to the grantee immediately or after a set time, reversion safeguards the grantor's ultimate ownership rights if stipulated conditions are unmet.

Practical Examples of Vesting and Reversion

Vesting occurs when an employee gains non-forfeitable rights to employer-provided benefits, such as stock options becoming fully owned after a set period, exemplified by an employee receiving 100% ownership of granted shares after four years. Reversion happens when unvested benefits return to the employer, such as unclaimed stock options reverting back if the employee leaves before the vesting period concludes. Practical scenarios include a company granting restricted stock units that vest gradually, while any unvested shares return to the company upon employee termination.

Common Scenarios Where Vesting and Reversion Apply

Vesting commonly applies in employee stock options where ownership rights accumulate over time, ensuring employees earn shares progressively. Reversion typically occurs in property law when transferred assets return to the grantor or their heirs if certain conditions fail, such as unmet contingencies or time limits. Both vesting and reversion are crucial in estate planning and contract law to clarify the timing and conditions of ownership transfers.

Vesting vs. Reversion: Impact on Beneficiaries

Vesting guarantees beneficiaries a fixed interest in property or assets, ensuring their rights become legally enforceable and protected over time. Reversion, however, returns the property or asset rights to the original grantor or their heirs after a specified condition or period, limiting beneficiaries' long-term control. This distinction critically impacts estate planning, influencing beneficiaries' security and the ultimate disposition of transferred assets.

Choosing Between Vesting and Reversion in Estate Planning

Choosing between vesting and reversion in estate planning hinges on control and timing of asset distribution. Vesting grants immediate ownership rights to beneficiaries, ensuring clarity and reducing disputes, while reversion retains assets within the original estate if certain conditions fail, providing flexibility for changing circumstances. Evaluating estate goals and potential beneficiary needs guides the decision to optimize asset protection and tax efficiency.

Important Terms

Beneficial Interest

Beneficial interest vests when a beneficiary's rights in trust property become fixed and enforceable, whereas reversion occurs when the property rights return to the grantor or their heirs upon termination of the trust or interest.

Contingent Remainder

A contingent remainder is a future interest in property that depends on the occurrence of a specific condition or event before it can vest, contrasting with a reversion where the property automatically returns to the grantor if no conditions are met. Vesting in contingent remainders requires certainty regarding the beneficiary and event, while reversion provides a default ownership reversion to the original grantor upon failure of the contingent interest.

Executory Interest

An executory interest is a future property interest that cuts short a prior estate, contrasting with reversion which automatically returns property to the grantor, and vesting occurs when the executory interest becomes possessory upon a specified event.

Fee Simple Subject to Condition Subsequent

Fee Simple Subject to Condition Subsequent grants ownership rights that may be terminated upon a specified condition, differentiating from reversion which automatically returns property to the grantor, while vesting determines the specific party's secured interest following the condition.

Legal Title

Legal title determines the official ownership of a property, distinguishing between vesting, which grants immediate and absolute ownership rights, and reversion, where ownership returns to the original grantor or their heirs upon the occurrence of a specified condition or event. Vesting secures the owner's full legal rights, while reversion creates a future interest that reclaims ownership if conditions of the grant are unmet or terminated.

Possessory Estate

A possessory estate grants current property rights to a holder, while vesting ensures future ownership interest is secured to a specific party, and reversion returns estate ownership to the original grantor or their heirs upon termination of a prior estate.

Life Estate Pur Autre Vie

A Life Estate Pur Autre Vie grants property rights based on the lifespan of a third party, distinguishing vesting, where ownership rights transfer upon that life's end, from reversion, where property returns to the original grantor or their heirs.

Springing Interest

Springing interest activates after a specified event, impacting vesting by delaying ownership until conditions are met, unlike reversion where property returns to the grantor if the condition fails.

Future Interest

Future interest in property law involves rights that will begin in the future, where vesting ensures an immediate fixed entitlement to an interest, while reversion refers to the return of property rights to the original grantor after the expiration of a particular estate.

Condition Precedent

A condition precedent is a contractual requirement that must be fulfilled before vesting occurs, ensuring the transfer of rights or ownership, while non-fulfillment leads to reversion, returning the property or interest to the original grantor.

Vesting vs Reversion Infographic

moneydif.com

moneydif.com