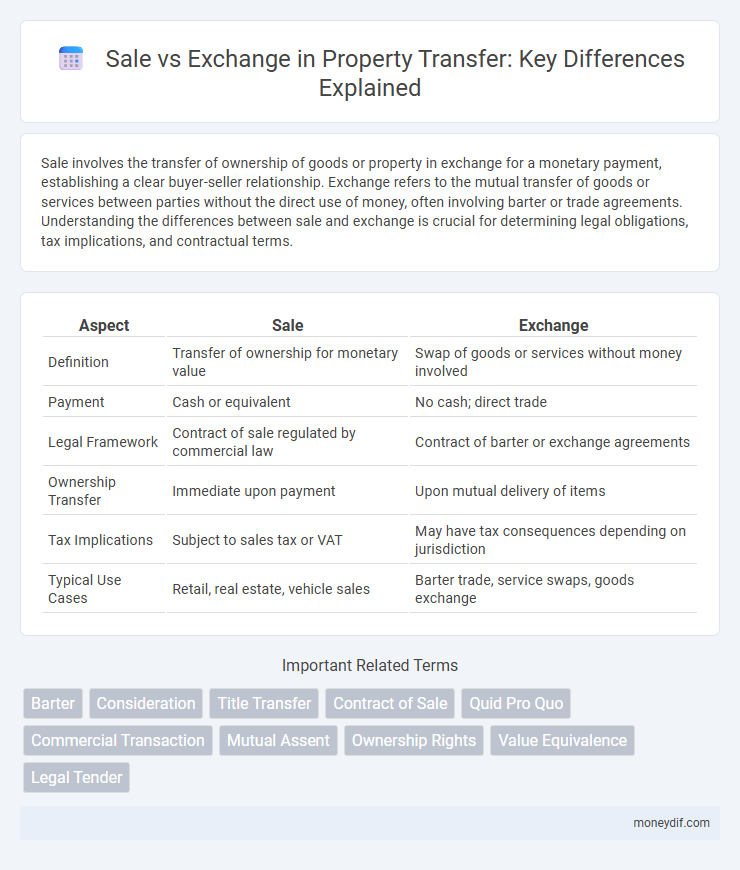

Sale involves the transfer of ownership of goods or property in exchange for a monetary payment, establishing a clear buyer-seller relationship. Exchange refers to the mutual transfer of goods or services between parties without the direct use of money, often involving barter or trade agreements. Understanding the differences between sale and exchange is crucial for determining legal obligations, tax implications, and contractual terms.

Table of Comparison

| Aspect | Sale | Exchange |

|---|---|---|

| Definition | Transfer of ownership for monetary value | Swap of goods or services without money involved |

| Payment | Cash or equivalent | No cash; direct trade |

| Legal Framework | Contract of sale regulated by commercial law | Contract of barter or exchange agreements |

| Ownership Transfer | Immediate upon payment | Upon mutual delivery of items |

| Tax Implications | Subject to sales tax or VAT | May have tax consequences depending on jurisdiction |

| Typical Use Cases | Retail, real estate, vehicle sales | Barter trade, service swaps, goods exchange |

Understanding the Basics: What is Sale vs Exchange?

Sale involves transferring ownership of goods or property in exchange for a monetary payment, creating a clear buyer-seller relationship. Exchange, also known as barter, entails swapping goods or services directly without using money, emphasizing equal value trade between parties. Understanding these fundamental differences aids in determining the legal and financial implications of each transfer method.

Legal Definitions: Sale and Exchange Compared

A sale involves the transfer of ownership of goods or property from the seller to the buyer for a monetary price, creating a contract that obliges the buyer to pay and the seller to deliver. An exchange entails the mutual transfer of ownership of goods or property between two parties without involving money, governed by a contract where each party agrees to transfer specific items. The key legal distinction lies in consideration: a sale requires a price, whereas an exchange is based on the reciprocal conveyance of goods or property.

Key Differences Between Sale and Exchange

Sale involves the transfer of ownership of goods or property for a definite price paid in money, creating a buyer-seller relationship. Exchange entails swapping goods or services between parties without monetary payment, emphasizing the equivalence of value in traded items. The primary difference lies in the involvement of monetary consideration in sales versus the barter system nature of exchanges.

Essential Features of a Sale Transaction

A sale transaction involves the transfer of ownership of goods or property from the seller to the buyer in exchange for a monetary price, which is the essential feature distinguishing it from an exchange. The agreement creates a binding contract where the seller is obligated to deliver the item, and the buyer is required to pay the specified amount. This monetary consideration and transfer of ownership rights define the legal framework of a sale transaction, contrasting with an exchange where goods or services are swapped without necessarily involving money.

Core Characteristics of an Exchange

An exchange involves the transfer of goods, services, or rights between parties with each providing something of value, unlike a sale where one party transfers ownership for money. Core characteristics of an exchange include mutual consent, reciprocal transfer, and the intention to negotiate value equivalently. The emphasis lies on the bilateral nature of the transaction, ensuring both parties receive consideration, distinguishing it from unilateral sales transactions.

Tax Implications: Sale vs Exchange

Sale transactions generate taxable capital gains based on the difference between sale price and adjusted cost base, resulting in immediate tax liabilities for the seller. Exchange transactions, often structured as like-kind exchanges under tax codes, defer capital gains taxes by transferring property without recognizing immediate gain or loss. Understanding these distinctions is essential for optimizing tax outcomes and compliance in property transfers.

Ownership Transfer: Sale versus Exchange

Ownership transfer through sale involves a definitive transfer of title from seller to buyer in exchange for a monetary consideration, ensuring clear and immediate change in property rights. In contrast, ownership transfer by exchange occurs when two parties mutually swap assets of equivalent value without cash involvement, effectively transferring ownership simultaneously. Legal implications differ as sale contracts typically require payment terms and warranties, whereas exchanges demand precise valuation and agreement on asset equivalency.

Rights and Liabilities in Sale and Exchange

In a sale, the transfer of ownership involves the seller passing all rights and liabilities related to the goods to the buyer, including risks and warranties. In an exchange, both parties simultaneously transfer ownership of different goods, with each assuming rights and liabilities corresponding to the exchanged items. The key distinction lies in the mutual transfer of rights and liabilities in exchange, whereas a sale involves a one-way transfer from seller to buyer.

Common Scenarios: When to Choose Sale or Exchange

In common transfer scenarios, a sale is preferred when immediate cash liquidity is the priority or when transferring ownership to unrelated parties. Exchanges are ideal in situations involving like-kind assets, such as real estate or equipment, where deferring capital gains taxes is advantageous. Businesses often choose exchanges to strategically reinvest in similar assets while preserving cash flow and tax benefits.

Conclusion: Making the Right Choice – Sale or Exchange

Selecting between a sale and an exchange hinges on financial goals, tax implications, and asset liquidity. Sales offer immediate cash flow and clear market value, while exchanges can defer capital gains taxes and facilitate asset diversification. Evaluating current market conditions, tax regulations, and long-term investment strategy ensures an optimal transfer decision.

Important Terms

Barter

Barter involves the direct exchange of goods or services without using money, contrasting with sales where transactions are conducted using currency.

Consideration

Consideration in Sale refers to the price paid for goods or services, while in Exchange it involves the mutual transfer of goods or services of equivalent value.

Title Transfer

Title transfer in a sale involves transferring ownership for monetary consideration, whereas in an exchange, ownership is transferred through the reciprocal transfer of properties without money.

Contract of Sale

A Contract of Sale involves transferring ownership of goods for a price, whereas an Exchange contract entails swapping goods or services without monetary payment.

Quid Pro Quo

Quid pro quo in sales involves a direct exchange of goods or services for monetary payment, whereas in exchanges it often implies a reciprocal transfer of goods or services without monetary consideration.

Commercial Transaction

A commercial transaction involves the sale when goods are transferred for monetary value, while an exchange entails trading goods or services without using money as a medium.

Mutual Assent

Mutual assent in sale requires agreement on price and transfer of ownership, whereas in exchange it involves consent to trade goods or services of equivalent value.

Ownership Rights

Ownership rights transfer immediately in a sale upon payment, while in an exchange, ownership rights are transferred mutually based on the agreed terms of the swap.

Value Equivalence

Value equivalence ensures that the monetary worth of assets exchanged in a sale matches precisely the value of assets swapped in an exchange transaction.

Legal Tender

Legal tender refers to the officially recognized currency that must be accepted for the settlement of debts and financial obligations. In the context of sale versus exchange, legal tender primarily facilitates sales transactions, where goods or services are transferred for money, unlike exchanges which involve reciprocal transfers of goods or services without monetary payment.

Sale vs Exchange Infographic

moneydif.com

moneydif.com