Dation and consignation are both legal mechanisms used to fulfill obligations when direct payment is hindered. Dation involves transferring ownership of a tangible asset to the creditor as full satisfaction of the debt, effectively substituting the original payment form. Consignation occurs when the debtor deposits the owed amount or goods with a court or authorized entity due to the creditor's refusal or inability to accept payment, ensuring the debt is legally settled.

Table of Comparison

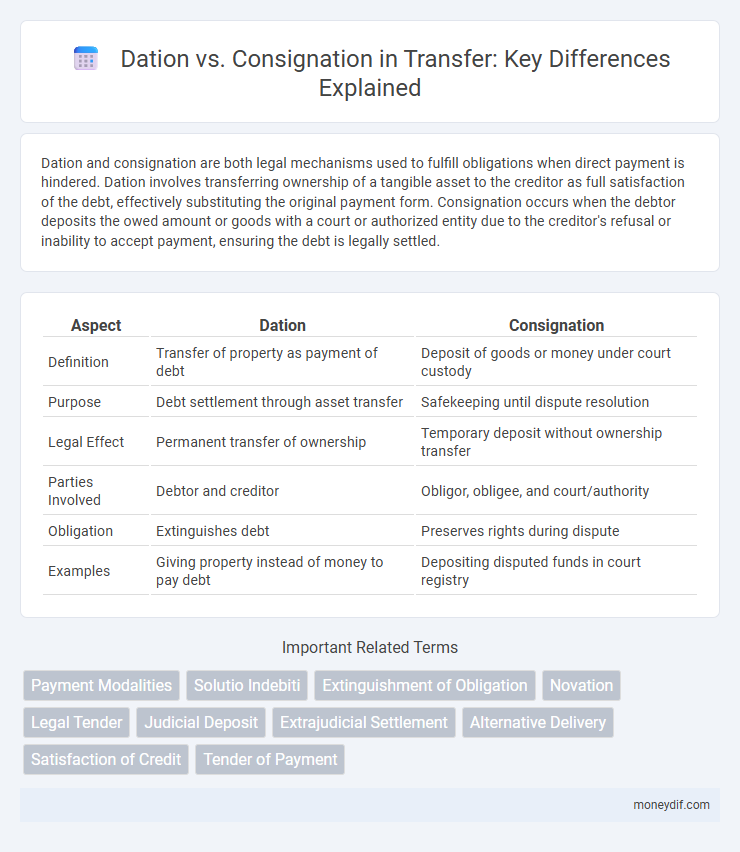

| Aspect | Dation | Consignation |

|---|---|---|

| Definition | Transfer of property as payment of debt | Deposit of goods or money under court custody |

| Purpose | Debt settlement through asset transfer | Safekeeping until dispute resolution |

| Legal Effect | Permanent transfer of ownership | Temporary deposit without ownership transfer |

| Parties Involved | Debtor and creditor | Obligor, obligee, and court/authority |

| Obligation | Extinguishes debt | Preserves rights during dispute |

| Examples | Giving property instead of money to pay debt | Depositing disputed funds in court registry |

Understanding Dation and Consignation: Key Concepts

Dation refers to the transfer of ownership of goods or property to satisfy an obligation, typically used when the debtor delivers an asset directly to the creditor as payment. Consignation involves depositing goods or money with a third party or court when the debtor is unable to deliver the owed item, protecting the debtor from liability until the creditor claims the consigned item. Understanding these key concepts clarifies the distinct legal mechanisms for fulfilling obligations through property transfer or secure deposit.

Legal Frameworks Governing Dation vs Consignation

The legal frameworks governing dation and consignation differ significantly, with dation typically regulated under property transfer laws that require consent and formal agreement for transferring ownership as payment of a debt. Consignation, on the other hand, falls under civil procedural codes allowing a debtor to deposit the owed amount or goods with a judicial or authorized entity when the creditor refuses to accept payment. This distinction ensures clear protocols for settling debts through property transfer (dation) versus judicial deposit (consignation) within their respective legal jurisdictions.

Core Differences Between Dation and Consignation

Dation involves the debtor transferring ownership of an asset to the creditor as full or partial payment of a debt, making it a direct method of debt settlement recognized under civil law. Consignation, however, is a procedure where the debtor deposits or hands over the owed amount or asset to a third party or court when the creditor refuses to accept payment, ensuring the debtor's obligation is legally fulfilled. The core difference lies in ownership transfer timing and acceptance: dation requires creditor acceptance for the transfer to settle debt, while consignation secures payment by depositing with an impartial entity, protecting the debtor from creditor refusal.

Essential Requirements for Dation in Payment

Dation in payment requires a valid underlying obligation and mutual agreement on the asset's value between debtor and creditor to ensure the transfer fulfills the debt. The transferred asset must be acceptable as payment, representing the exact or a negotiated portion of the debt, and properly delivered to effectuate the transfer. Unlike consignation, dation demands the creditor's explicit acceptance of the asset as satisfaction of the obligation.

Conditions Necessary for Valid Consignation

Valid consignation requires an uncontested debt or obligation, the debtor's offer to pay or deliver, and the creditor's refusal or unjustifiable delay in accepting performance. The debtor must consign the exact object or amount owed and ensure it is deposited with an appropriate third party, such as a public officer or court. Proper notification to the creditor about the consignation is essential to perfect the transfer and discharge the debtor's obligation legally.

Advantages and Disadvantages: Dation vs Consignation

Dation involves transferring ownership of goods or property to settle a debt, offering immediate debt relief but risking undervaluation of assets. Consignation allows the debtor to deposit goods with a third party until the creditor claims them, providing a temporary solution without transferring ownership but potentially leading to prolonged uncertainty and storage costs. Dation offers clear debt resolution, while consignation favors preservation of ownership with delayed settlement.

Common Scenarios for Applying Dation in Transfer

Dation in transfer often occurs in debt settlements where the debtor transfers ownership of goods or property to the creditor as full or partial payment. Common scenarios include real estate transfers to extinguish mortgage obligations or delivery of movable assets to satisfy monetary liabilities. This method streamlines the debt resolution process by substituting money with tangible assets agreed upon by both parties.

Practical Applications of Consignation in Transactions

Consignation facilitates secure asset transfers by allowing goods or funds to be held by a third party until contractual conditions are met, reducing risks in high-value or conditional transactions. It is commonly used in real estate deals, escrow services, and international trade where payment release depends on verification of delivery or compliance. This mechanism ensures transparency and trust between parties, minimizing disputes and enabling smoother transaction flows.

Dation and Consignation: Case Studies and Legal Precedents

Dation and consignation represent distinct legal mechanisms for fulfilling obligations through the transfer of assets, with dation involving direct delivery of goods or property to satisfy a debt, while consignation entails depositing the owed items with a third party when the creditor refuses acceptance. Legal precedents highlight key case studies where dation is recognized as full payment only when the debtor's transfer is accepted by the creditor, whereas consignation serves as a protective measure ensuring debtor compliance despite creditor non-receipt. Courts have consistently underscored the necessity of creditor acceptance in dation cases and emphasized consignation's role in transferring risk and fulfilling the debtor's obligation when direct handover is obstructed.

Choosing the Right Method: Factors to Consider in Asset Transfer

When choosing between dation and consignation for asset transfer, it is crucial to evaluate factors such as the nature of the asset, obligations of the parties involved, and legal implications tied to ownership transfer and debt settlement. Dation typically involves transferring ownership as a means of settling debt, making it suitable for creditors seeking direct claims on assets, whereas consignation focuses on depositing assets with a neutral third party when the debtor disputes the debt or refuses to accept payment. Understanding jurisdiction-specific regulations and the intended outcome of the transfer process ensures the selection of the most effective method for securing creditor rights and minimizing legal risks.

Important Terms

Payment Modalities

Payment modalities in dation involve transferring ownership of assets as payment, whereas consignation entails depositing funds or goods with a third party to fulfill an obligation when direct payment is contested or delayed.

Solutio Indebiti

Solutio Indebiti occurs when a debtor mistakenly pays a debt not owed, contrasting with Dation in Solutum where payment is made through transfer of property and Consignation involves judicial deposit when the creditor refuses payment.

Extinguishment of Obligation

Extinguishment of obligation occurs when the debtor fulfills the owed performance, with dation in payment representing the transfer of a different asset or right to satisfy the debt, contrasting with consignation where the debtor deposits the owed amount with a court or authorized entity due to the creditor's refusal or incapacity to accept payment. Dation extinguishes obligations through mutual agreement and acceptance, while consignation serves as a legal remedy ensuring obligation discharge despite creditor non-cooperation.

Novation

Novation involves substituting a new obligation for an existing one, extinguishing the original debt, whereas dation in payment (dation) refers to transferring property instead of money to satisfy a debt. Consignation allows the debtor to deposit payment with a judicial authority when the creditor refuses or is unable to accept it, legally discharging the debtor's obligation despite non-acceptance by the creditor.

Legal Tender

Legal tender defines the official currency accepted for settling debts, where dation entails the debtor transferring ownership of an asset directly to the creditor as payment, while consignation involves depositing the owed amount with a judicial authority when the creditor refuses or is unavailable to receive payment. The distinction affects the enforcement of obligations and legal recognition of payment, with legal tender facilitating clear discharge of debts especially in cases where dation or consignation procedures apply.

Judicial Deposit

Judicial deposit serves as a legal mechanism to safeguard disputed assets by depositing them with the court, distinctly differing from dation, which involves transferring property to settle obligations, and consignation, a process where the debtor offers payment to the creditor but the creditor refuses to accept it. This judicial procedure ensures proper handling of assets during litigation, preventing unauthorized use or transfer while disputes are resolved.

Extrajudicial Settlement

Extrajudicial settlement resolves property disputes without court intervention, while dation involves transferring assets to settle debts, and consignation deposits payment with a court when the creditor refuses to accept it.

Alternative Delivery

Alternative delivery methods such as dation in payment involve transferring ownership of goods or assets to settle a debt, whereas consignation requires depositing the owed amount or goods with a third party when the debtor cannot fulfill payment directly. Understanding the legal distinctions between dation, which extinguishes obligations upon transfer, and consignation, which safeguards the debtor's interests by involving a neutral custodian, is crucial in contractual dispute resolutions.

Satisfaction of Credit

Satisfaction of credit is achieved through dation by directly transferring the debtor's property to the creditor, whereas consignation involves depositing the owed amount with judicial authority when the creditor refuses to accept payment.

Tender of Payment

Tender of payment involves offering the exact amount owed, triggering legal effects distinct from dation in payment where property is transferred as settlement or consignation where payment is deposited with a third party pending acceptance.

Dation vs Consignation Infographic

moneydif.com

moneydif.com