Repossession involves the lender taking back property, typically personal assets like vehicles, due to default on a secured loan without court involvement. Foreclosure is a legal process where the lender seeks to recover the outstanding loan balance by selling the mortgaged real estate after the borrower defaults. Understanding the differences in procedure, asset type, and legal implications is crucial for borrowers facing financial difficulties.

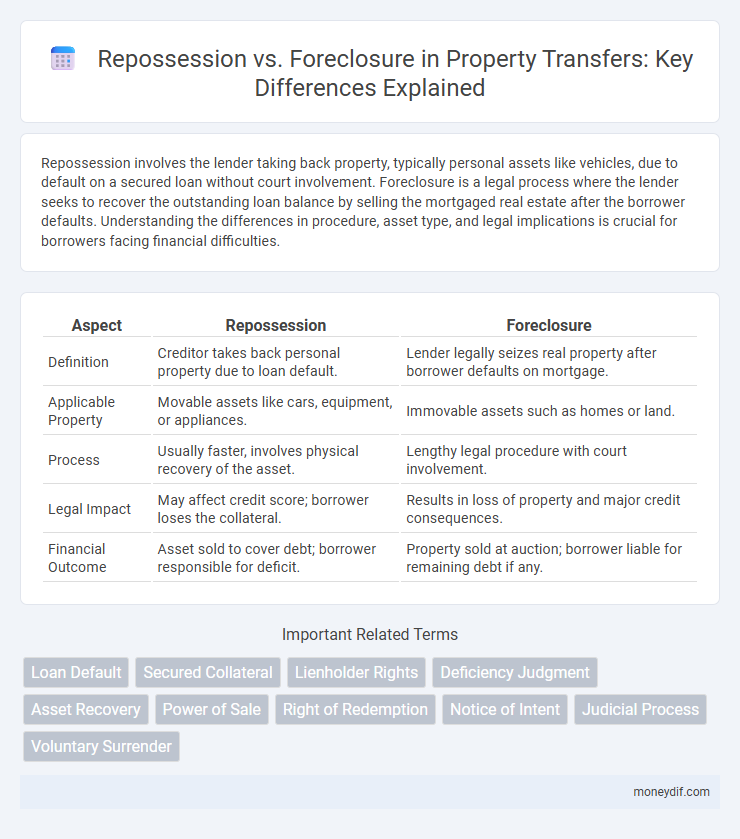

Table of Comparison

| Aspect | Repossession | Foreclosure |

|---|---|---|

| Definition | Creditor takes back personal property due to loan default. | Lender legally seizes real property after borrower defaults on mortgage. |

| Applicable Property | Movable assets like cars, equipment, or appliances. | Immovable assets such as homes or land. |

| Process | Usually faster, involves physical recovery of the asset. | Lengthy legal procedure with court involvement. |

| Legal Impact | May affect credit score; borrower loses the collateral. | Results in loss of property and major credit consequences. |

| Financial Outcome | Asset sold to cover debt; borrower responsible for deficit. | Property sold at auction; borrower liable for remaining debt if any. |

Understanding Repossession and Foreclosure: Key Definitions

Repossession occurs when a lender takes back property, typically vehicles or equipment, after the borrower defaults on loan payments, while foreclosure involves the legal process by which a lender attempts to recover the balance of a mortgage by forcing the sale of the home used as collateral. Both repossession and foreclosure serve as remedies for lenders to mitigate losses, but repossession usually pertains to personal property, and foreclosure applies specifically to real estate. Understanding these key definitions clarifies the nature of creditor rights and borrower obligations in secured loan agreements.

How Repossession Works: Vehicles, Assets, and Beyond

Repossession involves a lender reclaiming vehicles or assets when the borrower defaults on loan payments, typically without court involvement. Lenders often hire repossession agents who locate and seize the collateral, such as cars, trucks, or equipment, using tracking technology or inspection. After repossession, the lender may auction the items to recover outstanding debt, while borrowers must cover any remaining balance beyond the sale proceeds.

Foreclosure Explained: The Homeowner’s Guide

Foreclosure is a legal process that allows lenders to recover the balance of a loan by forcing the sale of the property used as collateral after the homeowner defaults on mortgage payments. Understanding foreclosure timelines, such as notice of default and auction dates, helps homeowners prepare and explore options like loan modification or short sale to avoid losing their home. Knowledge of state-specific laws and the distinction between judicial and non-judicial foreclosure can guide homeowners through the complex steps involved in this process.

Legal Processes: Comparing Repossession and Foreclosure

Repossession typically involves the lender reclaiming personal property, such as vehicles, due to loan default without court intervention, while foreclosure is a judicial or non-judicial process that enables lenders to recover real estate after a borrower's failure to meet mortgage obligations. Foreclosure proceedings often require notice, waiting periods, and can lead to public auction, whereas repossession is usually faster and limited to movable assets secured by a loan agreement. Understanding these distinct legal frameworks helps borrowers anticipate rights, timelines, and potential consequences in property recovery scenarios.

Financial Impacts: Credit Score and Long-Term Consequences

Repossession typically causes a significant immediate drop in credit score, often ranging from 100 to 160 points, while foreclosure can result in a more severe decline, sometimes exceeding 160 points. Both events remain on credit reports for up to seven years, negatively impacting loan eligibility and interest rates long-term. Foreclosure generally leads to longer-lasting damage due to the legal process involved, whereas repossession might be recoverable faster with proactive credit management.

Repossession vs Foreclosure: Major Differences

Repossession involves a lender reclaiming personal property, typically vehicles or movable assets, after default, while foreclosure is the legal process of selling real estate due to unpaid mortgage debt. Repossession usually occurs faster and without court intervention, whereas foreclosure requires judicial approval and can take several months. Key differences include the asset type, the legal procedures involved, and the impact on the borrower's credit report.

Rights and Protections for Borrowers

Borrowers facing repossession retain the right to redeem the property by paying the owed amount before the sale, ensuring protection through notice requirements and fair valuation. In foreclosure, borrowers are entitled to a redemption period varying by jurisdiction and must receive formal notification of the default and auction date. Both processes include legal safeguards that protect borrowers from unlawful seizure and allow for dispute resolution.

Avoiding Repossession and Foreclosure: Proactive Strategies

Avoiding repossession and foreclosure requires immediate communication with lenders to negotiate modified payment plans or forbearance options, reducing the risk of asset loss. Maintaining detailed financial records and seeking professional financial counseling can help identify early signs of distress and develop sustainable repayment strategies. Prioritizing timely payments and exploring loan refinancing or government assistance programs enhances the chances of retaining ownership and protecting credit scores.

Repossession vs Foreclosure: Which is More Common?

Repossession is more common in personal property loans, such as car loans, because lenders can reclaim the collateral without court involvement. Foreclosure primarily applies to real estate and often involves lengthy legal processes, making repossession faster and more frequent. Statistical data shows repossessions outnumber foreclosures due to the ease of reclaiming movable assets compared to real estate properties.

Recovery After Repossession or Foreclosure: Steps to Rebuild

Recovery after repossession or foreclosure involves assessing financial standing and creating a realistic budget to regain stability. Rebuilding credit begins with timely payments on current debts and may include secured credit cards or credit-builder loans. Seeking professional advice from credit counselors or legal experts enhances the chances of successful financial rehabilitation.

Important Terms

Loan Default

Loan default occurs when a borrower fails to meet debt repayment obligations, triggering legal actions like repossession and foreclosure. Repossession involves reclaiming personal property secured by the loan, while foreclosure pertains to the lender seizing real estate used as collateral to recover unpaid mortgage debt.

Secured Collateral

Secured collateral allows lenders to reclaim assets through repossession for personal property or foreclosure for real estate when borrowers default on secured loans.

Lienholder Rights

Lienholder rights grant the lender the legal authority to repossess collateral in repossession or initiate foreclosure to claim ownership of the property upon borrower default.

Deficiency Judgment

Deficiency judgment occurs when a foreclosure sale does not cover the full mortgage balance, allowing the lender to pursue the borrower for the remaining amount, whereas repossession involves reclaiming personal property without a deficiency judgment since the value is typically realized through the sale of the collateral. In foreclosure, the real estate is sold at auction, potentially leading to a deficiency judgment, while repossession specifically targets movable assets like vehicles or equipment, limiting lender recovery to the sale proceeds only.

Asset Recovery

Asset recovery involves reclaiming property through repossession, where a lender takes back an asset like a vehicle due to missed payments without court intervention, whereas foreclosure is a legal process to seize real estate property after borrower default on a mortgage. Repossession is typically faster and limited to movable assets, while foreclosure requires court approval and targets immovable assets.

Power of Sale

Power of Sale enables lenders to quickly repossess and sell property without court intervention, contrasting with foreclosure, which requires judicial approval to reclaim ownership.

Right of Redemption

The right of redemption allows a borrower to reclaim repossessed or foreclosed property by paying the full debt amount within a specified period, thereby preventing permanent transfer of ownership.

Notice of Intent

Notice of Intent serves as a formal declaration from a lender or creditor indicating their plan to initiate repossession or foreclosure proceedings due to borrower default. In repossession, this notice typically pertains to reclaiming personal property like vehicles, whereas in foreclosure, it signals the intent to seize and sell real property to satisfy a mortgage debt.

Judicial Process

Repossession involves reclaiming property after default without court proceedings, while foreclosure is a judicial or statutory process terminating ownership rights through court judgment.

Voluntary Surrender

Voluntary surrender allows borrowers to return collateral to lenders willingly, reducing costs and credit damage compared to repossession or foreclosure proceedings.

Repossession vs Foreclosure Infographic

moneydif.com

moneydif.com