Subrogation involves one party stepping into the shoes of another to enforce their rights, commonly used in insurance claims to recover costs from third parties. Delegation transfers the performance of a duty to a third party while the original obligor remains liable if the delegatee fails to perform. Understanding these distinctions is crucial for effectively managing contractual obligations and risk allocation.

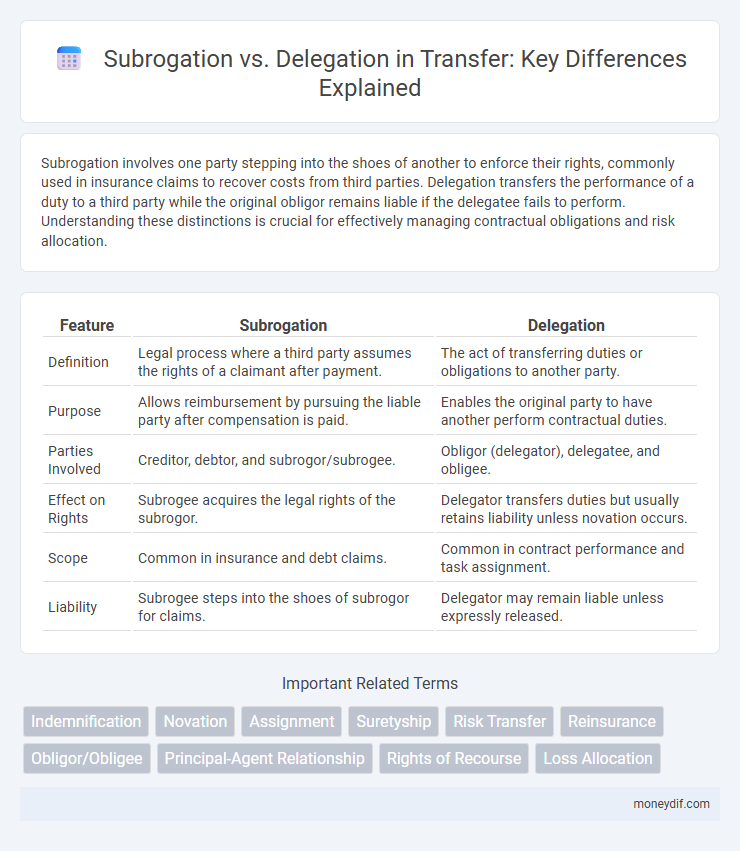

Table of Comparison

| Feature | Subrogation | Delegation |

|---|---|---|

| Definition | Legal process where a third party assumes the rights of a claimant after payment. | The act of transferring duties or obligations to another party. |

| Purpose | Allows reimbursement by pursuing the liable party after compensation is paid. | Enables the original party to have another perform contractual duties. |

| Parties Involved | Creditor, debtor, and subrogor/subrogee. | Obligor (delegator), delegatee, and obligee. |

| Effect on Rights | Subrogee acquires the legal rights of the subrogor. | Delegator transfers duties but usually retains liability unless novation occurs. |

| Scope | Common in insurance and debt claims. | Common in contract performance and task assignment. |

| Liability | Subrogee steps into the shoes of subrogor for claims. | Delegator may remain liable unless expressly released. |

Understanding Subrogation and Delegation

Subrogation involves one party stepping into the shoes of another to enforce their rights or claims, commonly occurring in insurance when an insurer seeks reimbursement from a third party. Delegation refers to transferring contractual duties or obligations to a third party while the original party remains liable if the delegate fails to perform. Understanding subrogation and delegation requires recognizing that subrogation transfers rights whereas delegation transfers performance obligations.

Key Differences Between Subrogation and Delegation

Subrogation involves one party stepping into the shoes of another to assume their legal rights, typically in insurance claims, allowing reimbursement for losses paid on behalf of the insured. Delegation refers to the transfer of contractual duties from one party to another, where the original obligor may still retain responsibility if the delegate fails to perform. Key differences include the nature of rights transferred, with subrogation focusing on rights recovery, while delegation centers on duty performance, and the liability retention, as subrogation extinguishes the original claimant's rights, whereas delegation often maintains the delegator's liability.

Legal Definitions: Subrogation vs Delegation

Subrogation legally allows one party to step into the shoes of another to enforce rights or claims, often used in insurance contexts where the insurer seeks reimbursement from a third party responsible for a loss. Delegation involves the transfer of contractual duties from one party to another, enabling the delegatee to perform the obligations originally assigned to the delegator, but the delegator typically remains liable for performance. Understanding the distinction is crucial: subrogation transfers the right to enforce a claim, while delegation transfers the duty to perform a contract.

When to Use Subrogation in Contracts

Subrogation is used in contracts primarily when one party has paid a debt or fulfilled an obligation on behalf of another and seeks to step into the original party's legal shoes to recover the amount from a third party responsible for the loss. This mechanism is crucial in insurance agreements, where insurers pay claims and pursue reimbursement from liable third parties. Employing subrogation clauses ensures clarity in rights transfer and efficient recovery processes without altering the original contractual obligations between the principal parties.

Delegation of Duties: Core Principles

Delegation of duties involves the transfer of contractual obligations from the original obligor to a third party, who then assumes responsibility for performance. The delegator remains liable unless the obligee explicitly releases them from the obligation, ensuring that delegation does not extinguish the original duty. Courts typically require clear consent from the obligee and emphasize that delegation cannot impair the obligee's rights or materially change the contract terms.

Advantages and Limitations of Subrogation

Subrogation allows an insurer to step into the shoes of the insured to recover costs from a third party, ensuring financial reimbursement and reducing claim expenses. Its advantages include minimizing insurer losses and promoting accountability by holding liable parties responsible for damages. Limitations involve potential delays in recovery, complexities in proving fault, and restrictions based on policy terms or jurisdictional laws.

Risks and Challenges in Delegation

Delegation in legal and contractual contexts carries significant risks, including the potential for decreased accountability when the delegatee fails to perform as expected, which can complicate enforcement and recovery efforts. Unlike subrogation, where rights and obligations transfer entirely to the subrogee, delegation often results in multiple parties bearing responsibility, increasing the likelihood of disputes and confusion over liability. Challenges also arise from the need to ensure the delegatee's competence and reliability, as inadequate performance or non-compliance can lead to financial losses and damage to the delegator's reputation.

Real-World Examples of Subrogation

In insurance claims, subrogation allows an insurer to pursue a third party responsible for a policyholder's loss after indemnifying the insured, such as when a car insurer seeks compensation from a negligent driver's insurer. Real estate transactions often involve subrogation when a mortgage lender pays off the borrower's debt and then steps into the borrower's shoes to recover funds from a guarantor. In workers' compensation, employers may use subrogation to recover medical expenses from a third party who caused the employee's injury, illustrating how subrogation enforces financial responsibility across parties in various sectors.

Common Scenarios for Delegation in Business

Delegation in business commonly occurs when a manager assigns specific tasks or authority to a subordinate while retaining ultimate responsibility for the outcome. Examples include delegating contract performance to a third party or authorizing an employee to sign documents on behalf of the company. This practice streamlines operations and enhances efficiency without transferring underlying contractual obligations.

How to Choose: Subrogation or Delegation?

Choosing between subrogation and delegation depends on the nature of the contractual obligations and the desired legal outcomes. Subrogation is appropriate when a party seeks to step into another's shoes to recover rights or claims, often used in insurance to claim reimbursement. Delegation suits scenarios where the obligor transfers contractual duties to a third party, but liability typically remains with the original obligor unless novation occurs.

Important Terms

Indemnification

Indemnification involves one party compensating another for losses or damages, often including rights of subrogation, where the indemnitor steps into the indemnified party's shoes to pursue recovery from third parties. Unlike delegation, which transfers duties to a third party, subrogation focuses on the transfer of legal rights for reimbursement after indemnification has occurred.

Novation

Novation is a contract law concept where the original obligation is replaced by a new one, transferring both rights and duties to a third party, unlike subrogation which involves a third party stepping into the shoes of the original creditor to enforce the debt without altering the original obligation. Delegation differs by allowing a party to appoint another to perform an obligation while remaining liable for its fulfillment, whereas novation extinguishes the original contract and creates a new one involving different parties.

Assignment

Assignment involves transferring contractual rights to a third party, whereas subrogation allows a party to step into another's shoes to enforce rights, and delegation refers to transferring contractual duties without relieving the original party of obligation.

Suretyship

Suretyship involves a guarantor assuming responsibility for a debtor's obligation, enabling the surety to exercise subrogation rights to recover payments from the principal debtor. In contrast, delegation transfers contractual duties to a third party without necessarily conferring the right to enforce claims, distinguishing it from the surety's subrogation mechanism.

Risk Transfer

Risk transfer mechanisms such as subrogation allow an insurer to step into the shoes of the insured to recover losses from a third party, while delegation involves assigning specific duties or obligations to another party to mitigate potential liabilities. Understanding the distinctions between subrogation and delegation is critical for effective risk management in insurance contracts and legal agreements.

Reinsurance

Reinsurance involves the ceding insurer transferring risk to a reinsurer, where subrogation allows the reinsurer to pursue recovery from third parties after indemnification, while delegation assigns specific claims handling responsibilities without transferring legal rights.

Obligor/Obligee

In legal terms, the obligor is the party required to perform an obligation, while the obligee is the party entitled to receive performance; subrogation transfers the obligee's rights to a third party, enabling them to step into the obligee's position, whereas delegation involves the obligor appointing a third party to fulfill their duty without transferring the contractual rights. Subrogation typically occurs in insurance claims or debt settlements, allowing the subrogee to pursue recovery from the obligor, while delegation focuses on the obligor's responsibility and consent in executing contractual duties through another party.

Principal-Agent Relationship

The principal-agent relationship involves an agent acting on behalf of the principal, with subrogation allowing the principal to step into the agent's legal rights after fulfilling an obligation, whereas delegation permits the agent to transfer duties but not the underlying rights without the principal's consent. Understanding the distinction clarifies liability and authority boundaries in contract and legal contexts.

Rights of Recourse

Rights of recourse enable one party to seek reimbursement from another after fulfilling an obligation, often emerging in subrogation scenarios where an insurer gains the insured's legal claims against a third party. Delegation differs by involving the transfer of duty performance to a third party without necessarily conveying the right to seek recourse, limiting the delegatee's liability in the process.

Loss Allocation

Loss allocation involves determining financial responsibility, where subrogation allows one party to pursue recovery from a third party after paying a loss, while delegation transfers contractual duties but not liabilities between parties.

Subrogation vs Delegation Infographic

moneydif.com

moneydif.com