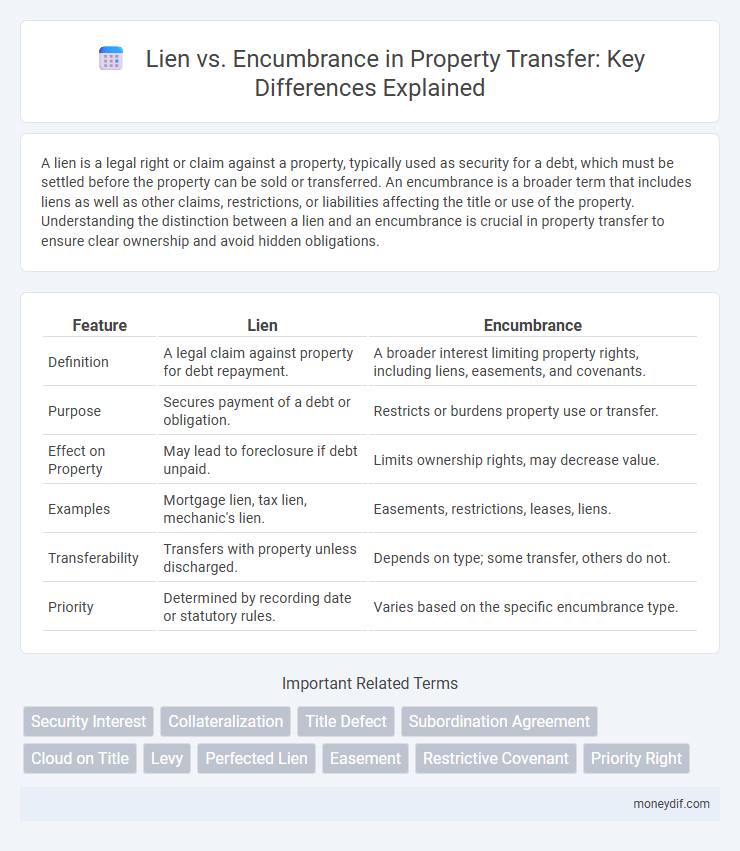

A lien is a legal right or claim against a property, typically used as security for a debt, which must be settled before the property can be sold or transferred. An encumbrance is a broader term that includes liens as well as other claims, restrictions, or liabilities affecting the title or use of the property. Understanding the distinction between a lien and an encumbrance is crucial in property transfer to ensure clear ownership and avoid hidden obligations.

Table of Comparison

| Feature | Lien | Encumbrance |

|---|---|---|

| Definition | A legal claim against property for debt repayment. | A broader interest limiting property rights, including liens, easements, and covenants. |

| Purpose | Secures payment of a debt or obligation. | Restricts or burdens property use or transfer. |

| Effect on Property | May lead to foreclosure if debt unpaid. | Limits ownership rights, may decrease value. |

| Examples | Mortgage lien, tax lien, mechanic's lien. | Easements, restrictions, leases, liens. |

| Transferability | Transfers with property unless discharged. | Depends on type; some transfer, others do not. |

| Priority | Determined by recording date or statutory rules. | Varies based on the specific encumbrance type. |

Understanding Transfer: Lien vs Encumbrance

A lien represents a legal claim or hold on an asset, typically used as collateral to secure a debt or obligation, restricting the owner from transferring full ownership until the lien is satisfied. Encumbrance broadly includes any claim, lien, charge, or liability attached to property that may diminish its value or restrict its transferability. Understanding the distinction between lien and encumbrance is crucial in property transfer processes, as liens specifically denote secured debts, while encumbrances encompass all possible restrictions affecting the title.

Key Differences Between Liens and Encumbrances

Liens are legal claims or holds on property as security for a debt, granting the lienholder the right to satisfy the debt from the property's value upon default. Encumbrances encompass a broader category of claims, restrictions, or liabilities attached to property, including liens, easements, and covenants, which can affect ownership and transferability. Unlike liens that specifically secure payment obligations, encumbrances may not always involve debts but still impact the property's marketability and use.

Impact of Liens on Property Transfer

Liens significantly impact property transfer by legally restricting the owner's ability to sell or refinance until the debt securing the lien is satisfied. These claims create a financial burden on the lienholder, as the property cannot be transferred free and clear without addressing the lien. Encumbrances, including liens, reduce marketability and may require negotiation or settlement to clear title during the property transaction.

How Encumbrances Affect Ownership Rights

Encumbrances limit property ownership rights by imposing legal claims or restrictions without outright ownership transfer, impacting the owner's ability to sell or use the property freely. Liens represent specific types of encumbrances where creditors hold a security interest in the property until debts are settled, directly affecting an owner's clear title. Understanding the nature and impact of encumbrances is critical for property transfer, as they can reduce property value and complicate ownership rights.

Types of Liens in Property Transactions

Types of liens in property transactions include voluntary liens such as mortgages, where the property owner consents to the lien as security for a loan, and involuntary liens like tax liens or mechanic's liens, which are imposed by law due to unpaid taxes or services rendered. Specific liens encompass judgment liens resulting from court rulings and equitable liens based on fairness principles. Understanding the distinctions among these liens is essential for clear property title transfers and protecting creditor and buyer rights.

Common Encumbrances in Real Estate Transfers

Common encumbrances in real estate transfers include liens, easements, and restrictive covenants, which affect the property's title and usage rights. A lien represents a legal claim on a property, often resulting from unpaid debts such as mortgages, tax obligations, or mechanics' liens, potentially complicating ownership transfer until settled. Understanding the nature of these encumbrances is crucial for buyers and sellers to ensure clear title transfer and avoid future legal disputes.

Legal Implications of Liens During Transfer

Liens create a legal claim against property, restricting the owner's ability to transfer clear title until the debt or obligation is satisfied. Encumbrances, while broader in scope, may include liens but also cover easements or restrictions that do not necessarily interfere with ownership transfer. During property transfer, outstanding liens must be resolved to avoid legal disputes or clouded titles, ensuring the new owner acquires unencumbered rights.

Resolving Encumbrances Before Property Transfer

Resolving encumbrances before property transfer is crucial to ensure clear title and prevent legal disputes. Liens, a specific type of encumbrance, must be satisfied or released through payment or legal action to allow the transfer to proceed unimpeded. Failure to address liens or other encumbrances can lead to delayed closings and potential financial liabilities for the property buyer.

Title Search: Identifying Liens and Encumbrances

A title search meticulously examines public records to identify any existing liens or encumbrances that could affect property ownership. Liens, such as mortgages or tax debts, represent legal claims against the property, while encumbrances may include easements or restrictions limiting property use. Accurate identification ensures clear title transfer and safeguards buyers from undisclosed financial or legal obligations.

Best Practices for a Smooth Property Transfer

Clearing all liens before a property transfer prevents legal disputes and ensures clear title ownership. Conducting a thorough title search identifies existing encumbrances, allowing buyers and sellers to address issues proactively. Employing professional title insurance safeguards against unforeseen claims, fostering a smooth and secure property transfer process.

Important Terms

Security Interest

A security interest creates a lien, which is a specific type of encumbrance granting a creditor legal claim over collateral until debt obligations are fulfilled.

Collateralization

Collateralization involves pledging assets to secure a loan, where a lien specifically grants the lender a legal right to the collateral until the debt is fulfilled, whereas an encumbrance broadly refers to any claim or restriction on property that may affect its transferability or value. Understanding the distinction between lien and encumbrance is critical for accurately assessing the risk and legal implications of collateralized agreements.

Title Defect

A title defect occurs when a lien or encumbrance improperly restricts property ownership, reducing the owner's clear title rights and marketability.

Subordination Agreement

A Subordination Agreement legally prioritizes liens by ranking one lien below another, altering the typical order of encumbrances on a property title.

Cloud on Title

Cloud on title refers to any claim, lien, or encumbrance that may impair the clear ownership of a property and must be resolved before sale or transfer.

Levy

Levy refers to the legal seizure of property to satisfy a debt, often resulting from a lien, which is a legal claim against the property as security for payment. Unlike an encumbrance, which broadly includes any claim or liability on property that may affect its value or transfer, a lien specifically grants the creditor a right to enforce the debt through property seizure.

Perfected Lien

A perfected lien legally establishes a creditor's priority claim on a property, distinguishing it from a general encumbrance by ensuring enforceability against third parties.

Easement

An easement is a non-possessory interest granting usage rights over a property, classified as an encumbrance but distinct from a lien, which is a financial claim against the property.

Restrictive Covenant

A restrictive covenant limits property use and is a type of encumbrance that differs from a lien, which is a legal claim ensuring debt repayment.

Priority Right

Priority right determines the order of lien enforcement, where liens hold a superior claim over general encumbrances on a property.

Lien vs Encumbrance Infographic

moneydif.com

moneydif.com