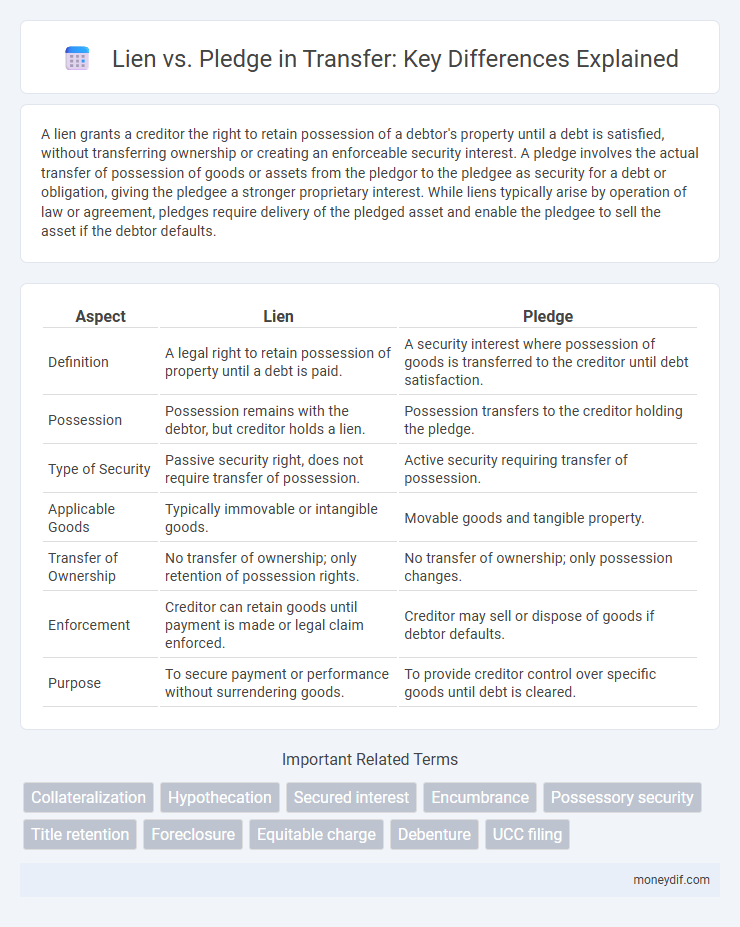

A lien grants a creditor the right to retain possession of a debtor's property until a debt is satisfied, without transferring ownership or creating an enforceable security interest. A pledge involves the actual transfer of possession of goods or assets from the pledgor to the pledgee as security for a debt or obligation, giving the pledgee a stronger proprietary interest. While liens typically arise by operation of law or agreement, pledges require delivery of the pledged asset and enable the pledgee to sell the asset if the debtor defaults.

Table of Comparison

| Aspect | Lien | Pledge |

|---|---|---|

| Definition | A legal right to retain possession of property until a debt is paid. | A security interest where possession of goods is transferred to the creditor until debt satisfaction. |

| Possession | Possession remains with the debtor, but creditor holds a lien. | Possession transfers to the creditor holding the pledge. |

| Type of Security | Passive security right, does not require transfer of possession. | Active security requiring transfer of possession. |

| Applicable Goods | Typically immovable or intangible goods. | Movable goods and tangible property. |

| Transfer of Ownership | No transfer of ownership; only retention of possession rights. | No transfer of ownership; only possession changes. |

| Enforcement | Creditor can retain goods until payment is made or legal claim enforced. | Creditor may sell or dispose of goods if debtor defaults. |

| Purpose | To secure payment or performance without surrendering goods. | To provide creditor control over specific goods until debt is cleared. |

Understanding the Basics: What is a Lien vs a Pledge?

A lien is a legal right or interest a creditor has in the debtor's property, typically used as security for the payment of a debt, allowing the creditor to retain possession until the obligation is fulfilled. A pledge involves the delivery of personal property by the debtor to the creditor as collateral for a loan or obligation, where the creditor holds possession with the intention of returning it once the debt is repaid. Understanding the distinction lies in possession and control: liens may confer a right without actual possession, whereas pledges require physical custody of the pledged item.

Key Legal Differences Between Lien and Pledge

A lien grants a creditor a legal right to retain possession of a debtor's property until a debt is paid, without transferring ownership, whereas a pledge involves the actual delivery of goods or assets to the creditor as security for the debt. In a lien, the debtor retains ownership but loses possession, while in a pledge, the creditor holds possession but ownership remains with the debtor. The enforceability of a lien relies on possession without formal transfer, but a pledge requires explicit transfer of possession with a contractual agreement.

Types of Liens and Pledges in Financial Transactions

Liens in financial transactions typically include consensual liens like mortgages and car loans, statutory liens such as tax liens, and judgment liens arising from court decisions. Pledges involve the transfer of possession but not ownership of collateral, commonly categorized into pawn pledges, where goods are held as security for a debt, and financial pledges, such as securities pledged to secure a loan. Understanding these types helps clarify the creditor's rights and the mechanisms for securing obligations in asset-based financing.

Rights and Obligations of Parties in Lien vs Pledge

In a lien, the lienholder acquires a possessory right over the debtor's property as security for a debt without transferring ownership, obligating the lienholder to preserve the asset and return it once the debt is discharged. In a pledge, the pledgor transfers possession of the goods to the pledgee, who holds both possession and a limited property interest, with the pledgee obligated to return the goods after repayment and use due care during possession. The debtor retains ownership in both cases, but the pledgee's rights are stronger due to possession and proprietary interest, creating distinct legal obligations for safekeeping and enforcement between lien and pledge arrangements.

Transfer of Ownership: How Lien and Pledge Differ

A lien grants a creditor the right to retain possession of an asset until the debt is settled, without transferring ownership to the creditor. In contrast, a pledge involves the actual transfer of possession to the pledgee as security, while ownership remains with the pledgor until repayment. This fundamental difference affects the rights of sale and control over the asset during the security period.

Enforcement Procedures: Lien vs Pledge Explained

Enforcement procedures for liens involve the lienholder retaining possession of the asset until the underlying obligation is satisfied, often requiring court approval to sell or dispose of the asset. In contrast, pledge enforcement allows the pledgee to sell the pledged property without prior court intervention upon debtor default, typically following specified contractual terms or statutory guidelines. Both mechanisms secure creditor rights, but pledges provide more immediate remedies, whereas liens depend on possession and legal authorization for enforcement actions.

Risks and Protections for Creditors in Liens vs Pledges

Liens provide creditors with a legal claim on a debtor's property until the underlying obligation is satisfied, presenting risks such as difficulty in property liquidation due to potential disputes over lien validity. Pledges involve the creditor holding possession of a tangible asset, offering stronger protection through physical control but carrying risks of asset depreciation or loss during possession. Creditors benefit from liens by having a secured interest without asset custody, while pledges ensure asset control, reducing default risk but requiring careful management to avoid asset damage.

Real-World Examples of Liens and Pledges in Property Transfer

Liens commonly arise in real estate when a mortgage lender secures debt by placing a lien on the property until the loan is repaid. Pledges are frequently used in personal property, such as when a borrower hands over valuable jewelry to a pawnbroker as collateral for a loan. Unlike pledges, liens do not require physical possession, as exemplified by tax liens imposed on properties for unpaid taxes, enabling the government to claim interest or seize assets if debts remain unsettled.

Termination and Release: Ending a Lien vs a Pledge

Termination of a lien occurs when the underlying debt secured by the lien is fully paid or legally satisfied, resulting in the automatic release of the lien on the property. In contrast, releasing a pledge requires the explicit return of the pledged asset to the pledgor once the secured obligation is fulfilled, ensuring the transfer of possession back to the owner. While lien termination primarily affects property titles or public records, pledge release involves physical or constructive handover of the pledged collateral.

Choosing the Right Security: When to Use Lien or Pledge

Choosing the right security interest between lien and pledge depends on the nature of the collateral and control requirements. A lien grants a creditor the right to retain possession of the debtor's property until the obligation is fulfilled without transferring ownership, suitable for real estate and personal property. In contrast, a pledge involves transferring possession and control of movable assets to the creditor as security for a debt, providing stronger protection in cases where the creditor requires greater assurance of repayment.

Important Terms

Collateralization

Collateralization involves securing a loan by granting a lien, which creates a legal claim on property without transfer of possession, or a pledge, where possession of the collateral is transferred to the lender until the debt is repaid.

Hypothecation

Hypothecation is a security interest where the debtor retains possession of the asset while granting the creditor a charge, differing from a lien which often involves possession by the creditor, and from a pledge where the creditor physically holds the pledged asset. Unlike pledge, hypothecation does not transfer possession, and unlike lien, it is typically created through contract rather than operation of law.

Secured interest

A secured interest grants a creditor legal rights over collateral through a lien, which merely restricts the debtor's rights, or a pledge, where the creditor holds possession of the specific property until the debt is satisfied.

Encumbrance

Encumbrance refers to a legal claim on property that restricts ownership rights, with a lien being a creditor's right to retain property until a debt is paid, while a pledge involves delivering possession of an asset as security for a debt without transferring ownership.

Possessory security

Possessory security involves a creditor holding physical possession of a debtor's property as collateral, differentiating a lien--where possession secures payment without transfer of title--from a pledge, which includes a contractual transfer of possession while the pledgor retains ownership.

Title retention

Title retention secures ownership until full payment, differing from a lien that grants a creditor a legal claim and a pledge that involves transferring possession as collateral.

Foreclosure

Foreclosure occurs when a lienholder enforces their legal claim to recover debt by selling a pledged asset used as collateral.

Equitable charge

An equitable charge is a security interest granted over an asset without transferring possession, creating a lien that binds the asset but does not confer ownership, whereas a pledge requires delivering possession to the creditor to secure the debt. In contrast to a pledge, the equitable charge allows the debtor to retain control while providing the creditor with a floating or fixed charge enforceable in equity.

Debenture

A debenture is a long-term debt instrument backed primarily by the issuer's creditworthiness rather than specific collateral, whereas a lien represents a legal claim or hold on an asset to secure payment of a debt, and a pledge involves the actual delivery of movable property to the creditor as security. Unlike a pledge, which requires possession transfer, a lien can be created without possession, making debentures typically unsecured or sometimes secured by a lien on company assets rather than a pledge.

UCC filing

UCC filing secures a creditor's interest by publicizing a lien on a debtor's property, whereas a pledge involves the physical delivery of collateral to the creditor without necessarily requiring public filing.

Lien vs Pledge Infographic

moneydif.com

moneydif.com