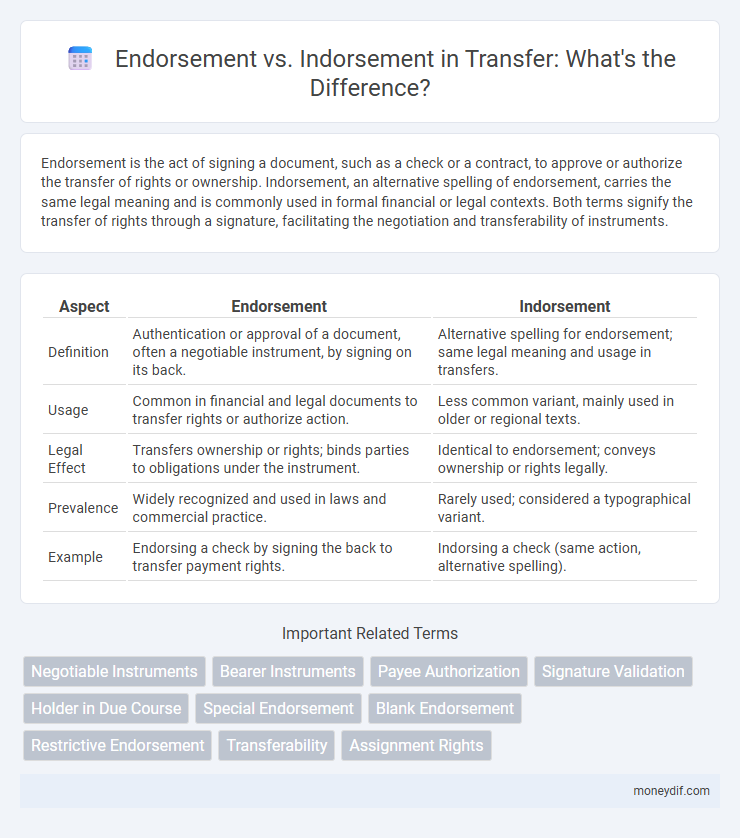

Endorsement is the act of signing a document, such as a check or a contract, to approve or authorize the transfer of rights or ownership. Indorsement, an alternative spelling of endorsement, carries the same legal meaning and is commonly used in formal financial or legal contexts. Both terms signify the transfer of rights through a signature, facilitating the negotiation and transferability of instruments.

Table of Comparison

| Aspect | Endorsement | Indorsement |

|---|---|---|

| Definition | Authentication or approval of a document, often a negotiable instrument, by signing on its back. | Alternative spelling for endorsement; same legal meaning and usage in transfers. |

| Usage | Common in financial and legal documents to transfer rights or authorize action. | Less common variant, mainly used in older or regional texts. |

| Legal Effect | Transfers ownership or rights; binds parties to obligations under the instrument. | Identical to endorsement; conveys ownership or rights legally. |

| Prevalence | Widely recognized and used in laws and commercial practice. | Rarely used; considered a typographical variant. |

| Example | Endorsing a check by signing the back to transfer payment rights. | Indorsing a check (same action, alternative spelling). |

Meaning and Definition: Endorsement vs Indorsement

Endorsement refers to the act of signing the back of a negotiable instrument, such as a check or promissory note, to transfer ownership or authorize payment, ensuring the instrument's negotiability. Indorsement is an alternative spelling of endorsement used primarily in legal and historical contexts but holds the same meaning related to the transfer of rights in financial documents. Both terms signify the process by which the holder of a negotiable instrument endorses it to another party, facilitating the instrument's legal transfer and negotiation.

Historical Origins of Both Terms

Endorsement and indorsement both stem from Latin origins, with "endorsement" derived from the Old French "endosser," meaning "to put on the back," specifically in the context of writing on the back of a document to signify approval or transfer. "Indorsement" shares the same root but represents an older English legal term for signing the back of a negotiable instrument to validate the transfer of rights. Historically, endorsement gained broader use in commercial law, while indorsement appears more frequently in earlier English common law documents related to property and contract assignments.

Legal Usage: Endorsement in Financial Transfers

Endorsement in financial transfers refers to the legal act of signing the back of a negotiable instrument, such as a check or promissory note, to assign ownership or authorize payment. This process ensures the validity and enforceability of the instrument during transfer, facilitating secure transactions in banking and commerce. Understanding the legal implications of endorsement is crucial to prevent unauthorized transfers and maintain the integrity of financial operations.

Indorsement in Negotiable Instruments Law

Indorsement in Negotiable Instruments Law refers to the signature or statement added by the holder on a negotiable instrument, such as a check or promissory note, thereby transferring title and rights to another party. Unlike endorsement, which broadly means approval or support, indorsement specifically facilitates negotiation by enabling the instrument's transferability and enforceability. The indorser assumes secondary liability, ensuring the instrument's payment if the primary obligor defaults.

Key Differences Between Endorsement and Indorsement

Endorsement and indorsement both refer to the act of signing a document, typically a negotiable instrument, to transfer rights, but endorsement is the modern term widely used in legal and financial contexts. Endorsement usually implies the transfer of ownership or rights by signing the back of a check or promissory note, making it negotiable to the bearer or a specified person. Indorsement, an older term with the same meaning, is less commonly used today but historically referred to the same process of signing for transfer or validation.

Common Applications in Modern Transactions

Endorsement and indorsement are often used interchangeably in modern transactions, primarily referring to the signing of negotiable instruments like checks, promissory notes, and bills of exchange to transfer rights. Endorsements facilitate the seamless transfer of these financial instruments, enabling holders to negotiate or assign payment rights to others efficiently. Common applications include endorsing checks for deposit or transfer, and indorsements in commercial paper to secure payment or ownership rights in business dealings.

Endorsement vs Indorsement in Banking Context

Endorsement in banking refers to the act of signing the back of a negotiable instrument, such as a check, to transfer ownership or authorize payment. Indorsement is an alternative spelling of endorsement primarily used in legal and financial documents but holds the same meaning in banking contexts. Both terms facilitate the transferability of financial instruments, ensuring the rightful holder can claim funds or negotiate further.

Transfer of Ownership: Which Term Applies?

Endorsement applies to the transfer of ownership in negotiable instruments like checks and promissory notes, where the holder signs the instrument to assign rights to another party. Indorsement is an alternative spelling of endorsement, both legally recognized but endorsement is the standard term used in modern legal and financial contexts. Understanding this distinction is crucial for accurate execution and validation of ownership transfers in financial transactions.

Importance of Correct Terminology in Transfers

Using correct terminology in transfer processes is crucial to avoid legal disputes and ensure smooth transactions; "endorsement" refers to the formal signature on a negotiable instrument that signifies the transfer of ownership, while "indorsement" is an alternative spelling often found in older or regional documents. Proper understanding and application of "endorsement" in contracts, drafts, and checks clarify parties' intentions and rights, reducing ambiguity. Misusing or confusing these terms can lead to invalid transfers, questioning the instrument's negotiability and enforceability.

Summary Table: Endorsement vs Indorsement

Endorsement involves the signature on a negotiable instrument to transfer ownership or rights, typically categorized as blank, special, or restrictive endorsements. Indorsement, an older variant spelling, holds the same legal implication but is less commonly used in modern financial documentation. The summary table highlights key differences, emphasizing endorsement's formal acceptance in transactional processes and standard banking terminology.

Important Terms

Negotiable Instruments

Negotiable instruments require proper endorsement, which is the legal transfer of ownership, while indorsement refers specifically to the written signature or instruction on the instrument facilitating its negotiation.

Bearer Instruments

Bearer instruments facilitate transferability without endorsement, whereas endorsement is required to transfer order instruments, differentiating negotiation processes in negotiable instruments law.

Payee Authorization

Payee authorization involves granting permission to transfer a negotiable instrument, where endorsement legally signifies the payee's consent to further negotiation or payment; the term "indorsement" is an older spelling variant rarely used today but carries the same legal meaning as endorsement. Proper endorsement ensures clear title transfer and protects the payee's rights, minimizing disputes in financial transactions.

Signature Validation

Signature validation ensures the authenticity and integrity of endorsements, distinguishing legally binding endorsements from informal indorsements in document processing.

Holder in Due Course

A Holder in Due Course acquires a negotiable instrument through proper indorsement, which legally transfers ownership and differs from a mere endorsement that may lack specific legal effect.

Special Endorsement

Special Endorsement specifies a particular person or entity as the endorsee, legally distinguishing it from a general endorsement that transfers rights to any bearer, while "indorsement" is an alternative spelling of endorsement.

Blank Endorsement

Blank endorsement involves signing only the back of a negotiable instrument without naming a specific endorsee, unlike an endorsement that explicitly designates the recipient, making the instrument payable to the bearer and freely negotiable.

Restrictive Endorsement

Restrictive endorsement limits the negotiability of a financial instrument by specifying conditions for further transfer, contrasting with general endorsement which permits free transferability.

Transferability

Transferability of negotiable instruments depends on endorsement, where the transferor signs on the instrument itself, versus indorsement, which may involve separate documents or endorsements specifying conditions.

Assignment Rights

Assignment rights transfer ownership of a claim or contract, often requiring endorsement--a formal signature on a negotiable instrument--while indorsement specifically refers to the act of signing such instruments to validate or transfer ownership rights.

endorsement vs indorsement Infographic

moneydif.com

moneydif.com