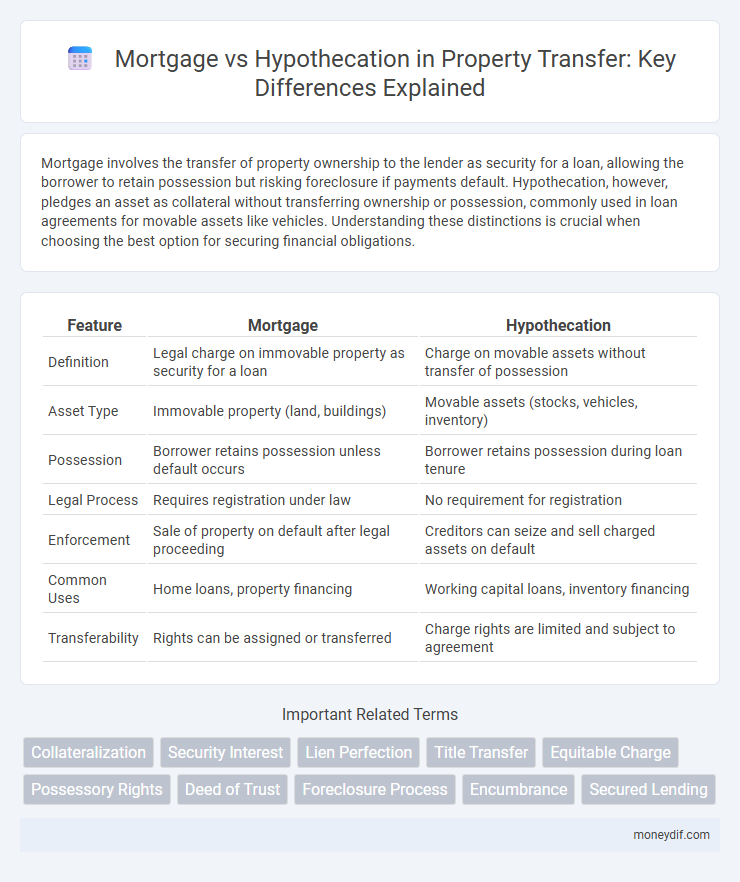

Mortgage involves the transfer of property ownership to the lender as security for a loan, allowing the borrower to retain possession but risking foreclosure if payments default. Hypothecation, however, pledges an asset as collateral without transferring ownership or possession, commonly used in loan agreements for movable assets like vehicles. Understanding these distinctions is crucial when choosing the best option for securing financial obligations.

Table of Comparison

| Feature | Mortgage | Hypothecation |

|---|---|---|

| Definition | Legal charge on immovable property as security for a loan | Charge on movable assets without transfer of possession |

| Asset Type | Immovable property (land, buildings) | Movable assets (stocks, vehicles, inventory) |

| Possession | Borrower retains possession unless default occurs | Borrower retains possession during loan tenure |

| Legal Process | Requires registration under law | No requirement for registration |

| Enforcement | Sale of property on default after legal proceeding | Creditors can seize and sell charged assets on default |

| Common Uses | Home loans, property financing | Working capital loans, inventory financing |

| Transferability | Rights can be assigned or transferred | Charge rights are limited and subject to agreement |

Understanding the Concept of Transfer in Mortgage and Hypothecation

Mortgage involves the transfer of ownership rights of an immovable property to the lender as security for a loan, whereas hypothecation entails pledging movable assets without transferring ownership. The concept of transfer in a mortgage is absolute and registered, ensuring the lender's claim on the property until the debt is repaid; hypothecation creates a charge over the asset, allowing the borrower to retain possession and ownership. Understanding these differences is crucial for evaluating secured credit options and the legal ramifications of transferring interest in collateral.

Key Definitions: Mortgage vs Hypothecation Explained

Mortgage involves transferring ownership of a property as security for a loan, allowing the lender legal rights to sell the asset if the borrower defaults. Hypothecation entails pledging an asset as collateral without transferring ownership, commonly used for movable assets like vehicles or stocks. Understanding these distinctions is crucial for borrowers and lenders in financial agreements and risk management.

Legal Framework Governing Transfer in Mortgages

The legal framework governing transfer in mortgages involves the formal conveyance of interest in immovable property as security for a loan, typically requiring a registered mortgage deed under the Transfer of Property Act, 1882. Unlike hypothecation, which grants possession of movable assets without transferring ownership, mortgage transfers create a legal charge on the property that must be recorded to be enforceable. This statutory requirement ensures priority of claims and protection for lenders by establishing clear ownership and lien rights in real estate transactions.

Legal Implications of Transfer in Hypothecation

Hypothecation involves the transfer of security interest without transferring possession, creating a charge on the asset while the borrower retains ownership and use. Legally, this means the lender's rights are limited to the asset specified in the agreement, with enforcement rights triggered only upon borrower default, reflecting a conditional transfer of interest. Unlike mortgages, hypothecation does not convey title or possession, making the legal implications primarily centered on lien creation and the borrower's continued control until default.

Ownership Transfer: Mortgage vs Hypothecation

Mortgage involves the transfer of ownership rights to the lender as collateral for the loan, allowing the lender to sell the property if the borrower defaults. Hypothecation does not transfer ownership but pledges movable assets as security, keeping ownership with the borrower while granting the lender a charge on the asset. This distinction is crucial for understanding the legal implications and risk control in secured lending agreements.

Transfer of Rights and Interests: Comparative Analysis

Mortgage and hypothecation both transfer rights and interests but differ in security and possession. In a mortgage, the mortgagor transfers the title or interest in property to the mortgagee as security for debt, often involving registration and public recording. Hypothecation allows the borrower to retain ownership and possession while granting the lender a charge over movable assets, creating a conditional transfer of interests that activates upon default.

Documentation Required for Transfer under Both Models

Mortgage transfer requires extensive documentation, including the original loan agreement, title deed, mortgage deed, no-objection certificate from the lender, and property valuation reports, ensuring clear ownership and lien details. Hypothecation transfer documentation primarily comprises the hypothecation agreement, stock or asset statements, lender consent letters, and updated security agreements, focusing on movable asset collateral rather than real estate title. Both models necessitate formal registration and verification to legally effect the transfer and safeguard lender interests.

Impact of Transfer on Lenders and Borrowers

Mortgage transfer directly affects lenders by allowing them to assign loan ownership and associated security interests to third parties, enhancing liquidity but requiring borrower notification to maintain legal enforceability. Borrowers experience a shift in payment handling and creditor relationships, which may involve changes in loan servicing but no alteration in loan terms. Hypothecation transfer impacts lenders by necessitating reassignment of charge rights without collateral possession, while borrowers retain possession and responsibilities, ensuring continuity of secured obligations under the transferred hypothecation.

Risks Associated with Transfer: Mortgage vs Hypothecation

Mortgage involves transferring ownership rights of the property to the lender until the loan is fully paid, increasing the risk of losing the asset if default occurs. Hypothecation, unlike mortgage, allows the borrower to retain ownership while the lender holds a charge on the asset, but risks include repossession without a transfer of title in case of non-payment. Both methods carry financial risks, with mortgage posing higher risk through legal ownership transfer and hypothecation limiting asset control but enforcing lender claims.

Choosing the Right Transfer Method: Factors to Consider

Choosing the right transfer method between mortgage and hypothecation depends on factors such as asset ownership, registration requirements, and legal implications. Mortgages typically involve immovable property and require formal registration, offering stronger security to lenders. Hypothecation suits movable assets, allowing debtors to retain possession without transferring title, but it may involve more complex enforcement processes.

Important Terms

Collateralization

Collateralization involves using an asset as security for a loan, with a mortgage specifically granting ownership rights over real property to the lender, while hypothecation pledges assets without transferring ownership.

Security Interest

Security interest in mortgage involves transferring legal title of the property to the lender as collateral, ensuring repayment security, whereas hypothecation creates a charge or lien on the asset without transferring ownership, commonly used for movable property. Mortgages provide stronger creditor rights through possession and sale authority, while hypothecation offers flexible security without physical asset transfer, typically in secured loans and financial credit lines.

Lien Perfection

Lien perfection ensures a mortgage grants the lender a prioritized legal claim on the property as collateral, whereas hypothecation allows the borrower to retain ownership while offering the asset as security without transferring possession.

Title Transfer

Title transfer involves legally transferring property ownership to the lender in a mortgage, whereas hypothecation allows the borrower to retain ownership while using the asset as collateral for a loan.

Equitable Charge

Equitable charge is a non-possessory security interest that allows lenders to claim specific assets as collateral in mortgage agreements, differing from hypothecation where the debtor retains possession of the asset without transferring title.

Possessory Rights

Possessory rights in mortgage transfers legal ownership and possession to the lender, while hypothecation allows the borrower to retain possession of the property as security for the loan.

Deed of Trust

A Deed of Trust involves a third-party trustee holding the property title as security for a mortgage loan, whereas hypothecation allows a borrower to pledge an asset as collateral without transferring ownership.

Foreclosure Process

The foreclosure process differs between mortgage and hypothecation as foreclosure under a mortgage grants the lender a lien on the property allowing sale upon default, whereas hypothecation involves a security interest without transfer of possession, often requiring legal action to claim the underlying asset.

Encumbrance

Encumbrance represents a legal claim against a property, reducing its value or restricting its use, commonly seen in mortgage and hypothecation agreements. Mortgages involve transferring the title deed as security for a loan, while hypothecation allows the borrower to retain ownership and possession of movable assets pledged as collateral.

Secured Lending

Secured lending through mortgages involves transferring ownership of real property as collateral, whereas hypothecation secures a loan by pledging movable assets without transferring ownership rights.

Mortgage vs Hypothecation Infographic

moneydif.com

moneydif.com