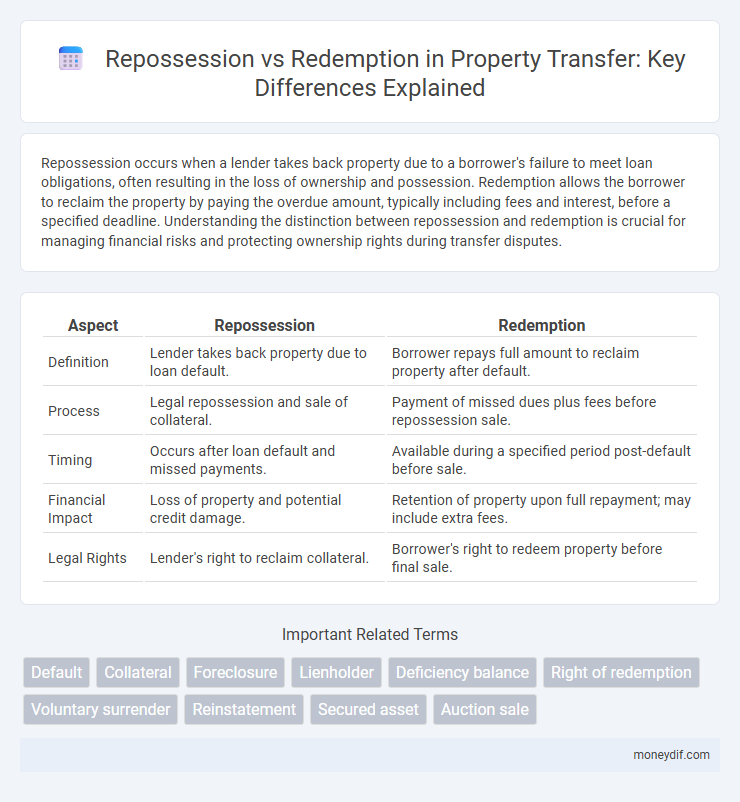

Repossession occurs when a lender takes back property due to a borrower's failure to meet loan obligations, often resulting in the loss of ownership and possession. Redemption allows the borrower to reclaim the property by paying the overdue amount, typically including fees and interest, before a specified deadline. Understanding the distinction between repossession and redemption is crucial for managing financial risks and protecting ownership rights during transfer disputes.

Table of Comparison

| Aspect | Repossession | Redemption |

|---|---|---|

| Definition | Lender takes back property due to loan default. | Borrower repays full amount to reclaim property after default. |

| Process | Legal repossession and sale of collateral. | Payment of missed dues plus fees before repossession sale. |

| Timing | Occurs after loan default and missed payments. | Available during a specified period post-default before sale. |

| Financial Impact | Loss of property and potential credit damage. | Retention of property upon full repayment; may include extra fees. |

| Legal Rights | Lender's right to reclaim collateral. | Borrower's right to redeem property before final sale. |

Understanding Repossession: Key Concepts

Repossession occurs when a lender takes back property due to the borrower's failure to meet payment obligations, typically under a secured loan agreement such as an auto or mortgage loan. Understanding repossession involves grasping key legal concepts like default, the lender's right to reclaim collateral, and the borrower's potential loss of ownership without prior consent. This process is governed by state laws and contract terms, which dictate how repossession must be conducted and the borrower's options afterward.

What is Redemption in Asset Transfers?

Redemption in asset transfers refers to the process by which a borrower recovers ownership of repossessed property by paying off the outstanding debt, including any fees and interest. This legal right allows the debtor to reclaim the asset before the lender finalizes the foreclosure or sale. Understanding redemption is crucial for borrowers to prevent permanent loss of assets during repossession proceedings.

Legal Framework for Repossession and Redemption

The legal framework for repossession and redemption governs the rights of creditors and debtors during asset recovery and payment settlement processes. Repossession laws specify conditions under which a secured party may reclaim collateral upon default, typically requiring compliance with non-judicial or judicial procedures outlined in the Uniform Commercial Code (UCC) or relevant state statutes. Redemption statutes permit debtors to reclaim repossessed property by paying the full outstanding debt plus any allowable costs before the final sale or disposal of the asset.

Differences Between Repossession and Redemption

Repossession occurs when a lender takes back property due to borrower default, effectively terminating the borrower's ownership rights. Redemption allows the borrower to reclaim the repossessed property by paying the total amount owed, including fees, before the lender sells it. The key difference lies in repossession being the lender's enforcement action, while redemption offers the borrower a chance to restore ownership.

The Process of Repossession Explained

The process of repossession begins when a borrower defaults on a secured loan, prompting the lender to reclaim the collateral, commonly vehicles or real estate, to recover the owed amount. Repossession typically involves a legal notice period, followed by the physical seizure of the asset, ensuring compliance with state laws to avoid wrongful repossession claims. The lender then sells the repossessed asset at auction or via private sale, with any remaining debt beyond the sale proceeds still owed by the borrower unless redeemed.

Steps Involved in Redemption Rights

Redemption rights involve specific steps such as notifying the lender of intent to redeem, paying the full amount owed including principal, interest, and any applicable fees, and completing the transaction within the redemption period set by law. Borrowers must ensure compliance with state-specific deadlines and documentation requirements to successfully exercise redemption rights. Failure to meet these obligations results in loss of the right to reclaim the property after repossession.

Impact of Repossession on Borrowers

Repossession significantly impacts borrowers by damaging their credit scores, reducing access to future credit, and often leading to financial instability due to loss of collateral. The process may result in additional fees and legal consequences if the repossession proceeds to deficiency judgments. Consequently, borrowers face increased difficulty in securing loans or favorable terms, hindering their overall financial recovery.

Redemption as a Way to Prevent Asset Loss

Redemption allows borrowers to reclaim repossessed assets by paying the outstanding debt, including fees and interest, before the lender completes the sale, effectively preventing permanent asset loss. This legal right safeguards ownership and provides a critical opportunity to resolve default without forfeiting valuable property. Timely redemption preserves credit standing and mitigates long-term financial damage associated with repossession.

Financial Implications: Repossession vs. Redemption

Repossession results in immediate loss of the asset and typically impacts credit scores, leading to potential difficulties in obtaining future financing. Redemption requires paying the full debt amount plus additional fees to retrieve the asset, often resulting in higher overall costs but preserving credit standing. Understanding the financial implications of repossession versus redemption is crucial for managing debt recovery and long-term financial health.

Choosing Between Repossession and Redemption

Choosing between repossession and redemption depends on the borrower's financial capacity and the lender's policies. Repossession allows the lender to reclaim the collateral asset after default, while redemption gives the borrower the opportunity to recover the asset by paying off the outstanding debt plus fees. Evaluating the legal implications, costs involved, and potential impact on credit scores helps determine the most suitable option.

Important Terms

Default

Default occurs when a borrower fails to meet loan obligations, triggering repossession by the lender while redemption allows the borrower to reclaim the property by paying the owed amount before the repossession is finalized.

Collateral

Collateral serves as security in repossession cases, allowing creditors to reclaim assets upon default, while redemption permits borrowers to repay owed amounts to reclaim collateral before final sale.

Foreclosure

Foreclosure permanently transfers property ownership to the lender, repossession allows reclaiming collateral for unpaid debts, and redemption enables the former owner to reclaim the property by paying the full amount owed before the foreclosure sale.

Lienholder

A lienholder holds a legal claim on a vehicle during repossession, allowing them to reclaim the asset until the borrower redeems it by paying off the outstanding debt.

Deficiency balance

Deficiency balance arises when the sale of a repossessed asset fails to cover the outstanding loan amount, leaving the borrower responsible for the remaining debt. Redemption allows the borrower to pay off the deficiency balance by repurchasing the repossessed property before it is sold, thereby preventing further credit damage.

Right of redemption

The right of redemption allows a borrower to reclaim repossessed property by paying the full debt amount plus any associated costs before the lender sells the item.

Voluntary surrender

Voluntary surrender allows a borrower to return collateral to the lender, impacting the repossession process and influencing the borrower's ability to redeem the property by paying the owed balance.

Reinstatement

Reinstatement allows borrowers to stop repossession by paying overdue amounts before the property is sold, while redemption enables them to recover ownership by paying the full balance even after repossession.

Secured asset

Secured assets serve as collateral in financial agreements, enabling lenders to repossess the property upon borrower default to recover outstanding debt. Redemption rights allow borrowers to reclaim the repossessed secured asset by paying the full amount owed before the lender completes the sale or foreclosure process.

Auction sale

Auction sales in repossession cases occur when a lender sells a secured asset to recover outstanding debt after the borrower defaults, while redemption allows the borrower to reclaim the asset by paying the full owed amount before the auction date. Understanding the legal timelines and financial implications of repossession versus redemption is crucial for both lenders and borrowers to protect their rights and minimize losses.

Repossession vs Redemption Infographic

moneydif.com

moneydif.com