Vesting involves acquiring ownership rights over assets or shares gradually, typically through a predetermined schedule that encourages commitment and long-term engagement. Divesting refers to the process of selling or disposing of assets or investments to reallocate resources or reduce risk exposure. Understanding the strategic balance between vesting and divesting is crucial for optimizing portfolio management and financial growth.

Table of Comparison

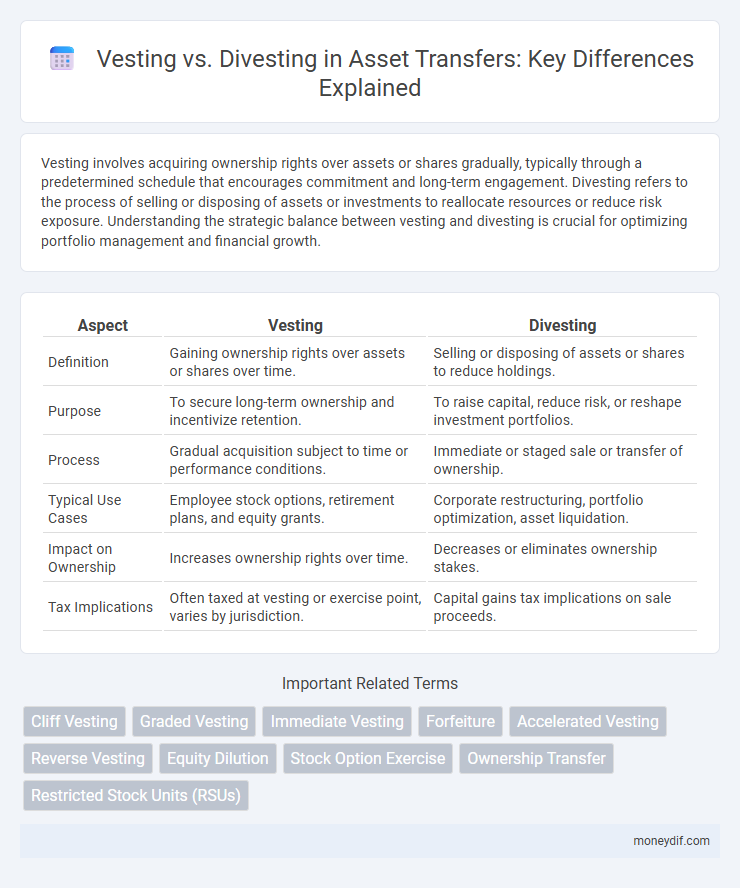

| Aspect | Vesting | Divesting |

|---|---|---|

| Definition | Gaining ownership rights over assets or shares over time. | Selling or disposing of assets or shares to reduce holdings. |

| Purpose | To secure long-term ownership and incentivize retention. | To raise capital, reduce risk, or reshape investment portfolios. |

| Process | Gradual acquisition subject to time or performance conditions. | Immediate or staged sale or transfer of ownership. |

| Typical Use Cases | Employee stock options, retirement plans, and equity grants. | Corporate restructuring, portfolio optimization, asset liquidation. |

| Impact on Ownership | Increases ownership rights over time. | Decreases or eliminates ownership stakes. |

| Tax Implications | Often taxed at vesting or exercise point, varies by jurisdiction. | Capital gains tax implications on sale proceeds. |

Understanding Vesting and Divesting: Key Definitions

Vesting refers to the process by which an individual gains full ownership of certain assets or rights, typically stock options or retirement benefits, after fulfilling specific conditions or time requirements. Divesting involves the deliberate act of selling or liquidating assets, investments, or subsidiaries to reallocate resources or reduce exposure. Understanding vesting and divesting is crucial for effective asset management and strategic financial planning.

Types of Vesting: Graded, Cliff, and Immediate

Types of vesting determine how and when employees gain ownership of transferred assets or stock options. Graded vesting awards ownership incrementally over a specified period, allowing partial access at intervals, while cliff vesting grants full ownership only after a set time, with no partial benefits beforehand. Immediate vesting confers complete ownership rights from the moment of transfer, providing instant control over the asset or equity.

The Mechanics of Divesting: How Assets are Released

Divesting involves the systematic release of assets through structured transactions such as sales, spin-offs, or asset write-offs, enabling organizations to reallocate capital and focus on core operations. The mechanics of divesting require thorough asset valuation, regulatory compliance, and strategic timing to maximize financial returns and minimize operational disruptions. Effective divesting strategies leverage detailed due diligence and clear contractual frameworks to ensure smooth transfer and ownership transitions.

Vesting vs. Divesting: Core Differences Explained

Vesting refers to the process by which an individual gains ownership of assets or benefits over time, typically linked to conditions such as employment duration or performance milestones. Divesting involves the deliberate act of selling or disposing of assets, often to reallocate resources or reduce exposure to certain investments. Understanding the core differences between vesting and divesting is crucial for effective financial planning and asset management strategies.

Legal Implications in Vesting and Divesting

Vesting legally grants an individual unconditional rights to assets or benefits, often linked to employment contracts and stock options, ensuring protection against forfeiture once vested. Divesting involves the legal process of selling or disposing of assets, which may trigger regulatory compliance requirements, tax obligations, and contractual restrictions. Understanding the legal frameworks governing vesting and divesting is crucial to mitigate risks such as breach of contract, tax penalties, and regulatory violations.

Impact on Employees: Vesting Periods and Benefits

Vesting periods significantly affect employee motivation and retention by defining the timeline for earning full ownership of benefits such as stock options or retirement plans. An extended vesting schedule can encourage long-term commitment but may cause dissatisfaction if perceived as too restrictive. Conversely, divesting, or the loss of unvested benefits upon departure, can result in financial setbacks and decreased employee morale.

Divesting in Business: Strategies and Best Practices

Divesting in business involves the strategic sale or liquidation of assets, subsidiaries, or business units to improve financial health or focus on core operations. Key strategies include thorough market analysis, identifying non-core or underperforming assets, and timing the divestment to maximize value and minimize disruption. Best practices emphasize clear communication with stakeholders, detailed due diligence, and reinvestment of proceeds into high-growth areas to drive long-term profitability.

Tax Considerations for Vesting and Divesting

Vesting triggers tax events when ownership rights to assets or shares become non-forfeitable, often resulting in ordinary income tax based on the fair market value at the time of vesting. Divesting, or the sale of vested assets, typically incurs capital gains tax, calculated on the difference between the sale price and the asset's basis established at vesting. Understanding the timing and valuation during vesting and divesting is crucial for optimizing tax liabilities and compliance.

Common Scenarios Involving Vesting and Divesting

Common scenarios involving vesting include employee stock options, where shares become fully owned over a predetermined period, and retirement plans, where benefits accrue progressively. In contrast, divesting typically occurs when investors or companies reduce holdings by selling assets to reallocate capital, manage risk, or comply with regulatory requirements. These scenarios highlight the strategic importance of timing and ownership rights in financial and corporate transfers.

Choosing Between Vesting and Divesting: Factors to Consider

Choosing between vesting and divesting requires careful analysis of financial goals, tax implications, and risk tolerance. Vesting ensures gradual ownership transfer with potential tax advantages, while divesting provides immediate liquidity but may trigger taxable events. Evaluating market conditions and long-term investment strategies is crucial to optimize asset management and maximize returns.

Important Terms

Cliff Vesting

Cliff vesting grants full ownership of retirement benefits only after a specified period, contrasting with divesting, which involves the partial or complete loss of assets or rights.

Graded Vesting

Graded vesting allows employees to earn ownership of benefits incrementally over a set period, contrasting with cliff vesting where full ownership occurs all at once. This system ensures a proportional accumulation of rights, reducing the risk of divesting unvested shares when employees leave before complete vesting.

Immediate Vesting

Immediate vesting grants full ownership of equity or benefits instantly, contrasting with standard vesting schedules that gradually transfer rights, while divesting refers to the process of selling or relinquishing those vested assets.

Forfeiture

Forfeiture occurs when vested property rights are lost due to divesting conditions, reversing ownership despite prior vesting.

Accelerated Vesting

Accelerated vesting enables employees to gain ownership of stock options faster than the typical vesting schedule, contrasting with divesting, which involves selling or disposing of those vested shares.

Reverse Vesting

Reverse vesting secures founder equity by gradually transferring ownership back to the company if conditions like continued involvement are unmet, contrasting with standard vesting which grants ownership over time, while divesting involves selling or disposing of owned shares.

Equity Dilution

Equity dilution occurs when new shares are issued, reducing the ownership percentage of existing shareholders, often linked to vesting schedules that allocate shares over time to employees or founders. Divesting involves selling or disposing of equity, which can counteract dilution by reducing one's stake or redistributing ownership among shareholders.

Stock Option Exercise

Stock option exercise depends on vesting schedules that grant the right to purchase shares over time, while divesting involves selling those vested shares, influencing liquidity and tax strategies.

Ownership Transfer

Ownership transfer involves vesting to grant equity rights over time and divesting to sell or relinquish those rights, directly impacting control and investment value.

Restricted Stock Units (RSUs)

Restricted Stock Units (RSUs) undergo vesting, a process where employees earn shares over a predetermined schedule, granting ownership rights progressively. Divesting RSUs involves selling shares after they have vested, enabling liquidity but potentially triggering tax obligations based on the holding period and capital gains regulations.

Vesting vs Divesting Infographic

moneydif.com

moneydif.com