Encumbrance refers to any claim, lien, or liability attached to property that may restrict its transfer or use, while a charge specifically denotes a legal or financial claim placed on an asset as security for a debt. Understanding the difference is crucial in property transfers because encumbrances can be broader, including easements or leases, whereas charges primarily relate to secured debts. Both affect the title's freedom but charges typically must be settled or agreed upon during a transfer to clear the property's title.

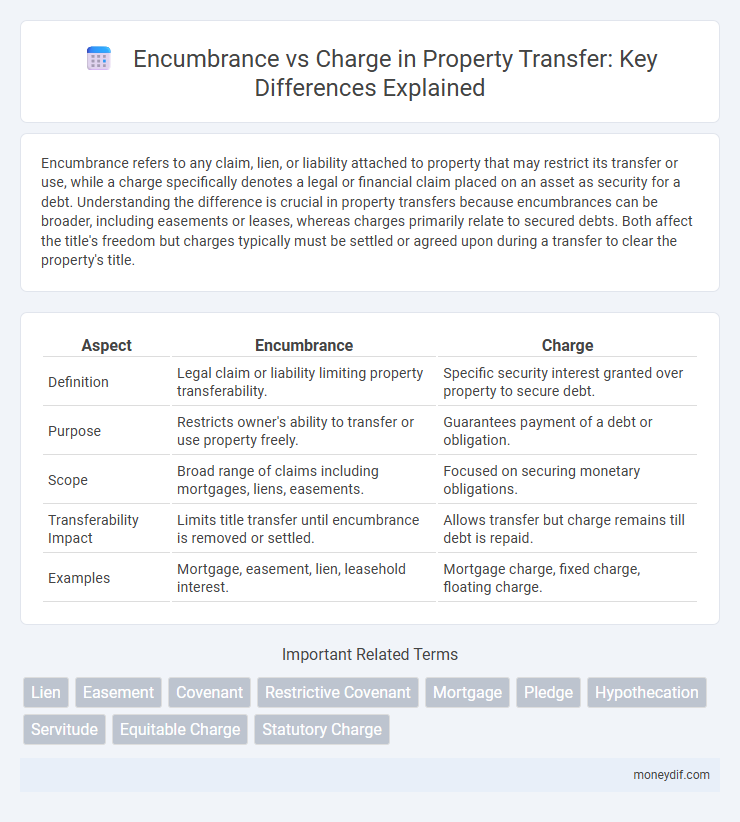

Table of Comparison

| Aspect | Encumbrance | Charge |

|---|---|---|

| Definition | Legal claim or liability limiting property transferability. | Specific security interest granted over property to secure debt. |

| Purpose | Restricts owner's ability to transfer or use property freely. | Guarantees payment of a debt or obligation. |

| Scope | Broad range of claims including mortgages, liens, easements. | Focused on securing monetary obligations. |

| Transferability Impact | Limits title transfer until encumbrance is removed or settled. | Allows transfer but charge remains till debt is repaid. |

| Examples | Mortgage, easement, lien, leasehold interest. | Mortgage charge, fixed charge, floating charge. |

Understanding Encumbrance and Charge in Property Transfer

Encumbrance refers to any legal claim or liability attached to a property, such as easements or liens, that can limit the owner's ability to transfer full rights. Charge, specifically in property transfer, typically denotes a financial obligation secured against the property, like a mortgage or loan repayment requirement. Understanding the distinction between encumbrance and charge is crucial for evaluating property liabilities and ensuring clear title transfer during transactions.

Key Differences Between Encumbrance and Charge

Encumbrance refers to any claim, lien, or liability attached to property that may restrict its transfer or use, while a charge specifically denotes a financial claim secured against an asset, often to guarantee repayment of a debt. Encumbrances may include easements, leases, or restrictions impacting ownership rights, whereas charges are primarily concerned with securing creditor interests through legal means such as mortgages or fixed charges. Understanding these distinctions is crucial for accurately assessing property rights and obligations during the transfer process.

Legal Definitions: Encumbrance vs Charge

Encumbrance refers to a legal claim or liability attached to property that can affect its transferability but does not necessarily involve the transfer of ownership rights. A charge specifically denotes a security interest granted over an asset, ensuring the performance of an obligation, typically a debt, and often allows the creditor to seize the asset upon default. Understanding the distinction between encumbrance and charge is crucial for assessing property titles and the extent of legal restrictions impacting ownership and transfer.

Impact of Encumbrance and Charge on Property Transactions

Encumbrance and charge significantly affect property transactions by restricting the owner's ability to freely transfer or use the property, often requiring clearance before sale or refinancing. An encumbrance, such as a lien or easement, limits property rights and can lower market value by signaling potential legal or financial obligations to buyers. Charges, typically mortgages or financial claims, must be settled or negotiated during transactions to ensure clear title transfer and secure buyer confidence.

Common Types of Encumbrances in Property Law

Common types of encumbrances in property law include liens, easements, and restrictive covenants, each affecting the property's use or transferability. Liens represent a legal claim against a property for unpaid debts, such as mortgages or tax liens, limiting the owner's ability to sell or transfer clear title. Easements grant third parties the right to use a portion of the property for specific purposes, while restrictive covenants impose limitations on property use to maintain community standards or property values.

How Charges Affect Property Transferability

Charges on a property create legal obligations that can limit or restrict transferability by requiring the fulfillment of specific conditions before ownership can be passed on. Unlike encumbrances, which may include broader claims or liabilities, charges directly impact the ability to sell or mortgage the property until the debt secured by the charge is settled. Understanding the nature and terms of these charges is essential for buyers and sellers to ensure a clear and uninterrupted property transfer.

Encumbrance and Charge: Implications for Buyers and Sellers

Encumbrance refers to any claim or liability attached to a property that may restrict its use or transfer, impacting both buyers and sellers during a property transaction. Charge is a specific type of encumbrance, usually a financial claim, such as a mortgage, that must be settled or acknowledged for clear title transfer. Understanding the distinctions between encumbrance and charge is crucial for buyers to avoid unforeseen liabilities and for sellers to ensure a smooth transfer and avoid legal disputes.

Removal and Settlement of Encumbrance vs Charge

Removal of an encumbrance involves clearing any legal claims or liabilities on a property, often requiring settlement of outstanding debts or obligations tied to the asset. Charges are formal financial liabilities registered against a property, and their removal usually necessitates full repayment of the secured loan followed by a formal discharge documentation filed with the relevant authority. Settlement of encumbrances or charges enables the transfer of clear title to the buyer, ensuring unencumbered ownership and reducing the risk of future legal disputes.

Documentation Required for Encumbrance and Charge Transfers

Documentation required for encumbrance transfers typically includes the original loan agreement, a notarized encumbrance certificate, and proof of ownership, ensuring the lien is properly recorded against the property. Charge transfers necessitate a formal charge assignment deed, bank consent letters, and updated registration documents to legally transfer the chargeholder's interest. Accurate preparation and submission of these documents are crucial to validate and enforce the encumbrance or charge rights during property or asset transfers.

Best Practices to Manage Encumbrance and Charge During Transfer

Effective management of encumbrance and charge during transfer requires thorough due diligence to identify all existing liabilities attached to the property. Maintaining accurate records and timely communication with lenders ensures clear title and minimizes disputes. Employing legal counsel to draft precise transfer documents safeguards against unforeseen encumbrances affecting the transaction.

Important Terms

Lien

A lien is a legal claim or encumbrance on property securing the payment of a debt or obligation, whereas a charge is a type of encumbrance granting a creditor a right over the property without transferring possession.

Easement

An easement grants a non-possessory right to use another's property for a specific purpose, distinguishing it from an encumbrance, which broadly restricts property rights, and a charge, which specifically involves a financial claim or liability on the property.

Covenant

A covenant restricts property use or imposes obligations, while an encumbrance like a charge typically affects the title by securing a debt against the property.

Restrictive Covenant

A restrictive covenant is a legal obligation imposed in a property deed that limits the use or activities on the land, often creating a form of encumbrance that binds current and future owners. Unlike a charge, which typically serves as a financial security interest allowing lenders to claim the property upon default, a restrictive covenant restricts property use without involving monetary debt.

Mortgage

A mortgage is a type of charge on property that creates an encumbrance, restricting ownership rights until the loan is repaid.

Pledge

A pledge creates a possessory security interest in an asset as collateral, whereas an encumbrance or charge imposes a legal claim or lien on the asset without transferring possession.

Hypothecation

Hypothecation is a legal process where a borrower pledges an asset as collateral without transferring possession, creating a charge that acts as a security interest rather than an outright transfer of ownership. Unlike an encumbrance, which broadly includes any claim or liability on property restricting its use, hypothecation specifically refers to a charge placed on movable assets, allowing the borrower to retain possession while securing the lender's interest.

Servitude

Servitude is a type of encumbrance granting a non-possessory right to use another's property, differing from a charge which involves a financial obligation secured by the property.

Equitable Charge

Equitable charge is a non-possessory security interest that allows a creditor to claim specific property as security without transferring legal ownership, distinguishing it from a fixed charge which is a legal encumbrance granting stronger control over the asset.

Statutory Charge

A statutory charge is a legally enforceable encumbrance imposed on property by law to secure payment of a debt or performance of an obligation, distinct from general charges as it arises directly from statutory authority.

Encumbrance vs Charge Infographic

moneydif.com

moneydif.com