Leasing grants temporary possession and use of an asset under specific terms, with the lessee often responsible for maintenance and usage conditions. Licensing provides permission to use intellectual property without transferring ownership, allowing the licensee limited rights under defined conditions. Choosing between leasing and licensing depends on whether the transfer involves tangible assets or intangible rights and the extent of control required.

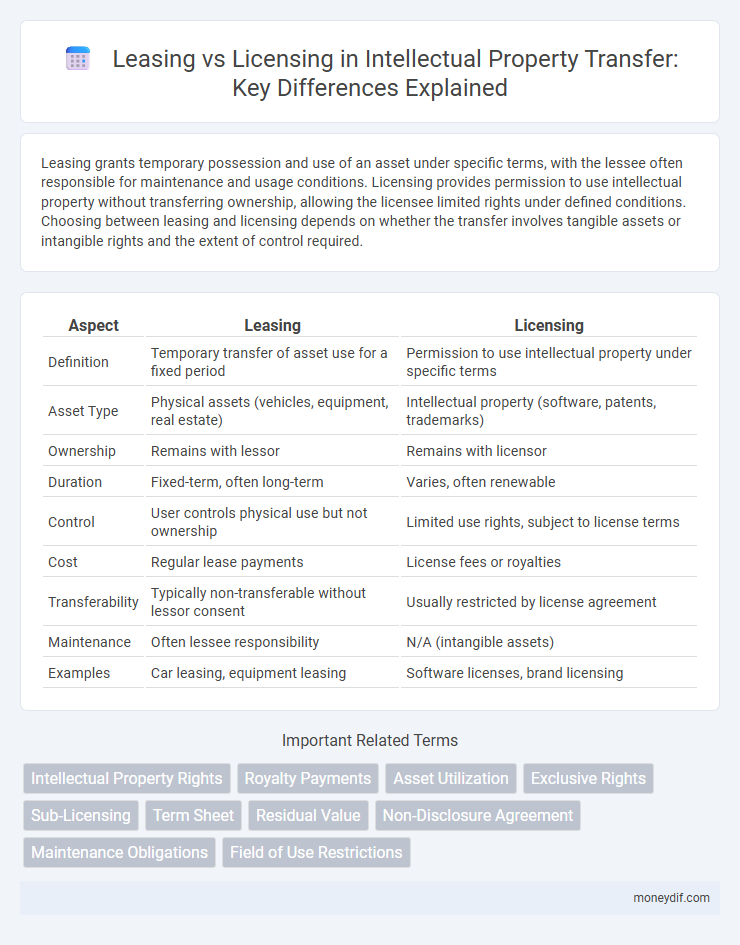

Table of Comparison

| Aspect | Leasing | Licensing |

|---|---|---|

| Definition | Temporary transfer of asset use for a fixed period | Permission to use intellectual property under specific terms |

| Asset Type | Physical assets (vehicles, equipment, real estate) | Intellectual property (software, patents, trademarks) |

| Ownership | Remains with lessor | Remains with licensor |

| Duration | Fixed-term, often long-term | Varies, often renewable |

| Control | User controls physical use but not ownership | Limited use rights, subject to license terms |

| Cost | Regular lease payments | License fees or royalties |

| Transferability | Typically non-transferable without lessor consent | Usually restricted by license agreement |

| Maintenance | Often lessee responsibility | N/A (intangible assets) |

| Examples | Car leasing, equipment leasing | Software licenses, brand licensing |

Understanding Transfer: Lease vs License

Leasing grants exclusive possession of property to the lessee for a specified period, allowing control and use under legally binding terms. Licensing provides permission for limited use without transferring exclusive possession, typically non-transferable and revocable. Understanding the distinction clarifies rights and obligations in property transfer agreements, ensuring proper legal compliance.

Key Differences Between Leasing and Licensing

Leasing grants lessees temporary ownership rights to use an asset for a specified period with an option to purchase, while licensing provides permission to use intellectual property without transferring ownership. Lease agreements typically involve physical assets such as vehicles or equipment, whereas licenses pertain to intangible assets like software, trademarks, or patents. Financially, leasing requires regular payments reflecting asset depreciation, contrasting with licensing fees that compensate for usage rights without asset devaluation.

Legal Implications of Leasing and Licensing

Leasing grants the lessee possessory rights to use the asset for a specified term, conferring obligations akin to ownership such as maintenance and compliance with local laws, which can lead to liability for damages or breaches. Licensing, conversely, is a permission to use intellectual property without transferring possession, limiting the licensee's responsibilities primarily to adhering to usage terms and protecting the licensor's rights. Legal implications of leasing include regulatory adherence to lease contracts and potential financial liabilities, while licensing emphasizes intellectual property protection and enforcement against unauthorized use.

Asset Ownership in Transfers: Lease vs License

Leasing transfers limited ownership rights of an asset to the lessee for a specified period, granting control and exclusive use while the lessor retains ultimate ownership. Licensing merely provides permission to use the asset without transferring any ownership or possessory rights, typically under strict conditions and for defined purposes. Understanding the distinction between leasing's temporary ownership transfer and licensing's usage permission is critical for asset management and legal compliance.

Duration and Flexibility in Leasing vs Licensing

Leasing agreements typically involve longer, fixed durations often ranging from one to several years, providing less flexibility for adjustments during the term. Licensing contracts usually offer shorter, more adaptable periods with options for renewal or termination, catering to evolving business needs. The inherent flexibility in licensing allows easier modifications in scope or technology use, whereas leasing commitments are generally more rigid and time-bound.

Financial Considerations: Lease vs License Agreements

Lease agreements typically involve higher upfront costs and longer financial commitments compared to licensing, which often requires lower initial fees and flexible payment structures. Leasing provides lessees with greater asset control and potential tax benefits through depreciation, whereas licensing usually grants limited usage rights without ownership implications. Financially, businesses must weigh the predictable expenses and asset control in leasing against the lower financial risk and operational flexibility in licensing.

Rights and Obligations of Parties

Leasing grants the lessee possession and use rights over an asset while the lessor retains ownership, obligating the lessee to make periodic payments and maintain the asset according to the lease terms. Licensing transfers specific rights to use intellectual property without granting ownership, requiring the licensee to adhere to usage restrictions and royalty payments set by the licensor. Both arrangements define clear responsibilities: lease agreements emphasize asset care and payment schedules, whereas license agreements focus on compliance with usage conditions and protection of proprietary rights.

Common Use Cases for Leasing vs Licensing

Leasing commonly applies to physical assets such as vehicles, equipment, and real estate, allowing businesses to use these high-cost items without upfront purchase expenses. Licensing is typically used for intangible assets like software, patents, and trademarks, granting users legal permission to use intellectual property under defined terms. Companies often lease machinery to maintain operational flexibility while licensing software to access critical technology without ownership.

Termination and Renewal Clauses

Leasing agreements typically include fixed renewal clauses with defined terms and conditions, offering lessees options to extend or terminate the lease upon expiration. Licensing contracts often contain more flexible termination provisions, allowing licensors to revoke rights under specific circumstances such as breach or non-compliance. Both agreements require careful negotiation of termination notice periods and renewal options to mitigate risks and ensure business continuity.

Choosing Between Leasing and Licensing: Strategic Factors

Choosing between leasing and licensing depends on factors such as duration, control, and financial commitment. Leasing offers temporary possession and usage rights with more control over the asset, ideal for fixed-term needs with predictable costs. Licensing grants permission to use intellectual property without ownership transfer, suited for flexible usage with lower upfront investment and fewer maintenance responsibilities.

Important Terms

Intellectual Property Rights

Intellectual Property Rights distinguish leasing as temporary asset use without ownership transfer, while licensing grants permission to use IP under defined conditions without transferring ownership.

Royalty Payments

Royalty payments for leasing typically depend on usage or time period agreements, while licensing royalties are based on intellectual property rights and product sales.

Asset Utilization

Asset utilization improves through leasing by enabling flexible access to equipment without ownership costs, while licensing enhances asset utilization by allowing rights to use intellectual property without physical asset management.

Exclusive Rights

Exclusive rights in leasing grant tenants sole control over property use, while in licensing, they provide licensees limited, revocable permissions without transferring ownership.

Sub-Licensing

Sub-licensing grants a licensee the right to lease or license the intellectual property to third parties, differentiating it from direct leasing or licensing agreements where only the original owner grants usage rights.

Term Sheet

A term sheet for leasing outlines key financial terms such as lease duration, payment schedule, and obligations for property use and maintenance, focusing on transfer of possession without ownership. Leasing term sheets differ from licensing agreements by emphasizing exclusive possession rights and longer commitment periods, while licensing term sheets detail usage rights, restrictions, and intellectual property considerations without transferring possession.

Residual Value

Residual value in leasing represents the estimated asset worth at lease end, directly influencing lease payments, while in licensing, residual value typically reflects ongoing intellectual property worth without affecting upfront costs.

Non-Disclosure Agreement

A Non-Disclosure Agreement (NDA) protects confidential information shared during Leasing or Licensing negotiations to prevent unauthorized use or disclosure.

Maintenance Obligations

Maintenance obligations in leasing agreements typically require lessees to manage routine upkeep and repairs of the leased asset, ensuring its functionality and compliance with contract terms. Licensing agreements generally place maintenance responsibilities on the licensor, who must keep the licensed property or software operational and updated while the licensee uses it under specified conditions.

Field of Use Restrictions

Field of Use Restrictions limit the scope of leased or licensed property by specifying allowable applications, thereby differentiating leasing, which grants possession and use rights, from licensing, which permits specific controlled use under agreed terms.

Leasing vs Licensing Infographic

moneydif.com

moneydif.com