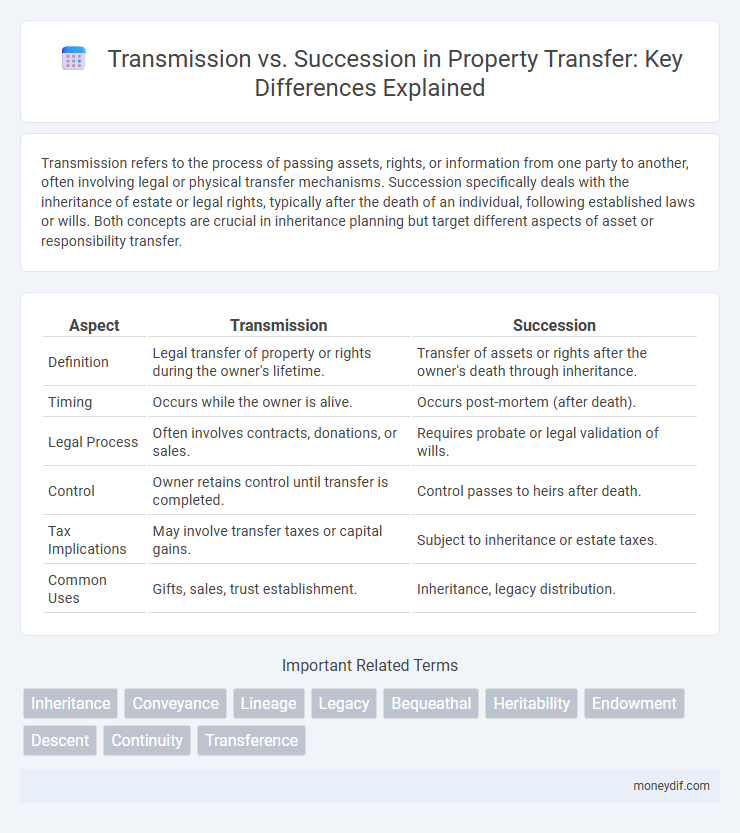

Transmission refers to the process of passing assets, rights, or information from one party to another, often involving legal or physical transfer mechanisms. Succession specifically deals with the inheritance of estate or legal rights, typically after the death of an individual, following established laws or wills. Both concepts are crucial in inheritance planning but target different aspects of asset or responsibility transfer.

Table of Comparison

| Aspect | Transmission | Succession |

|---|---|---|

| Definition | Legal transfer of property or rights during the owner's lifetime. | Transfer of assets or rights after the owner's death through inheritance. |

| Timing | Occurs while the owner is alive. | Occurs post-mortem (after death). |

| Legal Process | Often involves contracts, donations, or sales. | Requires probate or legal validation of wills. |

| Control | Owner retains control until transfer is completed. | Control passes to heirs after death. |

| Tax Implications | May involve transfer taxes or capital gains. | Subject to inheritance or estate taxes. |

| Common Uses | Gifts, sales, trust establishment. | Inheritance, legacy distribution. |

Understanding the Concepts: Transmission and Succession

Transmission involves the legal process of transferring rights or property upon someone's death, often occurring automatically by operation of law. Succession refers to the orderly transfer of estate ownership and obligations to heirs or beneficiaries, guided by statutory inheritance rules or wills. Both concepts ensure continuity of property rights but differ in procedural aspects and timing of transfer.

Key Differences Between Transmission and Succession

Transmission refers to the automatic transfer of property rights upon the owner's death without requiring legal formalities, typically seen in cases of inheritance law. Succession involves a legal process where heirs or beneficiaries are formally recognized and property distribution is validated through wills or statutory regulations. Key differences include that transmission operates by operation of law and is immediate, whereas succession requires certification or probate to establish rightful ownership.

Legal Framework Governing Transmission and Succession

The legal framework governing transmission and succession delineates the mechanisms for property transfer upon an individual's death, with transmission referring to rights passed by operation of law and succession involving the testamentary disposition or statutory inheritance. Transmission typically occurs automatically under statutory provisions without requiring probate, whereas succession usually entails formal probate procedures to validate wills or determine heirs. Both frameworks ensure the orderly transfer of assets, but differ in procedural requirements and legal recognition of heirs or beneficiaries.

Impact of Transmission in Asset Transfer

Transmission in asset transfer occurs automatically upon the death of the owner, enabling immediate legal transfer of property rights to heirs without the need for probate. This process significantly reduces administrative delays and legal formalities compared to succession, which requires formal acceptance and validation through a will or court. The impact of transmission ensures continuity of asset ownership, minimizing disputes and facilitating efficient wealth preservation across generations.

Succession: Processes and Procedures

Succession involves a structured legal process where ownership and rights of assets are transferred after death, ensuring property distribution according to a will or state laws. Key procedures include probate, validating the deceased's will, inventorying assets, paying debts, and formally assigning inheritance to beneficiaries. Proper succession minimizes disputes and secures clear title transfer, which is critical for estate continuity.

Role of Documentation in Transmission vs Succession

Documentation plays a crucial role in both transmission and succession by providing legal proof and clarity of ownership transfer. In transmission, documents such as death certificates and succession certificates validate the transfer of rights due to events like death, ensuring heirs receive the transfer accurately. Succession requires wills or legal agreements that clearly outline the succession process, preventing disputes and facilitating smooth property or asset handover.

Challenges in Implementing Transmission and Succession

Challenges in implementing transmission and succession primarily involve navigating complex legal frameworks and ensuring compliance with jurisdiction-specific regulations. Financial valuation discrepancies and the integration of diverse stakeholder interests often impede smooth asset or leadership transfer. Effective communication and strategic planning are critical to mitigating conflicts and securing seamless continuity during the transition process.

Tax Implications: Transmission versus Succession

Tax implications differ significantly between transmission and succession, with transmission often subject to transfer taxes and potential inheritance tax reliefs depending on jurisdiction-specific laws. Succession predominantly triggers inheritance tax liabilities based on the estate's value, impacting beneficiaries differently according to proximity and exemptions permitted by tax codes. Understanding these distinctions helps optimize estate planning and minimize tax burdens during asset transfer.

Comparative Analysis: Efficiency in Transmission and Succession

Transmission ensures the direct and immediate transfer of rights or property upon the event of death, reducing administrative delays and minimizing probate costs. Succession typically involves a formal probate process that may extend the timeline and incur higher expenses due to legal oversight and potential disputes. Evaluating both mechanisms highlights transmission as a more efficient approach in preserving asset value and expediting ownership transition.

Best Practices for Managing Transmission and Succession

Effective management of transmission and succession requires clear communication of roles and responsibilities to ensure seamless transfer of knowledge and authority. Establishing a detailed succession plan with defined timelines and criteria supports consistent leadership continuity and minimizes operational disruptions. Utilizing mentorship programs and cross-training accelerates skill development, fostering a resilient organizational structure during transitions.

Important Terms

Inheritance

Inheritance involves the legal transfer of assets, rights, and obligations from a deceased person to their heirs, focusing on the individual's estate transmission. Succession refers to the broader process, encompassing both voluntary and legal mechanisms through which titles, offices, or properties pass from one party to another, highlighting continuity beyond mere asset transfer.

Conveyance

Conveyance refers to the legal process of transferring property ownership or rights, typically involving a deed or contract that ensures clear title between parties. Transmission occurs by operation of law, such as inheritance or bankruptcy, passing property automatically without the need for conveyance, while succession specifically deals with the transfer of property rights upon a person's death according to a will or intestacy rules.

Lineage

Lineage defines the genetic or cultural transmission of traits through successive generations, distinguishing it from succession, which primarily refers to the orderly replacement of individuals or entities in roles or positions.

Legacy

Legacy encompasses both transmission of tangible and intangible assets and succession planning to ensure seamless transfer of leadership and ownership in family businesses.

Bequeathal

Bequeathal specifically refers to the transmission of property through a will, whereas succession encompasses the broader legal process of inheriting rights and obligations after death.

Heritability

Heritability quantifies genetic transmission of traits across generations, distinguishing inherited genetic factors from succession processes involving social or environmental inheritance.

Endowment

Endowment in legal context primarily concerns property transfer through transmission by operation of law upon death, whereas succession involves inheritance under a will or intestate succession rules.

Descent

Descent traces inheritance through biological lineage, emphasizing genetic transmission, while succession involves the legal or organizational transfer of roles, titles, or property independent of direct biological ties.

Continuity

Continuity in business ensures seamless transmission of ownership and management responsibilities, preventing disruption during succession through structured legal and financial mechanisms.

Transference

Transference involves the legal transmission of rights or property from one party to another, differing from succession which pertains to the inheritance of rights or assets upon a person's death.

Transmission vs Succession Infographic

moneydif.com

moneydif.com