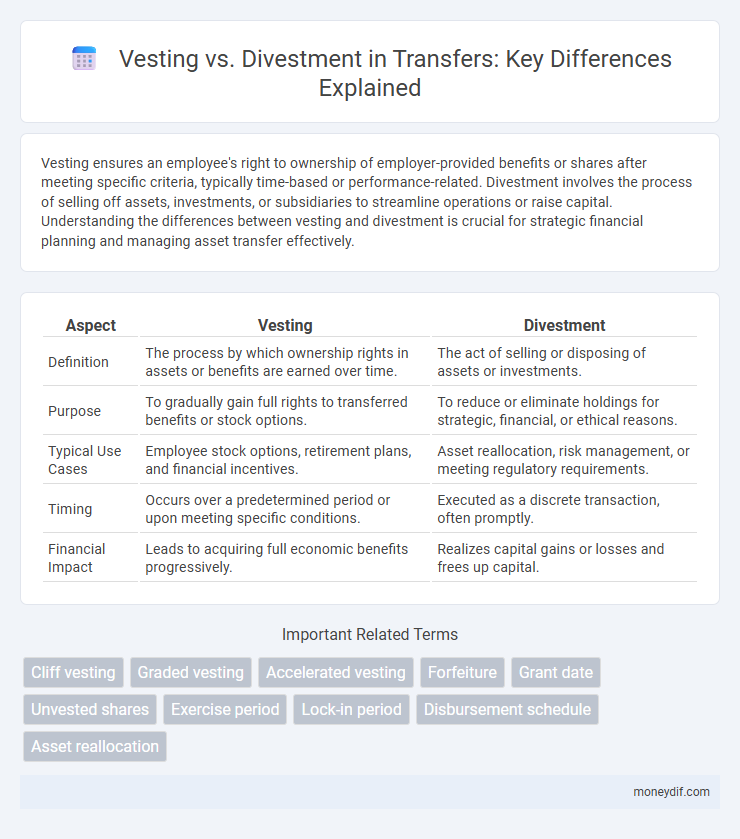

Vesting ensures an employee's right to ownership of employer-provided benefits or shares after meeting specific criteria, typically time-based or performance-related. Divestment involves the process of selling off assets, investments, or subsidiaries to streamline operations or raise capital. Understanding the differences between vesting and divestment is crucial for strategic financial planning and managing asset transfer effectively.

Table of Comparison

| Aspect | Vesting | Divestment |

|---|---|---|

| Definition | The process by which ownership rights in assets or benefits are earned over time. | The act of selling or disposing of assets or investments. |

| Purpose | To gradually gain full rights to transferred benefits or stock options. | To reduce or eliminate holdings for strategic, financial, or ethical reasons. |

| Typical Use Cases | Employee stock options, retirement plans, and financial incentives. | Asset reallocation, risk management, or meeting regulatory requirements. |

| Timing | Occurs over a predetermined period or upon meeting specific conditions. | Executed as a discrete transaction, often promptly. |

| Financial Impact | Leads to acquiring full economic benefits progressively. | Realizes capital gains or losses and frees up capital. |

Understanding Vesting and Divestment: Key Concepts

Vesting refers to the process by which an individual gains full ownership of certain assets or benefits over time, typically in employer stock options or retirement plans, ensuring rights to those assets cannot be forfeited. Divestment involves the deliberate sale or disposal of assets, investments, or subsidiaries, often to reduce risk, reallocate resources, or comply with ethical guidelines. Understanding these key concepts enables strategic financial planning by balancing the timing of asset control acquisition with the intentional reduction or withdrawal from specific holdings.

The Mechanics of Vesting in Asset Transfers

The mechanics of vesting in asset transfers involve the gradual acquisition of ownership rights over time, typically structured through a predetermined schedule or milestones. Vesting ensures that the recipient gains full control and benefits of the asset only after fulfilling specific conditions, such as the completion of a service period or achievement of performance targets. This process protects the transferring party by preventing immediate full transfer and aligns incentives for long-term commitment and value creation.

Divestment Explained: Process and Implications

Divestment involves the strategic process of selling off assets, subsidiaries, or investments to streamline operations or raise capital. This process impacts company financial structure by freeing up resources and potentially altering market positioning. Understanding divestment enables stakeholders to assess risks, valuation changes, and long-term implications on business growth and shareholder value.

Vesting vs Divestment: Fundamental Differences

Vesting refers to the gradual acquisition of full ownership rights to assets or benefits over time, typically seen in employee stock options or retirement plans. Divestment involves the process of selling or disposing of assets or investments, often used to reduce risk or comply with ethical standards. Understanding the fundamental differences between vesting and divestment is crucial for effective financial management and long-term strategic planning.

Legal Framework Governing Vesting and Divestment

The legal framework governing vesting and divestment establishes specific conditions under which ownership rights are transferred or revoked, ensuring compliance with statutory requirements and contractual obligations. Vesting laws typically define the timeline and criteria for acquiring full property rights, while divestment regulations outline the processes for legally relinquishing those rights, often involving formal documentation and regulatory approvals. Understanding jurisdiction-specific statutes, case law, and regulatory guidelines is critical for navigating the complexities of asset transfer and maintaining legal enforceability.

Impact on Ownership and Control

Vesting increases ownership and control as shares or options become fully owned by the recipient over time, solidifying their stake in the organization. Divestment reduces ownership and control by selling or relinquishing assets, thus decreasing influence in decision-making processes. The timing and structure of vesting ensure gradual transfer of control, while divestment results in immediate reduction of ownership rights.

Vesting vs Divestment in Corporate Transactions

Vesting in corporate transactions refers to the process where employees earn rights to company shares or stock options over time, typically contingent on continued employment, ensuring alignment with long-term corporate goals. Divestment involves the strategic sale or disposal of company assets or subsidiaries to refocus core business operations and improve financial health. Understanding the impact of vesting schedules on employee retention and the financial implications of divestment decisions is crucial for optimizing corporate transaction outcomes.

Tax Implications of Vesting and Divestment

Vesting triggers taxation on the fair market value of assets as they become fully owned, often resulting in income recognition and potential withholding tax obligations. In contrast, divestment involves the sale or disposition of vested assets, subjecting gains to capital gains tax based on the difference between the sale price and the asset's cost basis. Tax planning strategies must account for timing differences between vesting events and subsequent divestment to optimize overall tax liabilities.

Strategic Considerations: When to Vest or Divest?

Strategic considerations for vesting or divesting hinge on aligning asset control with long-term organizational goals and market conditions. Vesting enables firms to secure ownership and encourage commitment in joint ventures or employee stock options, ensuring sustained value creation. Divestment suits scenarios requiring capital reallocation or risk mitigation, often triggered by underperformance, shifting business focus, or unlocking shareholder value.

Case Studies: Real-World Applications of Vesting and Divestment

Case studies in vesting reveal how startups allocate equity to founders and employees, ensuring commitment and aligning interests through time-based ownership transfer. Divestment examples highlight corporations shedding non-core assets to optimize portfolios, improve financial health, and focus on strategic growth areas. Real-world applications demonstrate that effective vesting mechanisms secure talent retention, while strategic divestment enables resource reallocation and market adaptation.

Important Terms

Cliff vesting

Cliff vesting provides full ownership of benefits at a specific time, contrasting with divestment, which involves selling off or relinquishing assets.

Graded vesting

Graded vesting gradually increases an employee's ownership of benefits over a specified period, contrasting with divestment where rights or assets are reduced or removed. This method enhances employee retention by incrementally granting full benefits, whereas divestment often occurs during asset liquidation or policy termination.

Accelerated vesting

Accelerated vesting allows employees to gain ownership of stock options faster than the standard vesting schedule, contrasting with divestment, which involves the reduction or loss of those vested assets.

Forfeiture

Forfeiture occurs when unvested equity awards are revoked due to failure to meet vesting conditions, resulting in divestment of ownership rights.

Grant date

The grant date establishes the official start of the vesting schedule, determining when an employee earns ownership rights, while divestment occurs when those vested rights are revoked or sold.

Unvested shares

Unvested shares represent equity granted to employees or founders that have not yet met the vesting schedule, differing from divestment which involves the sale or disposal of vested shares.

Exercise period

The exercise period defines the limited timeframe during which an employee can convert vested stock options into shares before divestment rights expire.

Lock-in period

The lock-in period restricts the sale or transfer of vested shares, ensuring that employees retain ownership for a specific time before divestment is permitted.

Disbursement schedule

The disbursement schedule outlines the timeline for fund release based on vesting milestones, while divestment phases determine the reduction or withdrawal of ownership stakes over time.

Asset reallocation

Asset reallocation strategically adjusts portfolio holdings by balancing vesting schedules to secure ownership rights while managing divestment timing to optimize liquidity and tax efficiency.

vesting vs divestment Infographic

moneydif.com

moneydif.com