Fungible transfer involves exchanging assets that are identical and interchangeable, such as currency or standardized commodities, allowing seamless value exchange without differentiation. Non-fungible transfer pertains to unique, distinct assets like digital collectibles or real estate, where each item has specific attributes that cannot be substituted by another. Understanding the differences between fungible and non-fungible transfers is crucial for managing asset ownership and transaction protocols effectively.

Table of Comparison

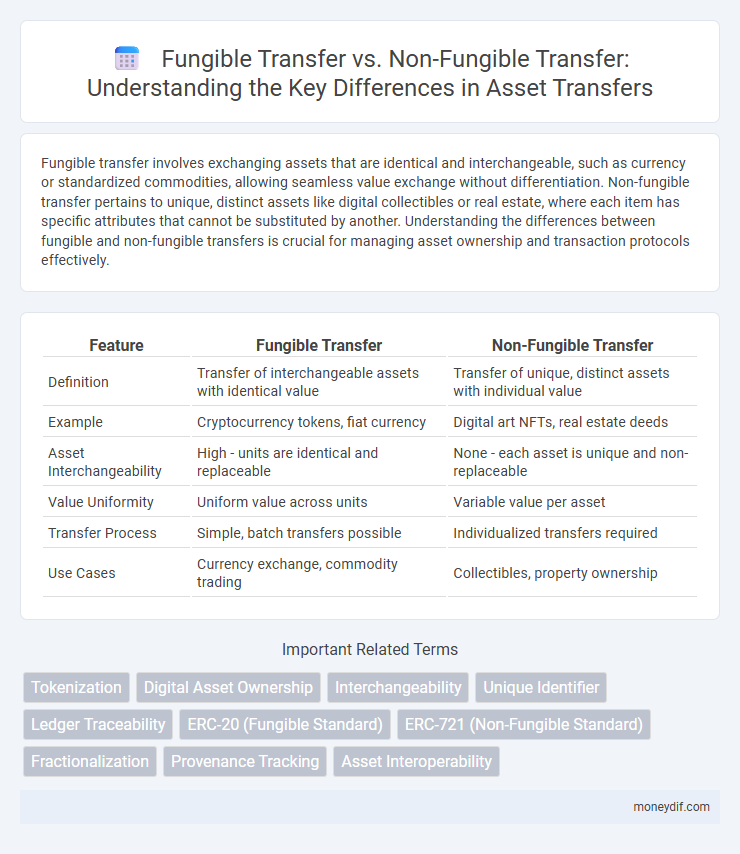

| Feature | Fungible Transfer | Non-Fungible Transfer |

|---|---|---|

| Definition | Transfer of interchangeable assets with identical value | Transfer of unique, distinct assets with individual value |

| Example | Cryptocurrency tokens, fiat currency | Digital art NFTs, real estate deeds |

| Asset Interchangeability | High - units are identical and replaceable | None - each asset is unique and non-replaceable |

| Value Uniformity | Uniform value across units | Variable value per asset |

| Transfer Process | Simple, batch transfers possible | Individualized transfers required |

| Use Cases | Currency exchange, commodity trading | Collectibles, property ownership |

Understanding Transfer: Fungible vs Non-Fungible

Fungible transfers involve the exchange of identical and interchangeable assets like currency or commodities, where each unit holds the same value and utility, enabling seamless substitution. Non-fungible transfers pertain to unique, indivisible assets such as digital collectibles or real estate, where each item has distinct characteristics and cannot be substituted on a one-to-one basis. Understanding these differences is crucial for applications in blockchain technology, digital ownership, and asset trading, where transfer protocols vary significantly based on fungibility.

Key Concepts: What Makes a Transfer Fungible or Non-Fungible

Fungible transfers involve assets or units that are identical and interchangeable, such as currency or stock shares, enabling seamless exchange without differentiation between individual units. Non-fungible transfers pertain to unique assets like digital art NFTs, real estate, or collectibles, where each item has distinct attributes and cannot be substituted on a one-to-one basis. The key concept distinguishing fungible from non-fungible transfers lies in interchangeability and uniqueness, determining whether the transferred asset holds identical value or requires individual identification.

Differences Between Fungible and Non-Fungible Transfers

Fungible transfers involve interchangeable assets like cryptocurrencies or currencies where each unit has equal value and is mutually exchangeable without loss of value, enabling seamless, divisible transactions. Non-fungible transfers pertain to unique assets such as digital art, real estate, or collectibles represented by NFTs, where each item has distinct attributes and value, requiring specific identification and verification during transfer. The primary difference lies in fungibility's uniformity and interchangeability versus non-fungibility's individuality and uniqueness, impacting transfer protocols and valuation methods.

Real-World Examples of Fungible Transfers

Fungible transfers involve exchanging assets that are interchangeable and identical in value, such as currency or commodities like gold and oil. In real-world scenarios, transferring money through bank accounts, stock trades of shares within the same class, or cryptocurrency transactions exemplify fungible transfers. These transfers ensure that each unit holds equal value, enabling seamless substitution and standardization across markets.

Non-Fungible Transfer Scenarios and Case Studies

Non-fungible transfer scenarios primarily occur in industries like real estate, digital art, and collectibles where unique asset identification and provenance are critical. Case studies include blockchain-based platforms like Ethereum's ERC-721 standard, which enable secure, transparent transfer of non-fungible tokens (NFTs) representing unique artworks or property deeds. These transfers ensure ownership authenticity, prevent duplication, and facilitate decentralized market transactions.

Legal Implications in Fungible and Non-Fungible Transfers

Fungible transfers involve interchangeable assets like currency or stocks, where legal implications primarily address ownership rights and contract enforcement. Non-fungible transfers pertain to unique assets such as real estate or NFTs, implicating detailed documentation, provenance verification, and intellectual property rights. Legal complexities increase in non-fungible transfers due to the asset's uniqueness, requiring precise terms to prevent disputes over valuation and authenticity.

Technology’s Role in Fungible and Non-Fungible Transfers

Blockchain technology enables seamless fungible transfers by standardizing token protocols such as ERC-20, facilitating uniform value exchange across multiple transactions. In contrast, non-fungible transfers leverage smart contracts and metadata on platforms like Ethereum's ERC-721 to ensure unique asset identification and provenance tracking. Advanced cryptographic techniques and decentralized ledgers play a critical role in verifying authenticity and preventing duplication in both fungible and non-fungible token transfers.

Market Impact: Fungible vs Non-Fungible Asset Transfers

Fungible asset transfers, such as currency or commodities, typically enable high liquidity and rapid market transactions due to their interchangeable nature, facilitating market efficiency and price stability. Non-fungible asset transfers, including unique digital collectibles or real estate, often result in lower liquidity and higher transaction costs, impacting market depth and price discovery processes. The distinct transferability characteristics of fungible versus non-fungible assets significantly influence market dynamics, investor behavior, and overall trading volume.

Security Challenges in Fungible and Non-Fungible Transfers

Fungible transfers face security challenges such as double-spending and replay attacks, requiring robust consensus mechanisms and cryptographic safeguards to ensure transaction integrity and prevent unauthorized duplication. Non-fungible transfers, particularly in blockchain-based NFTs, encounter risks including ownership fraud, smart contract vulnerabilities, and provenance tampering, necessitating advanced verification protocols and secure metadata management. Both transfer types demand rigorous security frameworks to protect asset authenticity, user privacy, and transaction transparency in decentralized environments.

Future Trends in Transfer Mechanisms: Fungible vs Non-Fungible

Future trends in transfer mechanisms indicate a growing emphasis on blockchain technology to enhance the efficiency and security of both fungible and non-fungible transfers. Fungible token transfers, commonly used in digital currencies, will increasingly support faster settlement times and interoperability across platforms, while non-fungible transfers are evolving to include more complex metadata for enhanced provenance and authenticity in digital assets like NFTs. Emerging standards such as ERC-20 for fungible tokens and ERC-721/1155 for non-fungible tokens will continue to drive innovation in transfer protocols, improving scalability and user accessibility.

Important Terms

Tokenization

Tokenization enables the digital representation of assets, where fungible tokens allow for interchangeable and divisible asset transfers, enhancing liquidity in markets like cryptocurrencies. Non-fungible token transfers, on the other hand, capture unique, indivisible asset ownership such as digital art or collectibles, ensuring provenance and authenticity through blockchain technology.

Digital Asset Ownership

Digital asset ownership involves fungible transfers, where identical units exchange seamlessly, contrasting with non-fungible transfers, which uniquely assign distinct digital items like NFTs.

Interchangeability

Interchangeability in asset transfers distinguishes fungible transfers, where identical units are exchanged seamlessly, from non-fungible transfers involving unique, individual assets with distinct value and characteristics.

Unique Identifier

Unique identifiers enable precise tracking and differentiation of non-fungible transfers, whereas fungible transfers rely on interchangeable asset quantities without distinct identifiers.

Ledger Traceability

Ledger traceability enhances transparency by recording detailed histories of fungible transfers as interchangeable asset exchanges and non-fungible transfers as unique, indivisible token movements.

ERC-20 (Fungible Standard)

ERC-20 is a widely adopted fungible token standard on the Ethereum blockchain, enabling seamless transfers of interchangeable assets with fixed decimal precision. Unlike ERC-721 or ERC-1155 standards used for non-fungible tokens (NFTs), ERC-20 tokens represent identical units that can be exchanged or divided without loss of value.

ERC-721 (Non-Fungible Standard)

ERC-721 is a non-fungible token (NFT) standard on the Ethereum blockchain that enables unique digital asset representation, contrasting with ERC-20 fungible tokens where each unit is identical and interchangeable. Unlike fungible transfers where tokens hold uniform value, ERC-721 facilitates ownership transfer of distinct, indivisible tokens with unique metadata and attributes.

Fractionalization

Fractionalization enables the division of a single fungible asset into multiple interchangeable units for transfer, whereas non-fungible transfer involves the movement of unique, indivisible digital assets with distinct identifiers.

Provenance Tracking

Provenance tracking ensures transparent ownership history by distinguishing fungible transfers of interchangeable assets from non-fungible transfers of unique, indivisible items.

Asset Interoperability

Asset interoperability enhances seamless integration by enabling fungible transfers of identical tokens and non-fungible transfers of unique digital assets across diverse blockchain platforms.

Fungible transfer vs Non-fungible transfer Infographic

moneydif.com

moneydif.com