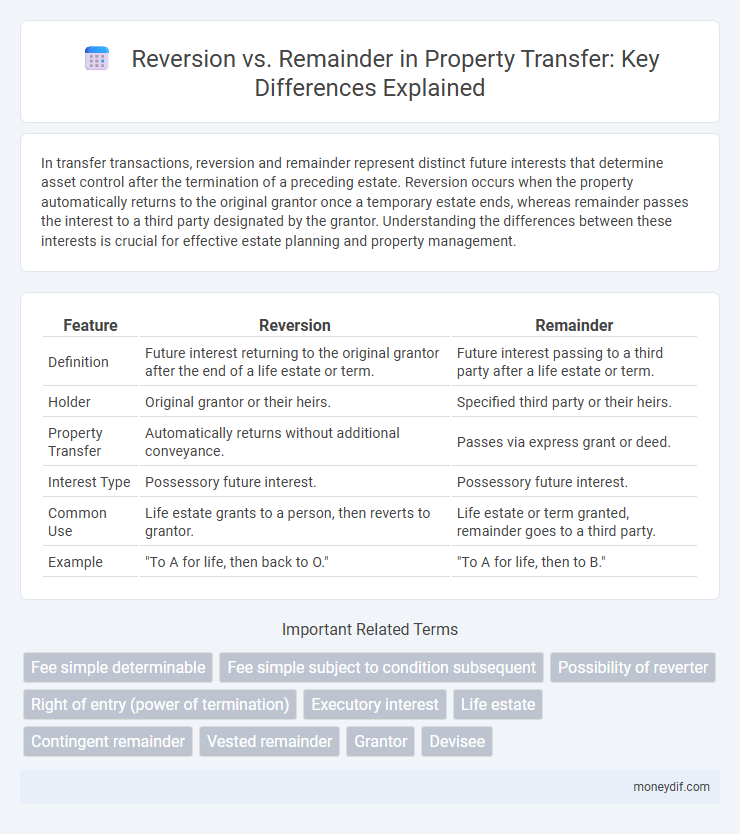

In transfer transactions, reversion and remainder represent distinct future interests that determine asset control after the termination of a preceding estate. Reversion occurs when the property automatically returns to the original grantor once a temporary estate ends, whereas remainder passes the interest to a third party designated by the grantor. Understanding the differences between these interests is crucial for effective estate planning and property management.

Table of Comparison

| Feature | Reversion | Remainder |

|---|---|---|

| Definition | Future interest returning to the original grantor after the end of a life estate or term. | Future interest passing to a third party after a life estate or term. |

| Holder | Original grantor or their heirs. | Specified third party or their heirs. |

| Property Transfer | Automatically returns without additional conveyance. | Passes via express grant or deed. |

| Interest Type | Possessory future interest. | Possessory future interest. |

| Common Use | Life estate grants to a person, then reverts to grantor. | Life estate or term granted, remainder goes to a third party. |

| Example | "To A for life, then back to O." | "To A for life, then to B." |

Understanding Reversion and Remainder Interests

Reversion and remainder interests are future property interests arising from a transfer that creates a life estate or similar limited estate. A reversion interest returns ownership to the original grantor once the lesser estate ends, while a remainder interest passes ownership to a third party after the termination of the prior estate. Understanding the distinctions between these interests is crucial for estate planning, as reversions remain with the grantor and remainders vest in someone else, influencing property rights and inheritance outcomes.

Key Differences Between Reversion and Remainder

Reversion grants ownership back to the original transferor after a temporary interest ends, while remainder transfers ownership to a third party following the same condition. Reversion typically occurs when a property interest is granted for a limited time without naming a third-party beneficiary, whereas remainder involves a specified third party who takes possession once the preceding estate concludes. The key difference lies in the recipient of the interest: the transferor for reversion, and a third party for remainder.

Legal Definitions: Reversion vs. Remainder

Reversion refers to the automatic return of property rights to the original grantor or their heirs upon the occurrence of a specified event or termination of a particular estate, often a life estate. Remainder is a future interest granted to a third party that becomes possessory only after the termination of the preceding estate, such as a life estate, and does not revert to the original grantor. The key legal distinction lies in reversion being retained by the grantor, while remainder is vested in a transferee or third party.

How Reversion Works in Property Transfer

Reversion in property transfer occurs when the grantor transfers an estate to another party but retains the future interest that returns to them once the current estate ends, typically after a life estate or a lease term. This future interest becomes possessory automatically upon the termination of the transferee's interest without requiring further action. Understanding reversion is essential for estate planning, as it allows original owners to regain possession while granting temporary use or enjoyment to another party.

The Role of Remainder in Estate Planning

The remainder interest plays a critical role in estate planning by ensuring that property passes to designated beneficiaries after the termination of a prior interest, such as a life estate. Remainder beneficiaries receive ownership rights that become possessory only after the initial interest ends, providing a clear and structured succession of assets. This strategic use of remainder interests helps minimize probate complications and supports the efficient transfer of wealth across generations.

Real-World Examples of Reversion and Remainder

Reversion occurs when property ownership returns to the original grantor after a particular interest, such as a life estate, expires, exemplified by a homeowner granting a life estate to a family member with the remainder reverting back to the owner. Remainder involves the transfer of future interest to a third party once the preceding estate ends, as seen when a property is conveyed to a friend for life and then to a charity upon the friend's death. Real-world cases include family trusts where beneficiaries hold remainder interests while the trustor retains reversionary interests until conditions are met.

Impact of Reversion and Remainder on Heirs

Reversion interests return property to the original grantor or their heirs if a specified condition ends, limiting heirs' control and future claims until the condition's fulfillment. Remainder interests pass directly to designated heirs or third parties after a prior estate ends, ensuring heirs receive full ownership without disruption. Understanding these distinctions impacts estate planning by clarifying heirs' rights, timing of possession, and potential legal challenges.

Common Mistakes in Reversion and Remainder Transfers

Common mistakes in reversion and remainder transfers often involve misunderstandings of future interests, such as assuming a reversion automatically grants possession upon the prior estate's termination without accounting for intervening claims. Confusing remainders with reversions can lead to improper drafting, where the intended beneficiary's rights are either prematurely vested or entirely negated due to ambiguous wording. Failure to specify survival conditions or contingencies in remainder interests frequently results in inadvertent estate forfeitures or unintended transfers.

Reversion vs. Remainder: Tax Implications

Reversion and remainder interests have distinct tax implications due to their different ownership structures and durations. A reversion interest returns property to the original owner or their heirs, often triggering estate tax considerations upon the grantor's death, while remainder interests transfer ownership to a third party, potentially affecting gift and capital gains taxes. Understanding these differences is crucial for effective estate planning and minimizing tax liabilities associated with property transfers.

Choosing Between Reversion and Remainder in Asset Transfers

Choosing between reversion and remainder interests in asset transfers hinges on the duration and conditions of ownership retention. A reversion interest allows the grantor to regain full ownership once a specified event or time occurs, ideal for retaining control over future use. In contrast, a remainder interest designates a third party to take possession after the prior estate ends, facilitating a clear transfer of property after a life estate or lease term concludes.

Important Terms

Fee simple determinable

Fee simple determinable creates an automatic reversion to the grantor when a specified condition ends the estate, distinguishing it from a remainder interest held by a third party, which only becomes possessory after the natural termination of the preceding estate. Key semantic entities include "automatic reversion," "grantor," "specified condition," and "remainder interest," emphasizing the difference between a possibility of reverter and a remainder in property law.

Fee simple subject to condition subsequent

Fee simple subject to condition subsequent grants the grantor the right of reentry upon breach of condition, distinguishing it from fee simple determinable which automatically reverts, while remainders are future interests held by third parties without affecting the grantor's reentry rights.

Possibility of reverter

The possibility of reverter is a future interest that automatically returns the estate to the grantor upon the occurrence of a stated condition, distinguishing it from a remainder which passes to a third party after the natural termination of a prior estate.

Right of entry (power of termination)

The right of entry (power of termination) allows a grantor to reclaim possession upon breach of a condition in a fee simple subject to a condition subsequent, distinguishing it from a remainder which is a future interest created in a third party.

Executory interest

Executory interests differ from reversion and remainder interests as they cut short a prior estate upon a triggering event, whereas reversion returns property automatically to the grantor and remainder passes property to a third party after the prior estate ends naturally.

Life estate

A life estate grants ownership for the duration of an individual's life, after which the property automatically reverts to the original grantor or passes to a remainder beneficiary designated in the deed.

Contingent remainder

A contingent remainder is a future interest in property that depends on the occurrence of an uncertain event, distinguishing it from a reversion, which automatically returns to the grantor if no prior condition is met.

Vested remainder

A vested remainder is a future interest secured in an ascertained person that becomes possessory upon the natural termination of the prior estate, differing from a reversion which returns to the grantor when no remainder is validly created.

Grantor

The grantor transfers property with a reversion interest if ownership returns to them upon the end of a prior estate, whereas a remainder interest passes ownership to a third party after the prior estate ends.

Devisee

Devisees receive property interests under a will, where reversion refers to the original grantor's retained interest upon termination of a prior estate, while remainder designates a future interest granted to a third party after the preceding estate ends.

Reversion vs Remainder Infographic

moneydif.com

moneydif.com