Vesting establishes the legal right to retain ownership of an asset, such as stocks or benefits, after meeting specific conditions or a set period. Relinquishment involves voluntarily giving up a right, claim, or interest in that asset, often as part of a transfer or settlement agreement. Understanding the differences between vesting and relinquishment is essential for managing asset transfers and ensuring compliance with contractual or regulatory requirements.

Table of Comparison

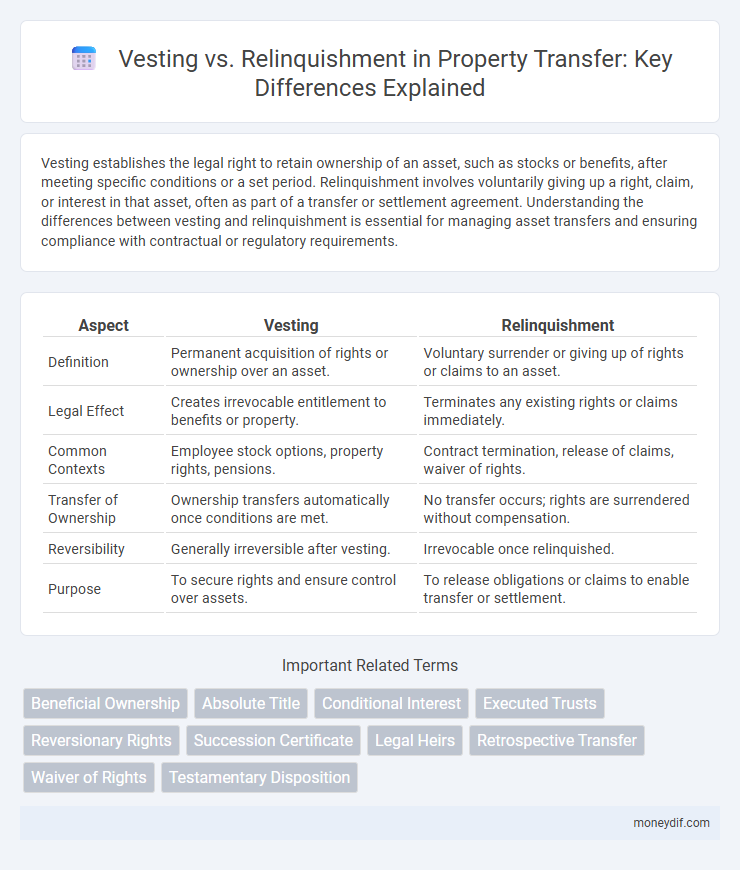

| Aspect | Vesting | Relinquishment |

|---|---|---|

| Definition | Permanent acquisition of rights or ownership over an asset. | Voluntary surrender or giving up of rights or claims to an asset. |

| Legal Effect | Creates irrevocable entitlement to benefits or property. | Terminates any existing rights or claims immediately. |

| Common Contexts | Employee stock options, property rights, pensions. | Contract termination, release of claims, waiver of rights. |

| Transfer of Ownership | Ownership transfers automatically once conditions are met. | No transfer occurs; rights are surrendered without compensation. |

| Reversibility | Generally irreversible after vesting. | Irrevocable once relinquished. |

| Purpose | To secure rights and ensure control over assets. | To release obligations or claims to enable transfer or settlement. |

Understanding Vesting and Relinquishment

Understanding vesting involves recognizing the process by which an individual gains full legal rights to a property or asset, often through fulfillment of specific conditions or time periods. Relinquishment, on the other hand, refers to the voluntary surrender of those rights, effectively transferring ownership or interest to another party. Mastery of these concepts ensures clarity in property transfers, legal agreements, and asset management.

Key Differences Between Vesting and Relinquishment

Vesting establishes a legal right or ownership interest in an asset or benefit, typically after meeting specific conditions or time frames, ensuring the holder cannot be deprived of these rights. Relinquishment involves voluntarily giving up or surrendering a right, claim, or ownership, often resulting in the transfer of control back to another party or the original grantor. The key difference lies in vesting securing and confirming rights, while relinquishment entails the intentional renouncement of those rights.

Legal Implications of Vesting vs Relinquishment

Vesting establishes an irrevocable right to property or benefits, securing legal ownership and preventing future claims by others, whereas relinquishment involves voluntarily giving up those rights, often requiring formal documentation to avoid disputes. Legal implications of vesting include enforceability of rights and protection under property or contract law, while relinquishment may impact inheritance, trust administration, or contractual agreements by transferring or terminating entitlements. Understanding these distinctions is crucial for estate planning, corporate share transfers, and real property transactions to ensure compliance and safeguard parties' interests.

Vesting: Definition and Process

Vesting refers to the process by which an individual gains an irrevocable right to a certain asset or benefit, typically over a specified period or upon meeting predefined conditions. The vesting process involves a schedule that gradually grants ownership or control, ensuring that the recipient earns full rights after completing requirements such as tenure or performance milestones. This mechanism protects both parties by aligning incentives and confirming entitlement before the transfer of legal title or benefits occurs.

Relinquishment: Definition and Process

Relinquishment refers to the formal legal process by which an individual voluntarily surrenders their ownership or interest in a property, asset, or right, effectively transferring it back to another party or the state. The process typically involves executing a relinquishment deed or document, ensuring clear consent, and may require registration with relevant authorities to validate the transfer and update official records. This action results in the complete transfer of rights and responsibilities, distinguishing it from vesting, where ownership is conferred but not necessarily surrendered by the initial holder.

Impact on Property Rights

Vesting grants a party an immediate, enforceable ownership interest in property, establishing clear legal rights and control. Relinquishment involves the voluntary surrender of property rights, often resulting in a transfer of ownership or the removal of claims against the property. The impact on property rights is significant: vesting solidifies ownership protections, while relinquishment terminates them, affecting subsequent legal claims and control over the asset.

Tax Considerations: Vesting vs Relinquishment

Tax considerations for vesting versus relinquishment differ significantly in transfer scenarios. Vesting typically triggers immediate tax liability based on the fair market value of the transferred asset at the time of ownership transfer, often treated as income or capital gains. Relinquishment may defer tax consequences until a subsequent event, such as sale or disposition, impacting timing and potential tax rates.

Common Scenarios for Vesting and Relinquishment

Vesting commonly occurs in employment and stock option agreements, where employees earn rights to benefits or shares over time, typically through a defined schedule or milestone achievement. Relinquishment often arises in property law and intellectual property cases, involving the voluntary surrender of rights or claims, such as abandoning a lease or patent. Both processes are critical in contractual negotiations and legal transfers, impacting ownership, control, and financial entitlements.

Documentation Required for Vesting and Relinquishment

Documentation required for vesting typically includes a formal declaration of ownership, proof of identity, and relevant legal agreements such as contracts or wills that establish the transfer of rights. In contrast, relinquishment demands documents evidencing the voluntary surrender of rights or interests, often comprising a notarized relinquishment form and any supporting legal instruments that validate the transfer back to the original owner or another party. Ensuring accuracy and completeness in these documents is crucial to avoid disputes and confirm the legitimacy of the transfer process.

Choosing the Right Option: Vesting or Relinquishment

Choosing between vesting and relinquishment depends on the long-term control and benefits desired from the transferred asset or interest. Vesting secures definitive ownership rights, ensuring continued claims and benefits, while relinquishment fully surrenders control and obligations, often simplifying legal or financial responsibilities. Evaluating the implications on asset management, tax consequences, and future flexibility is crucial for selecting the optimal strategy in transfer agreements.

Important Terms

Beneficial Ownership

Beneficial ownership involves the rights of individuals to vest interests in assets or shares, while relinquishment refers to the voluntary surrender of those beneficial rights.

Absolute Title

Absolute title grants unequivocal ownership free from any competing claims, contrasting with vesting, which establishes initial ownership interest subject to conditions, and relinquishment, where a party formally surrenders rights to transfer or clear title. Understanding the interplay between vesting and relinquishment is essential for securing absolute title in real estate transactions.

Conditional Interest

Conditional interest in property law arises when vesting depends on the occurrence of a specified event, creating future ownership rights that may be relinquished if conditions are unmet.

Executed Trusts

Executed trusts involve the legal transfer of title and rights to beneficiaries, emphasizing the importance of vesting to establish clear ownership and fiduciary duties. Relinquishment, in contrast, occurs when a trustee or beneficiary voluntarily surrenders interests or rights, affecting trust administration and the final distribution of assets.

Reversionary Rights

Reversionary rights refer to the interest that returns to the grantor or grantor's heirs when a property interest, granted to another party, terminates or is relinquished. Vesting establishes the permanent ownership of a property interest, whereas relinquishment involves consciously giving up or surrendering those rights, triggering potential reversionary interests back to the original owner.

Succession Certificate

A Succession Certificate is a legal document issued by a court to heirs for recovering debts and securities of a deceased person, establishing their right to inherit financial assets. Vesting refers to the automatic acquisition of ownership rights upon the predecessor's death, while relinquishment involves formally giving up one's share in favor of other heirs, often documented through a relinquishment deed.

Legal Heirs

Legal heirs' rights in property transfer hinge on vesting, which grants ownership, versus relinquishment, where heirs voluntarily surrender their claims.

Retrospective Transfer

Retrospective transfer in equity compensation involves reviewing past vesting events to adjust shares or options, impacting the final ownership structure. This process differs from relinquishment, where unvested shares are voluntarily surrendered, affecting the employee's equity stake and company's share distribution.

Waiver of Rights

Waiver of rights involves voluntarily giving up legal claims, which differs from vesting where rights become fully owned after meeting specified conditions, and relinquishment that entails formally surrendering rights without conditions. Understanding these distinctions is crucial in contracts and employment agreements to clarify entitlement and transfer of ownership or control.

Testamentary Disposition

Testamentary disposition involves the legal allocation of assets through a will, where vesting defines the moment beneficiaries gain enforceable rights, contrasting with relinquishment, which is the voluntary surrender of those rights before final distribution. Understanding the distinction between vesting--when property rights become fixed--and relinquishment--when beneficiaries renounce their interests--is crucial for effective estate planning and probate proceedings.

Vesting vs Relinquishment Infographic

moneydif.com

moneydif.com