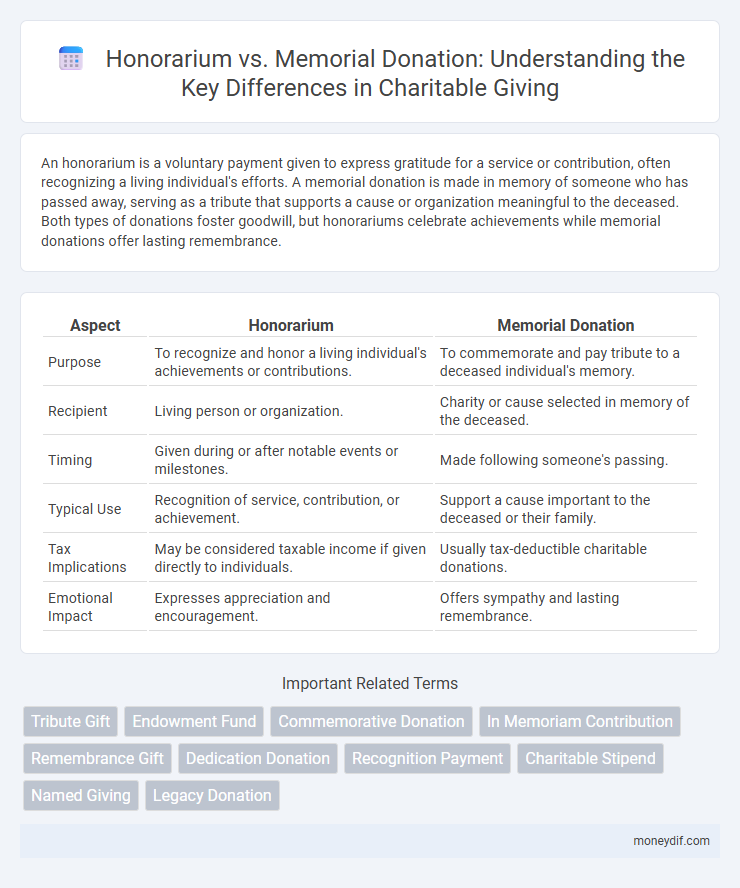

An honorarium is a voluntary payment given to express gratitude for a service or contribution, often recognizing a living individual's efforts. A memorial donation is made in memory of someone who has passed away, serving as a tribute that supports a cause or organization meaningful to the deceased. Both types of donations foster goodwill, but honorariums celebrate achievements while memorial donations offer lasting remembrance.

Table of Comparison

| Aspect | Honorarium | Memorial Donation |

|---|---|---|

| Purpose | To recognize and honor a living individual's achievements or contributions. | To commemorate and pay tribute to a deceased individual's memory. |

| Recipient | Living person or organization. | Charity or cause selected in memory of the deceased. |

| Timing | Given during or after notable events or milestones. | Made following someone's passing. |

| Typical Use | Recognition of service, contribution, or achievement. | Support a cause important to the deceased or their family. |

| Tax Implications | May be considered taxable income if given directly to individuals. | Usually tax-deductible charitable donations. |

| Emotional Impact | Expresses appreciation and encouragement. | Offers sympathy and lasting remembrance. |

Understanding Honorarium and Memorial Donations

Honorarium donations are contributions made to recognize or thank someone for their service or achievement, often given directly to the individual or an organization in their name. Memorial donations honor the memory of a deceased individual, supporting causes or charities meaningful to the person's life or family wishes. Understanding the distinction helps donors choose the appropriate fund, ensuring their gift aligns with their intent of recognition or remembrance.

Key Differences Between Honorarium and Memorial Contributions

Honorarium donations are given to recognize and appreciate a living individual's achievements or contributions, often presented during events or ceremonies. Memorial donations honor the memory of a deceased person, serving as a tribute to their legacy and providing support to causes meaningful to them. Key differences include the intent--celebration versus remembrance--and timing, with honorariums given during a person's lifetime and memorial donations made posthumously.

When to Choose an Honorarium Donation

Choose an honorarium donation to recognize someone's achievements, celebrate milestones, or express gratitude during their lifetime, creating a meaningful tribute that supports causes they value. Honorarium donations are ideal for birthdays, retirements, or special occasions where honoring an individual's contributions is important. This type of donation provides a personal connection and immediate recognition, unlike memorial donations which are made after a person's passing.

When to Opt for a Memorial Donation

Memorial donations are most appropriate when honoring the memory of a deceased loved one, serving as a lasting tribute that supports a cause meaningful to them. These donations typically coincide with funerals or anniversaries of a passing, offering a way to channel grief into positive impact. Choosing a memorial donation helps create a legacy while supporting organizations aligned with the honoree's values or passions.

Impact of Honorarium vs Memorial Donations on Beneficiaries

Honorarium donations provide immediate encouragement and recognition for living individuals, often directly funding projects or services that benefit beneficiaries in real time. Memorial donations create lasting legacies by honoring deceased individuals, supporting long-term programs and endowments that sustain ongoing community impact. Both donation types significantly enhance beneficiary support, with honorariums boosting current initiatives and memorials fostering enduring contributions.

Personalizing Your Gift: Honorarium and Memorial Approaches

Personalizing your donation through honorarium or memorial gifts offers meaningful ways to recognize individuals while supporting a cause. Honorarium donations celebrate living individuals' achievements or milestones, providing a thoughtful tribute that acknowledges their impact. Memorial donations honor the memory of those who have passed, creating a lasting legacy that helps continue their values and passions.

Tax Implications of Honorarium and Memorial Donations

Honorarium donations are typically considered gifts in exchange for services and may be taxable income for the recipient, requiring proper reporting to tax authorities. Memorial donations, given in memory of a deceased individual, are generally tax-deductible for the donor if made to a qualified nonprofit organization, providing potential tax benefits. Understanding the tax treatment of each can optimize financial planning and compliance with IRS regulations.

Common Misconceptions About Honorarium and Memorial Giving

Honorarium donations are often misunderstood as charitable gifts, but they typically serve as a token of appreciation for services rendered, whereas memorial donations honor the memory of a deceased individual by supporting causes important to them. Many donors mistakenly believe honorarium contributions provide tax benefits similar to memorial gifts, though tax deductibility depends on the recipient organization's status and the donation purpose. Clarifying these distinctions helps donors make informed decisions that align their giving intentions with the appropriate donation type.

How to Make an Honorarium or Memorial Donation

To make an honorarium or memorial donation, contact the chosen organization directly through their official website or donation hotline to ensure your contribution is properly designated. Provide the honoree's or memorialized person's full name, along with your contact information to receive acknowledgment notifications. Specify whether the donation is in honor or memory of the individual to guide the organization in sending personalized recognition to the recipient's family or the honoree.

Best Practices for Honoring Loved Ones Through Donations

Honorarium donations celebrate living individuals by recognizing their achievements, offering a personal and meaningful tribute that encourages ongoing support and connection. Memorial donations honor the memory of deceased loved ones, creating lasting legacies that fund causes important to them and provide comfort to grieving families. Best practices emphasize clear communication with donors, personalized acknowledgment letters, and transparent use of funds to maximize emotional impact and donor trust.

Important Terms

Tribute Gift

A tribute gift can be designated as an honorarium to recognize a living individual's achievements or as a memorial donation to honor the memory of a deceased loved one.

Endowment Fund

Endowment funds provide a permanent source of income by investing principal donations, offering long-term financial stability for institutions, while honorarium and memorial donations are typically one-time gifts made in recognition of individuals. Honorarium donations express gratitude for services rendered, whereas memorial donations honor a person's memory, both contributing differently to the growth and purpose of endowment funds.

Commemorative Donation

Commemorative donations distinguish between honorariums, given to celebrate or recognize a living individual's achievements, and memorial donations, made in memory of a deceased person to honor their legacy. Organizations often use honorarium donations to support causes meaningful to the honoree, while memorial donations typically fund programs or initiatives reflecting the values or passions of the departed.

In Memoriam Contribution

In memoriam contributions are charitable gifts made in honor of a deceased individual, often preferred over honorariums, which are honorary payments typically given to living individuals for services rendered. Memorial donations hold lasting philanthropic value by supporting causes meaningful to the deceased, while honorarium payments primarily recognize personal contributions or professional services.

Remembrance Gift

A Remembrance Gift often serves as a thoughtful gesture to honor someone's memory or contribution, distinguished from an honorarium which is a payment for services rendered. Memorial donations are typically directed toward charities or causes in memory of the deceased, while honorariums compensate living individuals for professional or voluntary services.

Dedication Donation

Dedication donations serve as meaningful contributions made in honor of a living individual or in memory of someone who has passed away, often distinguished as honorarium and memorial donations respectively. Honorarium donations recognize and appreciate a person's contributions or achievements during their lifetime, while memorial donations offer a tribute to preserve the legacy and memory of the deceased through charitable support.

Recognition Payment

Recognition payments, unlike honoraria which compensate for specific services, are formal acknowledgments, whereas memorial donations are charitable gifts made in memory of a deceased individual.

Charitable Stipend

Charitable stipends differ from honorariums as they are designated donations supporting a cause rather than payment for services, while memorial donations specifically honor a deceased individual through charitable contributions.

Named Giving

Named Giving offers a personalized way to honor individuals through Honorarium or Memorial Donations, providing meaningful recognition while supporting charitable causes. Honorarium Donations celebrate living individuals' achievements or milestones, whereas Memorial Donations commemorate and preserve the legacy of those who have passed away, both enhancing donor engagement and organizational funding.

Legacy Donation

Legacy donations, also known as planned gifts, provide long-term financial support to organizations and are often distinguished from honorarium and memorial donations, which are immediate gifts made in recognition or memory of individuals. Honorarium donations are given to honor someone's achievements or contributions, while memorial donations are made to commemorate and preserve the memory of a deceased person.

Honorarium vs Memorial Donation Infographic

moneydif.com

moneydif.com