Gift-in-kind donations involve providing tangible items or services directly to a cause, offering immediate utility and often reducing operational costs for nonprofit organizations. Monetary gifts provide flexible funding that allows charities to allocate resources where they are most needed, ensuring adaptability in addressing evolving priorities. Both forms of donation play crucial roles in supporting missions, with in-kind gifts supplying needed materials and cash donations enabling strategic program development.

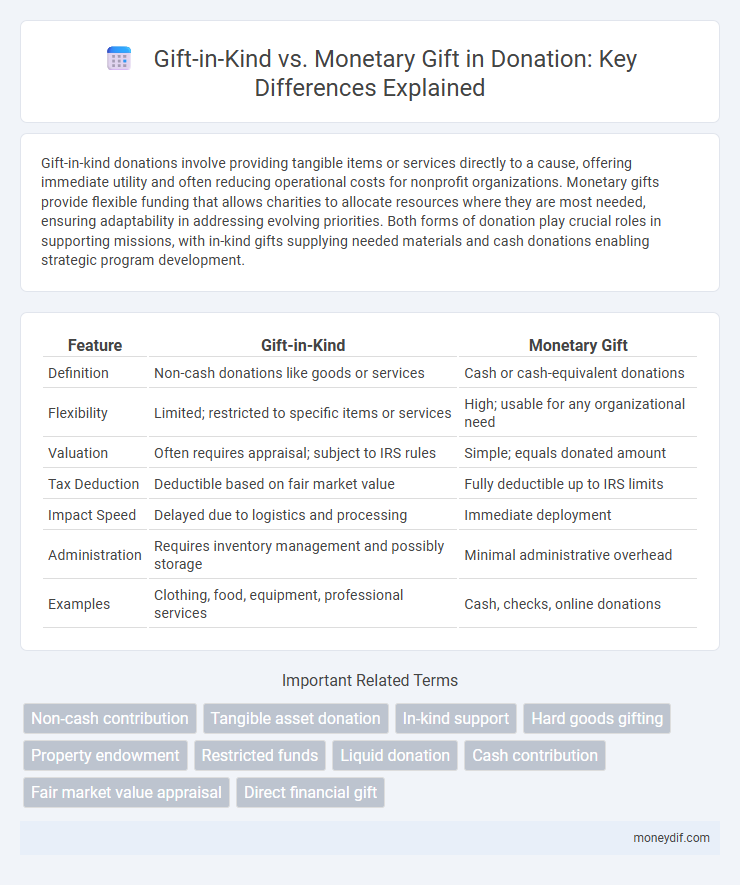

Table of Comparison

| Feature | Gift-in-Kind | Monetary Gift |

|---|---|---|

| Definition | Non-cash donations like goods or services | Cash or cash-equivalent donations |

| Flexibility | Limited; restricted to specific items or services | High; usable for any organizational need |

| Valuation | Often requires appraisal; subject to IRS rules | Simple; equals donated amount |

| Tax Deduction | Deductible based on fair market value | Fully deductible up to IRS limits |

| Impact Speed | Delayed due to logistics and processing | Immediate deployment |

| Administration | Requires inventory management and possibly storage | Minimal administrative overhead |

| Examples | Clothing, food, equipment, professional services | Cash, checks, online donations |

Understanding Gift-in-Kind vs Monetary Gifts

Gift-in-Kind donations involve donating goods or services directly, such as clothing, food, or professional expertise, which provide tangible resources to organizations. Monetary gifts offer financial flexibility, allowing nonprofits to allocate funds where they are most needed and cover operational costs. Understanding the benefits and limitations of each type helps donors maximize their impact and ensures organizations can effectively plan and utilize contributions.

Key Differences Between Gift-in-Kind and Cash Donations

Gift-in-kind donations involve providing tangible goods or services, such as clothing, food, or professional expertise, which directly meet specific needs without requiring financial transactions. Monetary gifts offer greater flexibility, allowing charities to allocate funds toward operational costs, programs, or urgent priorities according to evolving organizational goals. The key differences lie in liquidity, tax implications, and ease of distribution, with cash donations generally preferred for their efficiency in addressing broad or unforeseen needs.

Advantages of Gift-in-Kind Contributions

Gift-in-kind contributions provide tangible resources that directly support specific needs, reducing the administrative costs associated with purchasing goods. These donations can enhance project impact by supplying specialized items, equipment, or services that might otherwise be difficult to acquire. Donors benefit from potential tax deductions and the satisfaction of seeing their tangible support utilized efficiently within the organization.

Benefits of Monetary Donations for Nonprofits

Monetary donations provide nonprofits with unparalleled flexibility to allocate funds based on evolving needs, ensuring resources support priority programs and operational costs efficiently. Unlike gift-in-kind donations, cash gifts reduce administrative burdens, enabling quicker deployment and minimizing storage or logistical expenses. Financial contributions also enhance nonprofits' ability to respond to emergencies, invest in long-term growth, and maintain consistent cash flow for sustainable impact.

Tax Implications for Gift-in-Kind and Monetary Gifts

Gift-in-kind donations, such as goods or services, often provide tax deductions based on the fair market value of the item, but require proper documentation and appraisal for IRS compliance. Monetary gifts offer straightforward tax benefits, allowing donors to deduct the full amount up to specific limits outlined by the IRS, typically 60% of adjusted gross income for cash contributions. Both types of donations impact donor tax filings differently, necessitating accurate record-keeping to maximize tax advantages and comply with charitable contribution regulations.

When to Choose Gift-in-Kind Over Cash Donations

Gift-in-kind donations are ideal when specific items or services directly support the donor organization's immediate needs, such as medical supplies for a healthcare charity or food for a hunger relief program. Opt for gift-in-kind contributions when the donated goods have a higher impact than equivalent monetary donations or when logistical constraints limit the use of cash. Choose cash donations when flexibility is needed to allocate funds efficiently across various operational needs or emergency responses.

Evaluating the Impact: Gift-in-Kind vs Monetary Support

Evaluating the impact of gift-in-kind versus monetary support requires assessing resource flexibility and administrative efficiency; monetary gifts offer nonprofits enhanced adaptability for urgent needs, while gifts-in-kind provide tangible assets reducing immediate procurement costs. Studies indicate that monetary donations often yield higher overall value due to streamlined allocation, although targeted in-kind contributions can address specific shortages effectively. Measuring donor intent alignment and recipient capacity ensures optimized outcomes in leveraging these distinct donation types.

Managing and Reporting Gift-in-Kind Donations

Managing gift-in-kind donations requires detailed documentation of item descriptions, fair market values, and donor information to ensure accurate reporting and compliance with tax regulations. Organizations must implement inventory tracking systems and regularly update valuation records to provide transparency and support financial audits. Proper management of these non-cash gifts enhances donor trust and optimizes the impact of contributions compared to unrestricted monetary gifts.

Challenges Associated with Non-Cash Gifts

Non-cash gifts, such as donations of goods or services, present challenges including valuation difficulties, limited liquidity, and potential logistical costs for storage and distribution. Organizations must navigate complex tax regulations and ensure the donated items align with their needs and mission to avoid inefficiencies. Unlike monetary gifts, which provide flexible resources, gift-in-kind donations require careful management to maximize impact and minimize administrative burdens.

Best Practices for Soliciting Both Gift Types

Soliciting gifts-in-kind requires clear communication of specific needs and detailed descriptions of the items or services sought, ensuring donors understand the impact of their contributions. Monetary gifts benefit from transparent budgeting and demonstrating how funds will be allocated to maximize organizational goals. Combining both approaches with tailored outreach and follow-up strategies enhances donor engagement and maximizes overall resource acquisition.

Important Terms

Non-cash contribution

Non-cash contributions, also known as Gifts-in-Kind, consist of tangible assets or services donated instead of monetary gifts, providing tax benefits and supporting organizations through valuable physical resources.

Tangible asset donation

Tangible asset donation involves gifting physical items such as equipment or property, offering tax benefits distinct from monetary gifts which are direct cash contributions used for immediate funding.

In-kind support

In-kind support includes non-cash donations such as goods, services, or time, distinguishing it from monetary gifts which involve direct financial contributions.

Hard goods gifting

Hard goods gifting involves donating tangible items, known as gifts-in-kind, which can provide specific resources directly, whereas monetary gifts offer flexible funding for organizational needs and operations.

Property endowment

Property endowment refers to the donation of tangible assets such as real estate or equipment, offering potential tax benefits and long-term value, while gift-in-kind denotes non-cash contributions of goods or services distinct from monetary gifts that involve direct cash donations.

Restricted funds

Restricted funds from gift-in-kind donations require specific-use designation and non-cash valuation, whereas monetary gifts provide flexible funding with immediate liquidity.

Liquid donation

Liquid donation involves cash contributions that offer flexible funding, enabling organizations to allocate resources efficiently compared to Gift-in-Kind donations, which are non-cash goods or services often limited by specific use or timing constraints.

Cash contribution

Cash contributions provide flexible funding and are fully tax-deductible, while gift-in-kind donations involve non-cash assets valued at fair market prices for tax purposes and require proper valuation documentation.

Fair market value appraisal

Fair market value appraisal ensures accurate valuation of Gift-in-Kind donations by establishing their equivalent monetary worth for tax and reporting purposes, distinguishing them clearly from straightforward monetary gifts.

Direct financial gift

Direct financial gifts involve transferring money or its equivalent, whereas gifts-in-kind comprise tangible assets or services valued for donation purposes.

Gift-in-Kind vs Monetary Gift Infographic

moneydif.com

moneydif.com