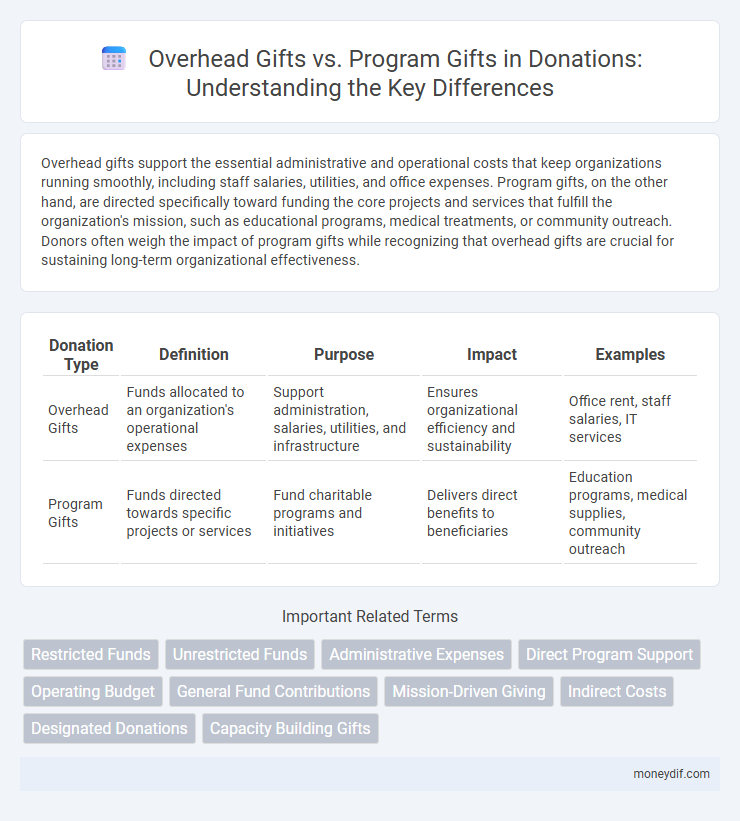

Overhead gifts support the essential administrative and operational costs that keep organizations running smoothly, including staff salaries, utilities, and office expenses. Program gifts, on the other hand, are directed specifically toward funding the core projects and services that fulfill the organization's mission, such as educational programs, medical treatments, or community outreach. Donors often weigh the impact of program gifts while recognizing that overhead gifts are crucial for sustaining long-term organizational effectiveness.

Table of Comparison

| Donation Type | Definition | Purpose | Impact | Examples |

|---|---|---|---|---|

| Overhead Gifts | Funds allocated to an organization's operational expenses | Support administration, salaries, utilities, and infrastructure | Ensures organizational efficiency and sustainability | Office rent, staff salaries, IT services |

| Program Gifts | Funds directed towards specific projects or services | Fund charitable programs and initiatives | Delivers direct benefits to beneficiaries | Education programs, medical supplies, community outreach |

Understanding Overhead Gifts vs Program Gifts

Overhead gifts fund essential operational expenses such as salaries, utilities, and administrative costs, ensuring nonprofit organizations maintain sustainability and efficiency. Program gifts directly support specific initiatives or services delivered by the organization, contributing to measurable impacts and project success. Understanding the distinction helps donors align contributions with their values, whether supporting infrastructure or tangible program outcomes.

Key Differences Between Overhead and Program Gifts

Overhead gifts fund an organization's administrative expenses, including salaries, office rent, and utilities, which are essential for sustaining operations but do not directly support program services. Program gifts are specifically allocated to mission-related activities, such as community outreach, education, or service delivery, ensuring tangible outcomes aligned with donor intent. Understanding the key difference between overhead and program gifts enables donors to strategically support both the infrastructure and the direct impact of nonprofit organizations.

Why Overhead Gifts Matter for Nonprofits

Overhead gifts provide essential funding to cover administrative costs, ensuring nonprofits maintain efficient operations and comply with regulations. These gifts enable investments in staff training, technology, and infrastructure, which directly support program delivery and organizational sustainability. Donors who fund overhead contribute to building a stronger foundation that enhances long-term impact and accountability.

The Impact of Program Gifts on Mission Delivery

Program gifts directly fund the core activities and initiatives of an organization, significantly enhancing mission delivery by enabling the implementation of essential services and projects. These gifts ensure resources are allocated toward measurable outcomes, increasing the effectiveness and reach of charitable programs. Donors contributing program gifts accelerate positive social impact by supporting tangible, frontline work rather than administrative overhead.

Donor Perceptions: Overhead vs Program Giving

Donors often perceive program gifts as more impactful because funds are directly allocated to services or projects, enhancing their sense of contribution effectiveness. Overhead gifts, covering administrative and operational costs, may be undervalued despite their critical role in sustaining organizational infrastructure. Transparent communication about the necessity of overhead expenses can shift donor perceptions, fostering trust and encouraging balanced giving that supports both program delivery and organizational sustainability.

Myths and Facts About Overhead Gifts

Overhead gifts are often misunderstood as wasteful or inefficient, but facts reveal they fund essential administrative services that sustain nonprofit programs and ensure regulatory compliance. Many donors mistakenly believe only program gifts directly impact beneficiaries, yet overhead investments improve fundraising, staff training, and infrastructure vital for long-term mission success. Dispelling myths about overhead encourages balanced support, fostering organizational transparency and greater overall impact.

Balancing Overhead and Program Funding Needs

Effective donation strategies emphasize balancing overhead gifts and program gifts to ensure nonprofit sustainability. Overhead gifts fund essential administrative costs such as staff salaries, technology, and office expenses, maintaining operational efficiency. Program gifts support direct project activities, making it crucial to allocate funds that meet both operational and programmatic needs for long-term impact and growth.

How to Communicate Overhead Needs to Donors

Clearly explain that overhead gifts cover essential expenses such as staff salaries, office rent, and utilities required to keep programs running effectively. Use transparent financial reports and real-life examples to demonstrate how overhead directly supports the mission's impact and sustainability. Emphasize that investing in overhead ensures long-term program success and maximizes overall donor impact.

Strategies for Encouraging Both Gift Types

Effective fundraising strategies emphasize transparent communication about the impact of both overhead and program gifts, highlighting how each supports organizational sustainability and mission delivery. Tailored donor engagement involves demonstrating that overhead gifts fund critical infrastructure like staff salaries and operational costs, while program gifts directly support services and initiatives benefiting the cause. Combining personalized appeals, clear reporting, and recognizing donor contributions fosters balanced support for both gift types, ensuring long-term organizational health and program effectiveness.

Maximizing Impact: Integrating Overhead and Program Gifts

Maximizing the impact of donations involves strategically integrating overhead gifts, which cover essential operational costs, with program gifts that directly fund charitable initiatives. Allocating resources to overhead ensures organizational sustainability, allowing programs to function efficiently and effectively. A balanced approach enhances transparency and donor trust, ultimately fostering greater long-term impact and mission success.

Important Terms

Restricted Funds

Restricted funds designate donor contributions specifically for program gifts or overhead gifts, ensuring targeted allocation and compliance with donor intent.

Unrestricted Funds

Unrestricted funds provide flexible financial support that covers overhead expenses such as administrative costs, unlike program gifts which are designated specifically for direct program activities.

Administrative Expenses

Administrative expenses primarily cover overhead gifts necessary for operational support, whereas program gifts directly fund specific mission-related activities.

Direct Program Support

Direct Program Support maximizes impact by allocating funds specifically to program gifts rather than overhead gifts, ensuring resources directly benefit program outcomes.

Operating Budget

Analyzing the operating budget reveals that overhead gifts typically cover administrative expenses, while program gifts are directly allocated to service delivery and mission-related activities.

General Fund Contributions

General Fund Contributions primarily support overhead expenses, whereas Program Gifts are designated specifically for direct program activities.

Mission-Driven Giving

Mission-driven giving prioritizes program gifts over overhead gifts to maximize impact on organizational goals and donor intentions.

Indirect Costs

Indirect costs, often covered by overhead gifts, support organizational infrastructure and administrative functions, whereas program gifts directly fund specific program activities and services.

Designated Donations

Designated donations are funds specifically allocated by donors for particular programs, differentiating from overhead gifts which support indirect costs like administrative expenses.

Capacity Building Gifts

Capacity building gifts provide essential funding for organizational infrastructure, contrasting with program gifts that directly support specific projects, while overhead gifts cover general administrative expenses.

Overhead Gifts vs Program Gifts Infographic

moneydif.com

moneydif.com