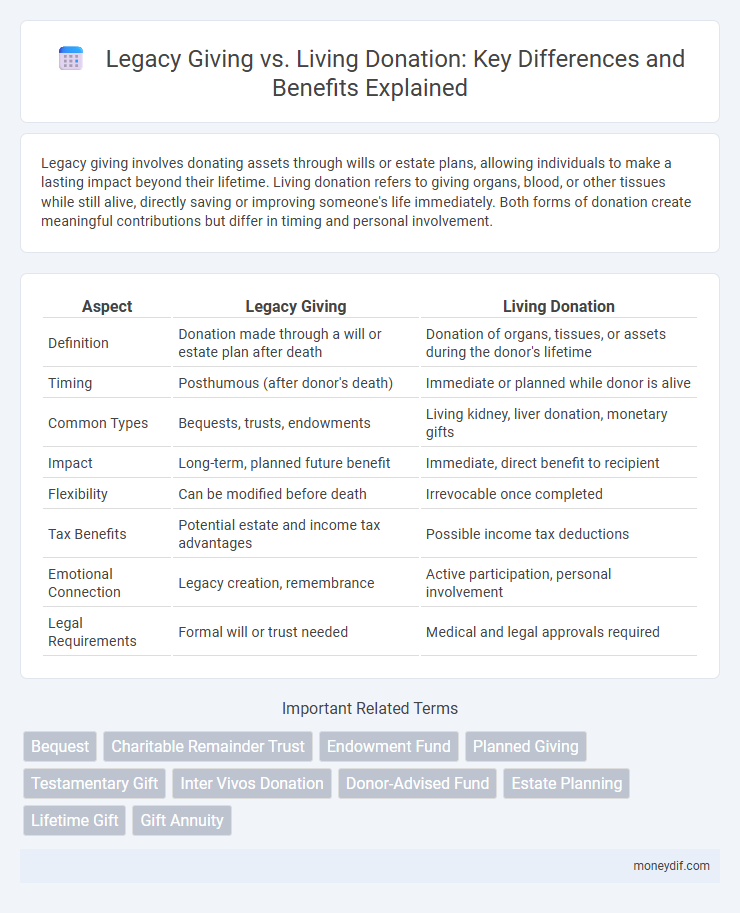

Legacy giving involves donating assets through wills or estate plans, allowing individuals to make a lasting impact beyond their lifetime. Living donation refers to giving organs, blood, or other tissues while still alive, directly saving or improving someone's life immediately. Both forms of donation create meaningful contributions but differ in timing and personal involvement.

Table of Comparison

| Aspect | Legacy Giving | Living Donation |

|---|---|---|

| Definition | Donation made through a will or estate plan after death | Donation of organs, tissues, or assets during the donor's lifetime |

| Timing | Posthumous (after donor's death) | Immediate or planned while donor is alive |

| Common Types | Bequests, trusts, endowments | Living kidney, liver donation, monetary gifts |

| Impact | Long-term, planned future benefit | Immediate, direct benefit to recipient |

| Flexibility | Can be modified before death | Irrevocable once completed |

| Tax Benefits | Potential estate and income tax advantages | Possible income tax deductions |

| Emotional Connection | Legacy creation, remembrance | Active participation, personal involvement |

| Legal Requirements | Formal will or trust needed | Medical and legal approvals required |

Understanding Legacy Giving: Definition and Impact

Legacy giving involves donors allocating assets or funds to charitable organizations through wills or estate plans, ensuring sustained support beyond their lifetime. This form of philanthropy creates a lasting impact by enabling nonprofits to plan long-term projects and expand their mission effectively. Unlike living donation, which involves direct, immediate gifts such as organ or blood donation, legacy giving secures future resources that can transform communities and causes over generations.

The Concept of Living Donation Explained

Living donation involves the voluntary transfer of organs or tissues from a healthy donor to a recipient while the donor is still alive, enabling immediate transplant opportunities and reducing waiting times. Common examples include kidney and partial liver donations, which are carefully evaluated to ensure donor safety and compatibility. This donation method can significantly improve the recipient's quality of life and survival rates compared to legacy giving, which typically occurs posthumously through bequests.

Key Differences Between Legacy Giving and Living Donation

Legacy giving involves donors arranging gifts through their estate plans, such as wills or trusts, allowing contributions after their lifetime, while living donation entails the immediate transfer of organs, tissues, or funds during the donor's lifetime. Legacy gifts often support nonprofit organizations or causes over the long term, whereas living donations provide direct, tangible benefits with immediate impact on recipients' health or organizational resources. The primary difference lies in timing and execution: legacy giving is posthumous and planned in advance, whereas living donation is active and performed when the donor is alive.

Motivations Behind Legacy and Living Donations

Legacy giving is often motivated by a desire to create a lasting impact, preserve family values, and support charitable causes aligned with the donor's life philosophy. Living donations are driven by immediate compassion, the urgency of helping a loved one, and the personal connection to the recipient's health needs. Both types of donations reflect altruism but differ fundamentally in timing and emotional focus, with legacy giving emphasizing long-term societal benefit and living donation focusing on direct, life-saving assistance.

Financial Implications: Legacy Giving vs Living Donation

Legacy giving involves transferring assets through wills or trusts, often providing significant tax benefits and minimizing estate taxes for donors while supporting charitable organizations. Living donation requires an immediate financial commitment, including potential medical expenses and lost income during recovery, but it can offer substantial life-saving impact for recipients. Both approaches have distinct financial implications, where legacy giving optimizes long-term estate planning and living donation demands upfront costs with immediate humanitarian outcomes.

Emotional Outcomes for Donors and Recipients

Legacy giving fosters a profound emotional connection by allowing donors to create a lasting impact beyond their lifetime, providing recipients with a sense of hope and gratitude that extends through generations. Living donation often generates immediate emotional fulfillment for donors through direct contributions to a recipient's health, while recipients experience gratitude and renewed optimism for the future. Both giving methods significantly enhance emotional well-being, with legacy giving tied to enduring legacy and living donation tied to tangible, present-life benefits.

Tax Benefits: Comparing Both Donation Types

Legacy giving offers significant tax benefits, including estate tax deductions and potential reduction of taxable estate value, making it advantageous for long-term financial planning. Living donations provide immediate tax deductions for charitable contributions, which can directly reduce taxable income in the year of donation. Comparing both, legacy giving often yields greater tax savings over time, while living donations offer upfront tax relief, allowing donors to choose benefits based on their financial goals.

Choosing the Right Path: Factors to Consider

Legacy giving involves donating assets through your estate plan after death, providing long-term impact and tax benefits, while living donation entails giving organs or tissue during one's lifetime, offering immediate life-saving assistance. Factors to consider include your financial situation, health status, and personal values, as well as the urgency and type of impact you wish to achieve. Evaluating these elements helps determine the most meaningful and feasible donation path aligned with your legacy goals and current capabilities.

Case Studies: Real-Life Stories of Legacy and Living Donors

Case studies of legacy giving reveal how donors have created enduring impact through bequests that fund scholarships, medical research, and community projects long after their lifetime. In contrast, living donation stories highlight the immediate life-saving effects of organ or blood donations, showcasing personal connections and health recoveries. Both legacy giving and living donation demonstrate powerful examples of generosity, with documented outcomes emphasizing their distinct yet complementary roles in philanthropy.

Future Trends in Charitable Donations and Philanthropy

Legacy giving is poised to grow as donors prioritize long-term impact through bequests and endowed gifts that ensure sustained support for causes beyond their lifetime. Living donation, involving real-time contributions of assets or property, is gaining traction due to its immediate philanthropic benefits and tax advantages. Future trends in charitable donations emphasize hybrid models combining legacy giving with living donations, leveraging digital platforms to facilitate planned giving and increase donor engagement.

Important Terms

Bequest

Bequest in legacy giving allows individuals to donate assets through their wills, whereas living donation involves the direct transfer of organs or tissues during the donor's lifetime.

Charitable Remainder Trust

A Charitable Remainder Trust enables donors to support legacy giving by transferring assets to charity while retaining income, offering a tax-efficient alternative to living donation.

Endowment Fund

Endowment funds provide sustainable financial support for institutions through legacy giving, while living donations offer immediate contributions for ongoing operational needs.

Planned Giving

Planned giving strategically allocates assets through legacy giving or living donation to maximize philanthropic impact and ensure long-term support for chosen causes.

Testamentary Gift

Testamentary gifts, made through wills or trusts after death, differ from living donations by enabling legacy giving that supports charitable causes without impacting the donor's current assets.

Inter Vivos Donation

Inter Vivos Donation involves transferring assets or organs during the donor's lifetime, contrasting Legacy Giving which typically occurs posthumously, highlighting its immediate impact in Living Donation scenarios.

Donor-Advised Fund

Donor-Advised Funds enable strategic legacy giving by allowing donors to recommend grants over time, complementing living donations which provide immediate charitable impact.

Estate Planning

Estate planning strategically balances legacy giving, which involves bequeathing assets after death, with living donation, allowing individuals to transfer wealth or gifts during their lifetime to maximize philanthropic impact and tax benefits.

Lifetime Gift

Lifetime gifts through legacy giving create enduring impact by bequeathing assets after death, while living donation provides immediate, tangible benefits by donating organs or resources during one's lifetime.

Gift Annuity

Gift annuities provide a secure income stream while supporting legacy giving by creating lasting charitable impact, contrasting with living donations that directly transfer assets during the donor's lifetime.

Legacy Giving vs Living Donation Infographic

moneydif.com

moneydif.com