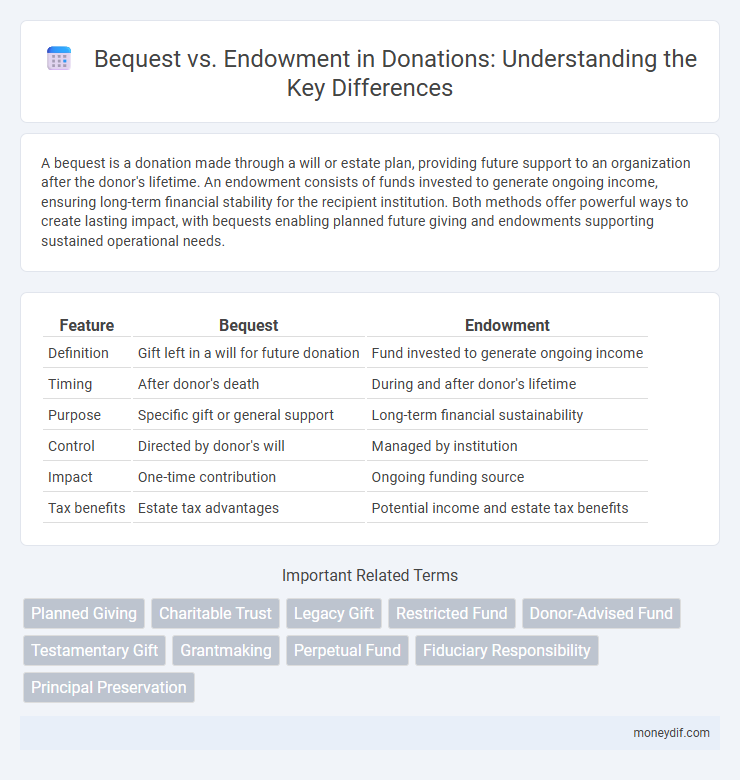

A bequest is a donation made through a will or estate plan, providing future support to an organization after the donor's lifetime. An endowment consists of funds invested to generate ongoing income, ensuring long-term financial stability for the recipient institution. Both methods offer powerful ways to create lasting impact, with bequests enabling planned future giving and endowments supporting sustained operational needs.

Table of Comparison

| Feature | Bequest | Endowment |

|---|---|---|

| Definition | Gift left in a will for future donation | Fund invested to generate ongoing income |

| Timing | After donor's death | During and after donor's lifetime |

| Purpose | Specific gift or general support | Long-term financial sustainability |

| Control | Directed by donor's will | Managed by institution |

| Impact | One-time contribution | Ongoing funding source |

| Tax benefits | Estate tax advantages | Potential income and estate tax benefits |

Understanding Bequests and Endowments

Bequests refer to donations made through a donor's will, allowing assets to transfer to a nonprofit after death, often specifying terms for use. Endowments consist of funds invested to generate ongoing income for an organization, supporting its mission indefinitely. Understanding the distinctions helps donors align their legacy goals with organizational sustainability and financial planning.

Key Differences Between Bequests and Endowments

Bequests are planned gifts made through a donor's will or estate plan, typically transferring assets upon their passing, while endowments are funds donated to an organization to be invested, generating ongoing income for specific purposes. Bequests may be unrestricted or designated, often providing a single future gift, whereas endowments create a permanent financial resource, supporting charitable activities indefinitely. Understanding these distinctions helps donors and nonprofits optimize estate planning and long-term fundraising strategies.

Advantages of Leaving a Bequest

Leaving a bequest allows donors to support their favorite causes without immediate financial impact, preserving liquidity during their lifetime. Bequests offer flexibility in estate planning, enabling the allocation of assets to multiple beneficiaries or charities with specific conditions. This method often provides significant tax advantages, potentially reducing estate taxes and maximizing the value passed on to philanthropic organizations.

Benefits of Establishing an Endowment

Establishing an endowment provides a sustainable source of funding by investing donated capital and using the generated income to support ongoing programs, ensuring long-term financial stability for nonprofit organizations. Unlike one-time donations or bequests that may be spent immediately, endowments create a perpetual legacy that enhances institutional credibility and attracts further contributions. Endowments also offer tax advantages and can be structured to align with specific donor intentions, maximizing impact over time.

Long-Term Impact: Bequest vs Endowment

Bequests allow donors to make significant gifts through their wills, creating a lasting legacy that supports causes after their lifetime. Endowments provide a sustainable source of funding by investing principal gifts to generate ongoing income for organizations. The fundamental difference lies in bequests often providing a one-time future gift, whereas endowments generate continuous financial support, ensuring long-term impact and stability.

Tax Implications for Donors

Bequests offer donors potential estate tax deductions, reducing the taxable value of their estates while ensuring assets support chosen causes after death. Endowments, funded during a donor's lifetime, provide immediate charitable tax deductions and allow donors to influence the long-term financial management of their contributions. Understanding the distinct tax benefits of bequests versus endowments helps donors optimize their philanthropic impact and financial planning.

How Nonprofits Utilize Bequests and Endowments

Nonprofits utilize bequests to receive planned gifts from donors' estates, providing flexible funds that support immediate operational needs or special projects. Endowments are invested funds where the principal remains intact while earnings generate a stable income stream, ensuring long-term financial sustainability. These tools enable organizations to balance current programming with future growth, strengthening their mission impact.

Choosing the Right Giving Option

When selecting a giving option, understanding the distinction between bequests and endowments is crucial for maximizing charitable impact. Bequests, arranged through wills, provide donors the flexibility to allocate assets upon death, whereas endowments involve funds invested to generate ongoing income for a cause. Evaluating financial goals, desired legacy, and the charity's capacity to manage funds helps donors choose the most effective approach to support long-term missions.

Factors to Consider Before Donating

Evaluate your long-term financial goals and the impact you want your donation to have when choosing between a bequest and an endowment. Consider the flexibility of a bequest, which allows assets to be transferred after death, versus the perpetual funding and specific purpose of an endowment. Tax implications, the donor's estate planning needs, and the recipient organization's stability are critical factors to optimize donation effectiveness.

Maximizing Your Philanthropic Legacy

Bequests allow donors to allocate assets through their wills, ensuring a lasting impact on chosen causes without affecting current finances. Endowments create a permanent fund where the principal remains intact while earnings provide continuous support for philanthropic initiatives. Combining both strategies maximizes your philanthropic legacy by securing immediate and enduring benefits for beneficiary organizations.

Important Terms

Planned Giving

Planned giving through a bequest transfers assets to an organization upon death, while an endowment involves investing donated funds to generate ongoing income for long-term financial support.

Charitable Trust

A charitable trust utilizes bequests as one-time gifts, while endowments generate ongoing income through invested principal to support long-term charitable activities.

Legacy Gift

A legacy gift, often structured as a bequest in a will, provides one-time or deferred donations, whereas an endowment generates ongoing financial support through invested principal for charitable organizations.

Restricted Fund

Restricted funds from bequests are typically designated for specific purposes, whereas endowments often invest principal to generate income for ongoing use within those restrictions.

Donor-Advised Fund

Donor-advised funds offer flexible charitable giving options with immediate tax benefits, while bequests and endowments provide long-term, sustained support through planned estate gifts and permanently invested funds.

Testamentary Gift

A testamentary gift, often structured as a bequest, transfers assets through a will upon death, while an endowment typically involves a gift that provides ongoing financial support to an institution.

Grantmaking

Grantmaking strategies differ significantly between bequests, which provide one-time or irregular funding from donor estates, and endowments, which offer sustainable, long-term financial support through invested principal.

Perpetual Fund

Perpetual funds function as endowments by maintaining principal capital intact while using investment income for ongoing bequests or charitable purposes.

Fiduciary Responsibility

Fiduciary responsibility requires managing bequests and endowments with prudent stewardship to ensure funds are invested wisely and used according to donor intent for sustainable organizational benefit.

Principal Preservation

Principal preservation ensures that the original Bequest or Endowment amount remains intact, allowing only the generated income to be utilized for funding purposes.

Bequest vs Endowment Infographic

moneydif.com

moneydif.com