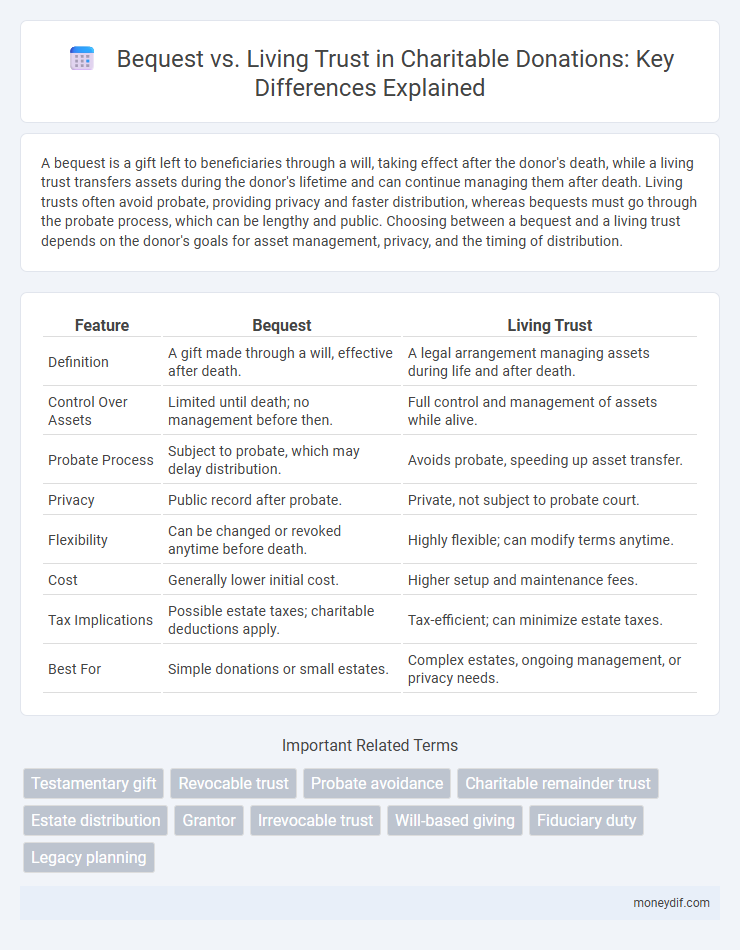

A bequest is a gift left to beneficiaries through a will, taking effect after the donor's death, while a living trust transfers assets during the donor's lifetime and can continue managing them after death. Living trusts often avoid probate, providing privacy and faster distribution, whereas bequests must go through the probate process, which can be lengthy and public. Choosing between a bequest and a living trust depends on the donor's goals for asset management, privacy, and the timing of distribution.

Table of Comparison

| Feature | Bequest | Living Trust |

|---|---|---|

| Definition | A gift made through a will, effective after death. | A legal arrangement managing assets during life and after death. |

| Control Over Assets | Limited until death; no management before then. | Full control and management of assets while alive. |

| Probate Process | Subject to probate, which may delay distribution. | Avoids probate, speeding up asset transfer. |

| Privacy | Public record after probate. | Private, not subject to probate court. |

| Flexibility | Can be changed or revoked anytime before death. | Highly flexible; can modify terms anytime. |

| Cost | Generally lower initial cost. | Higher setup and maintenance fees. |

| Tax Implications | Possible estate taxes; charitable deductions apply. | Tax-efficient; can minimize estate taxes. |

| Best For | Simple donations or small estates. | Complex estates, ongoing management, or privacy needs. |

Introduction to Charitable Giving: Bequest vs Living Trust

A bequest is a planned gift specified in a will that directs assets to a charity upon the donor's death, offering simplicity and potential estate tax benefits. A living trust involves transferring assets into a trust during the donor's lifetime, allowing for control, privacy, and potentially avoiding probate while supporting charitable causes. Both methods provide strategic options for charitable giving, tailored to the donor's financial goals and legacy planning needs.

Understanding Bequests in Estate Planning

Bequests are specific gifts or assets designated in a will to be transferred upon the donor's death, serving as a vital component of estate planning for charitable donations. Unlike living trusts which manage assets during a donor's lifetime and after death, bequests only take effect posthumously, ensuring precise allocation of funds or property to chosen beneficiaries. Understanding the tax benefits and legal requirements of bequests can maximize charitable impact while providing flexible options within comprehensive estate plans.

What Is a Living Trust in Philanthropy?

A living trust in philanthropy is a legal arrangement where assets are managed by a trustee for the benefit of charitable organizations during the donor's lifetime and after death. It helps donors maintain control over their donations while potentially reducing estate taxes and avoiding probate. This flexible vehicle supports strategic giving by allowing changes to beneficiaries or terms as philanthropic goals evolve.

Key Differences Between Bequest and Living Trust Donations

A bequest donation is a gift specified in a donor's will, taking effect after their death, while a living trust donation is established during the donor's lifetime and can avoid probate. Bequests are often simpler to implement but may face probate delays, whereas living trusts offer greater privacy and control over asset distribution. Key differences include timing of transfer, probate involvement, and control over asset management during the donor's lifetime.

Tax Implications: Bequest vs Living Trust for Donors

Bequests made through a will typically avoid immediate gift tax but may be subject to estate tax depending on the donor's total estate value and federal or state thresholds. Living trusts can provide greater control over asset distribution and may help minimize probate costs, although they do not inherently reduce estate taxes unless combined with specific tax-planning strategies. Both tools require careful consideration of tax laws to optimize charitable giving and reduce the overall tax burden on donors and beneficiaries.

Flexibility and Control: Choosing Your Charitable Path

A living trust offers greater flexibility and control by allowing you to manage and modify your charitable donations during your lifetime, ensuring your assets are distributed according to your current wishes. Bequests, while straightforward, only take effect after death, limiting your ability to adapt your giving strategy over time. Opting for a living trust enables proactive philanthropy with adjustable terms, maximizing the impact of your donation choices.

Impact Timing: When Do Charities Receive Your Gift?

Bequests in wills typically transfer assets to charities only after the donor's death, ensuring a deferred impact that aligns with estate settlement timelines. Living trusts can distribute gifts to charities during the donor's lifetime or upon death, allowing for more immediate or flexible philanthropic impact. Choosing between a bequest and a living trust affects when and how charities receive support, influencing the timing and utilization of donated funds.

Legal Considerations in Donating via Bequest or Living Trust

Donating through a bequest involves including a specific gift in a will, which becomes effective only after the donor's death and is subject to probate court oversight, potentially leading to delays and challenges. A living trust allows for managing and distributing assets during the donor's lifetime and after death without probate, offering greater privacy and faster transfer to beneficiaries or charitable organizations. Legal considerations include ensuring the trust or will is properly drafted, compliant with state laws, and regularly updated to reflect changes in assets or donor intentions.

Advantages and Disadvantages: Bequest vs Living Trust

Bequests offer simplicity and flexibility, allowing donors to specify asset distribution in a will, but they often face probate delays and potential legal challenges. Living trusts provide faster asset transfer bypassing probate, maintain privacy, and offer greater control during the donor's lifetime, yet they involve higher initial setup costs and ongoing administration. Choosing between bequest and living trust depends on balancing ease of setup, control over assets, probate avoidance, and estate privacy based on individual donation goals.

How to Decide: Choosing the Best Option for Your Legacy

Choosing between a bequest and a living trust depends on factors such as control, complexity, and tax implications for your estate. Bequests, made through wills, offer simplicity and take effect after death, while living trusts provide continuous management and can help avoid probate. Assess your goals for asset distribution, privacy preferences, and potential estate taxes to determine which legacy planning tool best aligns with your philanthropic intentions.

Important Terms

Testamentary gift

A testamentary gift is a transfer of assets specified in a will that becomes effective only upon the testator's death, contrasting with a bequest which specifically refers to personal property left through a will. Unlike living trusts that manage and distribute assets during the grantor's lifetime and beyond, testamentary gifts require probate to validate the will and execute the distribution.

Revocable trust

A revocable trust allows the grantor to retain control over assets while alive and facilitates seamless transfer of property upon death, often avoiding probate unlike a bequest made through a will, which may require court approval. Living trusts, a form of revocable trust, provide flexibility for asset management during the grantor's lifetime and ensure privacy and quicker distribution compared to traditional testamentary bequests.

Probate avoidance

Probate avoidance significantly reduces the time and costs associated with estate settlement by using a living trust, which allows assets to bypass the probate process and transfer directly to beneficiaries. Unlike a simple bequest in a will that must go through probate court, a living trust provides privacy and immediate asset distribution upon the grantor's death.

Charitable remainder trust

A charitable remainder trust allows donors to receive income during their lifetime and designate assets to charity after death, differing from a living trust which primarily manages asset distribution without inherent charitable benefits or tax advantages.

Estate distribution

Estate distribution through a living trust bypasses probate, ensuring faster asset transfer compared to a bequest in a will, which requires court validation.

Grantor

A grantor is the individual who creates a living trust by transferring assets into the trust for management and eventual distribution, whereas a bequest involves the grantor's assets being passed on through a will upon death without the need for trust administration. Living trusts offer probate avoidance and continuous asset control during the grantor's lifetime, contrasting with bequests that require probate court validation after the grantor's death.

Irrevocable trust

An irrevocable trust offers enhanced asset protection and tax benefits by permanently transferring ownership, contrasting with a living trust which remains revocable and primarily facilitates probate avoidance. Unlike a bequest outlined in a will that only takes effect after death, an irrevocable trust manages and distributes assets during the grantor's lifetime and beyond, ensuring greater control over inheritance and minimizing estate taxes.

Will-based giving

Will-based giving allows donors to specify bequests transferring assets to beneficiaries upon death, often subject to probate, while living trusts enable the transfer of assets outside probate, offering more privacy and potentially faster distribution. Bequests made through a will provide flexibility and simplicity for smaller estates, whereas living trusts are preferred for managing larger assets and avoiding court intervention.

Fiduciary duty

Fiduciary duty requires trustees managing a living trust to act in the best interest of beneficiaries, unlike the executor's role in handling bequests through probate.

Legacy planning

Bequest involves directing assets through a will to beneficiaries after death, while a living trust allows for asset management and transfer both during the grantor's lifetime and after, minimizing probate delays. Choosing between bequest and living trust depends on factors such as asset complexity, privacy preferences, and the desire to avoid probate court involvement.

Bequest vs Living Trust Infographic

moneydif.com

moneydif.com