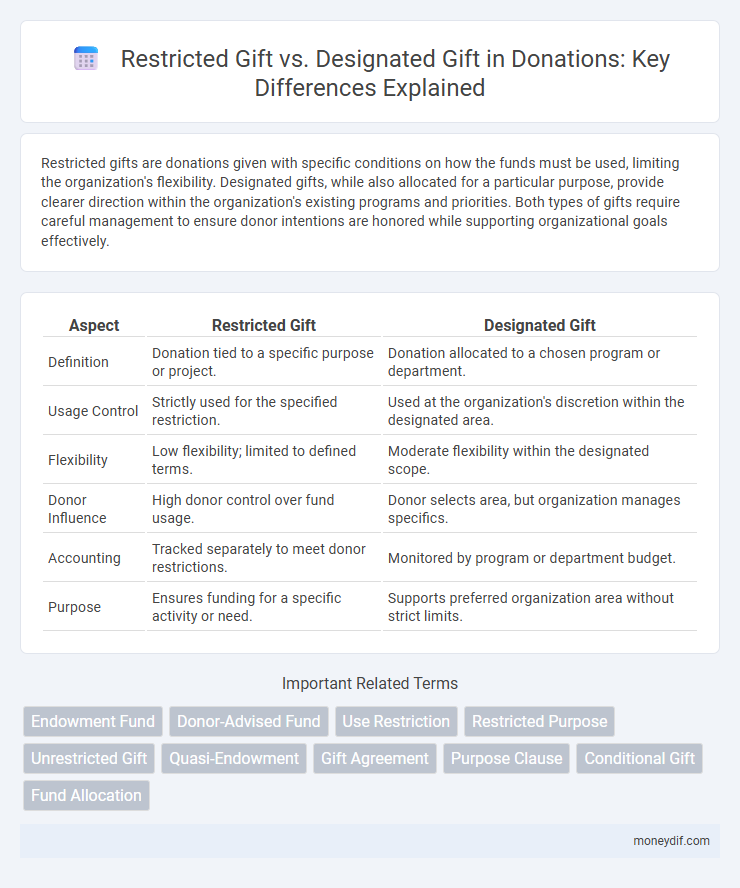

Restricted gifts are donations given with specific conditions on how the funds must be used, limiting the organization's flexibility. Designated gifts, while also allocated for a particular purpose, provide clearer direction within the organization's existing programs and priorities. Both types of gifts require careful management to ensure donor intentions are honored while supporting organizational goals effectively.

Table of Comparison

| Aspect | Restricted Gift | Designated Gift |

|---|---|---|

| Definition | Donation tied to a specific purpose or project. | Donation allocated to a chosen program or department. |

| Usage Control | Strictly used for the specified restriction. | Used at the organization's discretion within the designated area. |

| Flexibility | Low flexibility; limited to defined terms. | Moderate flexibility within the designated scope. |

| Donor Influence | High donor control over fund usage. | Donor selects area, but organization manages specifics. |

| Accounting | Tracked separately to meet donor restrictions. | Monitored by program or department budget. |

| Purpose | Ensures funding for a specific activity or need. | Supports preferred organization area without strict limits. |

Understanding Restricted vs. Designated Gifts

Restricted gifts limit the use of donated funds to a specific program or purpose defined by the donor, ensuring alignment with particular organizational priorities or projects. Designated gifts direct contributions to a specific department, project, or initiative within an organization, allowing donors to support targeted areas while still affording the organization some flexibility in fund management. Understanding the distinction between restricted and designated gifts is crucial for effective fund allocation and transparent donor communication.

Key Differences Between Restricted and Designated Donations

Restricted gifts require donors to specify how their contributions must be used, legally binding the organization to honor those stipulations. Designated gifts allow donors to recommend how funds should be spent, but the organization retains some flexibility to redirect if necessary. Understanding these key differences ensures transparent fund management and donor satisfaction.

Defining Restricted Gifts: Purpose and Limitations

Restricted gifts are donations allocated by donors for specific purposes or projects, ensuring funds are used exactly as intended and preventing diversion to other organizational needs. These gifts impose clear limitations on how the recipient organization can utilize the resources, often requiring detailed reporting and accountability to demonstrate adherence to donor conditions. Understanding the purpose and boundaries of restricted gifts is essential for nonprofits to maintain trust, comply with legal requirements, and maximize donor satisfaction.

What Are Designated Gifts? Flexibility and Use

Designated gifts are donations made to support a specific program, project, or purpose identified by the donor, ensuring their contribution directly benefits the intended area. Unlike restricted gifts with rigid limitations, designated gifts offer greater flexibility, allowing organizations to allocate funds within the specified category based on current needs and priorities. This approach balances donor intent with organizational adaptability, maximizing the impact of the donation while respecting donor preferences.

Donor Intent: The Driving Force Behind Gift Types

Donor intent is the driving force behind distinguishing restricted gifts from designated gifts, as it specifies how the funds should be used in alignment with the donor's wishes. Restricted gifts legally bind the organization to use the donation solely for the specified purpose, while designated gifts typically allow the organization some flexibility within the donor's broader intent. Understanding these nuances ensures proper stewardship, respects donor priorities, and maintains trust between donors and recipient organizations.

Organizational Impact of Restricted and Designated Gifts

Restricted gifts limit an organization's flexibility by earmarking funds for specific programs or purposes, ensuring targeted impact but potentially hindering resource allocation for evolving priorities. Designated gifts allow organizations to support particular projects or departments, enhancing donor intent fulfillment while maintaining some operational control. Both types influence strategic planning by balancing donor restrictions with the organization's ability to address broader needs and maximize overall impact.

Managing Compliance: Honoring Gift Restrictions

Managing compliance in donations requires distinguishing between restricted gifts and designated gifts to honor donor intentions accurately. Restricted gifts mandate that funds be used explicitly for the purpose specified by the donor, ensuring legal and ethical adherence to donor-imposed conditions. Designated gifts may offer more flexibility but still require careful tracking to respect the donor's specified program or project, maintaining transparency and accountability within nonprofit financial management.

Best Practices for Soliciting and Accepting Gifts

Best practices for soliciting and accepting gifts emphasize clear communication about the purpose and restrictions of each donation type, ensuring donors understand whether their contribution is a restricted gift with specific usage limits or a designated gift intended for particular programs. Organizations should establish transparent policies and documentation procedures to manage donor intent effectively, safeguarding compliance with legal and ethical standards. Proper tracking and reporting build donor trust and optimize resource allocation aligned with mission priorities.

Legal and Ethical Considerations in Gift Categorization

Restricted gifts legally bind the nonprofit to use funds strictly for the donor-specified purpose, ensuring compliance with donor intent and avoiding potential legal disputes. Designated gifts, while directed towards a particular program or project, allow the organization some flexibility in fund allocation, provided the use aligns ethically with donor expectations and organizational policies. Proper categorization mitigates risks of fund misappropriation, maintains donor trust, and upholds transparency in nonprofit financial practices.

Communicating Gift Types to Donors and Stakeholders

Communicating the differences between restricted gifts and designated gifts ensures donors and stakeholders clearly understand how their contributions will be used. Restricted gifts require funds to be spent on specific purposes set by the donor, while designated gifts are allocated to particular programs or projects chosen by the organization. Clear explanations of these gift types enhance transparency, foster trust, and improve donor engagement.

Important Terms

Endowment Fund

An Endowment Fund consists of permanently restricted gifts, which must be preserved intact, whereas designated gifts allow donors to specify spending purposes without permanent restriction.

Donor-Advised Fund

Donor-Advised Funds (DAFs) enable donors to recommend grants while Restricted Gifts legally bind funds to specific purposes and Designated Gifts allocate donations to particular organizations or projects without ongoing donor involvement.

Use Restriction

Use restriction differentiates a restricted gift, which must be used for a specific purpose defined by the donor, from a designated gift, which is allocated to a particular program or department within an organization.

Restricted Purpose

A Restricted Purpose limits the use of a Restricted Gift to a specific function or project defined by the donor, whereas a Designated Gift directs funds to a particular department or program without broader usage constraints.

Unrestricted Gift

An unrestricted gift provides donors the flexibility to allocate funds anywhere within an organization, unlike restricted gifts which are limited to specific purposes, and designated gifts that target particular programs or projects.

Quasi-Endowment

Quasi-endowments consist of funds designated by a board for investment, differing from restricted gifts that donors limit in use, while designated gifts are allocated by the organization for specific purposes.

Gift Agreement

A Gift Agreement specifies terms for Restricted Gifts, which donors limit to specific purposes, versus Designated Gifts intended for particular projects or departments, ensuring proper allocation and compliance.

Purpose Clause

A purpose clause specifies the intended use of a gift, distinguishing a restricted gift, which limits funds to a specific purpose legally binding the donor's intent, from a designated gift, which directs funds toward a particular program or department without legal restriction.

Conditional Gift

A conditional gift requires specific conditions to be met before transfer, whereas a restricted gift limits the use of funds to a particular purpose and a designated gift directs funds to a specified project or department without additional conditions.

Fund Allocation

Restricted gifts require fund allocation according to donor-imposed limitations, whereas designated gifts are allocated for specific purposes chosen by the organization.

Restricted Gift vs Designated Gift Infographic

moneydif.com

moneydif.com