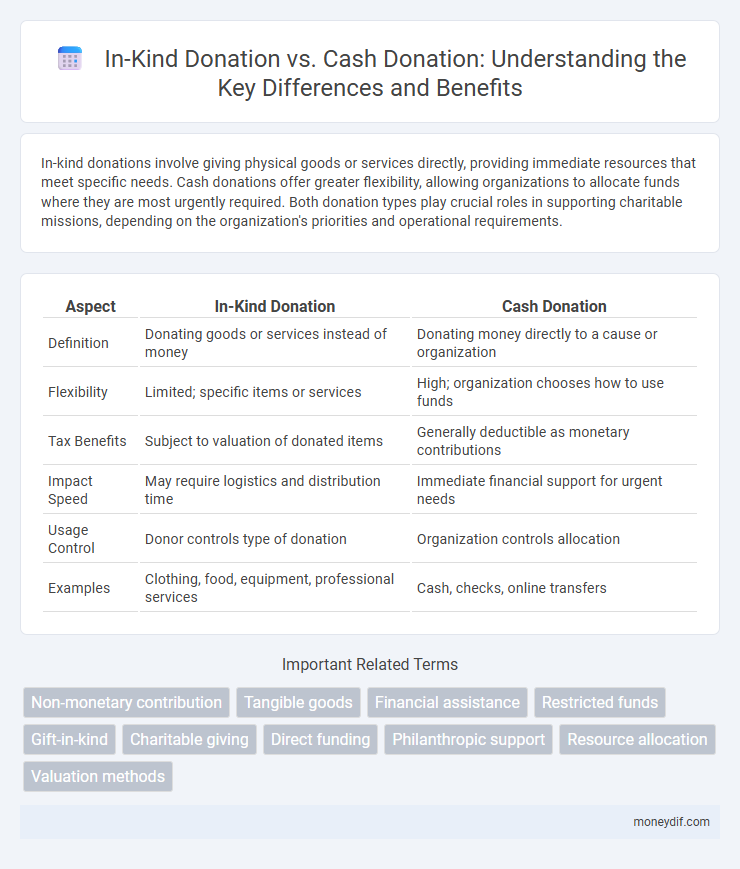

In-kind donations involve giving physical goods or services directly, providing immediate resources that meet specific needs. Cash donations offer greater flexibility, allowing organizations to allocate funds where they are most urgently required. Both donation types play crucial roles in supporting charitable missions, depending on the organization's priorities and operational requirements.

Table of Comparison

| Aspect | In-Kind Donation | Cash Donation |

|---|---|---|

| Definition | Donating goods or services instead of money | Donating money directly to a cause or organization |

| Flexibility | Limited; specific items or services | High; organization chooses how to use funds |

| Tax Benefits | Subject to valuation of donated items | Generally deductible as monetary contributions |

| Impact Speed | May require logistics and distribution time | Immediate financial support for urgent needs |

| Usage Control | Donor controls type of donation | Organization controls allocation |

| Examples | Clothing, food, equipment, professional services | Cash, checks, online transfers |

Understanding In-Kind and Cash Donations

In-kind donations involve the contribution of goods or services rather than money, such as clothing, food, or professional expertise, providing direct resources that meet specific needs. Cash donations offer flexible financial support, allowing organizations to allocate funds to priority areas and cover operational expenses efficiently. Understanding the distinctions between in-kind and cash donations helps donors maximize their impact by aligning contributions with the recipient organization's immediate requirements and strategic goals.

Key Differences Between In-Kind and Cash Donations

In-kind donations consist of goods or services directly provided, such as clothing, food, or professional expertise, whereas cash donations involve monetary contributions that organizations can allocate flexibly to various needs. Cash donations offer greater versatility, enabling nonprofits to address urgent priorities, cover operational costs, or invest in specific programs, while in-kind donations often meet immediate material needs but may require additional resources for storage and distribution. Understanding these key differences helps donors choose between tangible support and financial aid based on the nonprofit's requirements and donation impact goals.

Benefits of In-Kind Donations

In-kind donations provide tangible goods or services that directly address specific needs, ensuring recipients receive exactly what is required without intermediary costs. These donations often reduce overhead expenses for organizations, allowing more funds to be allocated toward program delivery and impacting beneficiaries more efficiently. In-kind contributions also foster stronger community engagement by involving local businesses and individuals in meaningful support beyond financial contributions.

Advantages of Cash Donations

Cash donations provide greater flexibility for nonprofits to allocate funds efficiently based on immediate needs and priorities. They reduce logistical challenges, enabling faster response times and maximizing the impact of charitable efforts. Cash gifts also allow organizations to invest in critical areas such as infrastructure, staffing, and program development.

Challenges of In-Kind Contributions

In-kind donations often pose significant logistical challenges, including storage, transportation, and timely distribution, which can strain organizational resources. The mismatch between donated items and actual needs can lead to wasted goods and inefficiencies. Unlike cash donations, in-kind contributions lack flexibility, limiting an organization's ability to allocate funds where they are most needed.

Limitations of Cash Giving

Cash donations offer flexibility but encounter limitations such as potential misuse and lack of transparency in allocation. Unlike in-kind donations, cash contributions may not directly address specific material needs, creating gaps between donor intent and beneficiary requirements. Financial constraints or restrictions on how funds can be spent further limit the effectiveness of cash giving in certain relief or development contexts.

When to Choose In-Kind Over Cash Donations

In-kind donations are ideal when specific goods or services directly fulfill the needs of recipients, such as food, clothing, or professional expertise, ensuring immediate and tangible impact. Organizations should opt for in-kind contributions when logistical challenges, urgent resource requirements, or donor expertise align more effectively with non-monetary support. Choosing in-kind donations over cash is advantageous when transparency in resource application is critical, or when cash management overhead must be minimized.

Impact on Nonprofit Operations

In-kind donations provide nonprofits with specific goods or services, reducing operational expenses and allowing funds to be allocated toward program development and outreach efforts. Cash donations offer flexibility for nonprofits to address immediate needs, invest in infrastructure, and respond to unforeseen challenges efficiently. The choice between in-kind and cash donations significantly influences resource management, program scalability, and overall organizational impact.

Tax Implications for Donors

In-kind donations allow donors to deduct the fair market value of the goods or services contributed, subject to IRS rules and potential appraisal requirements for items over $5,000. Cash donations offer straightforward tax deductions equal to the donated amount, often simplifying record-keeping and maximizing tax benefits under IRS Section 170. Donors must maintain proper documentation, such as receipts or acknowledgment letters, to validate tax deductions for both in-kind and cash contributions.

Best Practices for Effective Giving

In-kind donations require careful assessment of the recipient organization's needs to ensure items are useful and appropriate, preventing resource wastage and logistical challenges. Cash donations provide flexibility, allowing nonprofits to allocate funds where they are most urgently needed, increasing overall impact and efficiency. Combining both methods strategically enhances program effectiveness, aligning donor intent with organizational priorities for maximized community benefits.

Important Terms

Non-monetary contribution

Non-monetary contributions such as in-kind donations, which include goods or services, provide tangible support that complements cash donations by directly addressing specific needs without requiring financial transactions.

Tangible goods

Tangible goods, as in-kind donations, provide specific items such as food, clothing, or medical supplies directly to beneficiaries, often fulfilling immediate physical needs and reducing purchasing costs for organizations. Unlike cash donations, these gifts require logistics for storage and distribution but can ensure resource allocation aligns with donor intent and recipient needs.

Financial assistance

In-kind donations provide specific goods or services directly to organizations reducing operational costs, while cash donations offer flexible funding that supports overall program needs and administrative expenses.

Restricted funds

Restricted funds are designated for specific purposes as defined by donors, often influencing how in-kind donations or cash donations are utilized within these constraints. In-kind donations provide tangible goods or services directly aligned with fund restrictions, while cash donations offer flexible financial resources that must adhere to the donor's specified limitations.

Gift-in-kind

Gift-in-kind donations provide tangible goods or services directly to recipients, contrasting with cash donations that offer flexible financial support for organizational needs.

Charitable giving

Charitable giving through in-kind donations involves providing goods or services directly to beneficiaries, often resulting in targeted support and reduced overhead costs for charities. Cash donations offer nonprofits flexibility to allocate funds efficiently, addressing urgent needs and operational expenses essential for maximizing program impact.

Direct funding

Direct funding enables organizations to allocate resources precisely according to their most urgent needs, offering flexibility that In-Kind Donations often lack. While Cash Donations provide liquidity for operational costs or program expansion, In-Kind Donations contribute tangible goods or services that can offset specific expenses but may require additional logistical management.

Philanthropic support

Philanthropic support through in-kind donations provides tangible goods and services directly to beneficiaries, while cash donations offer flexible funding for organizations to allocate resources efficiently according to their most urgent needs.

Resource allocation

Resource allocation efficiency increases when prioritizing cash donations over in-kind donations due to greater flexibility and lower logistical costs.

Valuation methods

Valuation methods for in-kind donations typically involve assessing the fair market value of donated goods or services based on comparable sales or replacement cost, while cash donations are recorded at their actual monetary amount. Accurate valuation ensures compliance with accounting standards and tax regulations, enabling transparent financial reporting and maximizing donor benefits.

In-Kind Donation vs Cash Donation Infographic

moneydif.com

moneydif.com