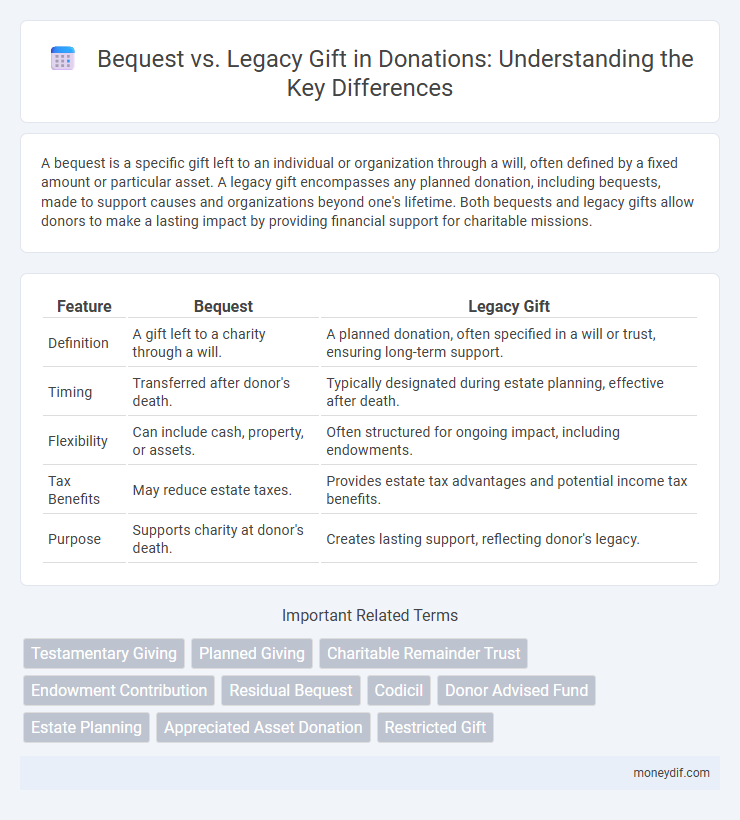

A bequest is a specific gift left to an individual or organization through a will, often defined by a fixed amount or particular asset. A legacy gift encompasses any planned donation, including bequests, made to support causes and organizations beyond one's lifetime. Both bequests and legacy gifts allow donors to make a lasting impact by providing financial support for charitable missions.

Table of Comparison

| Feature | Bequest | Legacy Gift |

|---|---|---|

| Definition | A gift left to a charity through a will. | A planned donation, often specified in a will or trust, ensuring long-term support. |

| Timing | Transferred after donor's death. | Typically designated during estate planning, effective after death. |

| Flexibility | Can include cash, property, or assets. | Often structured for ongoing impact, including endowments. |

| Tax Benefits | May reduce estate taxes. | Provides estate tax advantages and potential income tax benefits. |

| Purpose | Supports charity at donor's death. | Creates lasting support, reflecting donor's legacy. |

Understanding Bequests and Legacy Gifts

Bequests are specific directives in a will that allocate assets or property to a charitable organization upon the donor's death, providing a clear method for planned giving. Legacy gifts, encompassing bequests as well as other planned contributions like charitable trusts, represent a donor's intention to leave a lasting impact on a cause or institution. Understanding the distinctions between bequests and broader legacy gifts enhances strategic philanthropic planning and ensures donors maximize the potential benefits of their charitable contributions.

Key Differences Between Bequests and Legacy Gifts

Bequests are specific provisions made in a will designating certain assets or amounts to be donated upon the donor's death, whereas legacy gifts encompass a broader category including bequests, beneficiary designations, and life insurance policies. Bequests legally transfer ownership of specified estate assets after death, while legacy gifts may involve various planned giving strategies that can be activated during or after the donor's lifetime. Understanding these differences helps donors and organizations optimize estate planning and maximize philanthropic impact.

The Legal Framework of Bequests

Bequests are legally binding provisions in a donor's will that transfer assets to nonprofits upon their death, governed by state probate laws to ensure proper execution. Unlike general legacy gifts, bequests must comply with specific statutory requirements, including clear identification of the beneficiary and assets designated for transfer. The legal framework surrounding bequests offers donors flexibility while providing organizations with enforceable claims to receive the donated assets after probate completion.

How Legacy Gifts Impact Charitable Organizations

Legacy gifts provide charitable organizations with long-term financial stability, enabling them to plan and expand their programs more effectively. Unlike bequests, which may be one-time contributions from wills, legacy gifts often come with specific designations that support ongoing initiatives or endowments. This sustained funding enhances an organization's capacity to make a lasting impact in the community and ensures continued mission fulfillment.

Tax Benefits of Bequests vs. Legacy Gifts

Bequests offer significant tax benefits by reducing estate taxes, allowing donors to allocate a portion of their estate to charity, which can decrease overall taxable estate value. Legacy gifts, often structured as charitable trusts or annuities, provide ongoing income to beneficiaries while offering income tax deductions and potential estate tax reductions. Donors choosing bequests can maximize tax savings through estate planning, while legacy gifts enable flexible tax advantages combined with sustained charitable support.

Planning Your Estate: Bequest or Legacy Gift?

Planning your estate involves choosing between a bequest and a legacy gift as effective ways to support causes you care about. A bequest typically involves a specific provision in your will directing a portion of your estate to a charity, while a legacy gift refers to a broader range of planned giving options that may include trusts or other financial instruments. Understanding the tax benefits and legal implications of each option ensures your philanthropic goals are met while maximizing the impact of your donation.

Including Charities in Your Will: Step-by-Step

Including charities in your will involves clearly specifying bequest or legacy gifts to support causes close to your heart. Bequests are specific gifts in your will, such as money or assets, designated for a charity, while legacy gifts often encompass broader charitable intentions, including endowments or estate donations. Consult with an estate planning attorney to draft precise language, select the right type of gift, and ensure your charitable goals are legally documented and honored.

Common Misconceptions About Legacy Giving

Legacy giving is often mistaken as solely involving large cash donations or property, but it also includes stocks, life insurance policies, and retirement assets. Many believe that legacy gifts are only for the wealthy, overlooking that modest contributions through wills or trusts can have significant community impact. Understanding the distinctions between bequests (specific gift allocations in wills) and broader legacy gifts helps donors make informed philanthropic decisions.

Which Option is Right for Your Philanthropic Goals?

Choosing between a bequest and a legacy gift depends on your philanthropic goals and estate planning preferences. A bequest allows you to designate assets in your will for charitable purposes after your lifetime, providing flexibility but delayed impact. Legacy gifts often involve planned giving strategies that can offer immediate tax benefits and ensure a lasting tribute aligned with your values.

Maximizing Impact: Tips for Effective Legacy Donations

Maximizing the impact of legacy donations involves understanding the distinctions between bequests and legacy gifts, as bequests are typically made through a will, while legacy gifts may include life insurance policies or charitable trusts. Donors should work with financial advisors and nonprofit organizations to structure their legacy gifts in tax-efficient ways that align with personal values and ensure sustained support for chosen causes. Clear documentation and regular reviews of the legacy plan help maintain the intended impact and adapt to legal or financial changes over time.

Important Terms

Testamentary Giving

Testamentary giving primarily involves bequests, which are specific assets left in a will, whereas legacy gifts refer to broader, often intangible estate contributions intended to create a lasting impact.

Planned Giving

Planned giving options include bequests, which are specific gifts through a will, and legacy gifts, which encompass a broader range of long-term donations designed to support an organization's mission.

Charitable Remainder Trust

A Charitable Remainder Trust provides income to beneficiaries during their lifetime before transferring remaining assets to a charity, distinguishing it from a bequest or legacy gift that directly designates charitable beneficiaries through a will.

Endowment Contribution

Endowment contributions, typically larger and permanent funds, differ from bequest and legacy gifts primarily in their immediate investment purpose and donor intention for long-term institutional support.

Residual Bequest

Residual bequest allocates the remainder of an estate after specific bequests and debts are settled, distinguishing it from legacy gifts that designate fixed assets or amounts to specific beneficiaries.

Codicil

A codicil modifies a will to clarify or change bequests, which involve specific gifts of property, distinct from legacy gifts that typically refer to monetary or intangible inheritances.

Donor Advised Fund

Donor Advised Funds offer flexible, tax-efficient charitable giving options while Bequest and Legacy Gifts provide long-term philanthropic impact through planned estate donations.

Estate Planning

Estate planning distinguishes between a bequest, which is a specific gift left in a will, and a legacy gift, a broader term encompassing any transfer of assets intended to benefit heirs or charitable organizations.

Appreciated Asset Donation

Appreciated asset donations provide tax advantages compared to bequests or legacy gifts by allowing donors to avoid capital gains taxes while supporting charitable causes during their lifetime.

Restricted Gift

A restricted gift specifically designates how funds must be used by the recipient, whereas a bequest directs assets through a will, and a legacy gift often refers to a bequest intended to leave a lasting impact.

Bequest vs Legacy Gift Infographic

moneydif.com

moneydif.com