Corporate sponsorship involves businesses providing financial or in-kind support to events or causes in exchange for brand visibility and marketing opportunities, aligning their commercial objectives with community engagement. Corporate philanthropy focuses on voluntary contributions by companies through grants or charitable activities aimed at social impact without direct commercial returns. Both strategies play crucial roles in advancing nonprofit missions, but sponsorship is marketing-driven while philanthropy centers on altruistic giving.

Table of Comparison

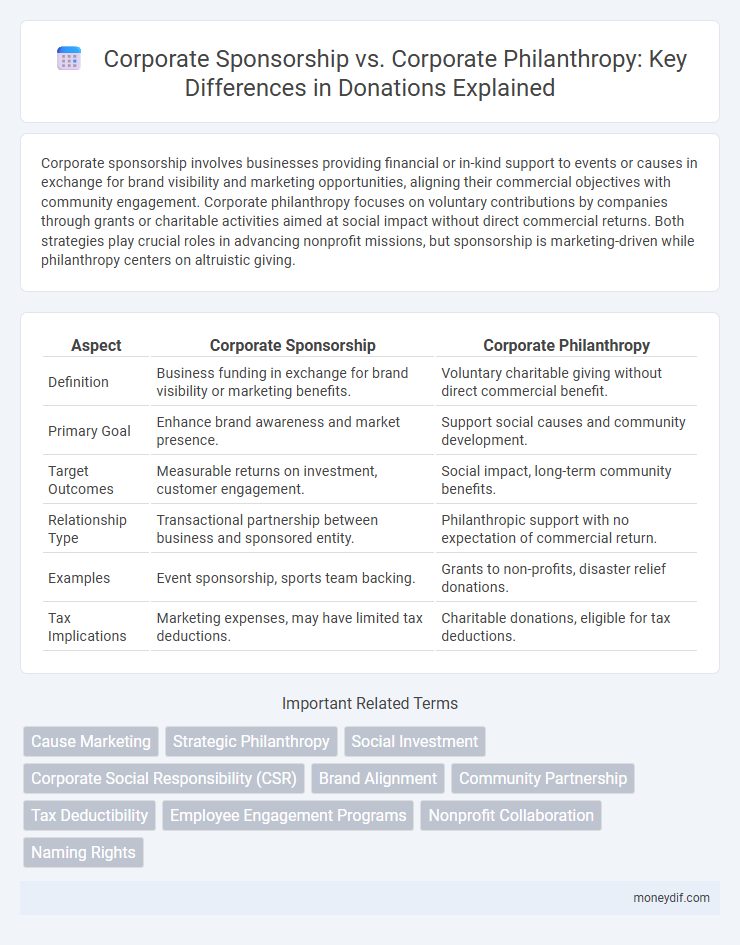

| Aspect | Corporate Sponsorship | Corporate Philanthropy |

|---|---|---|

| Definition | Business funding in exchange for brand visibility or marketing benefits. | Voluntary charitable giving without direct commercial benefit. |

| Primary Goal | Enhance brand awareness and market presence. | Support social causes and community development. |

| Target Outcomes | Measurable returns on investment, customer engagement. | Social impact, long-term community benefits. |

| Relationship Type | Transactional partnership between business and sponsored entity. | Philanthropic support with no expectation of commercial return. |

| Examples | Event sponsorship, sports team backing. | Grants to non-profits, disaster relief donations. |

| Tax Implications | Marketing expenses, may have limited tax deductions. | Charitable donations, eligible for tax deductions. |

Understanding Corporate Sponsorship and Corporate Philanthropy

Corporate sponsorship involves businesses providing financial or in-kind support to events, projects, or organizations in exchange for brand visibility and marketing opportunities, enhancing their corporate image and customer engagement. Corporate philanthropy refers to charitable donations made by companies to support social causes without direct commercial benefits, aiming to promote social responsibility and community development. Understanding the distinctions between sponsorship and philanthropy helps organizations align their donation strategies with business goals and social impact objectives.

Key Differences Between Sponsorship and Philanthropy

Corporate sponsorship involves a strategic partnership where companies provide financial or in-kind support in exchange for brand visibility, marketing opportunities, and customer engagement, often tied to specific events or projects. Corporate philanthropy refers to voluntary financial donations or grants given by companies to nonprofit organizations or causes without direct commercial benefits, aiming to support social, environmental, or community initiatives. Key differences include the intent behind contributions--sponsorship targets business objectives such as brand promotion, while philanthropy prioritizes altruistic goals without expecting direct returns.

The Motivations Behind Corporate Giving

Corporate sponsorship and corporate philanthropy both drive business giving but serve different strategic objectives; sponsorship primarily aims to enhance brand visibility and market reach through event support or cause association, while philanthropy focuses on social impact and community development without direct commercial return. Corporations engage in sponsorship to boost consumer recognition and build customer loyalty, leveraging marketing benefits, whereas philanthropic efforts are motivated by corporate social responsibility, ethical commitments, and long-term societal value creation. Understanding these underlying motivations helps organizations align their giving strategies with business goals and stakeholder expectations effectively.

Measuring Impact: Sponsorship vs Philanthropy

Measuring impact in corporate sponsorship involves tracking direct engagement metrics such as brand visibility, event attendance, and customer acquisition, often using data analytics and ROI calculations. In contrast, corporate philanthropy impact is assessed through social outcomes like community well-being, beneficiary feedback, and long-term societal changes, often measured with social impact assessments and sustainability indicators. Both approaches require tailored evaluation frameworks to accurately capture financial returns for sponsorships and social value for philanthropy.

Benefits of Corporate Sponsorship for Nonprofits

Corporate sponsorship provides nonprofits with substantial financial support, enhancing event funding and program development. It also boosts brand visibility through marketing collaborations, increasing public awareness and donor engagement. Partnering with corporations can open access to professional expertise and in-kind resources, amplifying the nonprofit's impact and sustainability.

Philanthropy: Building Long-Term Community Impact

Corporate philanthropy fosters long-term community impact by investing in sustainable programs that address root causes of social issues, enhancing overall community well-being. Unlike corporate sponsorships, which often focus on short-term brand visibility through event funding, philanthropy prioritizes strategic partnerships and funding for nonprofit organizations aiming for systemic change. This approach builds enduring trust and collaboration between businesses and communities, ultimately driving measurable social progress over time.

Financial Implications for Businesses

Corporate sponsorship involves businesses providing financial support to events or organizations in exchange for advertising benefits, enhancing brand visibility and often generating direct marketing returns. Corporate philanthropy focuses on charitable donations without expecting immediate commercial gains, although it can improve corporate reputation and stakeholder relations over time. Financially, sponsorships are usually considered marketing expenses with measurable ROI, while philanthropy is recorded as a charitable expenditure, potentially offering tax deductions but less direct revenue impact.

Brand Image and Public Perception

Corporate sponsorship directly associates a brand with events or causes, enhancing visibility and creating immediate positive brand recognition among target audiences. Corporate philanthropy, through charitable donations or community programs, fosters long-term trust and goodwill by demonstrating genuine commitment to social responsibility. Both strategies significantly impact public perception, but sponsorship often drives active engagement while philanthropy builds enduring credibility.

Legal and Tax Considerations

Corporate sponsorships typically involve a business providing funds or resources to an event or organization in exchange for promotional benefits, classified as marketing expenses and fully deductible under IRS rules as ordinary business expenses. Corporate philanthropy refers to charitable donations made without direct commercial benefits, qualifying as tax-deductible contributions under Section 170 of the Internal Revenue Code, subject to limits based on the corporation's taxable income. Legal considerations include compliance with IRS guidelines distinguishing sponsorship payments from charitable contributions and ensuring transparent reporting to maintain tax-exempt status and avoid potential penalties.

Choosing the Right Approach for Your Organization

Choosing between corporate sponsorship and corporate philanthropy depends on an organization's goals, target audience, and desired impact. Corporate sponsorship typically offers promotional benefits and brand visibility in exchange for funding events or initiatives, making it ideal for marketing-driven campaigns. Corporate philanthropy focuses on long-term social impact and aligns with core values through direct donations or grants, suitable for organizations prioritizing community development and social responsibility.

Important Terms

Cause Marketing

Cause marketing leverages corporate sponsorship to align brand messaging with social causes, driving consumer engagement and sales by integrating marketing objectives with nonprofit partnerships. Corporate philanthropy focuses on charitable giving without direct marketing benefits, emphasizing long-term social impact through donations or grants that enhance community well-being and corporate social responsibility.

Strategic Philanthropy

Strategic philanthropy focuses on aligning corporate philanthropy efforts with business objectives to create both social impact and competitive advantage, whereas corporate sponsorship primarily aims at brand promotion and customer engagement through financial or in-kind support for events or causes. By integrating strategic philanthropy, companies can ensure long-term value creation and stakeholder trust beyond the transactional nature of traditional sponsorship.

Social Investment

Corporate sponsorship involves businesses providing financial or in-kind support to events, organizations, or causes in exchange for brand exposure and marketing benefits, whereas corporate philanthropy focuses on charitable donations aimed at social impact without direct commercial returns. Both strategies represent key facets of social investment, enabling companies to align social responsibility with business objectives while fostering community development.

Corporate Social Responsibility (CSR)

Corporate Social Responsibility (CSR) encompasses corporate sponsorship and corporate philanthropy, where corporate sponsorship strategically supports events or organizations for marketing benefits and brand visibility, while corporate philanthropy involves direct charitable donations aimed at social impact without expecting commercial returns. Effective CSR programs integrate both approaches to enhance corporate reputation, foster community engagement, and promote sustainable business practices.

Brand Alignment

Brand alignment maximizes impact when companies strategically integrate corporate sponsorships that enhance marketing goals and corporate philanthropy efforts that authentically reflect their core values and community commitments.

Community Partnership

Community partnerships thrive when corporations engage through strategic sponsorships that align brand visibility with community needs, fostering mutual growth and long-term impact. Corporate philanthropy complements this by providing financial support without direct marketing intent, enhancing social responsibility and strengthening community trust.

Tax Deductibility

Tax deductibility differs significantly between corporate sponsorship and corporate philanthropy, with corporate philanthropy typically qualifying as a charitable contribution deductible under IRS rules, while corporate sponsorship expenses are often treated as advertising costs deductible as ordinary business expenses. Understanding the IRS guidelines and the distinction between promotional benefits and charitable intent is crucial for maximizing tax advantages in corporate giving strategies.

Employee Engagement Programs

Employee engagement programs driven by corporate sponsorship often focus on strategic partnerships that enhance brand visibility, while corporate philanthropy initiatives prioritize charitable contributions to support community well-being.

Nonprofit Collaboration

Nonprofit collaboration thrives when corporate sponsorship delivers targeted marketing support while corporate philanthropy provides unrestricted funding for long-term social impact.

Naming Rights

Naming rights serve as a strategic asset in corporate sponsorship, offering brand visibility and long-term association with venues or events that enhance market presence and customer engagement. In contrast, corporate philanthropy focuses on charitable contributions without commercial exchange, aiming to strengthen community relations and corporate social responsibility rather than direct marketing benefits.

Corporate Sponsorship vs Corporate Philanthropy Infographic

moneydif.com

moneydif.com