Restricted gifts are donations designated by the donor for specific programs or purposes, ensuring funds are allocated according to their intent. Unrestricted gifts provide organizations with the flexibility to use funds wherever they are most needed, supporting general operations and emergent priorities. Understanding the distinction between restricted and unrestricted gifts is essential for donors and nonprofits to align expectations and maximize impact.

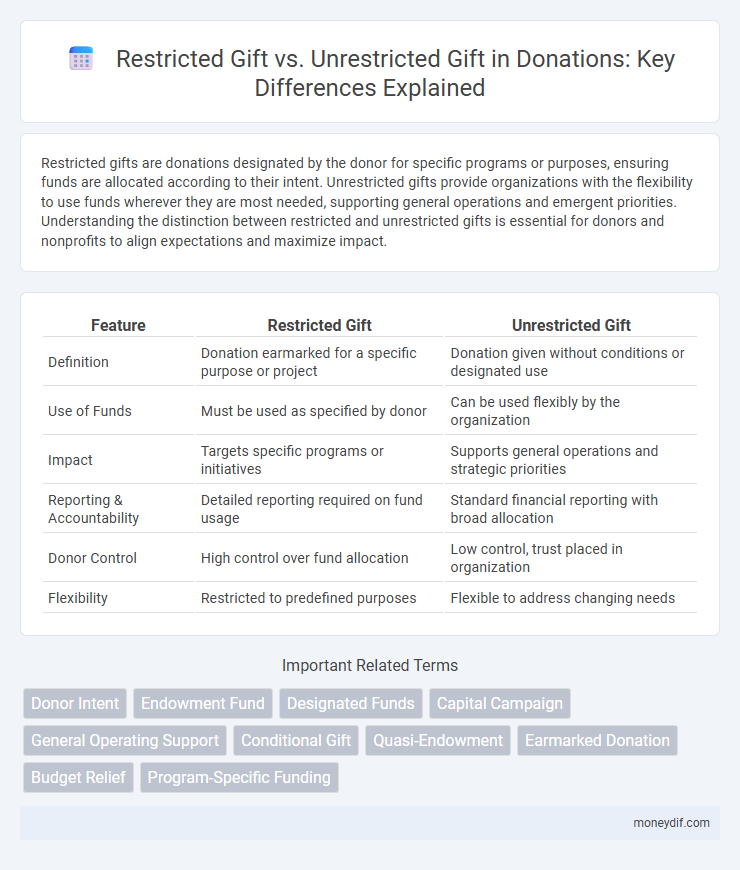

Table of Comparison

| Feature | Restricted Gift | Unrestricted Gift |

|---|---|---|

| Definition | Donation earmarked for a specific purpose or project | Donation given without conditions or designated use |

| Use of Funds | Must be used as specified by donor | Can be used flexibly by the organization |

| Impact | Targets specific programs or initiatives | Supports general operations and strategic priorities |

| Reporting & Accountability | Detailed reporting required on fund usage | Standard financial reporting with broad allocation |

| Donor Control | High control over fund allocation | Low control, trust placed in organization |

| Flexibility | Restricted to predefined purposes | Flexible to address changing needs |

Understanding Restricted vs Unrestricted Gifts

Restricted gifts are donations designated by the donor for a specific purpose, project, or program, requiring the organization to use the funds according to those stipulations. Unrestricted gifts provide nonprofits with the flexibility to allocate funds where they are most needed, supporting operational costs or urgent priorities without donor-imposed limitations. Understanding the distinction between restricted and unrestricted gifts is crucial for effective financial planning and donor relationship management within charitable organizations.

Definition of Restricted Gifts

Restricted gifts are donations designated by the donor for a specific purpose, project, or fund, ensuring the funds are used only according to the given instructions. These gifts require organizations to track and report their use separately from other funds, maintaining compliance with donor intent and legal obligations. Restricted donations play a crucial role in funding targeted programs, capital campaigns, or endowments.

Definition of Unrestricted Gifts

Unrestricted gifts are donations given without any donor-imposed limitations, allowing the recipient organization to allocate funds according to its most urgent needs or strategic priorities. These gifts provide maximum flexibility, enabling nonprofits to cover operational costs, develop new programs, or respond to unforeseen opportunities. Unlike restricted gifts, unrestricted donations are essential for the overall sustainability and adaptability of charitable organizations.

Benefits of Making Restricted Donations

Restricted donations ensure funds are allocated specifically toward donor-designated programs, enhancing transparency and accountability. They allow nonprofits to advance targeted projects that align with the donor's values, fostering a stronger partnership. These gifts often inspire greater donor confidence and sustained support by demonstrating clear impact and purpose.

Advantages of Unrestricted Giving

Unrestricted gifts provide nonprofits with the flexibility to allocate funds where they are most needed, enhancing operational efficiency and impact. These donations allow organizations to respond swiftly to emerging opportunities and challenges without the constraints of donor-imposed limitations. By supporting core activities, unrestricted giving strengthens overall organizational sustainability and long-term growth.

Donor Intent and Organizational Flexibility

Restricted gifts are donations designated by the donor for specific programs or purposes, ensuring their intent is honored but limiting the organization's ability to allocate funds flexibly. Unrestricted gifts allow organizations to use funds at their discretion, enhancing operational flexibility and addressing urgent or evolving needs. Balancing donor intent and organizational adaptability is crucial for effective resource management and mission fulfillment.

Common Examples of Restricted Gifts

Common examples of restricted gifts include donations designated for specific programs, such as scholarships, building funds, or research projects. These gifts often come with explicit stipulations from donors on how the funds must be used, ensuring alignment with their philanthropic intent. Organizations must track and report restricted gifts separately to maintain compliance and donor trust.

Risks and Challenges of Restricted Funding

Restricted gifts limit donor funds to specific projects or purposes, creating risks such as reduced organizational flexibility and potential misalignment with evolving needs. Challenges include increased administrative burdens to track and report on fund use, which can divert resources from mission-critical activities. Organizations may face financial instability if restricted funds are insufficient to cover operational costs or if donor priorities shift.

How Nonprofits Manage Gift Restrictions

Nonprofits manage restricted gifts by allocating funds strictly according to donor specifications, ensuring compliance with legal and ethical mandates, often through designated accounts or project-specific budgets. In contrast, unrestricted gifts offer nonprofits flexibility to direct resources toward operational expenses or emerging priorities, enhancing overall organizational agility. Effective tracking systems and transparent reporting are essential for maintaining donor trust and demonstrating responsible stewardship of both gift types.

Choosing the Right Giving Approach

Choosing the right giving approach depends on aligning donations with organizational needs and donor intentions. Restricted gifts direct funds to specific programs or projects, enhancing targeted impact and accountability, while unrestricted gifts provide flexibility for operational costs and emerging priorities. Understanding the donor's goals and the nonprofit's strategic plans ensures that contributions maximize effectiveness and sustainability.

Important Terms

Donor Intent

Donor intent determines whether a gift is classified as restricted, requiring funds to be used for a specific purpose, or unrestricted, allowing the organization full discretion in allocation.

Endowment Fund

Endowment funds classify gifts as restricted, where principal must remain intact and earnings are used per donor specifications, versus unrestricted, allowing the institution to use funds flexibly to support its mission.

Designated Funds

Designated funds are a type of restricted gift allocated by donors for specific purposes, while unrestricted gifts allow organizations the flexibility to use funds for general operations or priorities.

Capital Campaign

Capital campaigns primarily rely on restricted gifts designated for specific projects, while unrestricted gifts provide flexible funding to support overall organizational needs.

General Operating Support

General Operating Support refers to unrestricted gifts that provide organizations with flexible funding to cover various operational expenses, unlike restricted gifts which are designated for specific purposes or programs.

Conditional Gift

A conditional gift requires specific terms to be met, unlike unrestricted gifts that allow donors to provide funds without limitations, while restricted gifts demand the use of funds for designated purposes only.

Quasi-Endowment

A quasi-endowment is a fund designated by an institution's board from unrestricted gifts, allowing investment for income generation while preserving principal, unlike restricted gifts that legally limit fund use or purpose.

Earmarked Donation

An earmarked donation is a restricted gift designated by the donor for a specific purpose, while an unrestricted gift allows the recipient organization to use the funds at their discretion.

Budget Relief

Budget relief often occurs when unrestricted gifts provide flexible funding compared to restricted gifts, which are designated for specific purposes and limit financial maneuverability.

Program-Specific Funding

Program-specific funding restricts the use of gifts to designated purposes, contrasting with unrestricted gifts that provide organizations flexibility in allocating funds across various needs.

Restricted Gift vs Unrestricted Gift Infographic

moneydif.com

moneydif.com