Planned giving involves donors arranging future charitable contributions through wills, trusts, or life insurance, allowing for long-term philanthropic impact and financial benefits such as tax advantages. Major gifts are significant donations made during a donor's lifetime, often used for immediate funding priorities like capital projects or program expansions. Both methods are essential for sustaining nonprofit organizations, with planned giving ensuring future stability and major gifts addressing urgent needs.

Table of Comparison

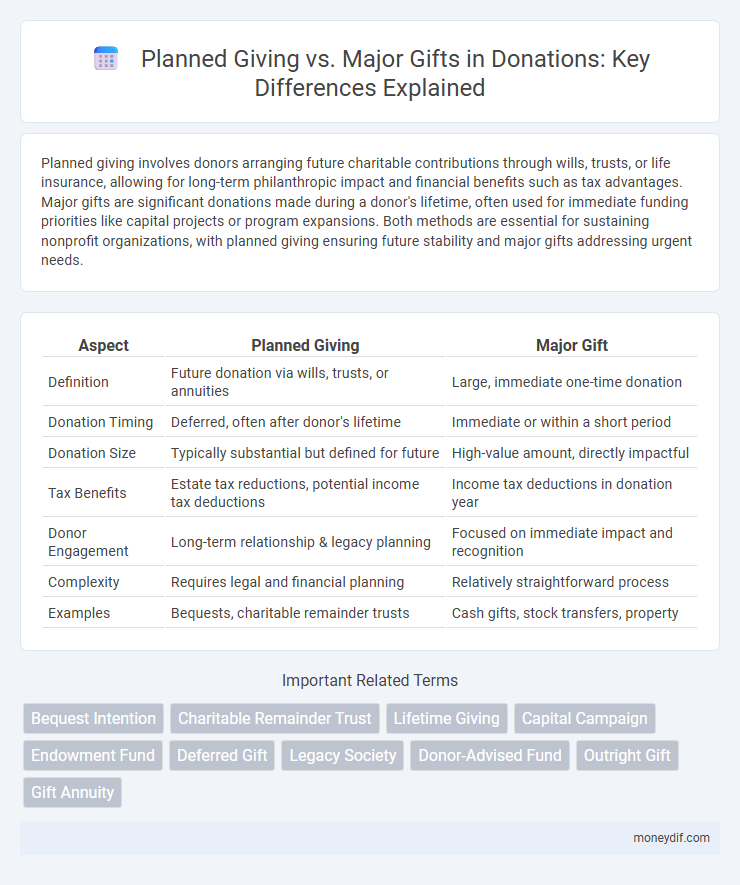

| Aspect | Planned Giving | Major Gift |

|---|---|---|

| Definition | Future donation via wills, trusts, or annuities | Large, immediate one-time donation |

| Donation Timing | Deferred, often after donor's lifetime | Immediate or within a short period |

| Donation Size | Typically substantial but defined for future | High-value amount, directly impactful |

| Tax Benefits | Estate tax reductions, potential income tax deductions | Income tax deductions in donation year |

| Donor Engagement | Long-term relationship & legacy planning | Focused on immediate impact and recognition |

| Complexity | Requires legal and financial planning | Relatively straightforward process |

| Examples | Bequests, charitable remainder trusts | Cash gifts, stock transfers, property |

Understanding Planned Giving and Major Gifts

Planned giving involves donors committing assets through wills, trusts, or beneficiary designations, allowing significant future contributions that support long-term organizational goals. Major gifts are substantial, immediate donations that typically fund specific projects or operational needs, often accompanied by donor recognition and engagement. Understanding the strategic timing and impact of both planned giving and major gifts enables nonprofits to cultivate meaningful relationships and secure sustainable funding.

Key Differences Between Planned Giving and Major Gifts

Planned giving involves donors committing assets through estate plans or trusts, often benefiting organizations over time with tax advantages and legacy impact, whereas major gifts are substantial, outright donations made during a donor's lifetime for immediate use. Major gifts typically require direct personal solicitation and are often associated with specific projects or capital campaigns, while planned giving emphasizes long-term financial planning and deferred gifts. Understanding donor intent, timing, and financial mechanisms distinguishes planned giving strategies from major gift fundraising.

Benefits of Planned Giving for Donors and Organizations

Planned giving offers donors significant tax advantages and the opportunity to leave a lasting legacy, supporting causes they care about beyond their lifetime. For organizations, it provides a predictable, long-term source of funding that enhances financial stability and enables strategic growth. This form of philanthropy fosters deeper donor relationships by aligning charitable goals with personal estate planning.

Advantages of Major Gifts in Fundraising

Major gifts generate significant financial support quickly, enabling nonprofits to fund substantial projects or investments with immediate impact. These contributions often come from committed donors, fostering strong, personalized relationships that encourage ongoing support and stewardship. Institutions benefit from major gifts by enhancing their reputation and attracting additional high-value donors through demonstrated trust and successful outcomes.

Typical Donor Profiles: Planned Giving vs Major Gifts

Typical donor profiles for planned giving often include older individuals with long-term commitments to a cause, seeking to leave a lasting legacy through bequests or charitable trusts. Major gift donors tend to be high-net-worth individuals, philanthropic leaders, or business executives motivated by impactful, large-scale contributions for immediate organizational needs. Understanding these distinct profiles allows nonprofits to tailor communication strategies and engagement efforts effectively, maximizing donation potential.

Common Types of Planned Gifts and Major Contributions

Common types of planned gifts include bequests, charitable remainder trusts, and gift annuities, allowing donors to contribute assets over time or through their estate. Major contributions typically consist of large cash donations, stock transfers, and real estate gifts, directly supporting organizational priorities and capital campaigns. Both planned giving and major gifts play crucial roles in long-term financial sustainability for nonprofits.

How Nonprofits Can Encourage Planned Giving

Nonprofits can encourage planned giving by educating donors on the long-term impact of bequests and establishing dedicated legacy programs that highlight tax benefits and personal stories. Offering personalized financial planning consultations and seamless estate gift processing enhances donor confidence and commitment. Cultivating relationships through regular communication and recognition events motivates supporters to consider planned gifts alongside one-time major donations.

Strategies for Securing Major Gifts

Securing major gifts requires personalized stewardship strategies that emphasize building long-term relationships and demonstrating impact through transparent reporting and donor recognition. Implementing targeted communication plans and engaging donors in organizational milestones increases trust and encourages substantial contributions. Tailored cultivation events and involving leadership in donor interactions create opportunities to align donor interests with strategic philanthropic goals.

Impact on Organizational Sustainability: Planned Giving vs Major Gifts

Planned giving provides long-term financial stability by creating a steady stream of future income through trusts, bequests, and annuities, which supports organizational sustainability over decades. Major gifts deliver immediate, significant funding that can drive strategic initiatives, capital projects, or urgent operational needs, enhancing short-term impact and growth opportunities. Balancing both planned giving and major gifts enables nonprofits to secure diverse revenue streams, ensuring resilience and sustained mission fulfillment.

Integrating Planned Giving and Major Gifts into Fundraising Efforts

Integrating planned giving and major gifts into fundraising efforts enhances donor engagement by creating personalized giving options that cater to diverse financial capabilities and philanthropic goals. Strategic alignment of these approaches leverages long-term commitments from planned gifts alongside immediate impact from major gifts, optimizing cash flow and sustainability. Employing data-driven segmentation and targeted communication ensures effective stewardship and maximizes overall fundraising outcomes.

Important Terms

Bequest Intention

Bequest intention reflects a donor's planned giving strategy to allocate assets through their will, contrasting with major gifts, which involve immediate, substantial donations during the donor's lifetime; understanding this distinction enhances fundraising effectiveness by aligning solicitation methods with donor motivations. Incorporating bequest intentions into fundraising plans leverages long-term legacy giving, supplementing the immediate impact of major gifts and ensuring sustained organizational support.

Charitable Remainder Trust

A Charitable Remainder Trust leverages planned giving strategies to provide donors with income tax benefits and lifetime income while ultimately supporting major gift goals through the transfer of substantial assets to nonprofit organizations.

Lifetime Giving

Lifetime giving encompasses both planned giving and major gifts, with planned giving involving structured commitments such as bequests or charitable trusts made during or after a donor's lifetime, while major gifts are substantial one-time or periodic contributions given outright. Effective donor stewardship integrates lifetime giving strategies to maximize philanthropic impact, leveraging tax benefits and aligning with donor intent for sustained support.

Capital Campaign

Capital campaigns leverage both planned giving and major gifts to secure substantial, long-term funding for organizational growth and infrastructure projects. Planned giving provides a sustainable future revenue stream through bequests and trusts, while major gifts deliver immediate, large-scale financial support essential for meeting urgent capital campaign goals.

Endowment Fund

Endowment funds benefit from planned giving by securing long-term financial stability through bequests, trusts, and other deferred gifts, which provide a steady income stream for institutional support. Major gifts, typically large one-time donations, can rapidly increase the endowment's principal, enabling immediate capital projects or program expansions while planned gifts ensure sustained growth over time.

Deferred Gift

A Deferred Gift in Planned Giving allows donors to commit assets that transfer after their lifetime, providing long-term financial benefits to the organization. Unlike a Major Gift, which usually involves an immediate, substantial donation, Deferred Gifts leverage estate plans, trusts, or annuities to support future organizational growth and sustainability.

Legacy Society

Legacy Society membership recognizes donors who include planned giving in their estate plans, ensuring long-term support for an organization's mission, while major gifts are substantial one-time contributions that fund immediate priorities. Both strategies are essential for sustainable philanthropy, with planned giving focusing on future impact and major gifts addressing current funding needs.

Donor-Advised Fund

Donor-Advised Funds ensure flexible, tax-efficient planned giving strategies, complementing major gifts by enabling sustained philanthropy with donor control over fund distribution.

Outright Gift

Outright gifts provide immediate financial support in planned giving strategies, contrasting with major gifts that often involve larger, structured commitments over time.

Gift Annuity

Gift annuities offer donors a reliable income stream while contributing to planned giving strategies, blending philanthropy with financial planning. Unlike major gifts that typically provide one-time large donations, gift annuities create ongoing donor engagement through structured payments tied to charitable contributions.

Planned Giving vs Major Gift Infographic

moneydif.com

moneydif.com