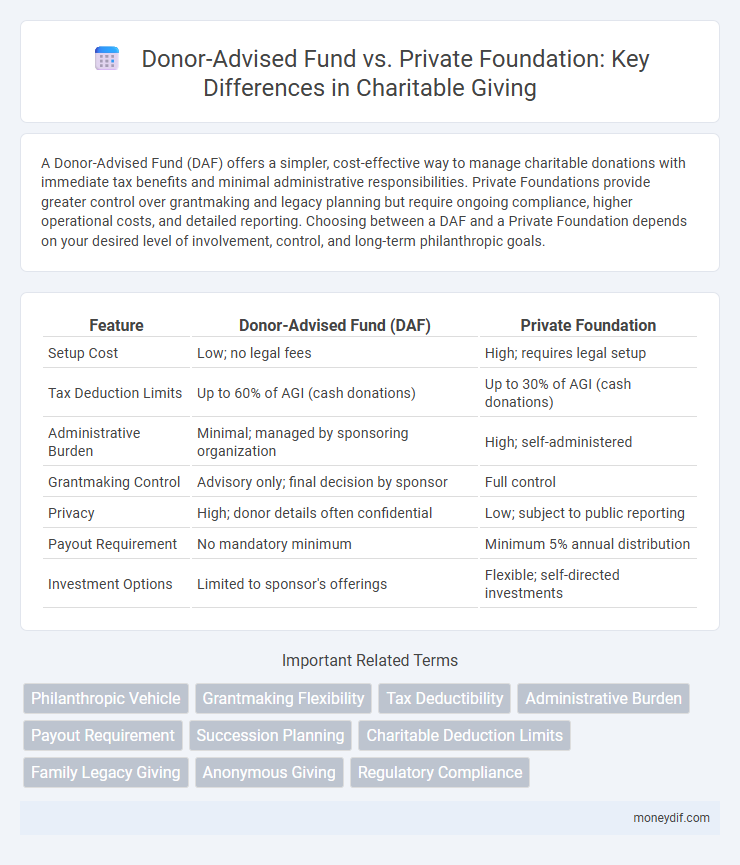

A Donor-Advised Fund (DAF) offers a simpler, cost-effective way to manage charitable donations with immediate tax benefits and minimal administrative responsibilities. Private Foundations provide greater control over grantmaking and legacy planning but require ongoing compliance, higher operational costs, and detailed reporting. Choosing between a DAF and a Private Foundation depends on your desired level of involvement, control, and long-term philanthropic goals.

Table of Comparison

| Feature | Donor-Advised Fund (DAF) | Private Foundation |

|---|---|---|

| Setup Cost | Low; no legal fees | High; requires legal setup |

| Tax Deduction Limits | Up to 60% of AGI (cash donations) | Up to 30% of AGI (cash donations) |

| Administrative Burden | Minimal; managed by sponsoring organization | High; self-administered |

| Grantmaking Control | Advisory only; final decision by sponsor | Full control |

| Privacy | High; donor details often confidential | Low; subject to public reporting |

| Payout Requirement | No mandatory minimum | Minimum 5% annual distribution |

| Investment Options | Limited to sponsor's offerings | Flexible; self-directed investments |

Understanding Donor-Advised Funds and Private Foundations

Donor-Advised Funds (DAFs) offer a flexible and cost-effective way to support charitable causes by allowing donors to make irrevocable contributions and recommend grants over time without the administrative burden of managing a foundation. Private Foundations require more rigorous compliance, such as annual tax filings, minimum distribution rules, and stricter governance, often involving higher administrative costs. Understanding the differences in control, tax advantages, and regulatory responsibilities helps donors choose between the simplicity of DAFs and the autonomy of Private Foundations.

Key Differences Between DAFs and Private Foundations

Donor-Advised Funds (DAFs) offer lower administrative costs and simplified tax reporting compared to Private Foundations, which require extensive record-keeping and annual tax filings. Private Foundations provide greater control over investments and grantmaking decisions, whereas DAFs are managed by sponsoring organizations that control fund distribution. DAF contributions receive immediate tax deductions with fewer legal obligations, while Private Foundations face stricter regulatory requirements and excise taxes on investment income.

Setup and Administrative Requirements

Donor-Advised Funds offer a streamlined setup process with minimal administrative burdens, allowing donors to contribute assets quickly and recommend grants without managing complex regulatory requirements. Private Foundations require formal establishment with IRS approval, ongoing compliance including annual tax filings, and adherence to strict governance and distribution rules. Choosing between the two depends on the donor's preference for administrative control versus convenience and reduced compliance obligations.

Tax Benefits and Considerations

Donor-advised funds offer immediate tax deductions and avoid the excise tax on investment income, making them more tax-efficient for many donors compared to private foundations that face a 1-2% excise tax. Contributions to donor-advised funds can be deducted up to 60% of adjusted gross income for cash gifts, whereas private foundations limit deductions to 30%. Unlike private foundations requiring complex annual filings and minimum distributions, donor-advised funds provide simplified administration and flexibility in grant timing, enhancing overall tax and operational benefits.

Grantmaking Flexibility and Control

Donor-Advised Funds offer streamlined grantmaking with flexible distributions and lower administrative burdens, enabling donors to recommend grants to multiple charities without formal board oversight. Private Foundations provide greater control over grant recipients and program activities, allowing donors to establish specific guidelines and maintain decision-making authority through a governing board. Both structures influence donor involvement and philanthropic impact, but Private Foundations require ongoing compliance and expense management, unlike the simpler administration of Donor-Advised Funds.

Costs and Fees Comparison

Donor-Advised Funds (DAFs) typically have lower administrative fees, ranging from 0.6% to 1.5% annually, while Private Foundations incur higher costs due to operational expenses, legal fees, and mandatory IRS reporting, often exceeding 2% of assets. DAFs eliminate the need for separate tax filings and reduce grant management burdens, whereas Private Foundations require extensive compliance management and separate Form 990-PF submissions. The cost-efficiency of DAFs makes them preferable for donors seeking simplified giving with reduced overhead compared to the more hands-on control but higher expenses of Private Foundations.

Privacy and Reporting Obligations

Donor-advised funds offer greater privacy by shielding donor identities from public disclosure, whereas private foundations must disclose detailed financial and operational reports annually via IRS Form 990-PF, accessible to the public. Private foundations face stricter reporting obligations, including mandatory expenditure distribution requirements and transparency about grants and administrative expenses. Donor-advised funds simplify compliance by handling all regulatory filings, reducing the administrative burden on donors seeking anonymity.

Succession Planning and Legacy Options

Donor-advised funds (DAFs) offer flexible succession planning by allowing multiple generations to recommend grants, ensuring long-term family involvement and streamlined legacy options without the administrative burden of a private foundation. Private foundations provide more control over grantmaking and legacy preservation but require complex governance structures and ongoing compliance, which can complicate succession planning. Choosing between a DAF and a private foundation depends on the donor's preference for ease of administration versus direct control over legacy and philanthropic impact.

Ideal Donor Profiles for DAFs vs Foundations

Donor-Advised Funds (DAFs) suit individuals seeking simple, tax-efficient giving with lower administrative burdens and minimum contributions typically around $5,000, ideal for donors prioritizing flexibility and anonymity. Private Foundations attract high-net-worth donors capable of managing $250,000 or more, offering greater control over grants, investments, and legacy but requiring extensive regulatory compliance and annual filings. Donors aiming for personalized philanthropy with active involvement and family engagement often prefer private foundations, while those valuing ease and immediate tax benefits lean toward DAFs.

Choosing the Right Philanthropic Vehicle

Choosing the right philanthropic vehicle depends on factors like tax benefits, control, and administrative responsibilities. Donor-advised funds offer immediate tax deductions, lower costs, and professional management without the need for legal setup, making them ideal for donors seeking simplicity. Private foundations provide greater control over grantmaking and legacy planning but require ongoing compliance, higher administrative costs, and detailed reporting to the IRS.

Important Terms

Philanthropic Vehicle

Donor-advised funds offer lower administrative costs and tax advantages compared to private foundations, making them a more flexible philanthropic vehicle for donors seeking streamlined charitable giving.

Grantmaking Flexibility

Grantmaking flexibility in donor-advised funds (DAFs) allows donors to recommend grants to a wide range of public charities without strict payout requirements, unlike private foundations which must distribute at least 5% of assets annually and adhere to more rigid grantmaking rules. DAFs offer simpler administration, lower costs, and anonymity, while private foundations provide greater control over grant recipients and programmatic activities but face more regulatory oversight and excise taxes.

Tax Deductibility

Donations to Donor-Advised Funds offer higher tax deductibility limits compared to Private Foundations, allowing donors to deduct up to 60% of adjusted gross income for cash gifts versus 30% for Private Foundations.

Administrative Burden

Donor-advised funds reduce administrative burden by outsourcing compliance and reporting tasks, unlike private foundations which require extensive IRS filings, grant administration, and operational oversight.

Payout Requirement

Donor-Advised Funds require no annual payout but must distribute 5% of assets annually, while Private Foundations must meet a legally mandated minimum payout of 5% of net investment assets each year.

Succession Planning

Succession planning for Donor-Advised Funds (DAFs) offers flexibility by allowing donors to advise grant distributions even after their passing, while Private Foundations require formal governance structures to manage leadership transitions. Strategic comparison of administrative control, tax implications, and grantmaking continuity is essential when evaluating long-term legacy preservation between DAFs and Private Foundations.

Charitable Deduction Limits

Charitable deduction limits for donor-advised funds allow individuals to deduct up to 60% of their adjusted gross income for cash contributions, while private foundations have a lower limit of 30%. Contributions to donor-advised funds benefit from immediate tax deductions and simplified administration compared to the stricter regulatory and payout requirements imposed on private foundations.

Family Legacy Giving

Family legacy giving often leverages donor-advised funds (DAFs) for tax efficiency, lower administrative costs, and streamlined grantmaking compared to private foundations. While private foundations provide greater control and legacy branding, DAFs offer simplicity, anonymity, and immediate tax benefits, making them a preferred vehicle for many philanthropic families.

Anonymous Giving

Donor-Advised Funds enable anonymous giving with lower administrative costs and greater tax efficiency compared to Private Foundations, which require public disclosure and involve higher operational complexities.

Regulatory Compliance

Regulatory compliance for Donor-Advised Funds (DAFs) is generally less burdensome than for private foundations, as DAFs are managed by public charities subject to fewer annual reporting requirements and no excise taxes on investment income. Private foundations face stricter IRS regulations, including mandatory annual distribution minimums, excise taxes, detailed Form 990-PF filings, and limits on self-dealing, making compliance more complex and costly.

Donor-Advised Fund vs Private Foundation Infographic

moneydif.com

moneydif.com