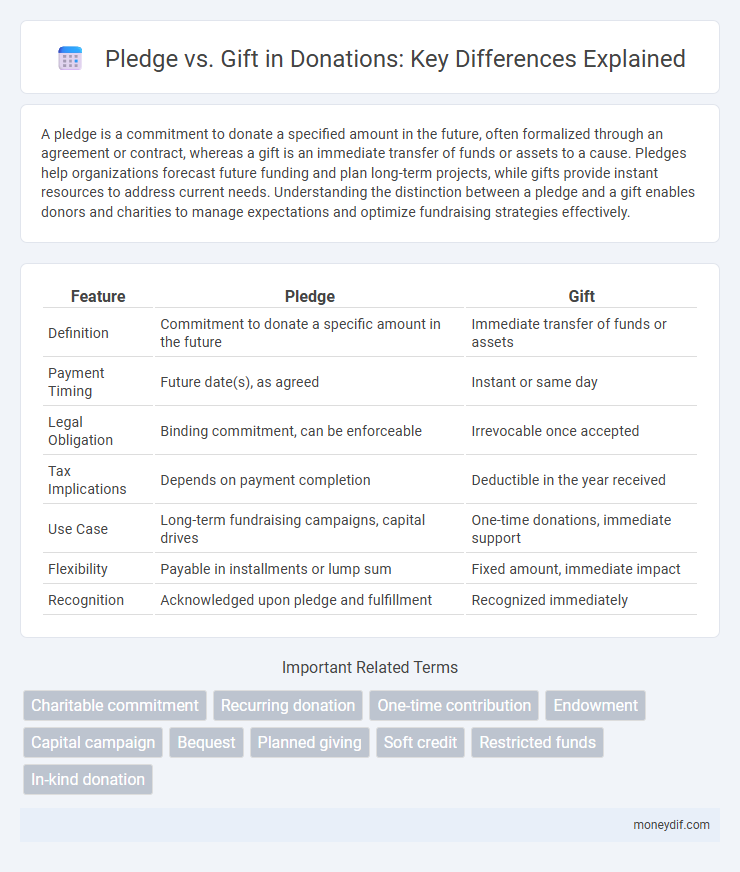

A pledge is a commitment to donate a specified amount in the future, often formalized through an agreement or contract, whereas a gift is an immediate transfer of funds or assets to a cause. Pledges help organizations forecast future funding and plan long-term projects, while gifts provide instant resources to address current needs. Understanding the distinction between a pledge and a gift enables donors and charities to manage expectations and optimize fundraising strategies effectively.

Table of Comparison

| Feature | Pledge | Gift |

|---|---|---|

| Definition | Commitment to donate a specific amount in the future | Immediate transfer of funds or assets |

| Payment Timing | Future date(s), as agreed | Instant or same day |

| Legal Obligation | Binding commitment, can be enforceable | Irrevocable once accepted |

| Tax Implications | Depends on payment completion | Deductible in the year received |

| Use Case | Long-term fundraising campaigns, capital drives | One-time donations, immediate support |

| Flexibility | Payable in installments or lump sum | Fixed amount, immediate impact |

| Recognition | Acknowledged upon pledge and fulfillment | Recognized immediately |

Understanding Pledges and Gifts: A Donation Primer

Pledges represent a commitment to donate a specific amount in the future, allowing donors to plan their giving over time while organizations can forecast funding. Gifts, in contrast, refer to immediate transfers of funds or assets that provide instant support to charities or causes. Understanding the distinction between pledges and gifts is crucial for donors and nonprofits to manage resources effectively and maximize philanthropic impact.

Key Differences Between a Pledge and a Gift

A pledge is a commitment to donate a specified amount over a defined period, often legally binding, whereas a gift is an immediate and irrevocable transfer of funds or assets. Pledges allow donors to spread contributions over time, facilitating long-term fundraising goals, while gifts provide organizations with instant resources for use. Understanding these distinctions is critical for nonprofits in financial planning and donor relationship management.

Legal Implications: Pledge Versus Gift

A pledge creates a legally binding promise to donate a specified amount, enforceable in court, whereas a gift is a completed transfer of assets with no future obligation. Donors making pledges may face legal consequences if they fail to fulfill the promise, which can affect nonprofit financial planning and reporting. Understanding the distinction is critical for organizations to manage commitments accurately and ensure compliance with donation laws.

Fulfillment Timelines: Immediate Gift vs. Future Pledge

Gifts are donations given immediately and available for use at once, ensuring instant impact on the recipient organization's projects or programs. Pledges, however, represent a commitment to donate in the future, often spread over months or years, allowing donors to plan payments incrementally while helping organizations forecast long-term funding. Understanding the fulfillment timeline is crucial for nonprofits to manage cash flow and allocate resources effectively between immediate needs and future initiatives.

Donor Expectations and Recognition

Pledges represent a committed promise from donors to contribute a specified amount over time, often allowing organizations to plan long-term projects with financial predictability. Gifts, typically received as immediate contributions, create instant impact but may lack the extended donor engagement that pledges foster. Donor recognition for pledges often includes ongoing updates and personalized acknowledgments, reinforcing trust and encouraging fulfillment, whereas gifts usually receive prompt appreciation to affirm donor generosity and build future support.

Tax Implications: Pledge or Gift?

Pledges are commitments to donate in the future and may not be tax-deductible until the payment is made, while gifts are completed donations eligible for immediate tax deduction. The IRS requires that pledged amounts must be fulfilled before claiming any tax benefits, and revoked pledges typically do not qualify for deductions. Donors should ensure that their contributions meet legal definitions of gifts to maximize tax advantages and avoid potential compliance issues.

Impact on Fundraising Strategy

Pledges create a commitment that can enhance donor retention and provide predictable future cash flow, influencing long-term fundraising strategies by enabling better financial forecasting. Gifts, as immediate contributions, offer instant capital that supports urgent project needs and boosts momentum in campaigns. Balancing pledges and gifts optimizes resource allocation, ensuring sustained engagement while meeting short-term objectives effectively.

Flexibility and Restrictions in Pledges and Gifts

Pledges offer donors flexibility by allowing multi-year commitments that can be adjusted or canceled before fulfillment, whereas gifts are typically immediate and irrevocable contributions with fewer restrictions. Gifts provide nonprofits with instant resources but often come with specific terms or designated purposes that limit their use. Understanding these differences helps organizations effectively plan and manage funding streams to maximize their impact.

Recordkeeping and Reporting Requirements

Pledge commitments require meticulous recordkeeping to track promised amounts and payment schedules for accurate financial reporting and donor engagement. Gifts, as completed donations, must be documented promptly to ensure compliance with tax regulations and to provide timely receipts for donor acknowledgment. Properly distinguishing between pledges and gifts in reporting systems enhances transparency and streamlines audit processes for nonprofit organizations.

Choosing the Right Option: When to Use Pledge or Gift

Choosing between a pledge and a gift depends on a donor's financial situation and commitment timing. A pledge allows donors to commit to giving a specified amount over a period, which is ideal for budgeting large contributions or for fundraising campaigns with goals. A gift, being an immediate transfer of funds or assets, suits those ready to provide support instantly without future obligations.

Important Terms

Charitable commitment

A charitable commitment involves a legally binding pledge to donate a specified amount over time, while a gift is an immediate and unconditional transfer of assets to a nonprofit organization.

Recurring donation

A recurring donation automates consistent giving based on a pledge commitment, ensuring timely gift fulfillment and sustained support.

One-time contribution

A one-time contribution differs from a pledge in that it involves an immediate, full payment of funds, whereas a pledge represents a committed promise to donate a specified amount over time.

Endowment

An endowment represents a long-term financial asset funded primarily through pledges, which are commitments to give, whereas gifts are immediate transfers of funds or assets used for current purposes.

Capital campaign

A capital campaign tracks pledges as promises to give future gifts, enabling organizations to forecast revenue and manage long-term fundraising goals effectively.

Bequest

A bequest is a testamentary gift transferred through a will, contrasting with a pledge which is a binding promise to donate but not an immediate gift.

Planned giving

Planned giving allows donors to commit future financial support through a legally binding pledge, which differs from an immediate gift that transfers assets or funds upfront.

Soft credit

Soft credit records donor recognition for pledged donations without transferring legal ownership, unlike gifts which represent actual transferred funds or assets.

Restricted funds

Restricted funds require donors' pledges to be fulfilled before recognition as gifts, ensuring designated use and compliance with donor-imposed conditions.

In-kind donation

In-kind donations involve non-cash items or services pledged by donors, which differ from outright gifts as they require fulfillment to convert promises into tangible contributions.

Pledge vs Gift Infographic

moneydif.com

moneydif.com