A pledge is a commitment made by a donor to contribute a specific amount over time, often serving as a promise rather than immediate funding. A grant is a formal transfer of funds awarded by an organization or foundation, usually provided with set terms and conditions for a particular project or purpose. Understanding the distinction helps nonprofits manage cash flow and plan their fundraising strategies effectively.

Table of Comparison

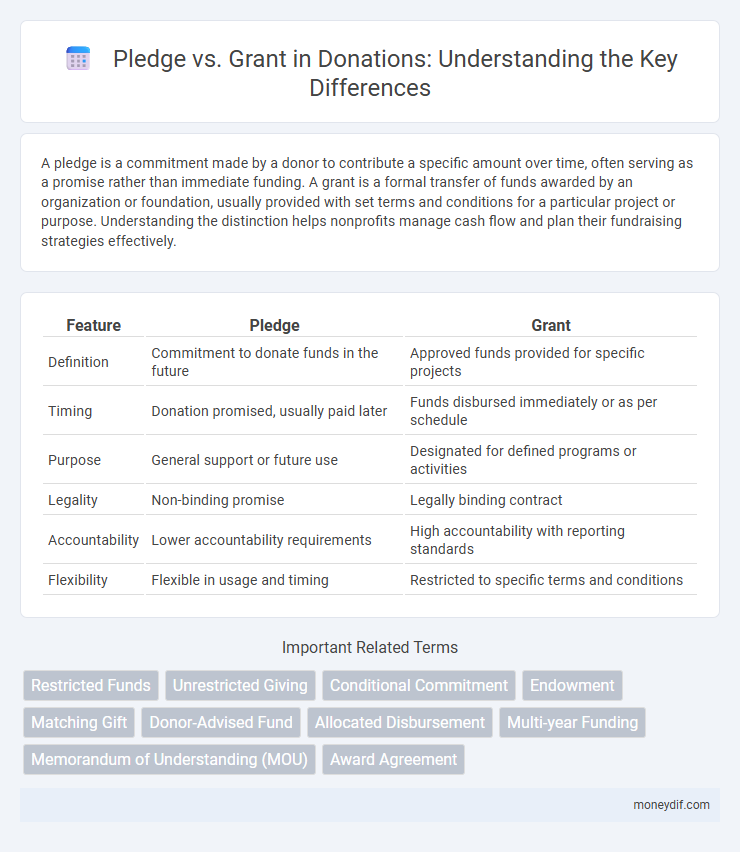

| Feature | Pledge | Grant |

|---|---|---|

| Definition | Commitment to donate funds in the future | Approved funds provided for specific projects |

| Timing | Donation promised, usually paid later | Funds disbursed immediately or as per schedule |

| Purpose | General support or future use | Designated for defined programs or activities |

| Legality | Non-binding promise | Legally binding contract |

| Accountability | Lower accountability requirements | High accountability with reporting standards |

| Flexibility | Flexible in usage and timing | Restricted to specific terms and conditions |

Understanding the Basics: What is a Pledge vs a Grant?

A pledge is a donor's commitment to contribute a specific amount of money over a set period, often without immediate payment, allowing organizations to plan future funding. A grant represents a formal transfer of funds from an entity, such as a foundation or government agency, typically awarded for a defined project with specific reporting requirements. Understanding the distinction helps nonprofits manage cash flow and comply with donor restrictions effectively.

Key Differences Between Pledges and Grants

Pledges represent a donor's promise to give a specific amount of money or resources in the future, often without immediate transfer of funds, while grants are formalized awards provided by organizations or governments with clear terms, conditions, and timelines for use. The key difference lies in the commitment level; pledges are non-binding intentions that may or may not be fulfilled, whereas grants are legally binding contracts requiring accountability and reporting. Furthermore, grants typically support defined projects or programs and include detailed application processes, contrasting with the informal nature of many pledges.

Common Uses: When to Seek Pledges or Grants

Pledges are commonly sought for fundraising campaigns, capital projects, or ongoing operational support where donors commit to giving a specified amount over time. Grants are typically pursued for specific programs, research initiatives, or community projects requiring detailed proposals and measurable outcomes. Organizations seeking flexible funding or donor engagement often prioritize pledges, while those needing structured financial support with reporting requirements focus on grants.

Legal Implications: Pledge Agreements vs Grant Contracts

Pledge agreements create binding legal obligations requiring the donor to fulfill their promised donation, often enforceable under contract law. Grant contracts typically define specific terms and conditions governing fund use, with legal implications tied to compliance and reporting requirements. Failure to meet pledge commitments can result in legal consequences, whereas grant breaches may lead to fund recovery or termination of the agreement.

Funding Consistency: Reliability of Pledges and Grants

Pledges provide a commitment to donate a specified amount over a period, offering predictable cash flow that supports long-term financial planning for organizations. Grants typically involve a lump sum payment upon approval, delivering immediate funding but less consistency in ongoing support. Relying on pledges enhances funding stability, while grants may require continual application efforts to maintain steady resources.

Reporting and Accountability: Requirements for Pledges vs Grants

Pledges require periodic reporting that demonstrates intent and progress toward fulfilling the donation commitment, often with less stringent auditing processes. Grants mandate detailed accountability through comprehensive financial reports, outcome evaluations, and compliance with specific donor conditions to ensure funds are used as intended. Both forms of contributions demand transparency, but grants typically involve more rigorous monitoring and formal oversight to maintain trust and regulatory adherence.

Flexibility in Funds: Restrictions in Grants and Pledges

Pledges offer donors greater flexibility as they can specify the timing and amount of their future donations, often with fewer restrictions on fund usage. Grants typically come with stringent conditions and predefined purposes, limiting how recipients can allocate the funds. Understanding these differences is crucial for organizations to align funding sources with their strategic financial needs.

Impact on Nonprofit Strategy: Grants vs Pledges

Grants provide nonprofits with structured funding that often comes with specific reporting requirements, enabling strategic planning aligned with donor priorities. Pledges offer flexible, committed future donations that can enhance cash flow forecasting and long-term budgeting. Balancing grants and pledges allows organizations to optimize resource allocation and sustain program impact effectively.

Example Scenarios: Choosing Between Grant and Pledge

A pledge involves a donor's commitment to give a specific amount over time, ideal for multi-year fundraising campaigns where funding is gradually secured. Grants provide immediate, lump-sum funding for projects requiring upfront resources, commonly used by nonprofits launching new initiatives or research programs. Organizations often choose pledges to ensure sustained support, while grants offer quick access to capital for time-sensitive activities.

Best Practices: Managing Pledged Gifts and Grant Awards

Effective management of pledged gifts and grant awards requires accurate tracking and timely communication with donors and grantors to ensure fulfillment and reporting compliance. Implementing robust donor management software and establishing clear documentation for each pledge or grant facilitates transparency and accountability throughout the donation lifecycle. Regular monitoring and evaluation of the use of funds enhance donor trust and support sustainable fundraising efforts.

Important Terms

Restricted Funds

Restricted funds are financial resources designated for specific purposes, with pledges representing commitments to give future donations while grants involve immediate allocation of funds under agreed terms.

Unrestricted Giving

Unrestricted giving refers to donations provided without limitations on their usage, offering nonprofits greater flexibility in addressing emerging needs. Unlike grants, which often have specific conditions or project-based restrictions, pledges represent donor commitments that may be fulfilled over time but can also be unrestricted, allowing organizations to allocate funds where they are most needed.

Conditional Commitment

Conditional commitment in legal contexts distinguishes a pledge, where ownership remains with the pledgor until default, from a grant, which transfers ownership immediately subject to conditions.

Endowment

An endowment is a fund established through a grant or pledge, where a grant typically involves an outright transfer of assets, while a pledge represents a formal promise to donate in the future, often binding the donor legally. Understanding the distinction between pledge and grant is crucial for managing endowment funds effectively, ensuring accurate financial planning and compliance with donor intentions.

Matching Gift

Matching gifts amplify donor pledges by doubling contributions through employer programs, effectively turning pledged amounts into grant-equivalent funds that nonprofits can access more quickly. Understanding the distinction between a pledge, which is a donor's commitment to give, and a grant, which is finalized funding, is essential for accurately forecasting matching gift revenues.

Donor-Advised Fund

A Donor-Advised Fund allows donors to make a pledge as a future commitment, but grants must be recommended for immediate distribution to qualified charities.

Allocated Disbursement

Allocated Disbursement ensures precise financial tracking by distinguishing funds committed through pledges from those formally approved as grants.

Multi-year Funding

Multi-year funding provides financial support over multiple years, enhancing stability for long-term projects, while pledges represent commitments to provide funds in the future without immediate transfer, contrasting with grants that involve immediate disbursement of funds. The distinction between pledge and grant affects cash flow management and reporting for non-profits, influencing planning and accountability in multi-year funding agreements.

Memorandum of Understanding (MOU)

A Memorandum of Understanding (MOU) represents a formal agreement outlining the intentions and commitments between parties involved in a pledge or grant, clarifying the scope, responsibilities, and conditions under which the pledged assets or granted funds are utilized. MOUs ensure transparency and mutual understanding in managing pledged resources or disbursed grants, facilitating accountability and legal clarity during the execution of funding agreements.

Award Agreement

An Award Agreement defines the terms under which a grantor provides a grant or a pledge to a recipient, clarifying ownership rights and obligations. Unlike a grant which transfers ownership outright, a pledge represents a conditional commitment, often requiring fulfillment of certain criteria before ownership or benefits are conferred.

Pledge vs Grant Infographic

moneydif.com

moneydif.com