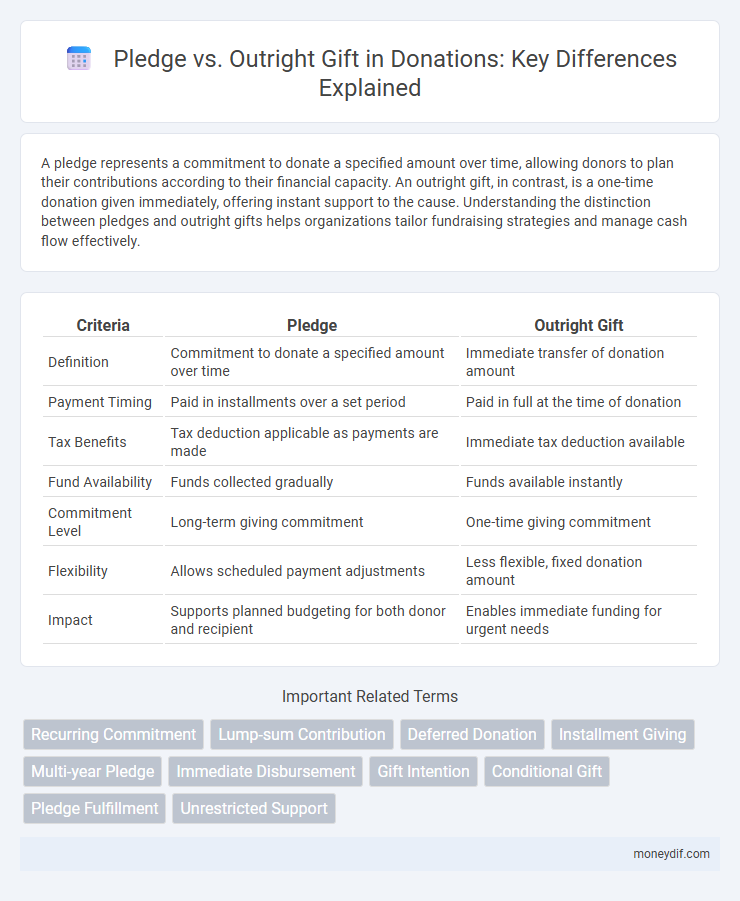

A pledge represents a commitment to donate a specified amount over time, allowing donors to plan their contributions according to their financial capacity. An outright gift, in contrast, is a one-time donation given immediately, offering instant support to the cause. Understanding the distinction between pledges and outright gifts helps organizations tailor fundraising strategies and manage cash flow effectively.

Table of Comparison

| Criteria | Pledge | Outright Gift |

|---|---|---|

| Definition | Commitment to donate a specified amount over time | Immediate transfer of donation amount |

| Payment Timing | Paid in installments over a set period | Paid in full at the time of donation |

| Tax Benefits | Tax deduction applicable as payments are made | Immediate tax deduction available |

| Fund Availability | Funds collected gradually | Funds available instantly |

| Commitment Level | Long-term giving commitment | One-time giving commitment |

| Flexibility | Allows scheduled payment adjustments | Less flexible, fixed donation amount |

| Impact | Supports planned budgeting for both donor and recipient | Enables immediate funding for urgent needs |

Defining Pledges and Outright Gifts

Pledges refer to commitments made by donors to give a specific amount of money or assets over time, often formalized through written agreements specifying payment schedules. Outright gifts consist of immediate, unconditional transfers of funds or property to a nonprofit organization, completed at the time of donation without deferred payment. Understanding the distinction between pledges and outright gifts is crucial for effective fundraising strategies and financial planning within charitable organizations.

Key Differences Between Pledges and Outright Gifts

Pledges are commitments to donate a specified amount over a set period, while outright gifts involve immediate transfer of funds or assets. Key differences include timing of donation recognition, with pledges recorded as receivables and outright gifts counted as current revenue. Outright gifts provide immediate resources for organizational use, whereas pledges offer future funding and require donor follow-up and tracking.

Advantages of Making a Pledge

Making a pledge offers the advantage of allowing donors to commit a specific amount over time, facilitating better budget management for both the donor and the recipient organization. Pledges provide organizations with predictable cash flow, enabling more effective planning and the execution of long-term projects. This method also encourages larger gifts by breaking down a significant donation into manageable payments, increasing donor participation and sustained support.

Benefits of Outright Gifts

Outright gifts provide immediate financial support, allowing nonprofits to allocate funds quickly toward urgent projects or operational needs. These donations often qualify for significant tax deductions in the year they are made, offering donors immediate fiscal benefits. Additionally, outright gifts simplify the giving process by eliminating the complexities associated with pledges, ensuring clear and direct impact.

Pledge Fulfillment and Tracking

Pledge fulfillment involves donors committing to contribute a specific amount over time, requiring organizations to implement robust tracking systems to monitor payment schedules and outstanding balances. Accurate pledge tracking enhances forecasting accuracy, improves donor relationship management, and ensures timely acknowledgment of contributions, which can increase donor retention. Effective software solutions enable nonprofits to automate reminders and generate reports, optimizing the pledge fulfillment process for sustained fundraising success.

Impact on Nonprofit Cash Flow

Pledges provide nonprofits with future financial commitments that can improve long-term planning but may delay immediate cash flow availability. Outright gifts offer instant liquidity, enabling nonprofits to address urgent needs and capitalize on timely opportunities. Balancing pledges and outright gifts is essential for maintaining steady cash flow and operational stability.

Donor Intent and Recognition

Donor intent is paramount in distinguishing a pledge from an outright gift, as a pledge represents a commitment to give in the future while an outright gift involves an immediate transfer of funds or assets. Recognition for pledges often occurs over the duration of the payment schedule, reflecting the donor's ongoing generosity, whereas outright gifts typically receive immediate acknowledgment and may influence donor recognition levels more promptly. Understanding these differences helps nonprofits tailor stewardship strategies to honor donor intent and maximize donor engagement.

Tax Implications of Pledges vs Outright Gifts

Pledges allow donors to commit to future payments, which are generally not tax-deductible until the funds are actually transferred, while outright gifts provide immediate tax deductions at the time of donation. The IRS requires that only completed gifts to qualified organizations qualify for a charitable tax deduction, highlighting the importance of payment timing. Understanding the difference in tax implications between pledges and outright gifts can optimize donor tax benefits and cash flow management for both donors and nonprofits.

Best Practices for Donors

Donors maximize impact by clearly distinguishing between pledges and outright gifts, ensuring legal and financial clarity in their commitments. Best practices involve setting realistic pledge timelines with transparent communication while executing outright gifts promptly to facilitate timely project funding. Maintaining thorough documentation and regular updates fosters trust and strengthens donor-charity relationships.

Choosing the Right Giving Method

Selecting between a pledge and an outright gift depends on cash flow and tax considerations; pledges allow donors to commit funds over time, distributing the financial impact while meeting philanthropic goals. Outright gifts provide immediate resources to the beneficiary organization, often maximizing current-year tax deductions and enabling prompt project funding. Evaluating personal financial situations alongside the nonprofit's needs ensures the chosen giving method aligns with both donor intent and organizational impact.

Important Terms

Recurring Commitment

Recurring commitments involve scheduled, repeated donations contrasting with outright gifts, which are singular, one-time contributions, enabling sustained support and predictable fundraising income.

Lump-sum Contribution

A lump-sum contribution can be structured as a pledge, involving a committed promise to donate over time, or as an outright gift, representing an immediate and irrevocable transfer of funds.

Deferred Donation

Deferred donation allows donors to commit gifts through estate plans or trusts, providing future financial support unlike outright gifts that transfer assets immediately. Pledges represent a promise to give over time or at a later date, bridging the gap between outright gifts and deferred donations by enabling structured, scheduled contributions.

Installment Giving

Installment giving allows donors to fulfill pledges over time, providing a flexible alternative to outright gifts that require full payment immediately.

Multi-year Pledge

Multi-year pledges enable donors to commit funds over several years, providing predictable revenue streams compared to outright gifts, which involve immediate, full contributions.

Immediate Disbursement

Immediate disbursement enables organizations to access funds instantly from outright gifts, whereas pledged donations typically require a waiting period before fulfillment.

Gift Intention

Gift intention distinguishes a pledge as a donor's promise to give in the future, while an outright gift represents an immediate and unconditional transfer of assets.

Conditional Gift

A conditional gift is a donation made contingent upon the fulfillment of specific terms, contrasting with an outright gift that transfers ownership immediately without prerequisites. In pledge scenarios, donors commit to giving in the future subject to certain conditions, whereas outright gifts involve unconditional, immediate transfers of assets or funds.

Pledge Fulfillment

Pledge fulfillment ensures donors complete their committed contributions over time, differentiating it from an outright gift which is given immediately and in full.

Unrestricted Support

Unrestricted support allows donors to provide funding without designated restrictions, offering recipients greater flexibility compared to pledges or outright gifts that may be allocated for specific purposes.

Pledge vs Outright Gift Infographic

moneydif.com

moneydif.com