Planned giving involves donors making a deliberate, often legally arranged commitment to contribute assets or funds over time or through their estate, ensuring sustained support for causes they care about. Spontaneous giving occurs without prior arrangement, driven by immediate emotional responses or urgent needs, providing quick but less predictable resources. Understanding the balance between these two strategies enables nonprofits to cultivate long-term stability while also responding effectively to immediate funding opportunities.

Table of Comparison

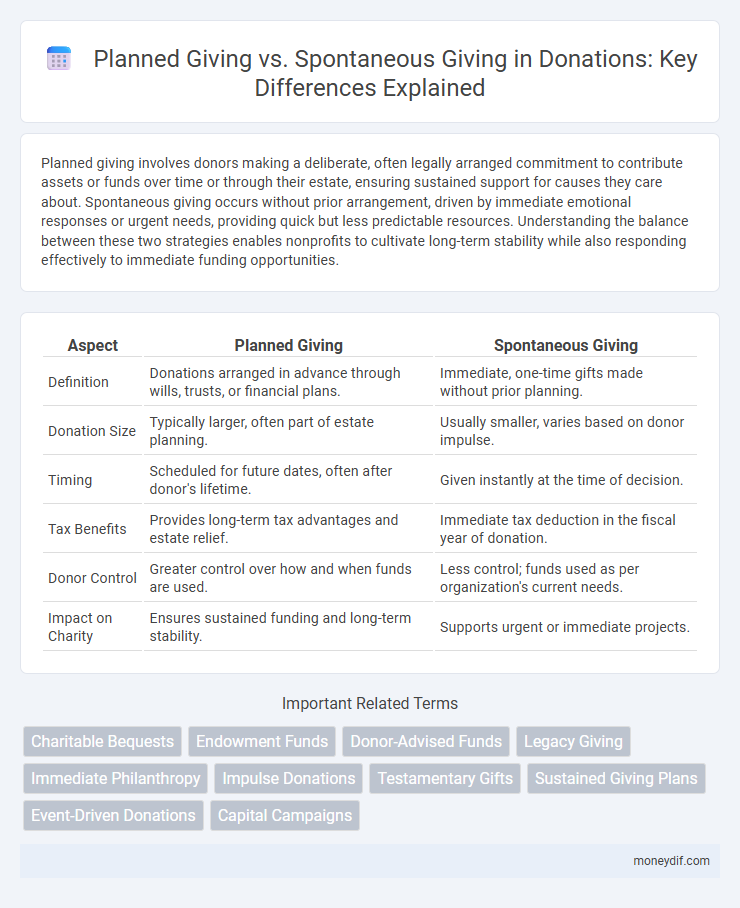

| Aspect | Planned Giving | Spontaneous Giving |

|---|---|---|

| Definition | Donations arranged in advance through wills, trusts, or financial plans. | Immediate, one-time gifts made without prior planning. |

| Donation Size | Typically larger, often part of estate planning. | Usually smaller, varies based on donor impulse. |

| Timing | Scheduled for future dates, often after donor's lifetime. | Given instantly at the time of decision. |

| Tax Benefits | Provides long-term tax advantages and estate relief. | Immediate tax deduction in the fiscal year of donation. |

| Donor Control | Greater control over how and when funds are used. | Less control; funds used as per organization's current needs. |

| Impact on Charity | Ensures sustained funding and long-term stability. | Supports urgent or immediate projects. |

Understanding Planned Giving: Definition and Benefits

Planned giving involves arranging donations through wills, trusts, or beneficiary designations, ensuring long-term support for causes while offering tax advantages and financial flexibility to donors. This method provides nonprofits with predictable funding streams, allowing for strategic growth and sustained impact. Unlike spontaneous giving, planned gifts are carefully structured, maximizing philanthropic outcomes and fostering enduring donor relationships.

What is Spontaneous Giving? An Overview

Spontaneous giving refers to unplanned, immediate donations made by individuals in response to an emotional appeal or urgent need, often during fundraising events or charitable campaigns. This type of giving is impulsive and driven by personal connection or situational factors rather than long-term financial planning. Charitable organizations benefit from spontaneous gifts as they provide quick funding, although these contributions are generally less predictable than planned giving commitments.

Key Differences Between Planned and Spontaneous Giving

Planned giving involves donors committing assets or funds through a formal strategy, often including bequests, trusts, or annuities, designed to benefit charities over time. Spontaneous giving occurs without prior arrangement, typically as one-time or ad hoc donations driven by immediate emotional responses or current events. Key differences include the timing, with planned giving focusing on long-term impact and tax benefits, while spontaneous giving provides immediate support but lacks structured financial planning.

Motivations Behind Planned Giving

Planned giving is often motivated by long-term financial strategies, tax benefits, and the desire to create a lasting legacy, distinguishing it from spontaneous giving driven by immediate emotional responses. Donors engaged in planned giving frequently aim to align their philanthropic goals with estate planning, ensuring their contributions have sustained impact. This intentional approach reflects a deliberate commitment to supporting causes over time, leveraging tools like bequests, trusts, and endowments.

Emotional Triggers of Spontaneous Donations

Spontaneous giving is often driven by emotional triggers such as empathy, urgency, and personal connection to a cause, creating immediate reactions that prompt donors to act quickly. Unlike planned giving, which relies on rational financial decisions and long-term commitment, spontaneous donations capitalize on moments of heightened emotional engagement. Fundraisers can increase spontaneous gifts by effectively storytelling and highlighting urgent needs that resonate deeply with potential donors.

Long-Term Impact: Planned Donor Contributions

Planned giving provides a structured approach to philanthropy, enabling donors to allocate significant resources over time, thereby maximizing long-term impact and financial stability for nonprofits. Contributions from planned donor agreements like bequests, trusts, and annuities often exceed spontaneous donations in both size and sustainability. Nonprofits that cultivate planned giving programs benefit from predictable funding streams that support strategic initiatives and ensure mission continuity.

Immediate Effects: Spontaneous Gifts and Their Reach

Spontaneous giving generates immediate financial resources, enabling nonprofits to address urgent needs and capitalize on timely opportunities. These unpredictable donations often spark community engagement and increase public awareness through social sharing and word-of-mouth promotion. Unlike planned giving, which accrues over time, spontaneous gifts create an instant impact that can sustain critical programs and respond quickly to emergencies.

Tax Advantages: Planned Giving vs Spontaneous Giving

Planned giving offers significant tax advantages by allowing donors to strategically allocate assets, such as appreciated securities or real estate, which can reduce capital gains taxes and provide income tax deductions. In contrast, spontaneous giving often involves outright cash donations that may not maximize tax benefits beyond the standard charitable deduction limits. Utilizing planned giving vehicles like charitable remainder trusts or donor-advised funds can enhance tax efficiency while supporting philanthropic goals.

Strategies to Encourage Both Giving Types

Planned giving strategies include offering clear information on legacy options and tax benefits to encourage donors to integrate donations into their long-term financial planning. Spontaneous giving is boosted by creating impactful, emotionally engaging campaigns and simplifying the donation process through mobile-friendly platforms and one-click options. Combining these approaches ensures a balanced fundraising portfolio by addressing both proactive commitment and immediate generosity.

Which is More Effective: Planned or Spontaneous Giving?

Planned giving, involving strategic donations through wills or trusts, often results in larger, more impactful contributions over time compared to spontaneous giving, which tends to be smaller and less predictable. Data shows that donors who engage in planned giving typically provide sustained support and significant lifetimes value to charitable organizations. While spontaneous giving boosts immediate funds during events or crises, planned giving establishes a reliable funding base essential for long-term organizational stability.

Important Terms

Charitable Bequests

Charitable bequests in planned giving involve donors intentionally allocating assets through wills for future philanthropy, contrasting with spontaneous giving where donations occur without prior arrangement.

Endowment Funds

Endowment funds grow sustainably through planned giving, ensuring long-term financial stability, while spontaneous giving provides immediate but less predictable support.

Donor-Advised Funds

Donor-advised funds provide a flexible platform for planned giving by allowing donors to strategically allocate assets over time, contrasting with spontaneous giving's immediate, less structured donations.

Legacy Giving

Legacy Giving strategically maximizes long-term impact through Planned Giving by allocating assets via wills or trusts, unlike Spontaneous Giving which involves immediate, often less structured donations.

Immediate Philanthropy

Immediate philanthropy often involves spontaneous giving driven by emotional impulses, whereas planned giving entails strategic contributions prepared in advance for long-term impact.

Impulse Donations

Impulse donations often lack the strategic foresight of planned giving but can significantly increase overall charitable contributions by capturing spontaneous generosity.

Testamentary Gifts

Testamentary gifts, as a core component of planned giving, offer donors a strategic way to provide future financial support, contrasting with spontaneous giving which occurs without prior arrangement or long-term intent.

Sustained Giving Plans

Sustained Giving Plans provide a structured approach to Planned Giving by encouraging consistent, long-term contributions that contrast with the unpredictable nature of Spontaneous Giving.

Event-Driven Donations

Event-driven donations leverage timely triggers to enhance planned giving strategies while increasing spontaneous giving participation.

Capital Campaigns

Planned giving in capital campaigns generates predictable, long-term funding through structured donations, whereas spontaneous giving provides immediate but less predictable financial support.

Planned Giving vs Spontaneous Giving Infographic

moneydif.com

moneydif.com