Planned giving allows donors to make significant contributions through bequests, trusts, or annuities, often providing tax benefits and the opportunity to support causes long-term. Outright giving involves immediate donations of cash or assets, offering quick impact and straightforward support for nonprofit programs. Both methods enhance philanthropic efforts, catering to different financial strategies and donor preferences.

Table of Comparison

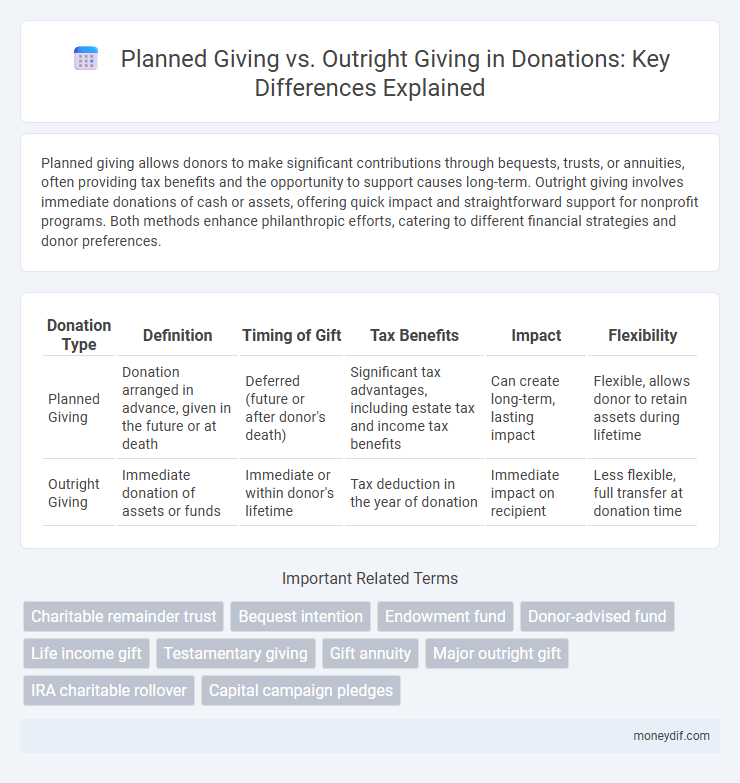

| Donation Type | Definition | Timing of Gift | Tax Benefits | Impact | Flexibility |

|---|---|---|---|---|---|

| Planned Giving | Donation arranged in advance, given in the future or at death | Deferred (future or after donor's death) | Significant tax advantages, including estate tax and income tax benefits | Can create long-term, lasting impact | Flexible, allows donor to retain assets during lifetime |

| Outright Giving | Immediate donation of assets or funds | Immediate or within donor's lifetime | Tax deduction in the year of donation | Immediate impact on recipient | Less flexible, full transfer at donation time |

Understanding Planned Giving and Outright Giving

Planned giving involves donors arranging contributions through instruments like bequests, charitable trusts, or life insurance policies, providing long-term support to nonprofits while potentially offering tax benefits. Outright giving refers to immediate, direct donations of cash, securities, or property, allowing nonprofits to access funds quickly for current needs. Understanding the strategic benefits of planned giving enables donors to align philanthropy with financial and estate planning goals, complementing the straightforward impact of outright gifts.

Key Differences Between Planned and Outright Gifts

Planned giving involves arranging donations through wills, trusts, or annuities, often providing long-term financial benefits and tax advantages to donors, while outright giving refers to immediate, direct contributions of cash, securities, or property. Key differences include the timing of the gift transfer, with planned gifts benefiting organizations over time versus the instant impact of outright gifts, and the complexity of administration, as planned gifts require legal and financial planning. Donors choosing planned giving can support causes posthumously or during their lifetime with strategic financial tools, whereas outright giving offers simplicity and immediate use of funds by nonprofits.

Benefits of Planned Giving for Donors

Planned giving offers donors significant tax advantages, including potential reductions in estate and income taxes, while allowing for larger contributions than outright giving. It provides donors the opportunity to create a lasting legacy by supporting causes over time, ensuring financial security for themselves and their beneficiaries. Furthermore, planned giving allows for flexibility in asset transfer, such as through bequests, charitable remainder trusts, or annuities, maximizing philanthropic impact and donor satisfaction.

Advantages of Outright Giving for Nonprofits

Outright giving provides immediate financial support, enabling nonprofits to address urgent needs and fund ongoing projects without delay. This type of donation simplifies accounting and reduces administrative costs, allowing organizations to allocate more resources directly to their mission. Donors also benefit from instant tax deductions, encouraging more frequent and generous contributions.

Tax Implications: Planned vs. Outright Giving

Planned giving offers significant tax advantages, including potential income tax deductions, reduced estate taxes, and the ability to avoid capital gains taxes by donating appreciated assets. Outright giving typically provides immediate tax deductions limited to the donor's adjusted gross income but does not offer the long-term tax benefits associated with estate planning. Strategic use of planned giving vehicles such as charitable remainder trusts or gift annuities can maximize tax savings compared to straightforward cash or asset donations.

Common Types of Planned Gifts

Common types of planned gifts include bequests, charitable remainder trusts, and gift annuities, providing long-term financial benefits to both donors and organizations. Bequests allow donors to leave assets through their wills, while charitable remainder trusts generate income streams before benefiting charities. These options offer flexibility and potential tax advantages compared to outright giving, which involves immediate transfer of assets.

When to Choose Planned Giving Over Outright Giving

Planned giving is ideal for donors seeking long-term impact and tax advantages by designating assets through wills or trusts, often benefiting both the donor's estate and the nonprofit. Outright giving suits donors who want immediate support for causes with cash or assets, providing instant liquidity to organizations. Choosing planned giving over outright giving depends on financial goals, desired timing of the gift, and the need for estate planning and legacy creation.

How Outright Gifts Impact Immediate Needs

Outright gifts provide immediate funding, enabling nonprofits to quickly address urgent community needs such as disaster relief, medical supplies, and food distribution. These gifts increase cash flow, allowing organizations to implement programs without delay and respond to unforeseen challenges effectively. The direct impact of outright giving often results in tangible benefits seen within weeks or months, enhancing the organization's ability to fulfill its mission promptly.

Integrating Both Strategies for Maximum Impact

Integrating planned giving and outright giving strategies allows donors to maximize charitable impact by balancing immediate support with long-term sustainability. Combining outright gifts like cash or assets with planned donations such as bequests or trusts diversifies funding streams and strengthens organizational resilience. This dual approach optimizes donor contributions, enhances legacy building, and ensures continuous resource availability for nonprofit missions.

Frequently Asked Questions About Planned and Outright Giving

Planned giving involves donors making charitable contributions through estate plans, such as wills or trusts, often providing long-term support and tax benefits, while outright giving consists of immediate donations like cash, stocks, or property. Frequently asked questions about planned giving include how it impacts taxes, eligibility for charitable deductions, and the types of assets that can be donated, whereas outright giving questions typically focus on donation methods, receipt acknowledgment, and donation limits. Understanding the differences helps donors align their philanthropic goals with financial planning and maximize the impact of their contributions.

Important Terms

Charitable remainder trust

A charitable remainder trust enables donors to receive income over time while supporting planned giving strategies, contrasting with outright giving that involves immediate, full transfers of assets to charity.

Bequest intention

Bequest intention in charitable giving reflects a donor's plan to leave assets through wills, contrasting planned giving's long-term, strategic gift arrangements with outright giving's immediate donations.

Endowment fund

Endowment funds benefit from planned giving through long-term, tax-advantaged contributions that ensure sustained financial support, whereas outright giving provides immediate, unrestricted funds for current operational needs.

Donor-advised fund

Donor-advised funds offer flexible planned giving options by allowing donors to recommend grants over time, unlike outright giving which entails immediate, irrevocable transfers of assets.

Life income gift

Life income gifts in planned giving provide donors with lifetime income and tax benefits, contrasting outright giving, which involves immediate, irrevocable transfers without ongoing financial returns.

Testamentary giving

Testamentary giving involves bequests made through a will, offering planned giving benefits like tax advantages and estate control, whereas outright giving provides immediate donations without future conditions.

Gift annuity

Gift annuities provide a structured planned giving option that offers donors fixed income and tax benefits, contrasting with outright giving's immediate, unconditional donations.

Major outright gift

Major outright gifts provide immediate funding and ownership transfer, whereas planned giving involves future commitments often structured through wills, trusts, or annuities to support long-term organizational sustainability.

IRA charitable rollover

IRA charitable rollover enables donors aged 70 1/2 or older to transfer up to $100,000 annually directly from their IRA to a qualified charity, offering tax advantages that contrast with outright giving by allowing planned giving strategies to maximize philanthropic impact while minimizing taxable income.

Capital campaign pledges

Capital campaign pledges from planned giving typically involve deferred gifts through wills or trusts, while outright giving provides immediate financial support.

Planned giving vs Outright giving Infographic

moneydif.com

moneydif.com