Pledge refers to a commitment to give a specific amount of money or resources in the future, while a donation is the actual transfer of those resources at the time of giving. Pledges help organizations plan budgets and fundraise strategically, but they do not provide immediate financial support like donations. Understanding the distinction between pledges and donations is crucial for effective fundraising management and donor engagement.

Table of Comparison

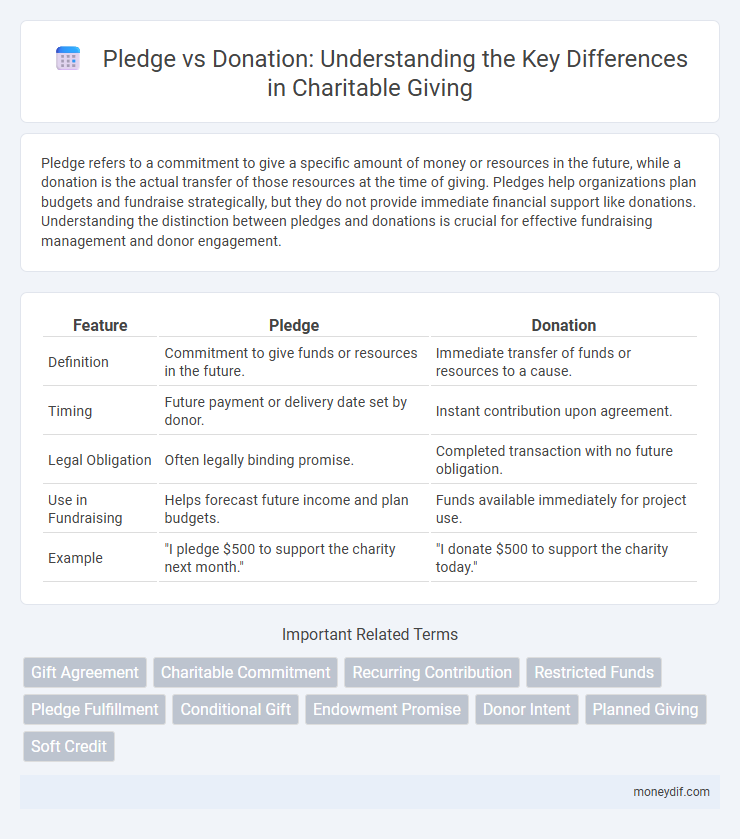

| Feature | Pledge | Donation |

|---|---|---|

| Definition | Commitment to give funds or resources in the future. | Immediate transfer of funds or resources to a cause. |

| Timing | Future payment or delivery date set by donor. | Instant contribution upon agreement. |

| Legal Obligation | Often legally binding promise. | Completed transaction with no future obligation. |

| Use in Fundraising | Helps forecast future income and plan budgets. | Funds available immediately for project use. |

| Example | "I pledge $500 to support the charity next month." | "I donate $500 to support the charity today." |

Understanding Pledges and Donations: Key Differences

Pledges represent a commitment to donate a specific amount of money or resources at a future date, whereas donations refer to the actual transfer of funds or goods to a cause. Understanding these distinctions helps nonprofits manage cash flow projections and donor engagement strategies effectively. Clear communication about pledges ensures donors follow through, enhancing the sustainability of fundraising efforts.

What Is a Pledge? Definition and Examples

A pledge is a formal commitment to donate a specific amount of money or resources in the future, often used by nonprofits to secure funding before the actual donation occurs. Unlike immediate donations, pledges allow donors to promise support over a set period, enabling organizations to plan long-term projects and budgeting with greater certainty. Examples of pledges include monthly giving pledges, capital campaign commitments, or event sponsorship promises.

What Constitutes a Donation? Core Concepts

A donation constitutes a voluntary transfer of assets, such as money, goods, or time, without expecting anything in return, creating an immediate and irrevocable commitment. Unlike a pledge, which is a promise to give in the future, a donation involves the actual delivery or transfer of the charitable gift to the recipient organization or cause. Core concepts of donation include donor intent, lawful transfer of ownership, and the absence of consideration or compensation.

Legal and Financial Implications: Pledges vs Donations

Pledges create a legal obligation for the donor to contribute a specified amount, often formalized through a written agreement, which can be enforced in court if unmet. Donations are typically completed transactions with the transfer of funds or goods occurring immediately, affecting the donor's tax deductions in the year of contribution. Understanding the distinction impacts financial planning and compliance, as pledges may require accounting as receivables, while donations are recognized as revenue upon receipt.

Benefits of Making a Pledge

Making a pledge offers donors the opportunity to commit funds over time, enhancing budget flexibility for both giver and recipient. Pledges provide organizations with reliable future financial forecasts, enabling more effective project planning and resource allocation. This commitment fosters long-term relationships between donors and nonprofits, increasing sustained support and engagement.

Advantages of Direct Donations

Direct donations provide immediate financial support, enabling organizations to allocate funds swiftly for urgent projects or operational costs. They increase donor impact transparency, allowing contributors to see the tangible effects of their giving. This approach also reduces administrative overhead often associated with managing pledges, ensuring more resources directly benefit the cause.

When to Choose a Pledge over a Donation

A pledge is ideal when donors want to commit to giving a specific amount over time, providing nonprofits with predictable future funding. Unlike a one-time donation, pledges allow for more strategic financial planning and enable organizations to budget long-term projects effectively. Choose a pledge when cash flow management and sustained support are essential for meeting organizational goals.

Fulfillment Rates: Do Pledges Lead to Donations?

Pledge fulfillment rates vary significantly depending on the cause and organization, with studies indicating that approximately 70% of pledges convert into actual donations. Factors influencing fulfillment include donor motivation, follow-up engagement, and the ease of payment methods. Organizations that actively communicate and remind donors typically experience higher conversion rates from pledges to completed donations.

Tax Considerations: Pledges and Donations Compared

Pledges represent a commitment to donate funds in the future, whereas donations refer to the actual transfer of assets to a charitable organization. For tax purposes, only donations made are typically deductible in the year they are received, while pledges may not be immediately eligible for tax deductions until fulfilled. Understanding IRS guidelines and documentation requirements ensures proper tax treatment of both pledges and donations, maximizing potential charitable deductions.

Best Practices for Nonprofits: Managing Pledges and Donations

Effective management of pledges and donations requires nonprofits to establish clear tracking systems that differentiate committed pledges from received donations, ensuring accurate financial reporting and donor communication. Utilizing donor management software enables organizations to set reminders for follow-up on outstanding pledges while processing donations promptly to maintain cash flow stability. Transparent acknowledgment and timely updates on pledge statuses foster trust and encourage continued donor engagement.

Important Terms

Gift Agreement

A gift agreement legally distinguishes a donation as an outright, unconditional transfer of assets, whereas a pledge constitutes a binding promise to donate assets in the future under specified conditions.

Charitable Commitment

A charitable commitment involves a pledge, which is a formal promise to donate a specific amount in the future, whereas a donation is the actual transfer of funds or resources given immediately to a cause.

Recurring Contribution

Recurring contributions offer a flexible alternative to one-time donations by converting pledges into automated, scheduled payments that enhance donor retention and financial forecasting.

Restricted Funds

Restricted funds refer to monetary contributions designated by donors for specific purposes, where pledges represent promises to give in the future and donations are actual transfers of funds that may be subject to donor-imposed restrictions.

Pledge Fulfillment

Pledge fulfillment ensures the committed contribution is collected and recorded accurately, distinguishing it from a donation which is an immediate gift without a prior commitment.

Conditional Gift

A conditional gift requires specific terms to be met before transferring ownership, differentiating it from a donation or pledge that generally implies an unconditional, voluntary transfer of assets or promises.

Endowment Promise

An Endowment Promise legally pledges future gifts to create a permanent fund, while a Donation refers to an immediate gift, often used for current operational needs.

Donor Intent

Donor intent clarifies the specific purposes and conditions set by a donor for using pledged funds compared to outright donations, ensuring alignment with the donor's wishes.

Planned Giving

Planned giving typically involves legally binding pledges that commit donors to future contributions, whereas donations are immediate transfers of funds or assets without deferred obligations.

Soft Credit

Soft credit attributes donor recognition without actual funds received, distinguishing it from a pledge, which is a donor's committed future donation.

Pledge vs Donation Infographic

moneydif.com

moneydif.com