Restricted funds are donations designated by the donor for specific purposes, limiting their use to particular projects or programs, ensuring targeted impact. Unrestricted funds offer nonprofits financial flexibility to allocate donations where the need is greatest, covering operational costs and unforeseen expenses. Understanding the difference between restricted and unrestricted funds helps organizations balance donor intent with organizational sustainability.

Table of Comparison

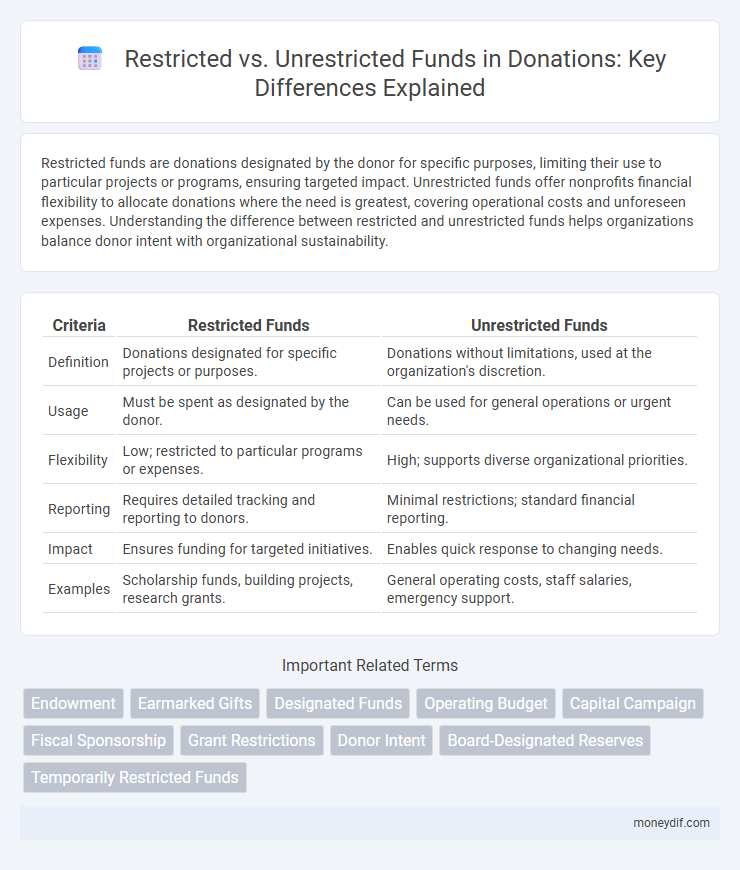

| Criteria | Restricted Funds | Unrestricted Funds |

|---|---|---|

| Definition | Donations designated for specific projects or purposes. | Donations without limitations, used at the organization's discretion. |

| Usage | Must be spent as designated by the donor. | Can be used for general operations or urgent needs. |

| Flexibility | Low; restricted to particular programs or expenses. | High; supports diverse organizational priorities. |

| Reporting | Requires detailed tracking and reporting to donors. | Minimal restrictions; standard financial reporting. |

| Impact | Ensures funding for targeted initiatives. | Enables quick response to changing needs. |

| Examples | Scholarship funds, building projects, research grants. | General operating costs, staff salaries, emergency support. |

Understanding Restricted and Unrestricted Funds

Restricted funds are donations designated by donors for specific purposes, projects, or programs, ensuring the money is used according to their intentions. Unrestricted funds provide organizations with flexibility to allocate resources where they are most needed, covering operational costs and general expenses. Understanding the distinction between restricted and unrestricted funds is crucial for effective financial management and transparency in nonprofit organizations.

Defining Restricted Funds in Charitable Giving

Restricted funds in charitable giving refer to donations designated by donors for specific purposes, projects, or programs within a nonprofit organization. These funds must be used in accordance with donor-imposed restrictions, ensuring accountability and targeted impact. Nonprofits rely on restricted funds to finance specialized initiatives while maintaining compliance with donor intentions and legal requirements.

What Are Unrestricted Funds?

Unrestricted funds are donations that can be used by nonprofit organizations for any purpose that supports their mission, providing flexibility to cover operational costs, emergency needs, or new initiatives. These funds are not tied to specific projects or programs, allowing organizations to allocate resources where they are most needed. Unrestricted funds are crucial for sustaining an organization's overall activities and strengthening its long-term financial health.

Differences Between Restricted and Unrestricted Donations

Restricted donations are contributions designated by donors for specific projects, programs, or purposes, limiting how organizations can allocate these funds. Unrestricted donations provide nonprofits with flexibility to use the money at their discretion, addressing general operational needs or urgent priorities. Understanding these differences helps organizations effectively plan budgets, comply with donor intent, and maximize impact.

Benefits of Donating Restricted Funds

Donating restricted funds ensures that contributions are allocated precisely to specific programs or projects, enhancing accountability and donor confidence. These targeted donations enable nonprofits to address critical needs with greater impact and transparency, demonstrating clear outcomes associated with donor intent. By supporting restricted funds, donors directly influence and sustain vital initiatives, fostering long-term organizational growth and mission effectiveness.

Advantages of Unrestricted Funds for Nonprofits

Unrestricted funds provide nonprofits with flexibility to allocate resources where they are needed most, enabling quick responses to emerging challenges and opportunities. These funds support core operational costs, ensuring organizational stability and sustained program delivery without the constraints of donor-imposed restrictions. Access to unrestricted funds enhances strategic planning and innovation, empowering nonprofits to maximize their impact and long-term growth.

Legal and Financial Implications of Donation Types

Restricted funds are donations designated by donors for specific purposes, requiring strict adherence to legal agreements and financial reporting to ensure compliance with donor intent. Unrestricted funds provide organizations with greater flexibility for operational expenses but still demand transparent financial management to maintain donor trust and regulatory compliance. Mismanagement of either fund type can result in legal liabilities, loss of tax-exempt status, and diminished donor confidence.

Choosing the Right Fund for Your Donation Goals

Selecting between restricted funds and unrestricted funds depends on aligning your donation with specific organizational needs and your philanthropic objectives. Restricted funds are designated for particular projects or purposes, ensuring that your contribution directly supports targeted programs. Unrestricted funds offer flexibility, allowing organizations to allocate resources where they are most needed, optimizing impact and sustainability.

How Nonprofits Manage Restricted vs Unrestricted Funds

Nonprofits manage restricted funds by allocating donations strictly for designated programs or projects, ensuring compliance with donor-imposed restrictions and maintaining detailed tracking for reporting purposes. Unrestricted funds provide nonprofits with flexibility to cover operational expenses, respond to emerging needs, and sustain core activities without limitations. Effective fund management involves transparent accounting systems and strategic budgeting to balance donor intent with organizational sustainability.

Impact of Fund Restrictions on Organizational Flexibility

Restricted funds limit an organization's flexibility by earmarking resources for specific projects or purposes, which can constrain the ability to allocate finances for urgent or general operational needs. Unrestricted funds provide greater adaptability, enabling organizations to address emerging challenges and invest in overall capacity building. The balance between restricted and unrestricted funds directly influences an organization's agility, financial health, and long-term sustainability.

Important Terms

Endowment

Endowments are typically composed of restricted funds, which donors designate for specific purposes, whereas unrestricted funds provide organizations with flexibility to allocate resources as needed.

Earmarked Gifts

Earmarked gifts are donations specifically designated for restricted funds, limiting their use to certain purposes, unlike unrestricted funds which allow organizations the flexibility to allocate resources based on general operational needs.

Designated Funds

Designated funds are a subset of unrestricted funds specifically allocated by an organization's management for a particular purpose, differing from restricted funds which are externally imposed and legally binding.

Operating Budget

Operating budgets allocated from restricted funds must adhere to donor-imposed limitations, while those funded by unrestricted funds offer greater flexibility for organizational expenses.

Capital Campaign

Capital campaigns typically raise restricted funds designated for specific projects, while unrestricted funds provide flexible financial support for general organizational needs.

Fiscal Sponsorship

Fiscal sponsorship distinguishes between restricted funds, which are earmarked by donors for specific projects, and unrestricted funds, which can be used flexibly to support the sponsor's overall mission.

Grant Restrictions

Grant restrictions classify funds as restricted, designated for specific purposes or projects, versus unrestricted funds, which can be used at the organization's discretion.

Donor Intent

Donor intent determines whether contributions are classified as restricted funds, which must be used for specific purposes, or unrestricted funds, allowing nonprofits flexible use of donations.

Board-Designated Reserves

Board-designated reserves are a subset of unrestricted funds set aside by the board for specific purposes, distinguishing them from restricted funds that are legally or externally mandated for designated uses.

Temporarily Restricted Funds

Temporarily Restricted Funds are a category of Restricted Funds designated for specific purposes or time periods, unlike Unrestricted Funds which can be used freely for general organizational needs.

Restricted Funds vs Unrestricted Funds Infographic

moneydif.com

moneydif.com