An endowment provides long-term financial stability by investing donated funds and using the generated income to support organizational needs, while an annual fund raises money each year to cover immediate operating expenses. Endowments build a lasting legacy and help secure future growth, whereas annual funds focus on sustaining ongoing programs and services. Both are crucial for a balanced funding strategy, ensuring current operations and future sustainability.

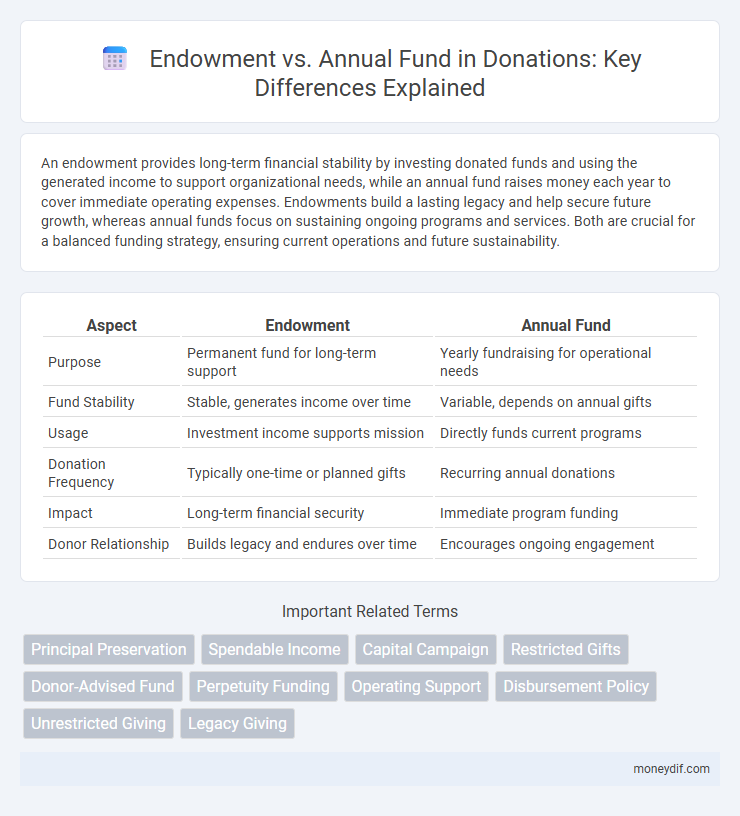

Table of Comparison

| Aspect | Endowment | Annual Fund |

|---|---|---|

| Purpose | Permanent fund for long-term support | Yearly fundraising for operational needs |

| Fund Stability | Stable, generates income over time | Variable, depends on annual gifts |

| Usage | Investment income supports mission | Directly funds current programs |

| Donation Frequency | Typically one-time or planned gifts | Recurring annual donations |

| Impact | Long-term financial security | Immediate program funding |

| Donor Relationship | Builds legacy and endures over time | Encourages ongoing engagement |

Understanding Endowments and Annual Funds

Endowments are permanent funds where the principal is invested, generating income to support an organization's long-term financial stability, while annual funds consist of yearly donations that provide flexible, immediate resources for operating expenses and special projects. Understanding the difference between endowments and annual funds is crucial for effective fundraising strategies, as endowments build sustainable wealth and annual funds drive ongoing program support. Donors often prefer endowments for legacy impact and annual funds for direct, timely influence on organizational needs.

Key Differences Between Endowment and Annual Fund

Endowments are long-term financial assets invested to generate income, providing perpetual support for an organization, whereas annual funds focus on raising donations within a specific fiscal year to meet immediate operational needs. Endowment gifts are typically restricted and cannot be spent directly, ensuring sustainability, while annual fund contributions are generally unrestricted and used for ongoing programs and expenses. The key differences lie in endowment's emphasis on capital preservation and income generation, compared to annual fund's goal of cash flow for current organizational priorities.

The Role of Endowments in Long-Term Giving

Endowments provide a sustainable source of income by investing principal donations to generate returns, supporting long-term financial stability for organizations. Unlike annual funds, which rely on yearly contributions for immediate needs, endowments ensure continuous funding for future programs and priorities. This long-term giving mechanism helps institutions plan strategically and maintain mission-critical activities regardless of economic fluctuations.

How Annual Funds Support Immediate Needs

Annual funds provide critical liquidity that supports an organization's immediate operational expenses, including staff salaries, program delivery, and facility maintenance. Unlike endowments, which are invested for long-term growth and generate income over time, annual funds enable nonprofits to respond swiftly to current community needs and unforeseen challenges. This timely financial support ensures continuity of services and sustains daily organizational functions.

Donor Perspectives: Choosing Between Endowment and Annual Fund

Donors prioritize long-term impact when choosing between endowment and annual fund contributions, viewing endowments as sustainable investments that support institutional stability over time. Annual fund donations appeal to donors seeking immediate influence, funding operational costs and urgent program needs within a fiscal year. Understanding donor preferences for legacy building versus immediate results guides nonprofit fundraising strategies for optimized financial growth.

Financial Sustainability: Endowments vs. Annual Fund

Endowments provide long-term financial sustainability by investing donated funds and generating steady income, ensuring ongoing support for institutional needs. Annual funds focus on raising unrestricted donations each year to cover immediate operational expenses but lack the perpetual financial stability of endowments. Strong endowment growth reduces dependency on fluctuating annual fund revenue, enhancing overall fiscal resilience.

Impact Measurement: Endowment vs Annual Giving

Endowment funds provide long-term financial stability by generating investment income that supports an organization's mission perpetually, allowing for sustained impact measurement over decades. In contrast, annual giving campaigns offer immediate, flexible funding that directly addresses current needs and programs, enabling short-term impact assessments tied to specific projects or events. Measuring the impact of endowments involves tracking the growth and disbursement of capital, while annual funds require constant evaluation of donor engagement and the effectiveness of funded initiatives.

Strategic Fundraising: Blending Endowment and Annual Approaches

Strategic fundraising blends endowment and annual fund approaches to balance long-term financial stability with immediate operational needs. Endowments provide sustainable income through invested principal, supporting institutional growth and future projects. Annual funds generate essential cash flow for yearly programs and engage donors in ongoing participation, creating a dynamic fundraising ecosystem.

Common Myths About Endowment and Annual Funds

Common myths about endowments and annual funds often confuse their purpose and flexibility; endowments are mistakenly believed to be inaccessible or reserved only for large donors, while annual funds are seen as less impactful. Endowments provide long-term financial stability by investing contributions to generate perpetual income, whereas annual funds support immediate operational needs and program expenses. Understanding these distinctions helps donors make informed decisions that align with their philanthropic goals and the institution's sustainability.

Which to Support: Endowment or Annual Fund?

Choosing between supporting an endowment or an annual fund depends on your impact preference: endowments provide long-term financial stability by investing donations to generate ongoing income, while annual funds offer immediate resources that support current programs and operational expenses. Donors seeking to create a lasting legacy often prioritize endowments, which help institutions grow sustainably over time. Conversely, those focused on addressing urgent needs and facilitating day-to-day activities opt for annual fund contributions to ensure continuous program delivery and flexibility.

Important Terms

Principal Preservation

Principal Preservation ensures the original endowment corpus remains intact, generating income without depleting the fund, whereas the Annual Fund focuses on yearly donations to support immediate operational expenses. Endowments prioritize long-term financial stability, whereas Annual Funds provide flexible, short-term cash flow for ongoing programs.

Spendable Income

Spendable income from endowments generates long-term financial stability, while annual funds provide immediate, flexible support for operational expenses.

Capital Campaign

Capital Campaigns focus on raising substantial, one-time contributions for endowment funds that provide long-term financial stability, while Annual Funds generate recurring donations to support operational expenses and short-term needs.

Restricted Gifts

Restricted gifts designated for endowments are committed to preserving principal while generating income for long-term institutional support, distinguishing them from annual fund donations that boost operational budgets and provide immediate financial flexibility. Unlike unrestricted annual fund contributions, restricted endowment gifts enhance financial stability by funding specific programs or initiatives in perpetuity.

Donor-Advised Fund

A Donor-Advised Fund (DAF) offers flexibility for charitable giving by allowing donors to recommend grants over time, contrasting with an Endowment Fund that restricts principal to generate perpetual income and an Annual Fund focused on yearly operational support. DAFs enable strategic philanthropy with tax advantages while Endowments preserve capital for long-term sustainability and Annual Funds ensure immediate financial resources for ongoing institutional needs.

Perpetuity Funding

Perpetuity funding ensures long-term financial stability by investing principal to generate continual income, contrasting with annual funds that rely on yearly donations for operational support. Endowments exemplify perpetuity funding by preserving capital while distributing earnings for specific purposes, whereas annual funds provide flexible, immediate resources for ongoing needs.

Operating Support

Operating support often stems from the annual fund, providing flexible, short-term funding for day-to-day expenses, while endowments generate long-term, stable income through invested principal, designed to support an organization's mission perpetually. Understanding the balance between these funding sources is crucial for financial sustainability, with annual funds addressing immediate needs and endowments securing future operating support.

Disbursement Policy

Disbursement policy for endowments typically governs the sustainable allocation of earnings to support long-term financial stability, whereas annual fund disbursement focuses on immediate, flexible funding for operational needs.

Unrestricted Giving

Unrestricted giving offers flexible funding that supports both endowment growth and annual fund operations, enabling organizations to allocate resources where they are most needed. Unlike restricted donations earmarked for specific projects, unrestricted gifts empower nonprofits to address immediate expenses and invest in long-term sustainability through strategic endowment contributions.

Legacy Giving

Legacy giving significantly enhances endowment funds by providing long-term financial stability and supporting institutional growth, while annual funds rely on recurring donations that address immediate operational needs. Endowments generate sustainable income through invested principal, contrasting with annual fund contributions that fund annual budgets and short-term projects.

Endowment vs Annual Fund Infographic

moneydif.com

moneydif.com