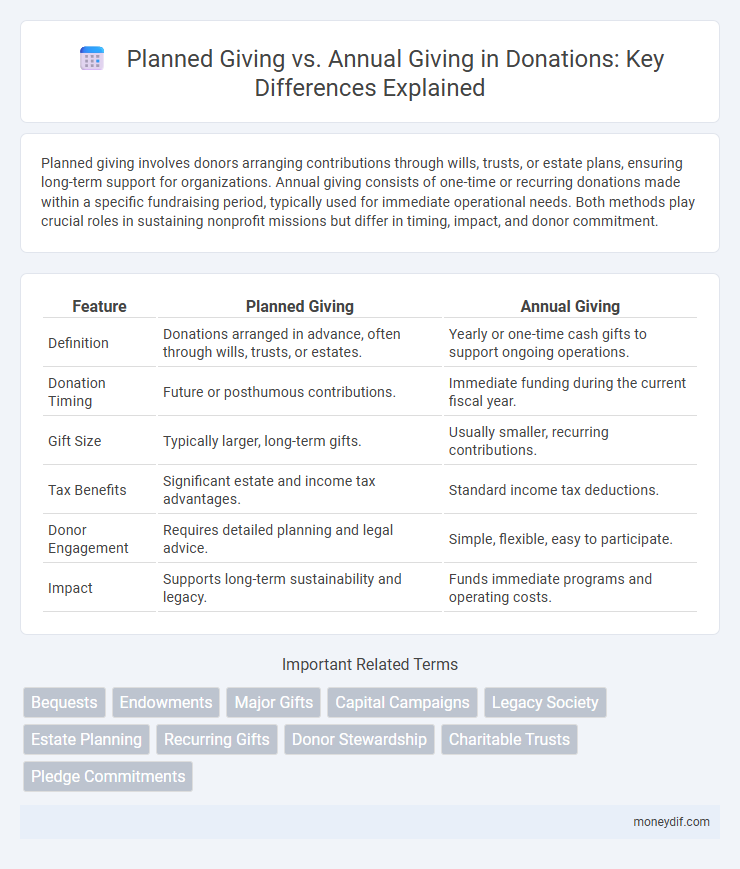

Planned giving involves donors arranging contributions through wills, trusts, or estate plans, ensuring long-term support for organizations. Annual giving consists of one-time or recurring donations made within a specific fundraising period, typically used for immediate operational needs. Both methods play crucial roles in sustaining nonprofit missions but differ in timing, impact, and donor commitment.

Table of Comparison

| Feature | Planned Giving | Annual Giving |

|---|---|---|

| Definition | Donations arranged in advance, often through wills, trusts, or estates. | Yearly or one-time cash gifts to support ongoing operations. |

| Donation Timing | Future or posthumous contributions. | Immediate funding during the current fiscal year. |

| Gift Size | Typically larger, long-term gifts. | Usually smaller, recurring contributions. |

| Tax Benefits | Significant estate and income tax advantages. | Standard income tax deductions. |

| Donor Engagement | Requires detailed planning and legal advice. | Simple, flexible, easy to participate. |

| Impact | Supports long-term sustainability and legacy. | Funds immediate programs and operating costs. |

Understanding Planned Giving and Annual Giving

Understanding Planned Giving involves recognizing it as a strategic donation method where donors commit assets through wills, trusts, or life insurance, providing long-term support to organizations. Annual Giving refers to regular, often yearly, contributions that sustain operational costs and fund immediate projects. Both giving types play crucial roles in nonprofit fundraising, with Planned Giving securing future financial stability and Annual Giving maintaining present-day programmatic needs.

Key Differences Between Planned Giving and Annual Giving

Planned giving involves long-term, often irrevocable commitments such as bequests, charitable trusts, or endowments, designed to provide substantial financial support over time, while annual giving consists of one-time or recurring donations made within a single fiscal year to support immediate organizational needs. The timing and size of contributions differ, with planned giving focusing on future legacy and tax benefits, whereas annual giving targets current operational funding and donor engagement. Donors in planned giving typically engage in estate planning, contrasting with the broader, more diverse donor base contributing through annual giving campaigns.

Benefits of Planned Giving for Donors and Organizations

Planned giving offers donors significant tax advantages and the opportunity to make a larger, lasting impact beyond their lifetime compared to annual giving. Organizations benefit from increased financial stability and the ability to forecast long-term funding, enhancing strategic planning and program sustainability. This form of giving strengthens donor relationships by aligning philanthropic goals with legacy objectives.

Why Annual Giving Remains Essential for Nonprofits

Annual giving provides nonprofits with a steady stream of unrestricted funds crucial for day-to-day operations, program support, and immediate community needs. Unlike planned giving, which offers long-term endowments or estate gifts, annual donations sustain ongoing activities and build donor relationships through recurring engagement. This consistent funding base enhances financial stability and helps nonprofits adapt quickly to changing circumstances.

Impact of Planned Giving on Long-Term Sustainability

Planned giving creates a reliable source of funding that supports long-term sustainability by providing endowments, bequests, and trusts, which ensure continual resources beyond immediate needs. Unlike annual giving that focuses on short-term operational costs, planned gifts enable nonprofits to strategically invest in enduring programs and infrastructure. This approach strengthens financial stability and fosters sustained impact across future generations.

Annual Giving: Driving Immediate Support and Engagement

Annual giving plays a crucial role in driving immediate support and engagement by encouraging donors to contribute on a recurring or one-time basis within a given year. These donations provide nonprofits with a steady cash flow that supports ongoing programs, urgent needs, and operational expenses. Emphasizing annual giving campaigns helps maintain donor relationships and sustains momentum for long-term financial stability.

Choosing Between Planned Giving and Annual Giving

Choosing between planned giving and annual giving depends on the donor's financial goals and tax planning strategies. Planned giving involves long-term commitments such as bequests, annuities, or trusts, offering significant tax benefits and lasting impact on the nonprofit's sustainability. In contrast, annual giving provides immediate support through one-time or recurring contributions, enhancing the organization's short-term projects and operational budget.

Strategies to Promote Planned Giving and Annual Giving

Strategic promotion of planned giving involves personalized donor engagement through tailored communication highlighting estate and legacy benefits, complemented by educational seminars and targeted marketing campaigns emphasizing long-term impact. Annual giving strategies focus on consistent outreach via multi-channel appeals, matching gift challenges, and timely reminders aligned with fiscal calendars to foster donor loyalty and recurring contributions. Leveraging donor data analytics enhances segmentation and messaging precision, optimizing both planned and annual giving outcomes for sustained philanthropic growth.

Donor Profiles: Planned Giving vs Annual Giving Supporters

Planned giving supporters typically consist of older donors with higher net worth who prioritize legacy and long-term impact through bequests, trusts, or endowment funds. Annual giving supporters are generally younger or mid-career donors who contribute smaller, more frequent gifts focused on immediate organizational needs and programs. Understanding these distinct donor profiles helps nonprofits tailor engagement strategies and optimize fundraising outcomes across both giving streams.

Integrating Planned Giving and Annual Giving for Maximum Impact

Integrating planned giving and annual giving strategies creates a comprehensive fundraising approach that cultivates donor relationships and maximizes financial support over time. Planned giving secures long-term commitments through bequests or trusts, while annual giving drives immediate funding and engagement, making their combination critical for sustained organizational growth. Leveraging donor data analytics enhances personalized appeals, ensuring that appeals for planned and annual gifts resonate with donors' philanthropic goals and increase overall giving effectiveness.

Important Terms

Bequests

Bequests, as a key component of Planned Giving, provide donors an opportunity to make significant future contributions through their wills, contrasting with Annual Giving which involves immediate, often smaller, donations aimed at supporting current organizational needs.

Endowments

Planned giving endowments provide long-term financial sustainability through deferred gifts, while annual giving focuses on immediate cash flow from yearly donations.

Major Gifts

Major gifts, typically exceeding $10,000, are strategically cultivated through planned giving programs that focus on long-term endowments, whereas annual giving campaigns emphasize smaller, recurring donations to support immediate organizational needs.

Capital Campaigns

Capital campaigns generate substantial long-term funding for major projects through planned giving commitments, while annual giving provides consistent, short-term operational support from regular donors.

Legacy Society

Legacy Society members commit to planned giving strategies that ensure long-term impact, while annual giving focuses on immediate, recurring contributions to support ongoing organizational needs.

Estate Planning

Planned giving in estate planning involves structured, long-term charitable contributions integrated into wills or trusts, whereas annual giving consists of regular, short-term donations typically made within a calendar year.

Recurring Gifts

Recurring gifts in planned giving provide long-term financial stability compared to one-time annual giving contributions.

Donor Stewardship

Donor stewardship strengthens relationships by tailoring communication and recognition strategies to maximize engagement and retention in both planned giving and annual giving programs.

Charitable Trusts

Charitable trusts enable planned giving by providing long-term financial support through assets management, whereas annual giving focuses on immediate, recurring donations to nonprofit organizations.

Pledge Commitments

Pledge commitments in planned giving involve legally binding promises for future donations, whereas annual giving typically includes non-binding, recurring contributions within a fiscal year.

Planned Giving vs Annual Giving Infographic

moneydif.com

moneydif.com