Legacy giving involves donors committing assets through wills or trusts to support causes after their lifetime, ensuring a lasting impact. Planned giving encompasses a broader range of charitable contributions arranged during a donor's lifetime, including life insurance policies, annuities, and bequests. Both methods provide strategic ways to support nonprofits, with legacy giving emphasizing posthumous gifts and planned giving allowing for flexible, often tax-advantaged, financial planning.

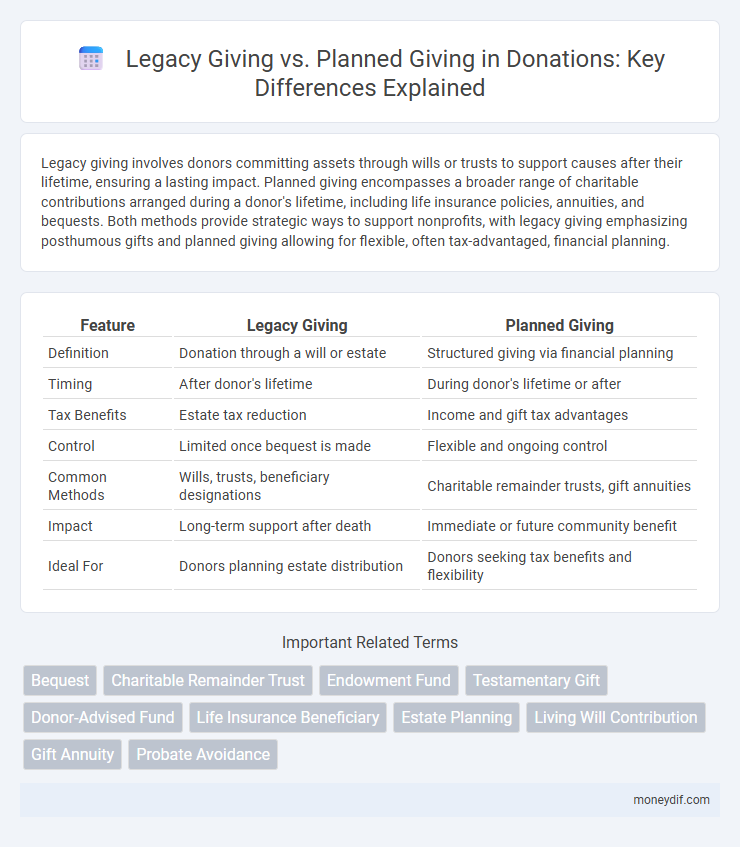

Table of Comparison

| Feature | Legacy Giving | Planned Giving |

|---|---|---|

| Definition | Donation through a will or estate | Structured giving via financial planning |

| Timing | After donor's lifetime | During donor's lifetime or after |

| Tax Benefits | Estate tax reduction | Income and gift tax advantages |

| Control | Limited once bequest is made | Flexible and ongoing control |

| Common Methods | Wills, trusts, beneficiary designations | Charitable remainder trusts, gift annuities |

| Impact | Long-term support after death | Immediate or future community benefit |

| Ideal For | Donors planning estate distribution | Donors seeking tax benefits and flexibility |

Understanding Legacy Giving and Planned Giving

Legacy giving involves donors making a significant charitable gift through their estate plans, such as bequests, trusts, or beneficiary designations, ensuring lasting impact beyond their lifetime. Planned giving encompasses a broader range of strategies, including lifetime gifts like charitable gift annuities and remainder trusts, designed to maximize tax benefits and financial advantages while supporting nonprofit missions. Understanding the distinctions between legacy and planned giving helps donors choose the most effective method to align philanthropic goals with personal financial plans.

Key Differences Between Legacy and Planned Giving

Legacy giving involves donors making a charitable gift as part of their estate plans, typically realized after their lifetime, whereas planned giving refers to a broader range of gifts arranged in advance, including but not limited to bequests, trusts, and annuities. Legacy giving usually emphasizes long-term impact and the donor's lasting values, while planned giving offers more flexibility in timing and methods, integrating both immediate and future benefits. Understanding these distinctions helps nonprofits tailor fundraising strategies to maximize donor engagement and financial sustainability.

Benefits of Choosing Legacy Giving

Legacy giving offers donors the opportunity to create a lasting impact by supporting causes they care about beyond their lifetime, ensuring their values endure through charitable bequests or endowments. This approach often provides significant tax benefits, including estate tax reductions and potential avoidance of capital gains taxes, maximizing the value of gifts passed on to nonprofits. Legacy giving fosters deep emotional fulfillment by allowing individuals to leave a permanent legacy, strengthen family philanthropy, and inspire future generations to continue charitable support.

The Process of Planned Giving Explained

Planned giving involves donors arranging contributions to charities through financial or estate plans executed during their lifetime or at death, often utilizing instruments like trusts, bequests, or annuities. This process allows donors to maximize tax benefits while providing long-term support to the organization, typically requiring coordination with legal and financial advisors to ensure compliance and alignment with personal objectives. Legacy giving, a subset of planned giving, specifically refers to donations made through wills or estate plans, emphasizing lasting impact beyond the donor's lifetime.

Tax Implications: Legacy vs. Planned Giving

Legacy giving often provides significant estate tax benefits by reducing the taxable value of an estate, allowing donors to leave assets to heirs or charities with minimized tax burdens. Planned giving strategies, such as charitable remainder trusts or gift annuities, offer immediate income tax deductions and can generate ongoing income streams while supporting charitable causes. Both legacy and planned giving play vital roles in effective tax planning, maximizing philanthropic impact while optimizing tax advantages.

Who Should Consider Legacy Giving?

Legacy giving suits individuals seeking to create a lasting impact through gifts in wills or trusts, often appealing to those with significant assets or a strong desire to support causes beyond their lifetime. Planned giving encompasses a broader range of options, including life income gifts and beneficiary designations, making it accessible to donors at various financial stages. Donors aiming for enduring philanthropic influence and estate planning benefits should consider legacy giving as part of their overall charitable strategy.

How Planned Giving Supports Long-Term Missions

Planned giving provides a structured approach to securing long-term funding for nonprofit missions through instruments such as charitable remainder trusts, gift annuities, and bequests. Unlike legacy giving, which typically involves donations through wills or estates after death, planned giving integrates financial and estate planning to ensure sustainable support during and after the donor's lifetime. Charitable organizations benefit from predictable revenue streams, enabling them to expand programs, invest in infrastructure, and achieve enduring social impact.

Myths and Facts About Legacy and Planned Gifts

Legacy giving often faces myths such as it being exclusively for the wealthy, whereas planned giving actually accommodates donors of various income levels through vehicles like charitable remainder trusts and gift annuities. Many believe legacy gifts must be monetary, but facts show they include assets such as real estate, stocks, or personal property, maximizing charitable impact. The misconception that planned giving reduces current financial flexibility is countered by strategies allowing donors to retain income streams while supporting causes in the future.

How Nonprofits Manage Legacy and Planned Gifts

Nonprofits manage legacy and planned gifts by establishing dedicated gift planning programs and working closely with donors' legal and financial advisors to ensure the proper structuring of bequests, trusts, and annuities. They implement sophisticated tracking systems to monitor pledge fulfillment and utilize stewardship strategies to maintain long-term relationships with legacy donors. Effective management of these gifts enhances sustainable funding, enabling nonprofits to support their missions well into the future.

Steps to Start Your Legacy or Planned Giving Journey

Begin your legacy or planned giving journey by assessing your financial goals and identifying charitable organizations aligned with your values. Consult with legal and financial advisors to design a giving strategy that maximizes tax benefits and ensures your intentions are clearly documented. Establish formal agreements, such as wills or trusts, to secure your legacy gift and provide a lasting impact on your chosen causes.

Important Terms

Bequest

Bequest is a form of legacy giving involving a donor's will, while planned giving encompasses a broader range of financial strategies including trusts, annuities, and life insurance policies.

Charitable Remainder Trust

A Charitable Remainder Trust strategically combines legacy giving and planned giving by allowing donors to provide lifetime income while ultimately benefiting their chosen charity.

Endowment Fund

Endowment funds benefit from legacy giving by securing long-term financial support through donor bequests, while planned giving encompasses a broader range of charitable contributions, including trusts and annuities, designed to provide sustained funding and tax advantages.

Testamentary Gift

Testamentary gifts, made through wills, represent a form of legacy giving distinguished from planned giving by their posthumous transfer, enabling donors to allocate assets after death without impacting current finances.

Donor-Advised Fund

Donor-Advised Funds enable donors to make legacy giving impactful by allowing strategic, flexible planned giving that supports long-term philanthropic goals.

Life Insurance Beneficiary

Designating a life insurance beneficiary ensures efficient legacy giving by directly transferring assets, while planned giving integrates life insurance into broader estate plans for long-term philanthropic impact.

Estate Planning

Legacy giving focuses on bequeathing assets through wills or trusts to beneficiaries, while planned giving encompasses a broader range of strategies, including charitable donations and financial instruments, designed to manage asset distribution during lifetime and after death.

Living Will Contribution

Living Will Contribution plays a crucial role in Legacy Giving by ensuring specific healthcare preferences are honored, while Planned Giving encompasses a broader range of financial and asset donations for long-term philanthropic impact.

Gift Annuity

Gift annuities provide a guaranteed income stream while supporting legacy giving goals by converting planned charitable contributions into lasting financial benefits.

Probate Avoidance

Probate avoidance enhances the efficiency of legacy giving by transferring assets outside of probate, while planned giving strategically integrates legacy donations into comprehensive estate plans to maximize charitable impact and tax benefits.

Legacy Giving vs Planned Giving Infographic

moneydif.com

moneydif.com