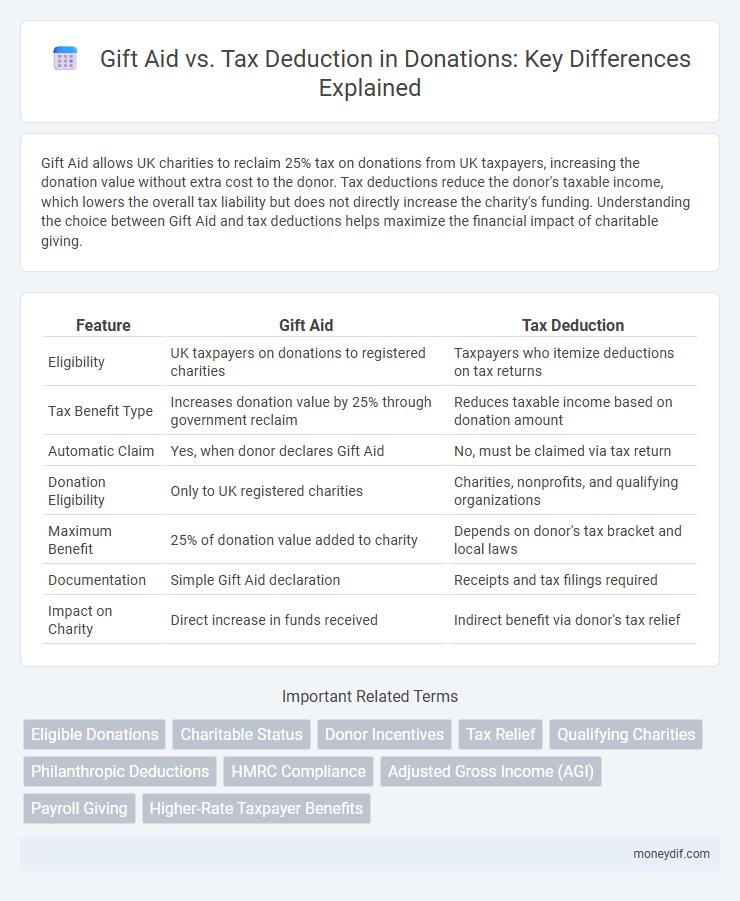

Gift Aid allows UK charities to reclaim 25% tax on donations from UK taxpayers, increasing the donation value without extra cost to the donor. Tax deductions reduce the donor's taxable income, which lowers the overall tax liability but does not directly increase the charity's funding. Understanding the choice between Gift Aid and tax deductions helps maximize the financial impact of charitable giving.

Table of Comparison

| Feature | Gift Aid | Tax Deduction |

|---|---|---|

| Eligibility | UK taxpayers on donations to registered charities | Taxpayers who itemize deductions on tax returns |

| Tax Benefit Type | Increases donation value by 25% through government reclaim | Reduces taxable income based on donation amount |

| Automatic Claim | Yes, when donor declares Gift Aid | No, must be claimed via tax return |

| Donation Eligibility | Only to UK registered charities | Charities, nonprofits, and qualifying organizations |

| Maximum Benefit | 25% of donation value added to charity | Depends on donor's tax bracket and local laws |

| Documentation | Simple Gift Aid declaration | Receipts and tax filings required |

| Impact on Charity | Direct increase in funds received | Indirect benefit via donor's tax relief |

Understanding Gift Aid: How It Works

Gift Aid allows UK charities to reclaim 25% of donations made by taxpayers, increasing the value of each gift without extra cost to the donor. Donors must have paid enough UK tax to cover the amount reclaimed by the charity, ensuring tax efficiency and maximizing donation impact. Unlike tax deductions, which reduce taxable income, Gift Aid directly boosts the charity's funds through government contributions.

Tax Deduction for Donations: Key Principles

Tax deductions for donations reduce taxable income by the amount of the gift, directly lowering tax liability based on the donor's tax bracket. Unlike Gift Aid, which increases the value of donations through government top-ups in the UK, tax deductions apply broadly and are common in many countries, including the US and Canada. Eligibility for tax deductions depends on donating to registered charities and proper documentation, ensuring compliance with tax regulations for maximum benefit.

Gift Aid vs Tax Deduction: Fundamental Differences

Gift Aid allows UK taxpayers to increase the value of their donations by 25% at no extra cost, as charities can reclaim basic rate tax on the donation amount. Tax deductions, commonly used in the US, reduce a donor's taxable income, potentially lowering their tax liability based on their tax bracket and itemized deductions. The fundamental difference lies in Gift Aid enhancing the charity's funds directly, while tax deductions primarily benefit the donor by reducing taxable income.

Eligibility Criteria for Gift Aid and Tax Deduction

Gift Aid eligibility requires donors to be UK taxpayers who have paid enough Income Tax or Capital Gains Tax to cover the amount reclaimed by charities. Tax deductions apply in various countries with differing criteria, often requiring the donor to itemize deductions and the donation to be made to registered charities. While Gift Aid boosts the donation value by 25% through tax reclaim, tax deductions reduce the donor's taxable income based on local tax laws.

Maximizing Donation Value: Which Option Benefits You More?

Maximizing donation value depends on understanding Gift Aid and tax deductions. Gift Aid increases the donation's worth by allowing charities to claim an extra 25% from the government on donations made by UK taxpayers, boosting the total contribution without extra cost to the donor. Tax deductions reduce taxable income, providing a direct financial benefit, but Gift Aid often results in a higher overall donation impact for both the charity and the donor when contributions qualify.

The Claiming Process: Gift Aid Compared to Tax Deduction

Gift Aid requires donors to complete a simple declaration confirming they pay enough UK tax to cover the amount claimed by the charity, enabling charities to reclaim 25% of the donation from HMRC. Tax deductions involve individuals itemizing donations on their self-assessment tax return, reducing taxable income to lower their overall tax liability. The Gift Aid claiming process is more straightforward for both donors and charities, while tax deductions require detailed record-keeping and tax return submissions.

Impact on Charities: Gift Aid vs Tax Deduction

Gift Aid increases the value of donations by allowing charities in the UK to reclaim 25% tax on eligible contributions, significantly boosting funds without extra cost to donors. Tax deductions reduce the donor's taxable income, providing personal financial relief but do not directly increase the charity's received amount. Gift Aid's direct enhancement of charitable income offers a more substantial and immediate impact compared to the indirect benefit of tax deductions on fundraising.

Common Myths About Gift Aid and Tax Deduction

Many donors mistakenly believe Gift Aid is a tax deduction when it actually allows charities to reclaim 25% of eligible donations, increasing their value without reducing the donor's taxable income. Another common myth is that only high earners benefit from Gift Aid, whereas any UK taxpayer can enable charities to claim this benefit on their donations. Confusion also arises around eligibility, as Gift Aid requires the donor to have paid enough UK tax to cover the claimed amount, unlike tax deductions which lower the taxable income directly.

International Perspectives: Donation Incentives Beyond the UK

Gift Aid is a UK-specific program allowing charities to reclaim basic-rate tax on donations, increasing donor impact without additional cost. In contrast, many countries offer tax deductions or credits directly reducing donor taxable income, such as the U.S. charitable deduction or Canada's non-refundable tax credit system. Understanding these diverse international donation incentives helps global donors maximize their giving advantages beyond the UK framework.

Making Informed Donation Choices: Gift Aid or Tax Deduction?

Gift Aid enhances donations by allowing UK charities to claim an extra 25% from HMRC on eligible contributions, maximizing the impact without extra cost to donors. Tax deductions reduce the donor's taxable income, lowering tax liability based on the donation amount, beneficial primarily for higher-rate taxpayers. Understanding the differences between Gift Aid and tax deductions empowers donors to choose the most efficient option, ensuring their charitable giving yields the greatest financial and social benefit.

Important Terms

Eligible Donations

Eligible donations under Gift Aid increase the value of a donation by allowing charities to claim an extra 25% from HMRC, whereas tax deductions reduce the donor's taxable income based on the donation amount.

Charitable Status

Charitable status enables organizations to claim Gift Aid on donations in the UK, increasing donation value by 25%, whereas tax deductions reduce taxable income for donors in countries like the US, highlighting distinct fiscal benefits in gift processing.

Donor Incentives

Donor incentives such as Gift Aid increase the value of donations by allowing charities to reclaim basic rate tax, whereas tax deductions reduce donors' taxable income, ultimately affecting the net cost of giving.

Tax Relief

Gift Aid increases the value of donations by allowing charities to reclaim 25% UK tax on gifts, while tax deductions reduce donors' taxable income, offering different tax relief benefits.

Qualifying Charities

Qualifying charities eligible for Gift Aid in the UK allow donors to increase the value of their donations by 25% at no extra cost, making Gift Aid more financially beneficial than a standard tax deduction. Gift Aid requires charities to be recognized by HM Revenue and Customs (HMRC) and donors to pay sufficient UK tax, whereas tax deductions reduce taxable income but do not enhance the charity's immediate funding.

Philanthropic Deductions

Philanthropic deductions through Gift Aid increase donation value by allowing charities to reclaim 25% tax, while tax deductions reduce the donor's taxable income, offering different financial benefits.

HMRC Compliance

HMRC Compliance mandates accurate Gift Aid declarations to maximize tax benefits, ensuring donors' contributions qualify for tax relief without directly reducing their taxable income like standard tax deductions.

Adjusted Gross Income (AGI)

Adjusted Gross Income (AGI) directly impacts the tax benefits of Gift Aid contributions by determining eligibility and the extent of tax deductions claimed on charitable donations.

Payroll Giving

Payroll Giving enables employees to donate directly from their salary before tax, increasing the donation's value without additional paperwork. Gift Aid allows charities to claim an extra 25% from UK donations by reclaiming basic tax paid, whereas Tax Deduction reduces the donor's taxable income, potentially lowering their tax bill but often involves more complex claims.

Higher-Rate Taxpayer Benefits

Higher-rate taxpayers benefit from Gift Aid donations as they can claim the difference between the higher rate (40% or 45%) and basic rate (20%) tax on the gross donation, effectively reducing their overall tax bill. In contrast, tax deductions reduce taxable income but do not directly increase the amount reclaimed on charitable donations as Gift Aid does.

Gift Aid vs Tax Deduction Infographic

moneydif.com

moneydif.com