Restricted funds are donations designated by donors for specific purposes, ensuring the money is used only for those outlined projects or programs. Unrestricted funds provide organizations with flexibility to allocate resources where they are needed most, supporting operational costs and unexpected expenses. Understanding the difference helps donors align their contributions with their desired impact and supports nonprofits in effective financial planning.

Table of Comparison

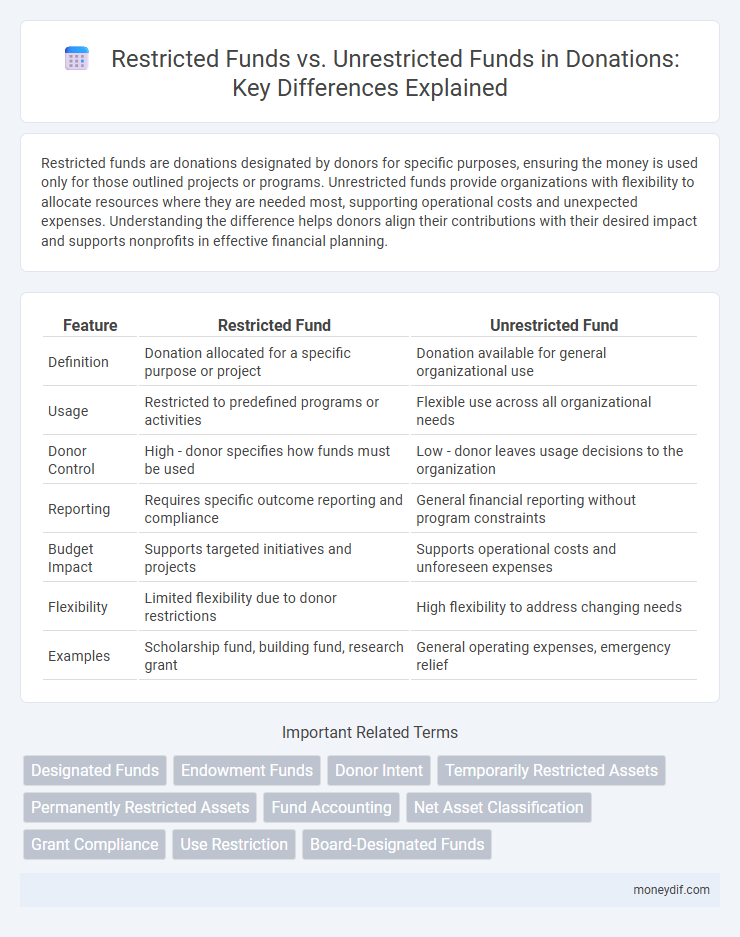

| Feature | Restricted Fund | Unrestricted Fund |

|---|---|---|

| Definition | Donation allocated for a specific purpose or project | Donation available for general organizational use |

| Usage | Restricted to predefined programs or activities | Flexible use across all organizational needs |

| Donor Control | High - donor specifies how funds must be used | Low - donor leaves usage decisions to the organization |

| Reporting | Requires specific outcome reporting and compliance | General financial reporting without program constraints |

| Budget Impact | Supports targeted initiatives and projects | Supports operational costs and unforeseen expenses |

| Flexibility | Limited flexibility due to donor restrictions | High flexibility to address changing needs |

| Examples | Scholarship fund, building fund, research grant | General operating expenses, emergency relief |

Understanding Restricted and Unrestricted Funds

Restricted funds are donations designated by donors for specific purposes, projects, or programs, ensuring that the contributed money is used only within those predefined parameters. Unrestricted funds offer organizations flexibility to allocate resources toward general operations, administrative costs, or emerging needs without donor-imposed limitations. Understanding the differences between these fund types is critical for effective financial planning and maintaining donor trust in nonprofit management.

Key Differences Between Restricted and Unrestricted Donations

Restricted funds are donations designated by donors for specific purposes, limiting their use to particular projects or expenses, ensuring accountability and targeted impact. Unrestricted funds allow organizations to allocate resources flexibly across their operations, supporting general expenses, administrative costs, and emergent needs without donor-imposed limitations. Understanding these distinctions is crucial for effective financial planning, compliance with donor intent, and maximizing organizational sustainability.

How Restricted Funds Support Specific Causes

Restricted funds are designated by donors for specific purposes, ensuring that donations directly support particular programs or projects, such as education, healthcare, or disaster relief. These funds provide transparency and accountability by aligning financial resources with donor intent, enabling organizations to address targeted needs effectively. By channeling contributions into restricted funds, nonprofits can guarantee that resources are used precisely for the causes donors are passionate about, enhancing impact and donor trust.

The Flexibility of Unrestricted Fund Contributions

Unrestricted fund contributions offer greater flexibility by allowing organizations to allocate resources where they are most needed, supporting general operations, program development, and unexpected expenses. Unlike restricted funds, which are designated for specific projects or purposes, unrestricted funds enable adaptive responses to changing priorities and emerging opportunities. This versatility enhances financial stability and fosters innovation within charitable organizations.

Legal Requirements for Managing Donation Funds

Legal requirements for managing donation funds vary significantly between restricted and unrestricted funds, with restricted funds mandating strict adherence to donor-imposed limitations and specific reporting obligations to ensure funds are used only for designated purposes. Unrestricted funds offer organizations greater flexibility in allocation but still require compliance with general nonprofit accounting standards and transparency in financial records. Proper segregation and accurate tracking of both fund types are essential to meet regulatory audits and maintain donor trust.

Best Practices for Communicating Fund Types to Donors

Clearly defining and communicating the purposes of restricted and unrestricted funds builds donor trust and enhances transparency in nonprofit operations. Best practices include using straightforward language to explain how restricted funds are designated for specific projects while unrestricted funds provide flexibility for operational needs, supported by clear examples and visual aids. Regular updates on fund usage and impact reporting ensure donors feel valued and understand the significance of each contribution type.

Tracking and Reporting on Restricted Fund Use

Restricted funds require precise tracking and reporting to ensure donations are used solely for their designated purposes, adhering to donor specifications. Accurate documentation and segmented accounting systems enable organizations to demonstrate compliance and maintain donor trust. Transparent reporting on restricted fund usage enhances accountability and supports future fundraising efforts.

The Impact of Unrestricted Funds on Organizational Growth

Unrestricted funds provide organizations with the flexibility to allocate resources strategically across various programs, operational costs, and emergent needs, driving sustainable growth and innovation. These funds enable nonprofits to invest in capacity-building initiatives, enhance infrastructure, and respond swiftly to unforeseen challenges without donor-imposed constraints. Consequently, unrestricted donations are critical for long-term organizational resilience and expanded community impact.

Challenges in Allocating and Managing Restricted Funds

Restricted funds pose significant challenges in allocation and management due to their specific donor-imposed limitations, which restrict flexibility in addressing emerging organizational needs. Organizations must carefully track and report the use of these funds to maintain compliance with donor intent and legal requirements, increasing administrative burden. Failure to adhere strictly to restrictions can jeopardize donor trust and lead to legal complications, underscoring the necessity for rigorous financial controls and transparent reporting systems.

Choosing the Right Fund Type for Your Nonprofit Campaign

Selecting the appropriate fund type for your nonprofit campaign is crucial for aligning donor intent with organizational needs. Restricted funds require donors to designate contributions for specific projects or purposes, ensuring targeted impact and accountability. Unrestricted funds offer flexibility, enabling nonprofits to allocate resources where most needed, fostering sustainable growth and operational stability.

Important Terms

Designated Funds

Designated funds are a subset of unrestricted funds that an organization earmarks for specific purposes without legal restrictions, unlike restricted funds which are legally bound for particular uses.

Endowment Funds

Endowment funds are typically classified into restricted funds, which legally limit usage to specific purposes, and unrestricted funds, allowing flexibility in allocation to support general organizational needs.

Donor Intent

Donor intent is crucial in fund management, ensuring contributions align with either restricted funds, which are designated for specific purposes or projects, or unrestricted funds, which allow organizations flexibility in allocation to meet operational needs. Properly honoring donor intent safeguards trust and compliance, enabling nonprofits to effectively plan budgets and fulfill donor expectations.

Temporarily Restricted Assets

Temporarily restricted assets are funds designated by donors for specific purposes or time periods, contrasting with unrestricted funds that management can use at their discretion to support general operations. These assets become unrestricted once the donor-imposed restrictions lapse or the specified purpose is fulfilled.

Permanently Restricted Assets

Permanently restricted assets in nonprofit organizations refer to funds that donors stipulate must be maintained intact indefinitely, often invested to generate income without spending the principal. These assets differ from unrestricted funds, which can be used at the organization's discretion, while restricted funds are designated by donors for specific purposes, either temporarily or permanently, requiring careful accounting to ensure compliance with donor intent.

Fund Accounting

Fund accounting distinguishes between restricted and unrestricted funds to ensure proper financial reporting and compliance with donor-imposed limitations; restricted funds are designated for specific purposes and cannot be used for general operations, whereas unrestricted funds allow organizations greater flexibility in allocating resources to meet overall mission goals. Accurate tracking and reporting of these fund types are essential for nonprofit transparency, accountability, and adherence to regulatory standards.

Net Asset Classification

Net asset classification differentiates between restricted and unrestricted funds based on donor-imposed limitations that dictate how resources can be utilized. Restricted funds are earmarked for specific purposes or time periods, while unrestricted funds provide organizations with flexibility to allocate resources according to operational needs and priorities.

Grant Compliance

Grant compliance requires strict adherence to guidelines distinguishing restricted funds, which are allocated for specific purposes, from unrestricted funds that offer flexibility in spending.

Use Restriction

Use restrictions define how restricted funds must be spent according to donor-imposed conditions, while unrestricted funds offer organizations flexibility to allocate resources as needed for general operations or projects. Proper classification ensures compliance with legal requirements and accurate financial reporting reflecting fund limitations.

Board-Designated Funds

Board-designated funds represent unrestricted resources that the board of directors has set aside for specific purposes, differing from restricted funds which are legally or donor-imposed with usage limitations. Unlike restricted funds bound by external constraints, board-designated funds offer flexibility while reflecting the organization's internal financial planning and stewardship priorities.

Restricted Fund vs Unrestricted Fund Infographic

moneydif.com

moneydif.com