Restricted donations are funds given with specific conditions on how they must be used, ensuring donors' intentions are respected. Unrestricted donations provide organizations with the flexibility to allocate resources where they are most needed, enabling quick response to emerging priorities. Understanding the differences helps donors and nonprofits align contributions with strategic goals and operational needs.

Table of Comparison

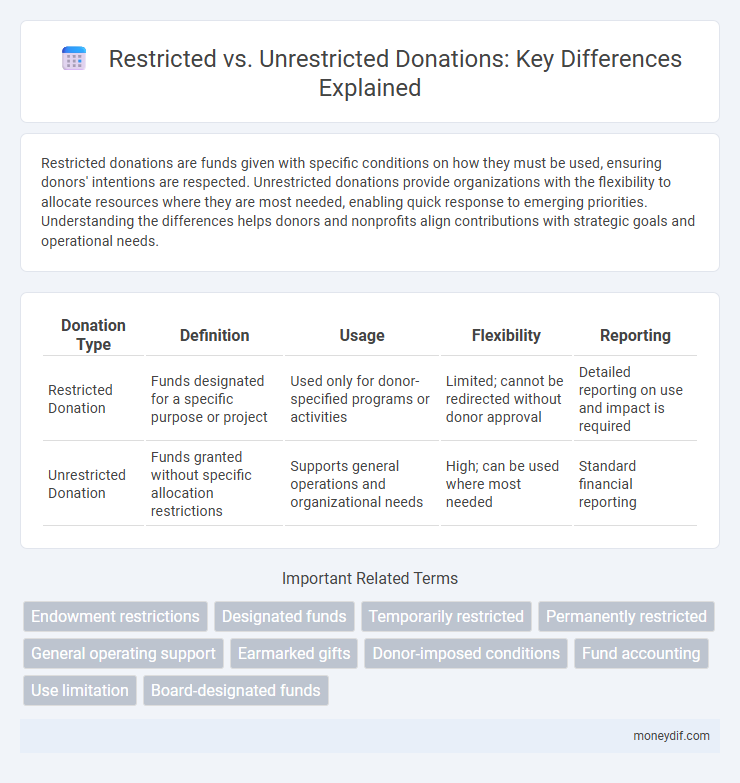

| Donation Type | Definition | Usage | Flexibility | Reporting |

|---|---|---|---|---|

| Restricted Donation | Funds designated for a specific purpose or project | Used only for donor-specified programs or activities | Limited; cannot be redirected without donor approval | Detailed reporting on use and impact is required |

| Unrestricted Donation | Funds granted without specific allocation restrictions | Supports general operations and organizational needs | High; can be used where most needed | Standard financial reporting |

Understanding Restricted vs Unrestricted Donations

Restricted donations are contributions designated by donors for specific programs or projects, ensuring funds are used exclusively for intended purposes. Unrestricted donations provide nonprofits with flexible resources, allowing allocation toward general operational costs or emerging needs. Understanding the distinction helps organizations manage budgets effectively and align donor intentions with organizational priorities.

Key Differences Between Restricted and Unrestricted Funds

Restricted funds are donations designated by donors for specific purposes, projects, or time frames, ensuring that the money is used only for those intended activities. Unrestricted funds provide nonprofits with flexibility to allocate resources where needed most, such as operational costs, salaries, or emergent priorities. The key difference lies in the donor-imposed conditions on restricted funds versus the freedom of use inherent in unrestricted donations, directly impacting organizational budgeting and strategic planning.

Pros and Cons of Restricted Donations

Restricted donations ensure funds are allocated specifically to designated projects, enhancing accountability and donor trust, but they can limit organizational flexibility and responsiveness to changing needs. These donations often attract donors seeking impact in particular areas, yet may create resource imbalances by diverting funds from broader operational costs. Managing restricted funds requires strict compliance and reporting, which can increase administrative burden and reduce efficiency.

Benefits of Unrestricted Giving for Nonprofits

Unrestricted giving provides nonprofits with flexible funding to address urgent needs and innovate programs without donor-imposed limitations. This financial adaptability enhances organizational stability, enabling strategic planning and rapid response to unforeseen challenges. Increased autonomy from unrestricted donations fosters improved efficiency and long-term impact in fulfilling the nonprofit's mission.

Legal and Ethical Considerations in Donation Types

Restricted donations legally bind organizations to allocate funds strictly according to donor specifications, ensuring transparency but requiring meticulous accounting and compliance. Unrestricted donations offer greater flexibility, allowing organizations to address urgent needs or operational costs without legal limitations, yet they pose ethical obligations to maintain donor trust through clear communication. Balancing these donation types demands adherence to fiduciary duties, regulatory frameworks such as IRS regulations for nonprofits, and ethical standards to protect donor intent and organizational integrity.

Donor Intent: Why Restrictions Matter

Donor intent shapes how donations can be used, with restricted funds designated for specific programs or purposes, ensuring alignment with the donor's wishes. Unrestricted donations provide organizations flexible resources to address emerging needs and operational costs, but respecting restrictions maintains trust and accountability. Clear adherence to donor-imposed limitations is essential for transparent stewardship and long-term donor relationships.

Maximizing Impact with Unrestricted Funds

Unrestricted funds provide nonprofits the flexibility to allocate resources where they are most needed, enabling rapid response to emerging challenges and strategic innovation. By maximizing impact with unrestricted donations, organizations can invest in capacity building, operational costs, and long-term projects that restricted funds often cannot cover. This financial agility strengthens overall program effectiveness and sustains organizational growth.

Transparency and Reporting for Restricted Donations

Restricted donations require donors' specific instructions on fund usage, ensuring transparency by clearly defining purposes and limitations. Organizations must provide detailed reporting and accountability on these funds, tracking expenditures to honor donor intentions and maintain trust. This practice enhances donor confidence and supports compliance with legal and ethical standards in philanthropy.

How to Decide: Choosing the Right Type of Donation

Choosing the right type of donation depends on the donor's intent and the recipient organization's flexibility in fund usage. Restricted donations require funds to be used for specific purposes, ensuring alignment with donor priorities, while unrestricted donations empower organizations to allocate resources where they are most needed, supporting overall operational sustainability. Evaluating the organization's current needs and the donor's desired impact helps determine whether restricted or unrestricted donations better serve the cause.

Communicating Donation Options to Supporters

Clearly distinguishing between restricted and unrestricted donation options empowers supporters to allocate funds according to their preferences, enhancing transparency and trust. Providing detailed explanations of how restricted donations target specific programs while unrestricted gifts offer flexibility promotes informed giving. Effective communication through multiple channels, such as websites, newsletters, and fundraising events, ensures donors understand the impact of their contributions.

Important Terms

Endowment restrictions

Endowment restrictions define how funds are classified as restricted or unrestricted, with restricted endowments requiring adherence to donor-imposed limitations while unrestricted endowments allow institutions flexible use of the principal and earnings.

Designated funds

Designated funds are subsets of unrestricted funds specifically allocated by an organization's board for particular purposes, distinguishing them from restricted funds which are externally imposed with usage constraints.

Temporarily restricted

Temporarily restricted funds are financial resources designated for specific purposes with usage limitations lifted after certain conditions are met, unlike unrestricted funds which have no usage constraints.

Permanently restricted

Permanently restricted funds are financial resources designated for specific purposes by donors, unlike unrestricted funds which can be used for any organizational needs.

General operating support

General operating support typically refers to unrestricted funds that organizations can use flexibly, whereas restricted funds are designated for specific projects or purposes.

Earmarked gifts

Earmarked gifts are classified as restricted donations, requiring funds to be used for specific purposes, unlike unrestricted gifts which can support general organizational operations.

Donor-imposed conditions

Donor-imposed conditions specify whether contributed funds are restricted for specific purposes or unrestricted for general organizational use.

Fund accounting

Fund accounting distinguishes between restricted funds, which are earmarked for specific purposes by donors or legal requirements, and unrestricted funds, which can be used at the organization's discretion for general operations.

Use limitation

Use limitation defines specific constraints on how data or resources can be accessed or utilized, distinguishing restricted access--where permissions are controlled and often require authorization--from unrestricted access, which allows open and free use without barriers. Restricted use ensures compliance with privacy, security, and regulatory requirements, while unrestricted use facilitates broad availability and collaboration.

Board-designated funds

Board-designated funds are unrestricted funds that the board of directors formally sets aside for specific purposes, distinguishing them from restricted funds which are legally or externally limited in use.

Restricted vs Unrestricted Infographic

moneydif.com

moneydif.com